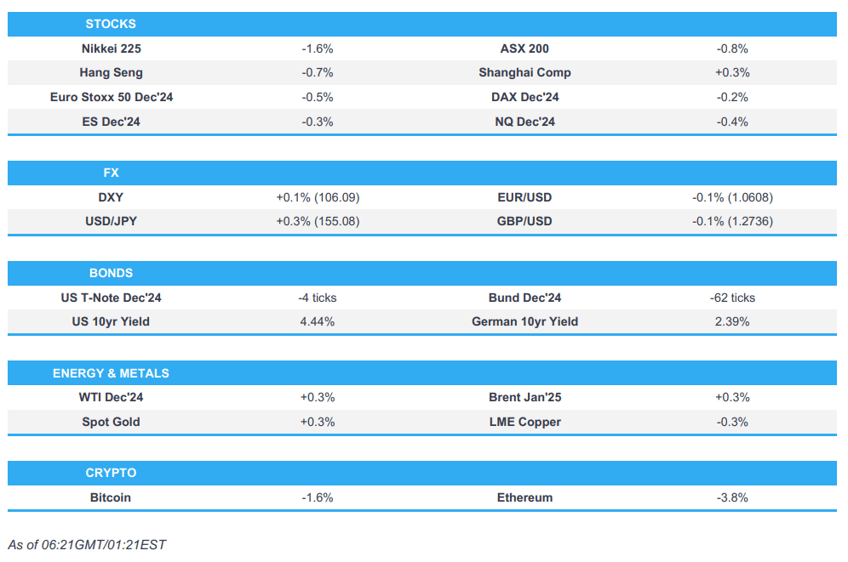

- APAC stocks were mostly subdued following the negative lead from the US alongside higher yields.

- European equity futures are indicative of a lower cash open with the Euro Stoxx 50 future -0.4% after the cash market closed lower by 2.3% on Tuesday.

- DXY remains above the 106 mark, USD/JPY has just crossed above the 155 level, EUR/USD sits just above 1.06.

- Bunds are lower, crude is marginally firmer, BTC has pulled back from its record high.

- Looking ahead, highlights include US CPI, EIA STEO, Speakers including Fed’s Logan, Williams, Musalem, Kashkari, Schmid & RBA’s Bullock, Supply from UK, Italy & Germany.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were lower on Tuesday in a slight pullback from record levels and cautiousness ahead of US CPI data with the small-cap Russell 2000 lagging as it gave back some of its recent strength post-US election, while sectors closed largely in the red with underperformance in Materials, Healthcare and Real Estate although there was some resilience in Communications, Technology, and Consumer Staples which were the only industries to finish higher. Elsewhere, the Dollar Index extended on its rally to its highest since May and Treasuries continued to sell off as yields climbed.

- SPX -0.29% at 5,984; NDX -0.17% at 21,071, DJI -0.86% at 43,911, RUT -1.77% at 2,392.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Kashkari (2026 Voter) said he does think growth can continue into next year and the economy has been remarkably resilient, according to Yahoo Finance. Kashkari said if inflation surprises to the upside between now and December, that might give us a pause, while his judgement is the Fed is currently 'moderately restrictive' and noted in hindsight, the Fed only put one foot on the brake instead of two.

- Fed's SLOOS stated regarding loans to businesses over Q3 that survey respondents reported on balance, basically unchanged lending standards for commercial and industrial (C&I) loans to large and middle-market firms and tighter standards for loans to small firms, while banks reported weaker demand for C&I loans to firms of all sizes.

- US President-elect Trump picked John Ratcliffe for CIA Director and will nominate Pete Hegseth for Defense Secretary, while it was also reported that Trump told allies he wants Robert Lighthizer as his trade czar. Furthermore, Trump said Elon Musk, working in conjunction with Vivek Ramaswamy, will lead the department of government efficiency and aim to dismantle government bureaucracy, slash excess regulations, cut wasteful expenditures, and restructure federal agencies.

- Business groups urged US President Biden to take decisive steps to ensure government chips funding is made available to recipients in the next 30 days.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued following the negative lead from the US amid higher yields and cautiousness ahead of US CPI data, while the region also digested a slew of earnings releases.

- ASX 200 was dragged lower by underperformance in the mining-related stocks and with the top-weighted financial industry also pressured in the aftermath of CBA's earnings which posted a flat Y/Y cash profit of AUD 2.5bln for Q1.

- Nikkei 225 retreated following the hotter-than-expected PPI data, while losses were initially stemmed by recent currency weakness and with Sharp and Tokyo Electron among the best performers post-earnings, although selling eventually worsened

- Hang Seng and Shanghai Comp were mixed amid light catalysts and as participants await Chinese tech earnings, while US President-elect Trump's first picks for his administration included China hawks such as Waltz, Rubio and Lighthizer, although he also named China-friendly Elon Musk to lead the department of government efficiency with Vivek Ramaswamy.

- US equity futures (ES -0.2%) were lacklustre after the recent pullback from record levels and as US CPI data looms.

- European equity futures are indicative of a lower cash open with the Euro Stoxx 50 future -0.4% after the cash market closed lower by 2.3% on Tuesday.

FX

- DXY took a breather after the continued strength yesterday which coincided with the upside in yields and eventually lifted the DXY back above 106.00 to print its highest level since May. There were several recent comments from Fed speakers although they had little impact on price action with Barkin suggesting a mixed view ahead on the labour market and inflation, while Kashkari said if inflation surprises to the upside between now and December, that might give them a pause.

- EUR/USD marginally softened but is off the prior day's lows with the currency helped by support at the 1.0600 level.

- GBP/USD remained stuck near a multi-month low beneath the 1.2800 handle after underperforming due to recent data.

- USD/JPY held on to the prior day's gains with a firm footing at the 154.00 handle and has just crossed above the 155 mark after the recent dollar strength and upside in US yields.

- Antipodeans were little changed with the upside contained by the mostly subdued risk appetite and after softer-than-expected Australian Wage Price Index for Q3, while a firmer-than-anticipated CNY reference rate setting provided some support for CNH but had little impact on AUD/USD.

- PBoC set USD/CNY mid-point at 7.1991 vs exp. 7.2305 (prev. 7.1927).

FIXED INCOME

- 10yr UST futures were contained near the prior day's lows after having extended on the post-election sell-off as yields climbed and participants continued to anticipate incoming higher US tariffs, while the attention now turns to CPI data.

- Bund futures traded subdued following the recent slide beneath the 132.00 level with prices not helped by upcoming supply.

- 10yr JGB futures tracked the recent declines in global peers with demand also contained after firmer-than-expected PPI data and mostly weaker results from the 30yr JGB auction.

COMMODITIES

- Crude futures were rangebound after the prior day's choppy performance in which the Middle East rhetoric including the pushback by Israel's Defence Minister against a ceasefire in Lebanon was offset by the broad dollar strength, while the latest inventory data is delayed by a day owing to the Veterans Day federal holiday at the start of the week.

- BSEE stated 10.5% of oil production in the Gulf of Mexico shut-in due to Rafael (prev. 25.7%) and 3.2% of nat gas shut-in (prev. 13.1%) in the final production notice from BSEE in response to Rafael.

- Spot gold reclaimed the USD 2,600/oz status with a bid seen at the open of Shanghai commodities trade.

- Copper futures lacked direction after recent selling pressure and amid the mostly risk-averse mood.

CRYPTO

- Bitcoin continued to pull back following its recent surges with prices back beneath the USD 88,000 level.

NOTABLE ASIA-PAC HEADLINES

- China is to release its homebuying tax cut plans soon and will likely cut taxes for home purchases by end-2024, according to China Securities Times.

- China's Taiwan Affairs Office said in response to the TSMC (2330 TT) chip curbs that the US is playing the Taiwan card to raise tensions in the Taiwan Straits and these chip curbs ultimately undermine the interests of Taiwan’s companies, while it added that restrictions also cause Taiwan companies to miss further opportunities for industrial development.

DATA RECAP

- Japanese Corporate Goods Prices MM (Oct) 0.2% vs. Exp. 0.0% (Prev. 0.0%)

- Japanese Corporate Goods Prices YY (Oct) 3.4% vs. Exp. 3.0% (Prev. 2.8%, Rev. 3.1%)

- Australian Wage Price Index QQ (Q3) 0.8% vs. Exp. 0.9% (Prev. 0.8%)

- Australian Wage Price Index YY (Q3) 3.5% vs. Exp. 3.6% (Prev. 4.1%)

GEOPOLITICS

MIDDLE EAST

- Israel conducted raids on the Haret Hreik and Lilaki areas in the southern suburbs of Beirut, according to Al Jazeera.

- Israeli military said it dismantled the majority of Hezbollah's weapons and missile facilities in southern Beirut.

- Israeli President Herzog said he had a productive meeting with US President Biden and hopes to see results on some commitments in the foreseeable future including in the next few days.

- US President Biden's advisor Hochstein said in a conversation with reporters at the White House that there is a chance to reach a ceasefire agreement in Lebanon soon, according to Axios.

- US Secretary of State Blinken has decided there will be no change for now in military assistance to Israel following the deadline the US gave Israel regarding the humanitarian situation in Gaza which expires this Tuesday, according to Axios' Ravid citing two US officials.

- US envoy to the UN told the Security Council that Israel has taken some important steps to address the undisputed humanitarian crisis in Gaza and that it is of urgent importance that Israel pause implementation of legislation targeting UNRWA, while the envoy added Israel must ensure its actions are fully implemented and improvements are sustained over time.Syrian media reported air strikes targeting the outskirts of the city of Albu Kamal on the Syrian-Iraqi border, while the US military later confirmed that it conducted strikes against an Iranian-backed militia group's weapons storage facility in Syria.

OTHER

- Chinese military organised naval and air forces to patrol the territorial waters and airspace of Scarborough Shoal in the South China Sea and surrounding areas on November 13th.

- US sanctions agency OFAC conducts an inquiry into Russian clients UBS (UBSG SW) took over with Credit Suisse, according to Reuters sources.

EU/UK

NOTABLE HEADLINES

- ECB's Kazaks said US tariffs will not be good for Europe and might push up inflation, while rates are dependent on what's happening in the economy and the base scenario is to lower rates step by step.

- France and China have resumed dialogue on the Cognac issue, according to the Cognac association, while it added that China's decision to change the deposit on Cognac to a less complex guarantee is a positive step.