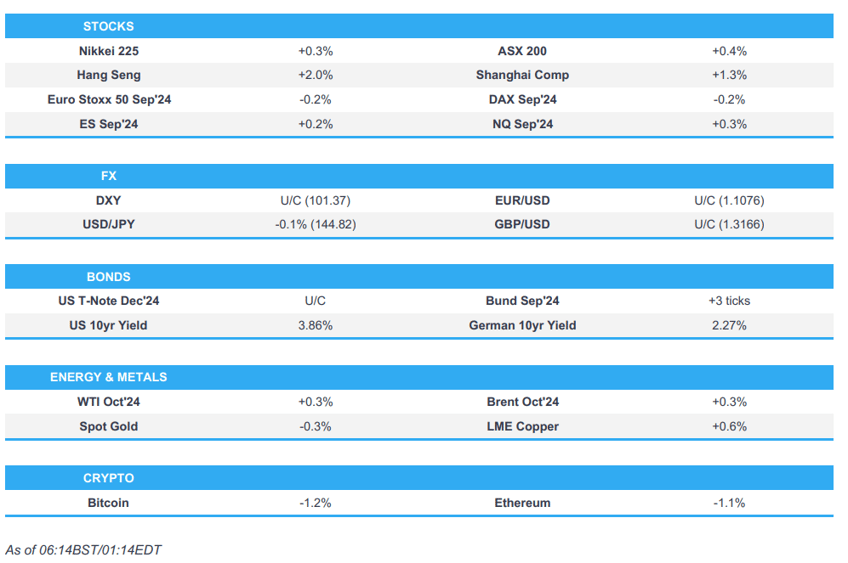

- APAC stocks traded higher across the board despite a lack of fresh catalysts following a mixed lead from Wall Street, and ahead of US PCE and the US long weekend.

- DXY traded within a very narrow range, EUR and GBP were uneventful, while JPY held a firmer bias after the Tokyo CPI surprisingly ticked higher.

- Fixed income futures diverged slightly overnight, with USTs flat ahead of PCE, Bunds faded gains pre-EZ CPI, and JGBs softer after Tokyo CPI.

- European equity futures are indicative of a softer open, with the Euro Stoxx 50 future -0.2% after cash closed +1.1% on Thursday.

- Looking ahead, highlights include German Trade, Retail Sales, French CPI, Spanish Retail Sales, EZ CPI, Italian CPI, US PCE, and ECB’s Schnabel.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed mixed after a late-trade tech sell-off unwound earlier gains, with NVIDIA extending on losses while some of the large-cap names propping up the indices earlier (TSLA, GOOGL, MSFT) waned off highs.

- SPX flat at 5,592, NDX -0.13% at 19,325, DJIA +0.59% at 41,335, RUT +0.66% at 2,203

- Click here for a detailed summary.

NOTABLE HEADLINES

- Apple (AAPL) is reportedly in talks to join the OpenAI funding round, according to WSJ citing sources. Nvidia (NVDA) has reportedly held discussions about joining the OpenAI funding round, according to Bloomberg.

- OpenAI (MSFT) said ChatGPT usage has doubled since last year, adding there are over 200mln weekly active ChatGPT users, according to Axios.

- Intel (INTC) is said to mull splitting off foundry and scrapping factory projects; explores options with Goldman Sachs (GS) and Morgan Stanley (MS), according to Bloomberg sources.

- US Democratic Presidential Candidate Harris said prices are still too high and added she will not ban fracking as President, via CNN

- US Republican Presidential candidate Trump said he would make government or insurance companies pay for all costs associated with IVF treatments if elected, according to Reuters.

- Fitch affirmed US at AA+; Outlook stable

APAC TRADE

EQUITIES

- APAC stocks traded higher across the board despite a lack of fresh catalysts following a mixed lead from Wall Street, and ahead of US PCE and the US long weekend.

- ASX 200 remained in a narrow range (8,045.10-8,085.00) but was propped up by its Industrials, Energy, and Gold names.

- Nikkei 225 traded firmer following a choppy start after August Tokyo core CPI surprisingly ticked higher, whilst the Japanese unemployment rate surprisingly rose.

- Hang Seng and Shanghai Comp opened with modest gains and eventually soared despite a lack of newsflow, whilst Bloomberg suggested the CSI 300 rallied amid heavy volume. Sentiment in China could've also seen tailwinds from the PBoC yesterday suggesting it will step up counter-cyclical adjustments and will strengthen financial support to the real economy, whilst the mood was further lifted amid Bloomberg reports China reportedly mulls allowing refinancing on USD 5.4tln in mortgages.

- US equity futures held a mild upward bias amid light newsflow and in the run-up to the US PCE today, whilst US traders will be away on Monday on account of Labor Day.

- European equity futures are indicative of a softer open with the Euro Stoxx 50 future -0.2% after cash closed +1.1% on Thursday.

FX

- DXY traded within a very narrow range in quiet newsflow ahead of US PCE. The Dollar index resided within 101.31-41 bounds and well within yesterday's 100.88-101.58 range.

- EUR/USD was uneventful in the run-up to EZ Flash CPI for August, although from a policy perspective, a September ECB rate cut is fully priced with a total of ~64bps of easing seen by year-end at the time of writing. EUR/USD traded in a narrow 1.1070-1.1083 range vs yesterday's 1.1054-1.1139 parameter.

- GBP/USD saw sideways trade with little on the UK docket ahead to close the week. GBP/USD sat in a 1.3159-1.3171 range and inside yesterday's 1.3142-1.3227 range.

- USD/JPY was slightly softer as the JPY saw incremental gains against G10 counterparts following the unexpected rise in Tokyo CPI. USD/JPY remained in a relatively narrow 144.65-145.07 parameter (vs 144.21-145.55 on Thursday).

- Antipodeans experienced a slight divergence with the Kiwi initially buoyed by data, albeit with modest gains which later faded. AUD/USD traded flat for most of the session with no reaction to the Aussie Retail Sales revision lower.

- Yuan saw modest late strength following reports that China reportedly mulls allowing refinancing on USD 5.4tln in mortgages.

- PBoC set USD/CNY mid-point at 7.1124 vs exp. 7.1116 (prev. 7.1299)

FIXED INCOME

- 10-year UST futures saw horizontal trade in APAC hours after fading yesterday's European strength on the upward US GDP revision and in-line Jobless Claims data, with traders looking ahead to PCE.

- Bund futures held a mild upward bias for most of the session ahead of EZ Flash CPI data - futures meandered just under 134.00 before encountering resistance, but the contract remained within yesterday's 133.79-134.49 parameter.

- 10-year JGB futures were softer with weakness seen at the open in reaction to the above-forecast Tokyo CPI metrics.

- US sells USD 44bln in 7yr notes; Tail 0.9bps. High Yield: 3.770% (prev. 4.162%, six-auction average 4.386%); WI 3.761%. Tail: 0.9bps (prev. -0.4bps, six-auction avg. -0.1bps). Bid-to-Cover: 2.50x (prev. 2.64x, six-auction avg. 2.55x). Dealers: 13.72% (prev. 8.9%, six-auction avg. 13.3%). Directs: 11.19% (prev. 16.8%, six-auction avg. 17.4%). Indirects: 75.09% (prev. 74.4%, six-auction avg. 69.2%).

COMMODITIES

- Crude futures held a mild upward bias following yesterday's gains facilitated by supply updates from Libya and Iraq, whilst updates during APAC hours were quiet.

- Spot gold was uneventful amid a steady Dollar and ahead of US PCE, with the APAC range between USD 2,514.96-2,521.58/oz (vs USD 2,503.43-2,528.55/oz on Thursday).

- Copper futures saw modest gains and within tight ranges amid a lack of newsflow and ahead of tier 1 data from the US and Eurozone, with 3M LME copper towards the upper end of a USD 9,256.50-9,308.50/t APAC range.

- Iraq's PM stressed, in a meeting with OPEC Sec Gen, Iraq's commitment to OPEC countries' plans for oil output policies or what is determined within the framework of the OPEC+ agreement, according to Reuters.

- Libya's NOC said total losses of oilfield closures in three days at 1.505mln bbls, worth around USD 120mln; the Country's average oil output on Wednesday was at 591k BPD.

- OPEC Sec Gen concludes successful missions to Iraq and Kazakhstan; both reaffirmed their unconditional commitment to the compensation plans as agreed under the framework.

- Liberian Environmental Protection Agency said China Union's iron ore Bong Mines is shut down for several environmental violations, according to Reuters.

CRYPTO

- Bitcoin was steady overnight on either side of USD 59k.

- Elon Musk and Tesla (TSLA) win dismissal of lawsuit claiming they rigged Dogecoin (DOGE)

NOTABLE ASIA-PAC HEADLINES

- China reportedly mulls allowing refinancing on USD 5.4tln in mortgages, according to Bloomberg.

- Acer (2353 TW) reportedly plans to sharply increase shipments of computers equipped with AI features; will raise the share of copilot+ PCs among deliveries to 40% by Q3 2025, according to Nikkei.

- Japanese government official on industrial output, said if output falls short of plans, August production could fall M/M. September is expected to fall M/M on lower production of semiconductor production equipment and electronic component devices, although the assessment is revised upward, need to be vigilant about the outlook. The official added that the impact of Typhoon Shanshan was not taken into account in August data.

- PBoC injected CNY 30.1bln via 7-day Reverse Repo at a maintained rate of 1.70%.

DATA RECAP

- ANZ Roy Morgan New Zealand Consumer Confidence Index (Aug) 92.2 (Prev. 87.9)

- New Zealand Building Consents (Jul) 26.2% (Prev. -13.8%, Rev. -17.0%)

- South Korean Industrial Output Growth (Jul) -3.6% vs. Exp. -0.4% (Prev. 0.5%); marks the fastest fall since Dec 2022

- South Korean Industrial Output YY (Jul) 5.5% vs. Exp. 7.0% (Prev. 3.8%)

- Japanese CPI Tokyo Ex fresh food YY (Aug) 2.4% vs. Exp. 2.2% (Prev. 2.2%)

- Japanese CPI, Overall Tokyo (Aug) 2.6% (Prev. 2.2%)

- Japanese Unemployment Rate (Jul) 2.7% vs. Exp. 2.5% (Prev. 2.5%)

- Japanese Jobs/Applicants Ratio(Jul) 1.24 vs. Exp. 1.23 (Prev. 1.23)

- Japanese Retail Sales YY (Jul) 2.6% vs. Exp. 2.9% (Prev. 3.7%, Rev. 3.8%)

- Japanese Industrial O/P Prelim MM SA (Jul) 2.8% vs. Exp. 3.3% (Prev. -4.2%)

- Japanese IP Forecast 2 Mth Ahead (Sep) -3.3% (Prev. 0.7%)

- Japanese IP Forecast 1 Mth Ahead (Aug) 2.2% (Prev. 6.5%)

- Australian Retail Sales MM Final * (Jul) 0.0% vs. Exp. 0.3% (Prev. 0.5%)

- Australian Private Sector Credit (Jul) 0.5% (Prev. 0.6%)

- Australian Housing Credit (Jul) 0.5% (Prev. 0.4%)

CENTRAL BANKS

- ECB's Nagel said while the 2% target is in sight, we have not reached it. He noted there is a risk that a somewhat stronger economic recovery could further delay the return to target. Nagel said a timely return to price stability cannot be taken for granted, and the ECB needs to be careful, and must not lower policy rates too quickly.

- SNB's Jordan said the mandate of the SNB is to maintain price stability, a crucial precondition for society and a good functioning country. He noted the weak Euro area is hurting demand for Swiss exports. The exchange rate makes the situation difficult for the Swiss industry, which is already dealing with weak demand in Europe, according to Reuters.

GEOPOLITICS

- "Lebanese sources: Israeli raids on different areas in southern Lebanon", according to Sky News Arabiya.

- Missile attack launched on US military base in eastern Syria, according to IRNA.

- There is now a planned call at the theatre commander level between the US and China, according to Fox's Heinrich. "It comes after China bristled at US Indo-Pacific Command's Adm. Paparo suggesting this week US forces could escort Philippine ships through the South China Sea, following a months-long series of violent confrontations between Chinese and Philippine ships".