- APAC stocks were mostly subdued after the indecisive lead from the US where geopolitics and Nvidia earnings were in the spotlight.

- NVIDIA was lower by 2.5% after hours despite top and bottom line beats; concerns cited over production levels and slowing growth rates.

- European equity futures are indicative of a slightly firmer cash open with the Euro Stoxx 50 future +0.3% after the cash market closed lower by 0.5% on Wednesday.

- DXY has taken a breather from recent advances, JPY is attempting to nurse losses vs. the USD, EUR/USD sits around 1.0550.

- Looking ahead, highlights US Jobless Claims, Philly Fed Index, US Existing Home Sales, CBRT & SARB Policy Announcement, ECB’s Villeroy, Cipollone, Patsalides, Lane, Elderson & Holzmann, Fed’s Hammack, Goolsbee & Barr, SNB’s Tschudin & Moser, RBA Governor Bullock & BoE's Mann, Supply from Spain, France, US & UK.

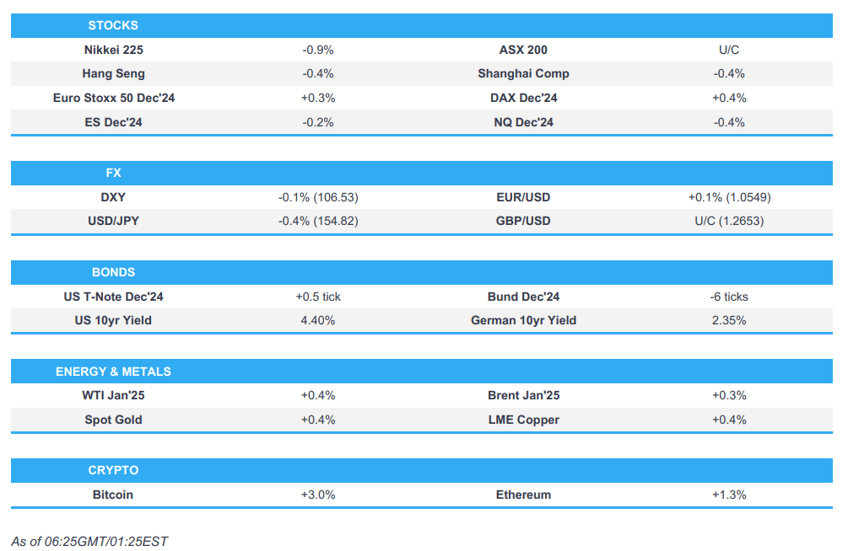

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks ultimately closed mixed with markets choppy amid geopolitical headlines on a data-light day and as participants awaited Nvidia earnings after-hours, while there was a late rally into the closing bell which helped the major indices finish off their worst levels. However, futures then saw mild two-way price action after-hours amid fluctuations in Nvidia post-earnings despite the AI darling beating on its top and bottom lines.

- SPX +0.00% at 5,917, NDX -0.09% at 20,667, DJIA +0.32% at 43,408, RUT +0.03% at 2,326.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed Governor Bowman (voter) said the Fed should pursue a cautious approach on monetary policy and may be closer to neutral policy than policymakers currently think but noted that inflation remains a concern. Furthermore, Bowman noted concern they are recalibrating policy but have not reached the inflation goal, while she added the Fed needs to be flexible and needs to be patient and cautious about what the immigration policy approach will be.

- Fed's Collins (2025 voter) said some additional rate cuts are needed as policy is still restrictive but she doesn’t want to cut rates too quickly and warned that overly slow rate cuts could hurt the labour market. Collins also stated that the final destination of rate cuts is unclear and monetary policy is well positioned for the economic outlook, while she added monetary policy is not on a preset course and Fed policy decisions will be made meeting-by-meeting.

- Fed's Williams (voter) says sees inflation is cooling and interest rates falling further, adds 2% is the rate that can best balance the central bank's employment and price stability goals, according to Barron's

- Marty Makary is reportedly seen as the leading candidate for US President-elect Trump's FDA nomination, according to Bloomberg.

- US Justice Department proposed remedies in the Google (GOOG) search monopoly case and asked the judge to make Google divest its Chrome browser and said it should not be allowed to re-enter the browser market for five years, while the DoJ asked the judge to make Google divest its Android operating system if other remedies fail to restore competition. Furthermore, it asked the judge to order Google to syndicate search results and information to competitors for 10 years, while it seeks an end to Google's multibillion-dollar payments to Apple (AAPL) that ensure it is the default search engine on Apple devices and seeks to prohibit Google from buying or investing in any search rivals, query-based AI products, or ad tech.

- Nvidia Corp (NVDA) Q3 2025 (USD): Adj. EPS 0.81 (exp. 0.75), Revenue 35.08bln (exp. 33.12bln). Q3 adj. gross margin 75% (exp. 75%), Q3 adj. operating expenses USD 3.05bln (exp. 2.99bln), Q3 adj. operating income 23.28bln (exp. 21.9bln). Exec said Blackwell production continue to ramp into fiscal 2026; it will be shipping both Hopper and Blackwell in Q4 FY25; Blackwell production shipments to begin in Q4 FY25; said that Hopper and Blackwell systems have some supply constraints, but Blackwell to exceed supply for several quarters in FY26. Co. shares were lower by 2.5% after-hours.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued after the indecisive lead from the US where geopolitics and Nvidia earnings were in the spotlight.

- ASX 200 lacked firm direction amid weakness in the consumer-related sectors and after Westpac pushed back its forecast for when the RBA will begin cutting rates to May next year from a prior forecast of February.

- Nikkei 225 underperformed and tested the 38,000 level to the downside as the Japanese currency nursed some of its recent losses and despite a report that Japan is planning an economic package of around JPY 21.9tln.

- Hang Seng and Shanghai Comp were uninspired as participants digested recent earnings releases although support was seen in automakers after a MOFCOM official said they are planning the continuation of car trade-in incentives for next year to stabilise market expectations.

- US equity futures (ES -0.2%, NQ -0.3%) were slightly pressured in the aftermath of Nvidia's earnings which beat on the top and bottom lines but failed to underpin the Co. shares as the figures were beneath the analysts' top estimates and showed a slowing in sales growth.

- European equity futures are indicative of a slightly firmer cash open with the Euro Stoxx 50 future +0.3% after the cash market closed lower by 0.5% on Wednesday.

FX

- DXY took a breather and held on to most of the prior day's notable gains in thin macro newsflow and a light data docket so far this week, although there were several Fed speakers including Cook who kept the options open and stated that policy is not on a pre-set path. Furthermore, Bowman noted concern that the Fed is calibrating policy despite not reaching its inflation goal, while Collins said some additional rate cuts are needed as policy is still restrictive but she doesn’t want to cut rates too quickly and warned that overly slow rate cuts could hurt the labour market.

- EUR/USD regained some composure after sliding firmly beneath the 1.0600 level yesterday as it gave way to the firmer dollar and briefly approached near the 1.0500 level where support held. There were recent comments from ECB officials including from Stournaras who stated the ECB may increasingly need to avoid inflation undershoot but added that rates will stay restrictive for some time, while Thursday's calendar is also packed with an abundance of central bank rhetoric.

- GBP/USD remained lacklustre after failing to sustain a brief return to the 1.2700 territory in the aftermath of the firmer-than-expected UK inflation, which was overshadowed by the broad dollar strength.

- USD/JPY pulled back from this week's peak and retested the 155.00 level to the downside ahead of BoJ Governor Ueda's comments which proved to be a non-event as he spoke very little on monetary policy.

- Antipodeans eked mild gains in quiet trade and after the PBoC set a firmer-than-expected CNY reference rate setting but with the upside contained in the absence of any tier-1 releases and amid the overall lacklustre risk sentiment.

- PBoC set USD/CNY mid-point at 7.1934 vs exp. 7.2482 (prev. 7.1935).

FIXED INCOME

- 10yr UST futures traded flat with demand constrained by the absence of major catalysts and after a below-par US 20yr auction.

- Bund futures were indecisive and remained stuck around the 132.00 level following the recent choppy performance and Bund supply.

- 10yr JGB futures languished near contract lows with slight gains seen in domestic yields including the 5yr which rose to its highest since 2009, while there was little to spur demand and the results of the latest 20yr JGB auction were mixed.

COMMODITIES

- Crude futures were mildly higher in rangebound trade after the prior day's choppy performance amid mixed geopolitical headlines and with headwinds from the recent dollar strength.

- US President-elect Trump's team is reportedly planning to revive the Keystone XL oil pipeline, according to POLITICO.

- Spot gold mildly extended on this week's advances above the USD 2,600/oz level with the prices unfazed by the firmer buck.

- Copper futures struggled for direction amid the mixed risk appetite in the region and a lack of macro drivers.

CRYPTO

- Bitcoin extended on advances and climbed above the USD 97,000 level for the first time amid expectations of crypto-friendly policies.

- US President-elect Trump’s team is reportedly considering creating the first-ever White House crypto role, according to Bloomberg.

NOTABLE ASIA-PAC HEADLINES

- Four Chinese government advisers advocate for a 2025 growth target of around 5% which is similar to this year, while one adviser presses for a growth target of above 4% and another recommends a 4.5%-5% range, while advisers suggested a higher budget deficit could mitigate the impact of expected US tariffs, according to Reuters.

- China MOFCOM official said they are planning the continuation of car trade-in incentives for next year to stabilise market expectations.

- Chinese banks are seen cutting lending rates in 2025 but may leave lending rates unchanged next month, according to analysts cited by China Securities Journal.

- Japan reportedly plans an economic package of around JPY 21.9tln, according to NHK. It was later reported that Japanese Deputy Chief Cabinet Secretary Aoki said the LDP-led coalition is introducing measures to reflect DPP requests as much as possible.

GEOPOLITICS

MIDDLE EAST

- Israel conducted raids on southern suburbs of Beirut, according to Al Jazeera.

- Israeli air strikes on several houses in Beit Lahiya in the northern Gaza Strip killed and wounded dozens, according to medics.

- Lebanon’s Speaker of Parliament Berri and US Envoy Hochstein reached a positive conclusion to the implementation of Resolution 1701 after two weeks of contacts, while sources close to Berri said there is agreement on 80% of issues, according to Kann.

- Israeli press Yedioth Ahronoth noted that sensitive and final details of Lebanon's ceasefire agreement have yet to be resolved, but there is agreement on about 90% of the terms, according to Al Arabiya.

- US Senate blocked measures that would have halted sales of tank rounds and joint direct attack munitions to Israel.

EU/UK

NOTABLE HEADLINES

- BoE's Ramsden said October CPI data was only marginally above the BoE's forecast and one small miss on the inflation forecast does not change his assessment of the outlook. "Based on the evolving evidence a gradual approach to removing policy restraint does seem appropriate in keeping inflation close to the 2% target". If uncertainties around inflation persistence and the wider economy were to diminish and evidence point more clearly to further disinflationary pressures "then I would consider a less gradual approach to reducing Bank Rate to be warranted."

- ECB's Stournaras said ECB policy, in taming inflation, has been a success and he sees inflation converging to 2% by the start of 2025. Stournaras stated the ECB may increasingly need to avoid an inflation undershoot and rates will stay restrictive for some time, while he added that downside risks to EZ growth remain.

- ECB's Villeroy said inflation could sustainably be at 2% in early 2025 and the economy remains resilient, while stated that victory against inflation is in sight in Europe but added the balance of risks on growth and inflation is shifting to the downside. Villeroy said it is possible that US tariffs are not expected to alter significantly the inflation outlook in Europe and the degree of monetary policy restriction should continue to be reduced in which the pace must be determined by agile pragmatism, with full optionality maintained for upcoming meetings.