- APAC stocks were mostly higher; Chinese official Manufacturing PMI and Caixin Manufacturing PMIs both topped forecasts

- US President-elect Trump demanded that BRICS nations commit to not creating a new currency to challenge the US dollar or they will face 100% tariffs

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -1.0% after the cash market closed higher by 1.0% on Friday

- USD is firmer vs. all major peers post-Trump tariff threat, JPY is the laggard across G10 FX

- Looking ahead, highlights include EZ Unemployment, US S&P manufacturing PMI, ISM Manuf. PMI & Construction Spending, Speakers including Fed’s Williams, Waller & ECB’s Lagarde

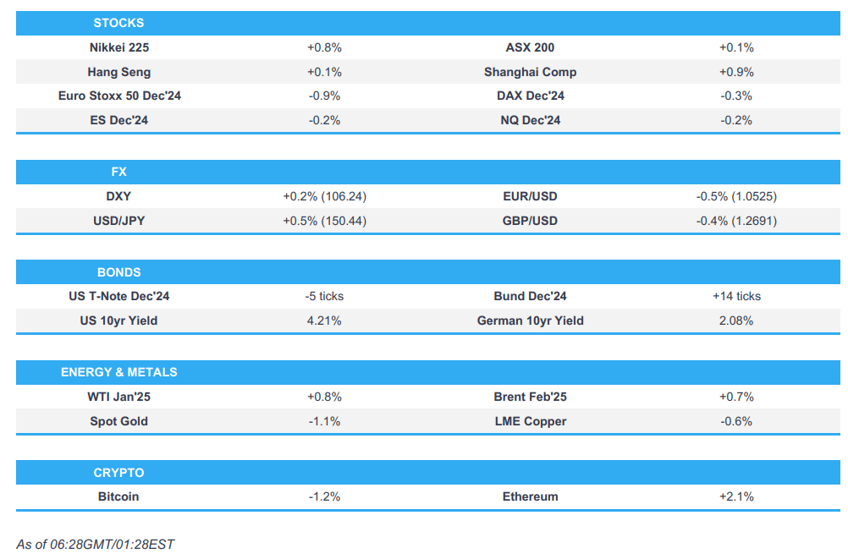

SNAPSHOT

US TRADE

EQUITIES

- US stocks closed in the green on Friday on what was a shortened trading session due to Thanksgiving on Thursday and with US newsflow light. Nonetheless, the sector breakdown saw Industrials, Tech and Consumer Discretionary outperform, while Utilities, Real Estate and Communication stocks lagged with headwinds in the latter amid Alphabet's (GOOG) underperformance following the Competition Bureau suing Google for alleged anti-competitive practices in online advertising.

- SPX +0.56% AT 6,032, NDX +0.90% AT 20,930, DJI +0.42% AT 44,911, RUT +0.35% AT 2,435.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President-elect Trump demanded that BRICS nations commit to not creating a new currency to challenge the US dollar or they will face 100% tariffs. Trump also stated that he had a very productive meeting with Canadian PM Trudeau and they discussed many important topics that will require both countries to work together to address such as fentanyl and the drug crisis, while they also spoke about many other important topics like energy, trade and the Arctic.

- US President Biden issued a pardon for his son Hunter Biden.

APAC TRADE

EQUITIES

- APAC stocks began the new trading month mostly higher as participants reflected on Chinese PMI data in which the official headline Manufacturing and Caixin Manufacturing PMIs both topped forecasts, while markets await a deluge of releases this week.

- ASX 200 eked mild gains with outperformance in tech making up for the slack in defensives and with data providing some encouragement.

- Nikkei 225 saw two-way price action but ultimately gained with the help of a weaker currency and encouraging Chinese data.

- Hang Seng and Shanghai Comp were varied with outperformance in the mainland following the latest Chinese PMI data including the official releases over the weekend which showed headline Manufacturing PMI topped forecasts but Non-Manufacturing PMI disappointed, while Caixin Manufacturing PMI surpassed the most optimistic analyst expectations and printed its highest since June.

- US equity futures (ES -0.2%) were marginally lower amid a stronger dollar and firmer yields, with participants bracing for the key data releases later this week culminating in the latest NFP report on Friday.

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -1.0% after the cash market closed higher by 1.0% on Friday.

FX

- DXY strengthened following US President-elect Trump's latest tariff threat over the weekend in which he demanded that BRICS nations commit to not creating a new currency to challenge the US dollar or they will face 100% tariffs. Furthermore, Trump also said he had a productive meeting with Canadian PM Trudeau, while looking ahead, there is a slew of data releases this week including the latest NFP jobs data on Friday.

- EUR/USD was pressured amid the firmer dollar and political uncertainty in France where French PM Barnier's government faces a potential collapse after the far-right National Rally's Marine Le Pen gave Barnier until today to answer her demands and amend his government's budget plans, while Le Pen updated on Sunday that the government effectively "put an end to discussions" on the country's 2025 budget.

- GBP/USD slipped back beneath the 1.2700 handle owing to the stronger buck and amid a lack of UK-specific catalysts.

- USD/JPY recouped last Friday's losses and returned to the 150.00 handle amid marginally firmer US yields and the positive risk tone. Antipodeans were subdued amid headwinds from the advances in USD albeit with losses in AUD/USD stemmed after a deluge of data releases including better-than-expected Australian Building Approval and Retail Sales.

- PBoC set USD/CNY mid-point at 7.1865 vs exp. 7.2384 (prev. 7.1877).

FIXED INCOME

- 10yr UST futures trickled lower in a pullback from the 111.00 level and with yields slightly higher following Trump's latest tariff threat.

- Bund futures took a breather and remained afloat after recently climbing to its highest level in around 2 months.

- 10yr JGB futures remained subdued after Friday's after-hours retreat with money markets leaning towards the BoJ resuming hiking rates at this month's meeting.

COMMODITIES

- Crude futures were marginally higher and regained some slight composure after Friday's whipsawing but with gains capped amid a lack of oil-specific newsflow and as markets look ahead to the OPEC+ meeting later this week.

- Polish pipeline operator PERN said pumping on a damaged branch of the Druzhba pipeline was immediately stopped and the cause of the incident is not known, while it noted that supply is fully ensured through the second branch of the pipeline.

- Spot gold retreated alongside early dollar strength following US President-elect Trump's BRICS tariff threat.

- Copper futures were pressured and have failed to take advantage of the better-than-expected Chinese NBS & Caixin Manufacturing PMIs.

CRYPTO

- Bitcoin was mildly lower with initial gains reversed on a pullback from overnight resistance at the USD 99,000 level.

NOTABLE ASIA-PAC HEADLINES

- US will add roughly a dozen Chinese toolmakers plus their subsidiaries and affiliates to the Commerce Department’s restricted trade list, while it will expand its powers to curb exports of certain chipmaking equipment made in places including Malaysia, Singapore, Taiwan, and Israel, according to sources cited by Reuters.

- BoJ Governor Ueda said on Friday that the timing of the next interest rate hike was "approaching" as the economy was moving in line with the central bank's forecasts and noted that yen weakness will be a risk to the outlook if the currency falls further after inflation starts rising, while he added the BoJ is to focus on wages and other areas when deciding whether to hike interest rates, according to Nikkei.

- Japan reportedly wants to lift GPIF real investment return target to 1.9% from 1.7%, according to Bloomberg.

DATA RECAP

- Chinese Manufacturing PMI 50.3 vs Exp. 50.2 (Prev. 50.1)

- Chinese Non-Manufacturing PMI 50.0 vs Exp. 50.4 (Prev. 50.2)

- Chinese Composite PMI 50.8 (Prev. 50.8)

- Chinese Caixin Manufacturing PMI Final (Nov) 51.5 vs. Exp. 50.5 (Prev. 50.3)

- Australian Building Approvals (Oct) 4.2% vs. Exp. 1.5% (Prev. 4.4%)

- Australian Retail Sales MM Final (Oct) 0.6% vs. Exp. 0.4% (Prev. 0.1%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu told the mother of a hostage that conditions are ready to complete a deal in Gaza after the end of the war in the north, according to Israel's Channel 12 cited by Sky News Arabia. It was also reported that Netanyahu decided to hold a security discussion on Sunday evening with the aim of reaching a deal in Gaza, while the security service warned the government that the army's continued dismantling of Hamas could lose control of the hostages, threatening their return due to the chaos.

- Israeli Foreign Minister said there are signs of progress on a deal with Hamas in light of flexibility that arose after the settlement in Lebanon, while the Israel Broadcasting Corporation reported that Hamas still insists that any agreement must ensure an end to the war, according to Sky News Arabia.

- Israel’s military said sirens sounded in a number of areas in central Israel following a launch from Yemen.

- UNRWA chief said aid delivery through the Israeli-controlled Kerem-Shalom crossing was paused due to an unsafe route and looting by armed gangs inside Gaza.

- Syrian opposition forces have taken control of much of the country’s second-largest city Aleppo, while rebel forces said all of Idlib province is under rebel control.

- Syrian and Russian air forces stepped up strikes on the positions of Syrian rebels and their supply lines with scores reportedly killed and injured, according to TASS citing the Syrian army.

- US-led international coalition forces launched two airstrikes against the positions of Iran-aligned forces in the suburbs of Syria’s Mayadeen, according to Syrian television cited by Iran International.

- Iran’s Foreign Ministry condemned aggression against its embassy in Aleppo and said all consulate members are safe, while the Iranian and Russian Foreign Ministers voiced support for Syria in confronting terrorist groups. Furthermore, the Iranian Foreign Minister said rebel attacks in Syria are part of an Israeli-US plan to destabilise the region.

- Turkey’s Foreign Minister spoke with US Secretary of State Blinken and discussed Syria, while the Turkish official also discussed Syria with his Iraqi counterpart.

RUSSIA-UKRAINE

- Ukrainian President Zelensky met with EU Council President Costa in Kyiv, while he said a NATO invitation is necessary for survival and that Ukraine will never recognise Russian occupation of its territory.

- White House National Security Adviser said the idea of returning nuclear weapons to Ukraine is not under consideration.

OTHER

- US State Department said it suspended the strategic partnership with Georgia and regrets Georgia’s decision to suspend EU accession. It was separately reported that Russian Security Council Deputy Chairman Medvedev said an attempted revolution is happening in Georgia and that Georgia is moving along the Ukrainian path into the abyss.

- China’s government said the Foreign Ministry lodged stern representations with the US over Taiwan President Lai’s Hawaii stopover and they are firmly opposed to Taiwan leaders transiting the US for any reason. China’s Foreign Ministry also lodged stern representations with the US over weapons sales to Taiwan and said it will take resolute countermeasures regarding the arms sale.

- Philippines President Marcos said the reported presence of a Russian submarine in the South China Sea is very concerning and any intrusion into the Philippine maritime zone is very worrisome.

EU/UK

NOTABLE HEADLINES

- ECB's Lane said while inflation had fallen close to the ECB’s target of 2%, there is a little bit of distance to go and while data dependence falls down in priority, the new challenge would be assessing the incoming risks on a meeting-by-meeting basis. Lane said the focus on the latest economic data will ebb and monetary policy decisions at some point in the future need “to be driven by upcoming risks rather than being backward-looking”. Furthermore, he said services inflation needs to come down further and at some point, there will be a transition from addressing the disinflation challenge to the new challenge of keeping inflation at 2%, according to FT.

- French far-right figurehead Marine Le Pen said on Sunday that the government effectively "put an end to discussions" on the country's 2025 budget, which increases the likelihood of a vote of no confidence in PM Barnier, according to France 24.

- S&P affirmed France at AA-; Outlook Stable, while Moody’s affirmed Hungary at Baa2; Outlook revised to Negative from Stable.

DATA RECAP

- UK Lloyds Business Barometer (Nov) 41 vs Exp. 40 (Prev. 44)