- APAC stocks were mixed for a bulk of the session before eventually trading mostly lower, with South Korean stocks underperforming amid more political angst.

- US President-elect Trump said he cannot guarantee Americans will not pay more as a result of tariffs, according to NBC's Meet the Press.

- Syrian rebel fighters captured the capital Damascus and toppled Bashar al-Assad's regime; Israeli ground forces advanced beyond the demilitarized zone on the Israel-Syria border over the weekend.

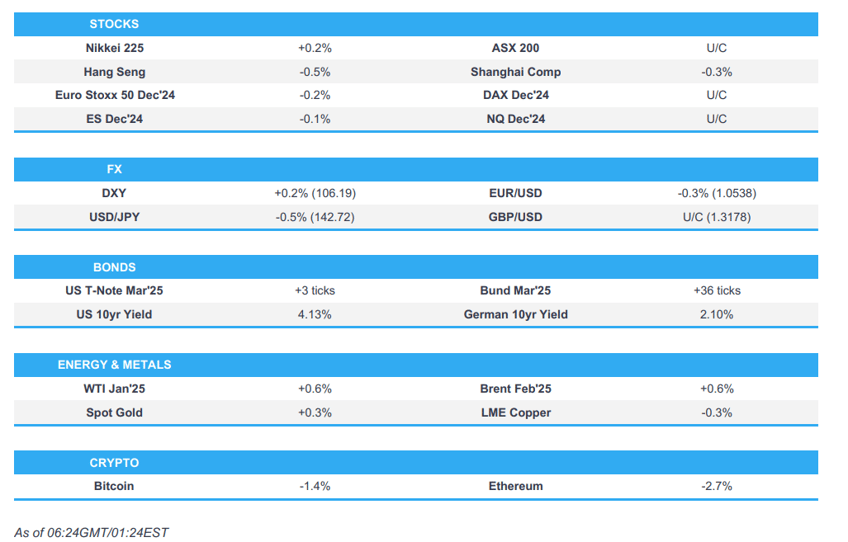

- European equity futures are indicative of a subdued cash open with the Euro Stoxx 50 future -0.2% after cash closed +0.5% on Friday.

- Looking ahead, highlights include US Employment Trends, US Wholesale Sales, NY Fed SCE, Commentary from BoE's Ramsden, EZ finance ministers' meeting, Earnings from Oracle

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed mostly firmer on Friday with the SPX and NDX both notching their third consecutive positive week and rising to fresh records following the November US jobs report, which keeps the Fed on course to cut at the December 18th announcement.

- Eyes now turn to the US CPI report on Wednesday to cement expectations, with current pricing suggesting an ~85% chance of a 25bps Fed rate cut at the upcoming meeting.

- SPX +0.25% at 6,090.27, NDX +0.81% at 19,859.77, DJIA -0.28% at 44,642.52 , RUT +0.54% at 2,408.99.

US PRESIDENT-ELECT TRUMP'S WEEKEND INTERVIEW

- US President-elect Trump said he cannot guarantee Americans will not pay more as a result of tariffs, according to NBC's Meet the Press.

- Trump said he does not have plans now to ask Powell to step down as Fed Chair.

- Trump said he absolutely would consider exiting NATO.

- Trump also said he doesn’t plan to divest from Truth Social (DJT).

NOTABLE HEADLINES

- Fed's Goolsbee (2025 voter) said for the Fed to change policy direction, data will need to show inflation is not heading to target or the jobs market looks like it's overheating. Goolsbee added a gradual pace of cuts seems appropriate, and hopes the Fed gets to neutral by end-2025. Economic conditions will determine the pace of cuts. Goolsbee said the speed at which the Fed is moving will probably slow as the debate proceeds on a stopping point, and will be watching rate-sensitive sectors, and the lagged impact of policy, for signs that neutral is approaching. Goolsbee said the outlook matters so when the Administration proposes new policies, the Fed will look at it, and a single month's data is not reliable, but if the Household Survey were to show deterioration, the Fed would look more closely.

- Fed's Daly (2024 voter) said the labour market is in a good, balanced position.

- Fed's Hammack (2024 Voter) said the Fed is at or near time to the slow pace of rate cuts, and is open-minded about the December FOMC meeting, more data is incoming. Hammack said the market view of one cut between November and late January is reasonable, and the slowing pace of rate cuts allows Fed time to sound the economy. Hammack added the economic landscape calls for 'modestly restrictive' monetary policy, and expects solid growth, low unemployment, and gradual inflation ebbing. Hammack said data will drive what the Fed does with monetary policy, and monetary policy is likely "somewhat restrictive", whilst the Fed has more work to do to cool inflation. Hammack also noted the economy is strong and the labour market is healthy, and labour market has become better balanced.

- US President-elect Trump announces Michael Needham will serve as Counsellor of the Department of State, and Christopher Landau to serve as Deputy Secretary of State, via Truth Social.

- Trump aides reportedly contacted Google (GOOG), Meta (META), and Snap (SNAP) over online drug sales, according to The Information.

- Meta (META) rolls out internal AI tool as it pushes into business market, according to the FT.

APAC TRADE

EQUITIES

- APAC stocks were mixed for a bulk of the session before eventually trading mostly lower, with South Korean stocks underperforming after the vote to impeach South Korea’s President failed following a boycott by ruling party MPs.

- ASX 200 was relatively flat for most of the session before tilting lower amid a late pullback in base metals and ahead of the RBA announcement tomorrow which is expected to keep rates unchanged at 4.35%.

- Nikkei 225 traded between gains and losses before adopting an upward bias as Q3 GDP was revised higher.

- Hang Seng and Shanghai Comp opened mixed but later traded lower with the former subdued by property names whilst the latter gears up for China’s Central Economic Work Conference on December 11th and 12th, whilst Chinese CPI missed expectations whilst PPI printed slightly above forecasts - with no major price action seen on the release.

- US equity futures traded flat across the board following Friday's US Jobs report and with traders looking ahead to the US CPI on Wednesday to solidify a 25bps cut by the Fed next week.

- European equity futures are indicative of a subdued cash open with the Euro Stoxx 50 future -0.2% after cash closed +0.5% on Friday.

FX

- DXY extended gains above 106.00 and rose above Friday's 106.15 high, with an upward bias ahead of Wednesday's US CPI, whilst US President-elect Trump over the weekend said he cannot guarantee Americans will not pay more as a result of tariffs.

- EUR/USD sat with modest losses and eventually dipped under the 1.0550 mark amid a rising dollar (vs intraday high of 1.0569). Traders look ahead to Thursday's ECB confab in which the deposit rate is expected to be cut by 25bps.

- GBP/USD was uneventful with some modest resistance seen at 1.2750 as GBP/USD was dictated by USD action whilst the GBP looks ahead to commentary from BoE Deputy Governor Ramsden who is to speak on financial stability, with a text release expected.

- USD/JPY printed on either side of 150.00 with modest weakness seen shortly after the Chinese cash open and short-lived modest strength on the GDP data.

- Antipodeans tilted upwards most of the session as base metals initially gained following the better-than-feared Chinese PPI. Thereafter, a stronger dollar took hold and dragged the AUD and NZD into losses, with the former looking ahead to the RBA decision on Tuesday.

- PBoC set USD/CNY mid-point at 7.1870 vs exp. 7.2627 (prev. 7.1848)

FIXED INCOME

- 10yr UST futures were flat and uneventful amid a lack of pertinent headlines overnight and with traders looking ahead to US CPI on Wednesday ahead of the Fed's final meeting of the year next week.

- Bund futures traded within a narrow range ahead of the ECB, with macro drivers light overnight.

- 10yr JGB futures held a mild upward bias with little notable reaction seen to the revisions higher in Q3 GDP.

COMMODITIES

- Crude futures gradually firmed since the open but remained within recent ranges with geopolitical uncertainty added over the weekend after Syrian rebel fighters captured the capital Damascus and toppled Bashar al-Assad's regime. However, gains for the complex were capped after Saudi cut their January OSPs for Asia and NW Europe.

- Spot gold was firmer amid the aforementioned weekend geopolitical updates, with some upside seen as Chinese player entered the market, with reports also suggesting the PBoC resumed gold purchases in November after a six-month hiatus, according to Reuters. Upside in the yellow metal later faded and the dollar gained more ground.

- Copper futures initially traded firmer with tailwinds from the better-than-feared Chinese PPI metrics, although a stronger dollar later dragged the red metal into the red.

- Saudi Arabia set January Arab Light crude OSP to Asia at +USD 0.90 vs Oman/Dubai average (prev. +USD 1.70); NW Europe at -USD 1.25 vs ICE Brent (prev. -0.15); United States at +USD 3.80 vs ASCI (prev. +USD 3.80), according to Reuters.

- Baker Hughes Rig Count: Oil rigs + 5 at 482; NatGas rigs +2 at 102; total rigs +7 to 589.

- Chevron (CVX) CEO said it will hit record US oil production next year as President Trump tries to reduce the burden on oil and gas.

- Polish pipeline operator Pern said it has restored proper operation of first branch of Western Druzhba pipeline after incident on December 1st, according to Reuters.

- PBoC resumed gold purchases in November after a six-month hiatus, according to Reuters.

CRYPTO

- Bitcoin traded with losses during the APAC session after it oscillated around the USD 100k mark over the weekend.

NOTABLE ASIA-PAC HEADLINES

- China’s regulators will try to bolster the property market with improved policies on land usage, tax and other financial measures, according to Xinhua.

- Fitch Ratings downgraded China's 2025 GDP growth forecast to 4.3% (prev. 4.5% in September); 2026 forecast cut to 4.0% (prev. 4.3%). Fitch said the prolonged downturn in the property market remains a risk.

- South Korean President Yoon survived an impeachment motion in the opposition-led parliament on Saturday after members of his party boycotted the vote - with too few members present to pass the measure as voting began., according to Reuters.

- South Korea's opposition party to propose new impeachment bill on December 11 for vote on December 14, according to Yonhap.

- South Korean Finance Ministry said it is making all-out efforts to stabilise markets and deploying contingency plans; will work with BoK on outright purchase of KTBs if needed; will announce measures to improve FX liquidity before end-Dec, according to Reuters.

- South Korean opposition leader Lee said some irreversible economic fallout expected on chips industry, and financial markets unless President Yoon steps down immediately, according to Reuters.

- RBNZ said the Board has engaged with finance minister over new financial policy remit, and welcomes an updated remit that is relevant to RBNZ’s current and future work programme.

DATA RECAP

- Chinese CPI YY (Nov) 0.2% vs. Exp. 0.5% (Prev. 0.3%)

- Chinese PPI YY (Nov) -2.5% vs. Exp. -2.8% (Prev. -2.9%)

- Chinese CPI MM (Nov) -0.6% vs. Exp. -0.4% (Prev. -0.3%)

- Japanese GDP Revised QQ (Q3) 0.3% vs. Exp. 0.2% (Prev. 0.2%)

- Japanese GDP Rev QQ Annualised (Q3) 1.2% vs. Exp. 0.9% (Prev. 0.9%)

- Japanese GDP Cap Ex Rev QQ (Q3) -0.1% vs. Exp. 0.1% (Prev. -0.2%)

MIDDLE EAST

- Syrian rebel fighters captured the capital Damascus and toppled Bashar al-Assad's regime.

- Syria's ousted President Bashar al Assad has arrived in Moscow, according Russian state media. Kremlin sources suggested a deal has been done to ensure the safety of Russian military bases in Syria, according to Reuters.

- Israeli ground forces advanced beyond the demilitarized zone on the Israel-Syria border over the weekend, "marking their first overt entry into Syrian territory since the 1973 October War", according to Israeli officials cited by NYT

- IDF called Syria 'fourth front', according to Sky News Arabia.

- Israeli military was instructed to seize the buffer zone and control points in order to ensure the protection of all Israeli communities in the Golan Heights, according to Israeli Defense Minister Katz.

- Israeli official said that in the coming days, Israel might capture more areas inside Syria, and further deepen the attacks against strategic targets in Syria, to prevent weapons from falling into the hands of the rebels, according to Kann's Stein.

- Israel's Channel 13 said "The Israeli army is considering continuing the incursion into Syrian territory to expand the buffer zone in the Golan., according to Sky News Arabia.

- Israel's Channel 13 said "Israeli intelligence is monitoring what is happening in Iran for fear that the collapse of the axis loyal to it will push it to develop nuclear weapons", according to Sky News Arabia.

- "US administration officials fear that Assad's fall will increase pressure on Iran's Supreme Leader Ali Khamenei to give the green light to produce a nuclear bomb.", according to Kann News.

- Israeli PM Netanyahu said the fall of Assad was a direct result of blows dealt to Hezbollah and Iran by Israel, and added that Israel will not allow any hostile force to establish itself on its borders, according to Reuters.

- Hezbollah pulled all forces out of Syria on Saturday, according to Lebanese security sources cited by Reuters.

- US encouraged Iraq to not get drawn into Syrian unrest, according to a Senior US official cited by Reuters, and US has been in discussions with Turkish officials and US focus is "a new Syria". Senior US official does not see role for US troops on the ground addressing chemical weapons in Syria.

- US Central Command said its forces conducted dozens of airstrikes on Islamic State camps in central Syria on Sunday, and struck over 75 Islamic State targets in central Syria, according to Reuters.

- US President Biden said the US will support Syria's neighbours through period of transition, and will speak with leaders in region in coming days and send administration officials, according to Reuters.

- US-backed Syrian Kurdish forces said they are still fighting Turkish-backed forces in Syria's Manbij, according to Reuters.

- Iran said it will monitor developments in Syria and the region closely, and will adopt appropriate approaches and positions, according to a Foreign Ministry statement, adding that the long-standing and friendly relations between the Iranian and Syrian nations are expected to continue.

- "Iranian Foreign Minister: Conflicts are expected to spread not only to Iraq but to the entire region", according to Sky News Arabia.

- President-elect Trump's Middle East envoy met Israel and Qatar PMs to broker a ceasefire, according to the FT.

OTHER

- US president-elect Trump said there should be an immediate ceasefire and negotiations in Ukraine this is time for Russia's Putin to act, and China can help, via Truth Social.

- US president-elect Trump, French President Macron and Ukrainian President Zelenskyy had "very good conversation" over the weekend, according to a source close to Macron cited by Reuters.

- Taiwan’s Defence Ministry said on Sunday China has almost doubled the number of warships around Taiwan in the past 24 hours, ahead of what is suspected to be a new round of war games, according to Reuters.

- Taiwan Defence Ministry said it instructed troops to closely monitor situation, maintain high alert on Chinese PLA drills; have raised alert level on Taiwan's outlying islands; activated combat readiness drills to carry out at strategic locations, according to Reuters.

- Chinese military and coast guard boats have entered waters around Taiwan and the Western Pacific to carry out missions, according to Reuters.

- Taiwan Coast Guard said seven Chinese Coast Guard ships began conducting “grey-zone harassment' against Taiwan from early Monday, according to Reuters.

- China currently has almost 90 navy and coast ships in the waters near Taiwan, Southern Japanese islands, East and South China Seas, according to Reuters.

EU/UK

NOTABLE HEADLINES

- Fitch affirmed Hungary at "BBB", revised outlook to "Stable" from "Negative"