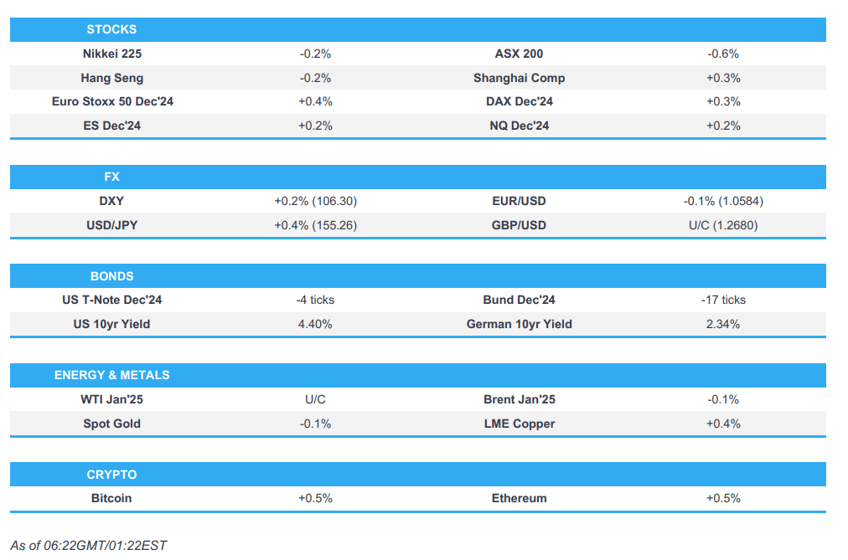

- APAC stocks traded mixed following the price swings seen across global markets on Tuesday in which the US indices staged a recovery.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.4% after the cash market closed lower by 0.8% on Tuesday.

- USD is broadly firmer vs. peers, JPY lags across the majors, EUR/USD failed to sustain a move onto a 1.06 handle.

- President Biden approved the provision of antipersonnel mines for Ukraine, according to The Washington Post.

- Looking ahead, highlights include German PPI, UK CPI, EZ Negotiated Wage Rates (Q3), ECB President Lagarde, de Guindos, BoE’s Ramsden, Fed's Barr, Cook, Bowman & Collins, Supply from Germany & US, Earnings from NVIDIA.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks mostly closed higher on what was a choppy day across markets as sentiment swung between the European and US sessions with initial risk-off trade seen amid heightened geopolitical tensions after Russia’s Kremlin said "Russia reserves the right to use nuclear weapons in an event of aggression" and Ukraine conducted its first ATACMS strike inside Russia. This triggered a flight to quality which underpinned treasuries, gold, the dollar and haven currencies, while stocks and oil sold off, although the moves were then reversed as sentiment improved in US trade.

- SPX +0.40% at 5,917, NDX +0.71% at 20,685, DJIA -0.28% at 43,269, RUT +0.80% at 2,325

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Schmid (2025 voter) said it remains uncertain how far interest rates can fall, though the initial reductions made by the Fed are a vote of confidence that inflation is returning to its 2% target and noted that now is the time to dial back restrictiveness of policy.

- US President-elect Trump picked Howard Lutnick for Commerce Secretary and picked former Small Business Administration head Linda McMahon for Education Secretary. It was also reported that Trump will interview former Fed Governor Kevin Warsh and Apollo Global Management CEO Marc Rowan for the Treasury Secretary role and is expected to name his choice for Treasury Secretary as soon as today, according to Bloomberg and CNN, while Rowan was separately reported to have emerged as the top contender for the position, according to FT.

APAC TRADE

EQUITIES

- APAC stocks traded mixed following the price swings seen across global markets on Tuesday in which the US indices staged a recovery from the initial risk-off conditions triggered by the Ukraine-Russia escalation, while participants now await Nvidia's earnings.

- ASX 200 pulled back from recent record highs but with losses contained by a quiet calendar and light macro newsflow.

- Nikkei 225 traded indecisively despite the mostly better-than-expected Japanese trade data, while there were firm gains seen in Seven & I Holdings and media powerhouse Kadokawa following respective M&A-related headlines.

- Hang Seng and Shanghai Comp swung between gains and losses with price action indecisive following the lack of fresh major catalysts in the region, while there were also no surprises from the PBoC's announcement of the benchmark Loan Prime Rates which were maintained at their current levels following last month's 25bp cuts.

- US equity futures (ES +0.2%, NQ +0.1%) remained afloat after yesterday's intraday recovery but with gains limited as the attention turns to Nvidia's earnings.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.4% after the cash market closed lower by 0.8% on Tuesday.

FX

- DXY eked marginal gains in rangebound trade following the prior day's two-way price action whereby an initial risk-off theme, spurred by Ukraine-Russia escalation, underpinned the dollar before the moves were gradually faded as sentiment in stateside improved. There were also recent comments from Fed's Schmid which had little sway on the dollar as he noted it remains uncertain how far interest rates can fall and the initial reductions made by the Fed are a vote of confidence inflation is returning to its 2% target, while he added now is the time to dial back restrictiveness of policy.

- EUR/USD was little changed after failing to sustain a brief return to 1.0600 territory and with participants now awaiting central bank rhetoric including from ECB's Lagarde and de Guindos.

- GBP/USD edged closer towards the 1.2700 level following yesterday's fluctuations, while the recent slew of BoE rhetoric ultimately had little sway on the currency heading into the latest UK inflation numbers.

- USD/JPY gradually strengthened to breach resistance at the 155.00 level despite mostly better-than-expected Japanese trade data.

- Antipodeans held on to recent sentiment-driven gains but with upside capped by the flimsy risk appetite and lack of catalysts.

- PBoC set USD/CNY mid-point at 7.1935 vs exp. 7.2386 (prev. 7.1911).

FIXED INCOME

- 10yr UST futures were lacklustre after fading yesterday's haven bid with demand contained ahead of Fedspeak and a 20yr auction.

- Bund futures took a breather following recent whipsawing and as the attention turns to German PPI data and 30yr Bund supply.

- 10yr JGB futures pared some of their recent gains and trickled beneath the 143.00 level following mostly better-than-expected Japanese trade data, but with downside cushioned as risk sentiment in Asia waned.

COMMODITIES

- Crude futures lacked direction after the choppy performance on Tuesday as geopolitical tensions dominated macro newsflow, while private sector inventory data was mixed which showed a larger-than-expected crude build and a surprise drawdown in gasoline.

- Private inventory data (bbls): Crude +4.8mln (exp. +0.1mln), Distillate -0.7mln (exp. -0.02mln), Gasoline -2.5mln (exp. +0.9mln), Cushing -0.3mln.

- Spot gold edged marginally higher in a continuation of its resurgence from beneath the USD 2,600/oz level.

- Copper futures remained afloat following the rebound in risk sentiment stateside but with gains capped amid cautiousness in Asia.

CRYPTO

- Bitcoin was indecisive overnight after mildly pulling back from yesterday's fresh record high above the USD 94,000 level.

- US President-elect Trump is said to consider crypto lawyer Teresa Goody Guillen to lead the SEC, according to CoinDesk and Reuters.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Nov) 3.10% vs. Exp. 3.10% (Prev. 3.10%)

- Chinese Loan Prime Rate 5Y (Nov) 3.60% vs. Exp. 3.60% (Prev. 3.60%)

- China's SCIO is reportedly to hold a briefing on Friday to outline measures for stabilising foreign trade growth, while the Vice Commerce Minister and officials from MOFA, MIIT, PBoC and Customs will attend the briefing, according to source on X.

- US vowed more sanctions on Hong Kong officials after 45 pro-democracy activists were recently jailed, according to SCMP.

- US Democratic Senator Blumenthal said Elon Musk's China ties are a profound threat to US national security and his business interests could be exploited by Beijing, according to SCMP.

DATA RECAP

- Japanese Trade Balance Total (JPY)(Oct) -461.2B vs. Exp. -360.4B (Prev. -294.3B, Rev. -294.1B)

- Japanese Exports YY (Oct) 3.1% vs. Exp. 2.2% (Prev. -1.7%)

- Japanese Imports YY (Oct) 0.4% vs. Exp. -0.3% (Prev. 2.1%, Rev. 1.8%)

GEOPOLITICS

MIDDLE EAST

- Israeli army said Hezbollah fired 75 rockets from Lebanon towards Israel on Tuesday, according to Asharq News.

- US Envoy Hochstein will stay in Lebanon until Wednesday and then go to Israel, while the new wording of the proposal stated that each side has the right to self-defence if attacked, provided the US guarantees that Israel does not carry out pre-emptive strikes. However, Israel's Channel 13 noted Hochstein's visit to Tel Aviv may be delayed due to large gaps between Israel and Lebanon, while the main dispute at the moment is Israel's demand to maintain freedom of military action in southern Lebanon, according to Al Jazeera.

- Saudi representative to the Security Council said they condemn Israeli military actions against Lebanon and reject the threat to its security and stability, according to Asharq News.

- Iranian Foreign Minister Araqchi told French Minister for Europe and Foreign Affairs Barrot that Tehran warns France, Germany and Britain about submitting a resolution against Iran at the IAEA Board of Governor's meeting, while Araqchi added the European resolution draft contradicts the 'positive atmosphere' created between Iran and the UN nuclear watchdog and will complicate matters.

RUSSIA-UKRAINE

- US will send Ukraine at least USD 275mln in new weapons in a push to bolster Kyiv ahead of Trump, according to AP. It was later reported that President Biden approved a provision of antipersonnel mines for Ukraine, according to The Washington Post.

- Ukrainian air defence units attempted to repel a Russian air attack on Kyiv, according to Ukraine's military.

- US State Department said the US embassy in Kyiv received specific information of a potential significant air attack on November 20th, while the Kyiv embassy will be closed and it recommended that US citizens be prepared to immediately shelter in the event an air alert is announced, according to a post on X cited by Reuters.

- North Korean troops participated in some battles as part of Russia's airborne unit and marines in the Ukraine war, according to News1. It was also reported that North Korea shipped howitzers and multiple rocket launchers to Russia, while a South Korean lawmaker said South Korea's spy agency is still trying to determine any North Korean troop casualties and surrenders in the Ukraine war, according to Reuters.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer is to visit Saudi Arabia and UAE to try to secure investment, according to FT.

- The Resolution Foundation think tank says the UK's ONS may be underestimating the number of people in employment by almost 1 million and overstating the extent of the country’s inactive workforce problem, according to The Times.