- APAC stocks were mostly subdued following the negative handover from the US; participants also digested mixed Chinese PMIs.

- BoJ kept rates unchanged as expected and refrained from any fresh policy clues.

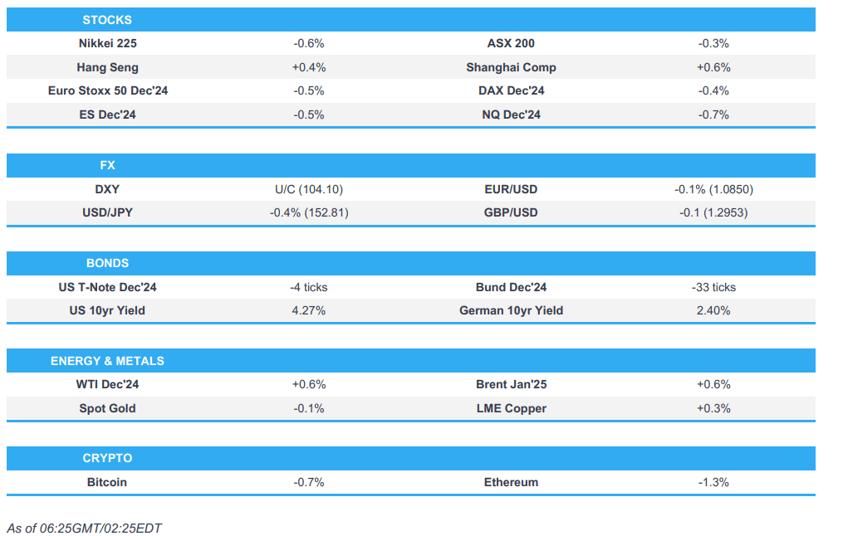

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -0.5% after the cash market closed lower by 1.3% on Wednesday.

- US equity futures (ES -0.5%, NQ -0.7%) were hampered by after-market earnings from Meta (-3.1% after-hours) and Microsoft (-3.7% after-hours).

- DXY is steady and just above the 104 mark, JPY leads peers post-BoJ with other majors steady.

- Looking ahead, highlights include German Retail Sales, EZ CPI, US Challenger Layoffs, PCE (Sept), Initial Jobless Claims, Employment Costs, Canadian GDP, NZ HLFS Jobs, Comments from BoJ Governor Ueda & BoE’s Breeden, Supply from the UK.

- Earnings from Mastercard, Merck, Linde, Uber, Comcast, Eaton, ConocoPhillips, Bristol-Myers Squibb, Regeneron Pharmaceuticals, Southern Company, ICE, Cigna, Altria, Estee Lauder, Kellogg, International Paper, Hyatt Hotels, Mobileye, Norwegian Cruise Line, Universal Music Group, ING, BBVA, Caixabank, Repsol, Societe Generale, STMicroelectronics, TotalEnergies, BNP Paribas, Carlsberg, Haleon, Shell, Smith & Nephew, Intesa Sanpaolo, Prysmian, Stellantis

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were ultimately pressured in the midst of earnings season and the NDX underperformed owing to the weakness in semis as AMD's earnings offset the strong results from Alphabet, and with Super Micro shares plummeting after its auditor Ernst & Young sent it a letter of resignation. Aside from a deluge of earnings, participants also digested mixed data releases as Q3 GDP disappointed but ADP jobs data surged, while the attention was also on the UK Budget announcement which saw Gilts tumble on the inflationary prospects of the Budget and heavy supply forecasts.

- SPX -0.33% at 5,814, NDX -0.79% at 20,388, DJIA -0.22% at 42,142, RUT -0.23% at 2,233.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Meta Platforms Inc (META) Q3 2024 (USD): EPS 6.03 (exp. 5.24), Revenue 40.59bln (exp. 40.27bln). Expects Q4 total revenue to be in the range of USD 45bln-48bln (exp. 46.3bln). Co. shares were lower by 3.1% after-hours with some desks questioning the Co.'s growth outlook amid potential AI-related losses

- Microsoft Corp (MSFT) Q1 2025 (USD): EPS 3.30 (exp. 3.10), Revenue 65.6bln (exp. 64.51bln). Microsoft Cloud revenue 38.9bln (exp. 38.11bln). Co. shares were lower by 3.7% after-hours following its disappointing cloud growth forecast

- Amgen Inc (AMGN) Q3 2024 (USD): Adj. EPS 5.58 (exp. 5.11), Revenue 8.50bln (exp. 8.52bln)

APAC TRADE

BOJ

- BoJ kept its short-term policy rate unchanged at 0.25%, as expected, through a unanimous decision and said it will conduct monetary policy from perspective of sustainably and stably achieving the 2% price target, while it stated given that real interest rates are at very low levels, the BoJ will continue to raise the policy rate if the economy and prices move in line with its forecast. BoJ said Japan's economy is recovering moderately although some weaknesses are observed and underlying consumer inflation is likely to be at a level generally consistent with the 2% target in the second half of the projection period through fiscal 2026. BoJ also stated that risks to prices are skewed to the upside for FY 2025 and noted uncertainty surrounding Japan's economy and prices remains high. Furthermore, it must be vigilant to financial and FX market moves and their impact on the economy and prices, as well as scrutinise US and overseas economic developments, while it added that financial conditions remain accommodative and it mostly maintained its forecasts in the Outlook Report.

EQUITIES

- APAC stocks were mixed albeit with most major indices subdued following the negative handover from the US and heading into month-end, while participants also digested a slew of data releases including somewhat mixed Chinese PMIs.

- ASX 200 declined amid losses in utilities and consumer stocks with retailer Coles pressured after its quarterly update.

- Nikkei 225 briefly dipped beneath the 39,000 level after mixed data and cautiousness heading into the BoJ announcement which lacked any major fireworks as the central bank kept rates unchanged as expected and refrained from any fresh policy clues.

- Hang Seng and Shanghai Comp were underpinned with earnings in focus and strength in Chinese banks after the Big 4 registered profit growth, although the upside was limited in the mainland after the mixed PMI data which showed manufacturing activity topped estimates and printed at a surprise expansion although non-manufacturing missed forecasts.

- US equity futures (ES -0.5%, NQ -0.7%) were hampered by after-market earnings from Meta (-3.1% after-hours) and Microsoft (-3..7% after-hours)

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -0.5% after the cash market closed lower by 1.3% on Wednesday.

FX

- DXY traded rangebound above the 104.00 level after mixed data releases in which Advanced GDP disappointed but the Core PCE component was firmer than expected and ADP National Employment surged, while the attention now turns to the Fed's preferred PCE inflation metric later today and then on to Friday's NFP report.

- EUR/USD held on to most of the prior day's gains against the buck, following a series of hot data releases out of Europe including German and Spanish CPI figures, as well as stronger-than-expected German and EZ Flash GDP.

- GBP/USD languished beneath 1.3000 after whipsawing in the aftermath of the Budget announcement which the OBR assessed would increase UK interest and gilt rates by 0.25% and that firms would pass most of the NI costs via lower wages and higher prices.

- USD/JPY traded indecisively amid an unsurprising BoJ decision but was eventually pressured after the dust settled given that there was very little to suggest a deviation from the central bank's stance in which it reiterated to continue to raise the policy rate if the economy and prices move in line with its forecast and noted risks to prices are skewed to the upside for FY 2025

- Antipodeans traded sideways and largely ignored the latest data releases including somewhat mixed Chinese PMI figures.

FIXED INCOME

- 10yr UST futures remained subdued following the prior day's curve flattening owing to mixed data and the quarterly refunding announcement, while a collapse in Gilts in the aftermath of the UK Budget provided headwinds for global peers.

- Bund futures languished at multi-month lows after yesterday's sharp drop which also followed firm EU data.

- 10yr JGB futures lacked firm direction with prices choppy following the lack of surprises from the BoJ policy decision.

COMMODITIES

- Crude futures marginally extended on gains after rebounding yesterday with the help of bullish inventory data and an OPEC+ source report that noted the group could delay the planned oil output hike scheduled for December by a month or more.

- Spot gold lingered around its record levels and continues to eye an approach towards the USD 2,800/oz level.

- Copper futures were rangebound as price action reflected the cautious mood and mixed data releases.

- Chile's Codelco September YTD copper output fell 4.9% Y/Y to 918k metric tonnes and it sees 2024 copper output at between 1.325-1.352mln metric tonnes.

CRYPTO

- Bitcoin traded indecisively and pulled back after hitting resistance around the USD 72,500 level.

NOTABLE ASIA-PAC HEADLINES

- EU is set to send envoys to China to discuss an EV tariff alternative, according to Bloomberg.

DATA RECAP

- Chinese Manufacturing PMI (Oct) 50.1 vs Exp. 49.9 (Prev. 49.8)

- Chinese Non-Manufacturing PMI (Oct) 50.2 vs Exp. 50.4 (Prev. 50.0)

- Chinese Composite PMI (Oct) 50.8 (Prev. 50.4)

- Japanese Industrial Production MM (Sep) 1.4% vs. Exp. 1.0% (Prev. -3.3%)

- Japanese Retail Sales YY (Sep) 0.5% vs. Exp. 2.3% (Prev. 2.8%, Rev. 3.1%)

- Australian Building Approvals (Sep) 4.4% vs. Exp. 3.0% (Prev. -6.1%, Rev. -3.9%)

- Australian Retail Sales MM Final (Sep) 0.1% vs. Exp. 0.3% (Prev. 0.7%)

- Australian Retail Trade (Q3) 0.5% vs. Exp. 0.5% (Prev. -0.3%, Rev. -0.4%)

GEOPOLITICS

MIDDLE EAST

- Israeli officials said Israel and the US had reached preliminary understandings on the principles for a political settlement to end the war in Lebanon, according to Axios’s Ravid. A senior Israeli official said Israel and the US "see eye to eye" on the principle that an agreement will first be reached and only then will the ceasefire begin, while the official estimated that it would take several weeks to reach an agreement.

- US envoy Hochstein is working on drafting an agreement between Israel and Lebanon, while the army will withdraw from Lebanon within a week and will resume its operations if the agreement is violated, according to Al Jazeera. However, US officials cited by Axios said Washington has not reached a final agreement with either the Lebanese or Israeli parties.

- Lebanon’s Prime Minister said they hope for a ceasefire with Israel in the coming hours or days.

- Cypriot President said he is optimistic that a ceasefire in Lebanon could be reached in the next 1-2 weeks.

- Israeli military said it attacked fuel reservoirs in Lebanon's Bekaa region located in military complexes of Hezbollah's logistical empowerment unit, while it added that Iran is behind supplying Hezbollah with fuel as part of its military support and it targeted oil depots belonging to Hezbollah's 4400 Logistics Armament Unit in the Bekaa.

- Hezbollah bombed gatherings of Israeli enemy soldiers in the settlement of Kiryat Shmona with a rocket barrage.

- CNN cited a senior source familiar with Iran's intentions who stated that the Israeli attack would be met with a "decisive and painful response", while the source did not provide a date but said it would "likely take place before the US election".

- Israel Broadcasting Corporation reported that Tel Aviv is considering launching a large-scale pre-emptive attack against Iran, according to Sky News Arabia.

- White House said the US will support Israel if Iran does respond.

OTHER

- North Korea launched a ballistic missile towards the East Sea which set a new record, while North Korean leader Kim said the missile test was appropriate military activity as their enemies' dangerous moves have emphasised the need to strengthen the nuclear force and North Korea will never change its stance of strengthening its nuclear arsenal, via KCNA.

- South Korea's National Security Council plans to designate new sanctions on North Korea and South Korea's military said the US is to respond to North Korea's missile test by deploying strategic assets for drills, according to Yonhap.

- South Korean Defence Minister said Russia could aid North Korea with technology for tactical nuclear weapons and ICBMs in exchange for North Korean troops.

- White House said the US condemns North Korea's intercontinental ballistic missile test, but noted North Korea's intercontinental ballistic missile test did not pose an immediate threat to US personnel, territory, or its allies.

- Japanese PM Ishiba will hold a national security council meeting and Defence Minister Nakatani said they will closely cooperate with the US and South Korea over North Korea's missile launch.

EU/UK

NOTABLE HEADLINES

- UK DMO's CEO said the Gilt market has reacted 'quite positively' to an increased issuance after the Budget and has a strong track record in absorbing higher prices.

- ECB President Lagarde said the inflation goal is in sight but cannot say inflation is completely under control, while they will base the size and order of cuts on economic data. Lagarde add that no Euro area recession is expected in 2024-2026 and she reaffirmed commitment to a continued interest rate reduction, according to Le Monde

- ECB's Nagel said price stability is not far off, but the last stretch of the road still has to be covered.