- APAC stocks were ultimately mixed with price action somewhat choppy following the similar performance stateside.

- US President Trump responded "We'll see" when asked if reciprocal tariffs are still coming on Wednesday.

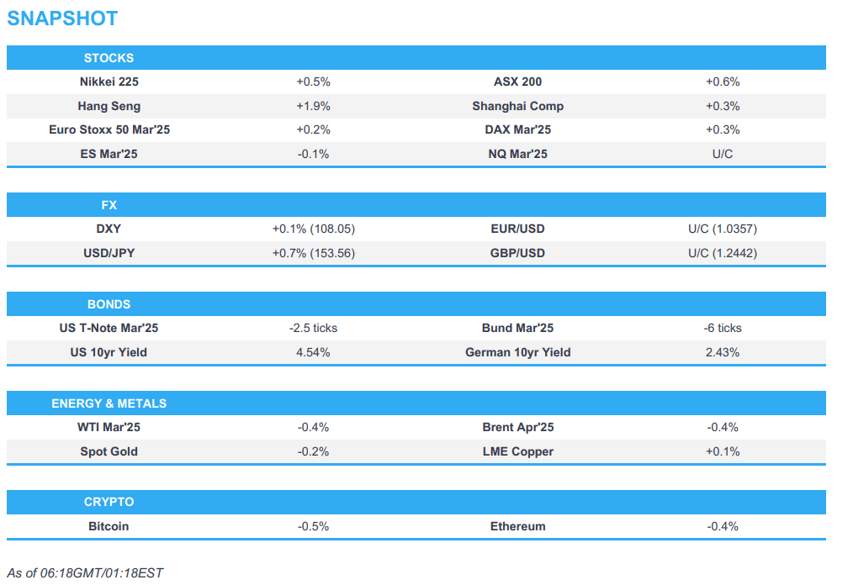

- European equity futures indicate a marginally positive cash market open with Euro Stoxx 50 future up 0.2% after the cash market closed with gains of 0.6% on Tuesday.

- FX markets are broadly steady asides from JPY which is the standout laggard across the majors.

- Looking ahead, highlights include US CPI, OPEC MOMR, BoC Minutes, ECB’s Elderson, Fed Chair Powell, Bostic, Waller & BoE’s Greene, Supply from UK, Germany & US

- Earnings from Vertiv, CVS, Barrick Gold, Biogen, Reddit, AppLovin, Robinhood, Heineken, ABN AMRO, Barratt, Redrow, Siemens Energy, Michelin & EssilorLuxottica.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished mixed as overnight weakness following President Trump's steel and aluminium tariffs pared to see the SPX close flat, NDX & RUT down and DJIA up. Sectors were also varied with outperformance in Consumer Staples after strong Coca-Cola (KO) earnings and with strength seen in Energy and Materials. Conversely, Consumer Discretionary was hit as TSLA shares tumbled after Musk announced an apparent bid for OpenAI, while Healthcare and Communications also underperformed.

- SPX +0.03% at 6,069, NDX -0.29% at 21,694, DJIA +0.28% at 44,594, RUT -0.53% at 2,276.

- Click here for a detailed summary.

TARIFFS

- US President Trump responded "We'll see" when asked if reciprocal tariffs are still coming on Wednesday.

- White House said 25% steel tariffs would stack on other levies, according to Canadian press cited by Reuters.

- Japanese Industry Minister Muto said they requested the US to exclude Japan from steel and aluminium tariffs, while Finance Minister Kato said they will assess the impact of US tariffs on the Japanese economy and respond appropriately.

NOTABLE HEADLINES

- Fed Chair Powell said the overall aggregate numbers on the economy are very good and what people are feeling is the results of several years of inflation, with low- and moderate-income people feeling very strapped which is another reminder of how bad high inflation is and furthers the Fed's resolve to get it down to 2%.

- Fed's Williams (Vice Chair) said monetary policy is well positioned to achieve Fed goals and the US economy is in a good place, while inflation expectations are well anchored and the US unemployment rate should stay between 4% to 4.25%. Williams also stated that the US is to grow by around 2% this year and next, while inflation is to hang around 2.5% this year and 2% in the coming years. Furthermore, Williams said it is hard to determine if uncertainty is weighing on the economy, as well as noted that monetary policy is where it should be and monetary policy remains appropriately restrictive.

- US President Trump's advisers reportedly eye bank regulator consolidation and are said to discuss consolidating bank regulators' OCC and FDIC, according to WSJ. In relevant news, the White House plans to nominate Jonathan McKernan to lead the CFPB full-time and Jonathan Gould to lead the OCC, according to Punchbowl.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed with price action somewhat choppy following the similar performance stateside in the aftermath of Trump's recent tariff announcements and with US CPI data on the horizon.

- ASX 200 traded higher as strength in the top-weighted financial sector and the industrials atoned for the losses in tech, while participants digested key earnings releases including from Australia's largest bank and most valuable company, CBA.

- Nikkei 225 advanced on return from yesterday's holiday closure amid recent currency weakness but momentarily pared all of its gains amid rising yields and tariff-related uncertainty.

- Hang Seng and Shanghai Comp were varied with outperformance in Hong Kong led by strength in tech stocks including Alibaba after reports that Apple partnered with Alibaba to develop AI features for iPhone users in China, while SMIC benefitted after it posted stronger-than-expected revenue and guided revenue growth. Conversely, the mainland was contained with price action choppy amid ongoing trade frictions and the PBoC's liquidity effort.

- US equity futures (ES -0.1%, NQ U/C) struggled for direction following the mixed close on Wall St and ahead of the US inflation data.

- European equity futures indicate a marginally positive cash market open with Euro Stoxx 50 future up 0.2% after the cash market closed with gains of 0.6% on Tuesday.

FX

- DXY traded rangebound but got some respite after weakening yesterday despite US President Trump announcing the imposition of 25% tariffs on all steel and aluminium coming into the US effective on March 12th, with the month-long wait seen as a negotiating period and the actual tariffs potentially a negotiating tactic. There was also attention on Fed comments including from Powell who gave his semi-annual testimony to the Senate although his remarks largely echoed recent commentary and noted the Fed is not in a rush to move on policy, while participants now look ahead to the incoming US CPI data scheduled later today.

- EUR/USD held on to the prior day's spoils with a firm footing at the 1.0300 handle after benefitting from dollar weakness.

- GBP/USD remained afloat after it recently outperformed its G10 counterparts following comments by BoE's Mann who gave her reasoning behind her dovish dissent at the last meeting but noted her “active rate policy does not mean cut, cut, cut" and suggested she may not opt for another 50bps cut at the next meeting.

- USD/JPY continued its advances and breached the 153.00 level to the upside after yesterday's haven underperformance.

- Antipodeans attempted to extend on recent gains but with the upside capped amid light catalysts and a quiet calendar.

- PBoC set USD/CNY mid-point at 7.1710 vs exp. 7.2971 (prev. 7.1716).

FIXED INCOME

- 10yr UST futures remained subdued after retreating yesterday as participants digested Trump's tariff announcement, Fed Chair Powell's comments and supply, while demand was also hampered as participants awaited the incoming US CPI data.

- Bund futures languished at a weekly low after recently slumping beneath the 133.00 level, with Bund supply due later.

- 10yr JGB futures were mildly pressured at sub-140.00 territory as Japanese yields continued their gradual advances and with prices not helped by a weaker-than-previous 10-year inflation-indexed JGB auction.

COMMODITIES

- Crude futures marginally pulled back after advancing yesterday on tariff escalation and geopolitical risk, while the latest private sector inventory data was mixed but showed a much larger-than-expected build in headline crude stockpiles

- Private inventory data (bbls): Crude +9.0mln (exp. +3.0mln), Distillates -0.6mln (exp. -1.5mln), Gasoline -2.5mln (exp. +1.4mln), Cushing +0.4mln.

- US Energy Secretary Wright said oil output can grow 'meaningfully' and the US is focused on reducing the cost to produce oil, while he added the US needs a ‘robust’ strategic oil reserve and is seeking to stop the closure of coal-fired power plants.

- EIA STEO (Feb) noted that 2025 world oil demand is seen at 104.1mln BPD (prev. saw 104.1mln BPD), while 2026 demand is seen at 105.2mln BPD (prev. 105.1mln BPD).

- EU considers a temporary gas price cap to counter diverging costs with the US, although the proposal has spurred backlash from the industry which warned it could damage trust, according to FT.

- Spot gold lacked demand and trickled further beneath the USD 2,900/oz level after retreating from record highs.

- Copper futures were choppy with price action rangebound amid the somewhat flimsy risk sentiment.

CRYPTO

- Bitcoin marginally declined following its recent retreat below the USD 96,000 level.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said they will conduct monetary policy appropriately to achieve the 2% target and will monitor the impact of US tariff and immigration policies. Ueda said the pace of monetary adjustment should depend on economic situations and he is aware that rising inflation, including fresh foods, is having a negative impact on households, while he he added there could be risks that rising prices of fresh foods may not be temporary and could affect people's sentiment.

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said if Hamas does not return hostages by Saturday noon, the ceasefire will end and the military will return to intense fighting until Hamas is finally defeated. It was also reported that Israeli PM Netanyahu ordered the army to boost troops in and around Gaza.

- US President Trump said when asked about Israeli annexation of the West Bank that it is going to work out with the US to run Gaza very properly and is not going to buy it. Furthermore Trump thinks there will be parcels of land in Jordan and in Egypt where Palestinians will live and does not think Hamas will make the Saturday deadline for the hostage release.

- US Secretary of State Rubio says if Hamas does not abide by the agreement by Saturday, he thinks Israel will intervene again, while he added that Trump wants to get all detainees out of the Gaza Strip at once and that Hamas violates the ceasefire agreement in the Gaza Strip, according to Asharq News.

- Egypt plans to offer a comprehensive proposal to rebuild Gaza while ensuring Palestinians remain on their land and looks forward to cooperating with US President Trump to achieve a comprehensive and just peace in the region. Egypt also affirmed the rejection of any proposal to allocate land to Gaza residents.

- Iran's UN envoy alerted the UN Security Council to "deeply alarming and irresponsible" remarks by US President Trump threatening the use of force and said the statements flagrantly violate international law. The envoy rejected and condemned Trump’s threat, as well as noted the UN Security Council must not remain silent. Furthermore, Iran warned that any act of aggression will have severe consequences for which the US will bear full responsibility.

RUSSIA-UKRAINE

- Ukrainian President Zelensky stated in a recent interview with AFP that he is willing to swap Russian territory captured by Ukraine in the Kursk region for Ukrainian territory captured by Russia in the east in a negotiated peace settlement to end the ongoing war.

- Russian air attack sparked fires in two Kyiv districts, according to the head of Kyiv's military administration. Furthermore, Ukrainian President Zelensky's aide said Russia carried out a missile strike on Kyiv, while the city mayor said emergency services were called to several districts.

- US President Trump said on Truth that he will send US Treasury Secretary Bessent to Ukraine to meet Zelensky, while he added the war must end and will end soon. It was separately reported that White House National Security Adviser Waltz said they are moving in the right direction to end the brutal and terrible war in Ukraine.Russia released a US prisoner after talks with Trump's envoy, while President Trump later commented that Russian President Putin got very little in return for the hostage release and called it a fair deal. Furthermore, Trump said somebody else will be released tomorrow who is well known and he thinks there is goodwill regarding the war, as well as appreciates what Putin did.

- Polish armed forces said a Russian military jet intruded into Polish airspace on Tuesday.

OTHER

- US Navy confirmed two US warships carried out a north-to-south Taiwan Strait transit and said it was routine, while China's military organised its naval and air force to monitor US ships crossing the Taiwan Strait from Feb. 10th-12th.

- China's Taiwan Affairs Office said it resolutely opposes and will never allow any foreign interference, while it has full confidence and sufficient ability to safeguard national sovereignty and territorial integrity. It also said the US should prudently and properly handle Taiwan-related issues and not send wrong signals to independence separatist forces.

- China's Coast Guard conducted a 'rights defence' patrol in the 'territorial waters' of the Diaoyu/Senkaku Islands on Wednesday, according to state media.

- The first conversation between European Commission President von der Leyen and US VP JD Vance yesterday was said to be "very constructive" and focused on areas where interests aligned, according to sources cited by the FT

EU/UK

NOTABLE HEADLINES

- ECB's Schnabel said uncertainty in trade has risen dramatically.

- UK Chancellor Reeves has wiped out the GBP 9.9bln headroom she left herself to borrow and may be forced to raise income tax to cover the cost of any future shocks, economists cited by The Telegraph have warned.