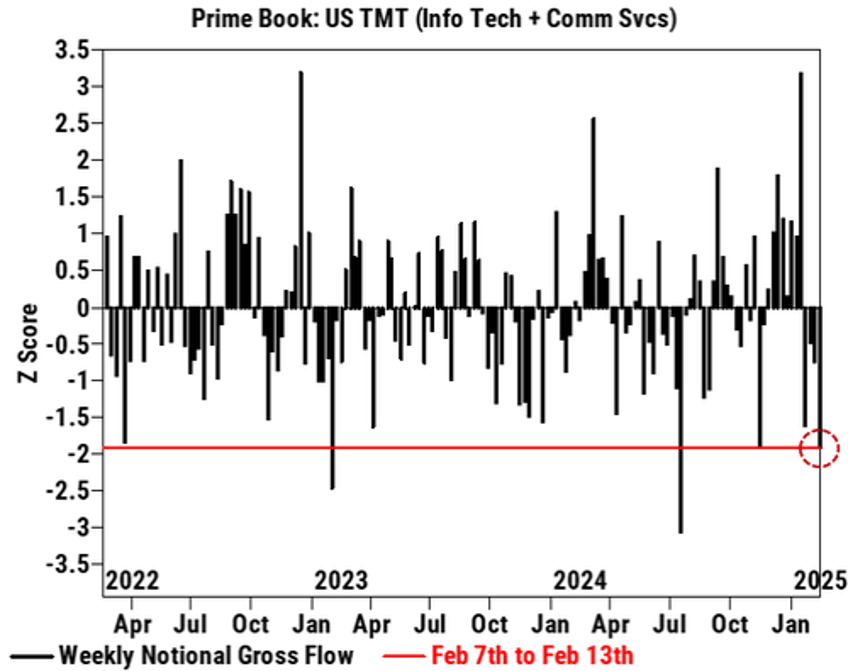

One week ago we noted that hedge fund sentiment hard-reversed again, and after breaking a streak of 5 consecutive weeks of selling with a week of solid buying the week prior, last week saw a fresh spike in notional de-grossing in US Tech/Media/Telecom (TMT) which was the largest since July ’24 and ranked in the 98th percentile vs. the past five years (and just ahead of the tech rout that would follow).

Fast forward one week to this weekend, when we find in the latest Goldman Equities Weekly Rundown note (as always must read, and as always available to pro subs) that hedge funds did little of note across the broader market of single stocks in the past week (i.e., "there was little net activity, driven by risk unwinds with short covers slightly outpacing long sales. Industrials, Staples, Materials, and Energy were the most notionally net bought sectors, while Consumer Disc and to a lesser extent Health Care were among the most net sold") as the retail euphoria finally cracked and the momentum stocks lifted to nosebleed levels by retail traders finally crashed (as described in Retail Favorite Momentum Names Are Crashing: Here's One Reason Why), but more notably, the renewed bearishness across tech accelerated and in the latest week, "hedge funds aggressively unwound longs in TMT stocks (Info Tech + Comm Svcs) for a second straight week, driven by long sales as well as short covers."