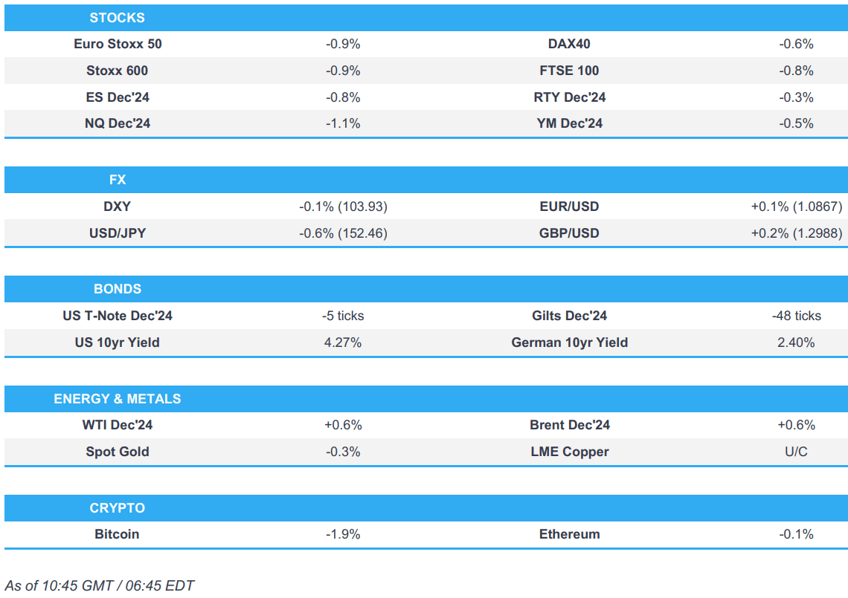

- European bourses & US futures are entirely in the red; Tech lags stateside given META & MSFT while European banks slip

- JPY leads post-BoJ with USD lower into PCE & weekly jobs, EUR unreactive to HICP while Cable nears 1.30

- Gilts remains for sale though the morning's DMO auction went well, EGBs and USTs soft in tandem with yields bid and curves flattening

- Crude ultimately firmer with two-way geopolitical updates factoring, XAU softer after fading from another ATH, base metals mixed after similar China data

- Highlights include US Challenger Layoffs, PCE (Sept), Initial Jobless Claims, Employment Costs, Canadian GDP, NZ HLFS Jobs.

- Earnings from Apple, Mastercard, Merck, Uber, Comcast, Eaton, ConocoPhillips, Bristol-Myers Squibb, Southern Company, Intercontinental Exchange, Cigna, Altria, Kellogg, Roblox, Ball Corporation, International Paper, Hyatt Hotels

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.7%) began the European session entirely in the red, and continued to traverse worse levels throughout the morning.

- European sectors hold a strong negative bias; Construction & Materials takes the top spot whilst Retail is found at the foot of the pile.

- US Equity Futures (ES -0.8% NQ -1.1% RTY -0.4%) are entirely in the red, with sentiment hit following post-earning losses tech heavyweights Meta (-3.8%) and Microsoft (-3.8%).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

Key Earnings:

- Meta Platforms Inc (META) Q3 2024 (USD): EPS 6.03 (exp. 5.24), Revenue 40.59bln (exp. 40.27bln). Expects Q4 total revenue to be in the range of USD 45bln-48bln (exp. 46.3bln). Co. shares were lower by 3.1% after-hours with some desks questioning the Co.'s growth outlook amid potential AI-related losses

- Microsoft Corp (MSFT) Q1 2025 (USD): EPS 3.30 (exp. 3.10), Revenue 65.6bln (exp. 64.51bln). Microsoft Cloud revenue 38.9bln (exp. 38.11bln). Co. shares were lower by 3.7% after-hours following its disappointing cloud growth forecast

- Amgen Inc (AMGN) Q3 2024 (USD): Adj. EPS 5.58 (exp. 5.11), Revenue 8.50bln (exp. 8.52bln)

- Shell (SHEL LN) Q3 (USD): Adj. Profit 6.03bln (exp. 5.39bln), Adj. EBITDA 16bln (exp. 15.40bln); plans a share buyback program of USD 3.5bln; Cuts FY24 Capex "less than" 22bln (prev. guided 22-25bln). Shares +1.1%

- Stellantis (STLAM IM/STLAP FP) Q3 (EUR) Revenue 33bln (exp. 33.1bln); notes it is clear the Chinese rivals are coming into Europe and taking a "very aggressive stance"; affirms guidance. Shares +2.4%

- STMicroelectronics (STM FP) Q3 (USD): EPS 0.37 (exp. 0.33), Revenue 3.25bln (exp. 3.22bln). Guides Q4 Revenue 3.32bln (exp. 3.38bln). Trims FY24 revenue 13.3bln (exp. 13.3bln, prev. guided 13.2-13.7bln). Launches new company-wide program to restore manufacturing footprint; "based on our current customer order backlog and demand visibility, we anticipate a revenue decline between Q4'24 and Q1'25 well above seasonality."(Newswires) Shares -2.4%

- TotalEnergies (TTE FP) Q3 (USD): adj. Net Income 4.07bln (exp. 4.27bln), adj. EBITDA 10bln (exp. 10.06bln); confirms investment guidance for 2024; interim dividend of EUR 0.79/shr for FY, +7% Y/Y; to execute a USD 2bln share buyback in Q4. Shares -7.2%

- Maersk (MAERSKB DC) Q3 (USD): Revenue 15.7bln (exp. 14.78bln), PBT 3.25bln (exp. 2.3bln), EBIT 3.3bln (exp. 2.99bln), EBITDA 4.8bln (exp. 4.4bln), EPS 193 (ex. 178). Lifted guidance. Shares +2.1%

FX

- DXY is lower as JPY strength acts as a drag on the index. Today sees core PCE metrics and weekly jobless claims, ahead of NFP on Friday. DXY is currently just below the 104 mark after briefly dipping below Wednesday's trough at 103.97.

- Little follow-through for the EUR from above-expected EZ CPI given that regional releases had suggested such an outcome. EUR/USD is currently in close proximity to its 200DMA at 1.0869 and yesterday's high at 1.0871.

- GBP is attempting to claw back Wednesday's post-budget losses, whereby concerns around borrowing forecasts from the OBR have subsequently embedded more of a fiscal risk premium into the GBP. Cable has been unable to make its way back onto a 1.30 handle and is currently stuck below its 100DMA at 1.2976.

- JPY has strengthened in the wake of the BoJ policy decision. The announcement itself provided little in the way of surprises. However, the JPY began to pick up steam as Governor Ueda spoke and downplayed concerns over financial stability risks acting as an impediment to further policy tightening. USD/JPY briefly made its way onto a 151 handle but has since stabilised around the 152.50 mark.

- Antipodeans are both broadly steady vs. the USD. No real follow through seen for AUD from mixed Australian Retail Sales, nor mixed Chinese PMI metrics.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Gilts gapped lower from Wednesday’s 94.92 close, briefly stabilised and attempted a rebound but remained around 24 ticks shy of that mark at best. Benchmark down to a 94.05 base, 28 ticks below Wednesday’s trough and at a fresh contract low; UK paper then lifted off worst levels after a relatively strong Green 2053 outing.

- Bunds were weighed on, in-fitting with Gilts into Flash HICP for October. The pan-EZ figure came in hotter-than-expected, but given the skew from data earlier in the week this had no real impact. Bunds down to 131.32 at worst this morning, since picked up modestly and erring back towards opening levels but remain well into the red overall.

- USTs are softer as Gilts weigh on the complex generally and as we look ahead to today’s monthly PCE number before tomorrow’s NFP print, a payrolls report which has the potential to print sub-zero. At a 110-14 trough, half a tick below Wednesday’s base.

- UK sells GBP 2.25bln 1.50% 2053 Green: b/c 3.15x (prev. 3.26x), average yield 4.831% (prev. 4.545%), tail 0.5bps (prev. 0.6bps)

- Click for a detailed summary

COMMODITIES

- Crude is in the green but only modestly so. Action which comes amidst a soft USD and as the geopolitical environment remains tense. Brent Jan'25 currently holding around USD 72.50/bbl.

- Spot gold is softer while the correlation has broken down, ongoing UK-led yield upside is likely weighing. The yellow metal awaits key US data today and tomorrow, currently towards session lows around USD 2773/oz.

- Base metals are mixed. LME Copper essentially unchanged as we await key US events over the next few days/week which will help determine the near/medium-term macro direction. Furthermore, leads from China were mixed with Manufacturing PMI making its way just back into expansionary territory though non-manufacturing missed consensus slightly.

- Energy Intel's Bakr says, re. recent OPEC+ source reports, that "they didn’t even talk about this yet".

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HICP Flash YY (Oct) 2.0% vs. Exp. 1.9% (Prev. 1.7%); Services 3.9% Y/Y (prev. 3.9%); HICP-X F&E Flash YY (Oct) 2.7% vs. Exp. 2.6% (Prev. 2.7%); Unemployment Rate (Sep) 6.3% vs. Exp. 6.4% (Prev. 6.4%, Rev. 6.3%); HICP-X F,E,A&T Flash YY (Oct) 2.7% vs. Exp. 2.60% (Prev. 2.70%); HICP-X F, E, A, T Flash MM (Oct) 0.2% (Prev. 0.10%)

- German Retail Sales YY Real (Sep) 3.8% vs. Exp. 1.6% (Prev. 2.1%); Retail Sales MM Real (Sep) 1.2% vs. Exp. -0.5% (Prev. 1.6%); Import Prices YY (Sep) -1.3% vs. Exp. -1.4% (Prev. 0.2%); Import Prices MM (Sep) -0.4% vs. Exp. -0.4% (Prev. -0.4%)

- French CPI (EU Norm) Prelim MM (Oct) 0.3% vs. Exp. 0.20% (Prev. -1.30%); CPI Prelim YY NSA (Oct) 1.2% vs. Exp. 1.10% (Prev. 1.10%); CPI Prelim MM NSA (Oct) 0.2% vs. Exp. 0.20% (Prev. -1.20%); CPI (EU Norm) Prelim YY (Oct) 1.5% vs. Exp. 1.5% (Prev. 1.4%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves says there will be more plans to boost growth. Is not going to come back for more money in the spring. Commenting on yesterday's budget, says "will not have to do anything like that ever again".

- ECB President Lagarde said the inflation goal is in sight but cannot say inflation is completely under control, while they will base the size and order of cuts on economic data. Lagarde added that no Euro area recession is expected in 2024-2026 and she reaffirmed commitment to a continued interest rate reduction, according to Le Monde.

- German engineering orders -8% Y/Y in September (Domestic -15%; Foreign Orders -5%); Jun-Sept-4% Y/Y (Domestic -16%, Foreign Orders Unch.), according to VDMA.

- ECB's Panetta says rates need to come down; inflation is easing and need to pay attention to weakness of the economy. ECB needs to avoid the risk of pushing inflation below target.

GEOPOLITICS

MIDDLE EAST

- Lebanon’s Prime Minister said they hope for a ceasefire with Israel in the coming hours or days.

- Cypriot President said he is optimistic that a ceasefire in Lebanon could be reached in the next 1-2 weeks.

- Israeli military said it attacked fuel reservoirs in Lebanon's Bekaa region located in military complexes of Hezbollah's logistical empowerment unit, while it added that Iran is behind supplying Hezbollah with fuel as part of its military support and it targeted oil depots belonging to Hezbollah's 4400 Logistics Armament Unit in the Bekaa.

- Hezbollah bombed gatherings of Israeli enemy soldiers in the settlement of Kiryat Shmona with a rocket barrage.

- CNN cited a senior source familiar with Iran's intentions who stated that the Israeli attack would be met with a "decisive and painful response", while the source did not provide a date but said it would "likely take place before the US election".

- Israel Broadcasting Corporation reported that Tel Aviv is considering launching a large-scale pre-emptive attack against Iran, according to Sky News Arabia.

- White House said the US will support Israel if Iran does respond.

OTHER

- North Korea launched a ballistic missile towards the East Sea which set a new record, while North Korean leader Kim said the missile test was appropriate military activity as their enemies' dangerous moves have emphasised the need to strengthen the nuclear force and North Korea will never change its stance of strengthening its nuclear arsenal, via KCNA.

- South Korea's National Security Council plans to designate new sanctions on North Korea and South Korea's military said the US is to respond to North Korea's missile test by deploying strategic assets for drills, according to Yonhap.

- South Korean Defence Minister said Russia could aid North Korea with technology for tactical nuclear weapons and ICBMs in exchange for North Korean troops.

- White House said the US condemns North Korea's intercontinental ballistic missile test, but noted North Korea's intercontinental ballistic missile test did not pose an immediate threat to US personnel, territory, or its allies.

- Japanese PM Ishiba will hold a national security council meeting and Defence Minister Nakatani said they will closely cooperate with the US and South Korea over North Korea's missile launch.

CRYPTO

- Bitcoin slips lower but remains above USD 72k, whilst Ethereum holds flat.

APAC TRADE

- APAC stocks were mixed albeit with most major indices subdued following the negative handover from the US and heading into month-end, while participants also digested a slew of data releases including somewhat mixed Chinese PMIs.

- ASX 200 declined amid losses in utilities and consumer stocks with retailer Coles pressured after its quarterly update.

- Nikkei 225 briefly dipped beneath the 39,000 level after mixed data and cautiousness heading into the BoJ announcement which lacked any major fireworks as the central bank kept rates unchanged as expected and refrained from any fresh policy clues.

- Hang Seng and Shanghai Comp were underpinned with earnings in focus and strength in Chinese banks after the Big 4 registered profit growth, although the upside was limited in the mainland after the mixed PMI data which showed manufacturing activity topped estimates and printed at a surprise expansion although non-manufacturing missed forecasts.

BOJ

- BoJ kept its short-term policy rate unchanged at 0.25%, as expected, through a unanimous decision and said it will conduct monetary policy from perspective of sustainably and stably achieving the 2% price target, while it stated given that real interest rates are at very low levels, the BoJ will continue to raise the policy rate if the economy and prices move in line with its forecast. BoJ said Japan's economy is recovering moderately although some weaknesses are observed and underlying consumer inflation is likely to be at a level generally consistent with the 2% target in the second half of the projection period through fiscal 2026. BoJ also stated that risks to prices are skewed to the upside for FY 2025 and noted uncertainty surrounding Japan's economy and prices remains high. Furthermore, it must be vigilant to financial and FX market moves and their impact on the economy and prices, as well as scrutinise US and overseas economic developments, while it added that financial conditions remain accommodative and it mostly maintained its forecasts in the Outlook Report.

- BoJ's Ueda says the domestic economy is recovering moderately, though some weak moves are seen. Did not need to use the language at this meeting that they can afford to spend time scrutinising risks. Uncertainties remain but markets have slowly regains stability. Can't currently say how much wages would need to increase for them to hike further; if wage hikes are similar to this year's Spring negotiations that would be a "positive development", but that does not mean we decide to hike with only that. Click for full details.

NOTABLE ASIA-PAC HEADLINES

- BoJ Quarterly Schedule of Outright Purchases of Japanese Government Bond: October-December 2024. Click for details.

DATA RECAP

- Chinese Manufacturing PMI (Oct) 50.1 vs Exp. 49.9 (Prev. 49.8); Non-Manufacturing PMI (Oct) 50.2 vs Exp. 50.4 (Prev. 50.0)

- Chinese Composite PMI (Oct) 50.8 (Prev. 50.4)

- Japanese Industrial Production MM (Sep) 1.4% vs. Exp. 1.0% (Prev. -3.3%)

- Japanese Retail Sales YY (Sep) 0.5% vs. Exp. 2.3% (Prev. 2.8%, Rev. 3.1%)

- Australian Building Approvals (Sep) 4.4% vs. Exp. 3.0% (Prev. -6.1%, Rev. -3.9%)

- Australian Retail Sales MM Final (Sep) 0.1% vs. Exp. 0.3% (Prev. 0.7%)

- Australian Retail Trade (Q3) 0.5% vs. Exp. 0.5% (Prev. -0.3%, Rev. -0.4%)