- APAC stocks were ultimately mixed and initially took their cues from the gains in the US, but with upside capped by a lack of fresh drivers ahead of a long weekend.

- ECB officials have not ruled out a rate cut at the October meeting, according to Bloomberg sources, while Reuters sources suggested an ECB October rate cut is said to be unlikely for now and a move before December would take exceptional negative growth surprises.

- US and UK governments are discussing allowing Ukraine to deploy British cruise missiles backed by US navigational data to conduct long-range strikes inside Russian territory, according to Bloomberg citing sources.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.5% after the cash market closed higher by 1.1% on Thursday.

- Looking ahead, highlights include French Final CPI, EZ Industrial Production, US Trade, UoM Prelim, BoE/Ipsos Survey & ECB TLTRO publication.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were firmer in a continuation of Wednesday's gains and risk-on trade with seemingly added tailwinds from an article by WSJ's Timiraos titled "The Fed’s Rate-Cut Dilemma: Start Big or Small?" which did not offer any sources but quoted a former senior adviser to Powell who said the amount of cuts over the next few months “is going to be a lot more important than whether the first move is 25 or 50", which he thinks is a close call. Attention was also on the ECB which cut rates as expected, while the latest data releases did little to shift the dial as PPI figures printed mixed and jobless claims matched estimates.

- SPX +0.75% at 5,596, NDX +0.97% at 19,423, DJIA +0.58% at 41,097, RUT +1.22% at 2,129.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Democratic candidate Harris leads Republican candidate Trump 47%-42% in the latest Reuters/Ipsos poll, and among registered voters who heard at least something about Tuesday's debate, 53% said Harris won the debate while 24% said Trump.

- Republican Presidential candidate Trump said there will not be another debate with VP Harris, while he also vowed to end all taxes on overtime.

- Georgia judge dismissed three criminal counts of election interference in case against Presidential candidate Donald Trump and allies, according to a court filing.

- WSJ's Timiraos released an article titled “The Fed’s Rate-Cut Dilemma: Start Big or Small?” which cited a former senior adviser to Fed Chair Powell, Jon Faust, who said the amount of cuts over the next few months will be a lot more important than whether the first move is 25 or 50, which he thinks is a close call.

- WSJ's Timiraos said economists who map the CPI and PPI into the PCE think core inflation using the Fed's preferred gauge will be around 0.13-0.17% in August, extending a streak of mild, target-consistent monthly readings.

APAC TRADE

EQUITIES

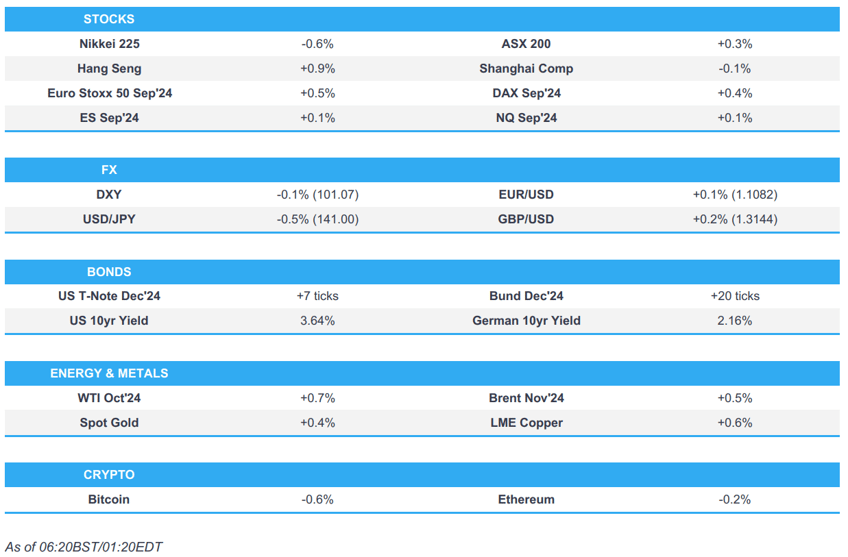

- APAC stocks were ultimately mixed and initially took their cues from the gains in the US, but with upside capped by a lack of fresh drivers ahead of a long weekend.

- ASX 200 was led by outperformance in mining stocks with gold miners boosted after the precious metal hit a fresh record high.

- Nikkei 225 underperformed owing to currency strength and as participants headed towards the extended weekend in Japan.

- Hang Seng and Shanghai Comp were mixed as the former spearheaded the advances in the region with the help of developers, energy stocks and financials, while the mainland was lacklustre ahead of the latest Chinese activity data on Saturday and the four-day weekend closure.

- US equity futures were uneventful amid the mixed performance in Asia and an absence of catalysts to spur price action.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.5% after the cash market closed higher by 1.1% on Thursday.

FX

- DXY lacked demand after the prior day's selling which coincided with the risk-on sentiment, while mixed PPI data and in-line jobless claims had little sway on the buck nor the likelihood of the Fed cutting rates by 25bps next week. Furthermore, the calendar for Friday is light with only UoM preliminary data the only notable release for the US.

- EUR/USD took a breather and held on to spoils after benefitting from the dollar weakness despite the ECB rate cut.

- GBP/USD marginally extended on advances above the 1.3100 level following the outperformance among activity peers.

- USD/JPY continued its retreat in the absence of any major catalysts and breached the 141.00 level to the downside

- Antipodeans plateaued overnight following yesterday's upward momentum owing to their high-beta statuses.

- PBoC set USD/CNY mid-point at 7.1030 vs exp. 7.1048 (prev. 7.1214).

- Peru Central Bank cut its reference rate by 25bps to 5.25%, as expected, but stated that the rate cut does not necessarily mean future rate cuts will follow.

- Banxico Deputy Governor Heath said it's "false" that the bank is injecting dollars into the market to keep the peso from depreciating further.

FIXED INCOME

- 10yr UST futures edged higher following yesterday's fluctuations and a rebound from support at the 115.00 level.

- Bund futures kept afloat and looked to reclaim the 135.00 level after the recent ECB rate cut.

- 10yr JGB futures tracked the gains in global counterparts as Japanese stocks underperformed.

COMMODITIES

- Crude futures mildly gained amid the positive risk sentiment and Gulf of Mexico output shut-ins.

- BSEE noted 42% of oil production at US Gulf of Mexico shut due to storm Francine.

- US Coast Guard said the New Orleans Port condition is normal following waterway assessments, with vessel movement and cargo operations authorised within the COTP New Orleans Zone.

- Spot gold traded rangebound with marginal gains to print a fresh record high.

- Copper futures were underpinned by the initial predominantly constructive mood and dollar weakness.

CRYPTO

- Bitcoin lacked conviction and swung between gains and losses on both sides of the USD 58,000 level.

GEOPOLITICS

MIDDLE EAST

- Lebanese media reported that rockets were fired from southern Lebanon towards Safad in northern Israel, according to Sky News Arabia.

- Sirens sounded in the Israeli settlement of Alemon in the West Bank warning of an infiltration of militants, according to Al Jazeera.

OTHER

- US and UK governments are discussing allowing Ukraine to deploy British cruise missiles backed by US navigational data to conduct long-range strikes inside Russian territory, according to Bloomberg citing sources.

- Russian President Putin warned the UK and the US that they will be "at war" with Russia if they allow Ukraine to use long-range missiles to strike targets inside Russia, according to The Times.

- US Ambassador to Ukraine strongly condemned Russia's attack on a vessel carrying grain from Ukraine.

- Russian Deputy Defence Minister said the China-Russia relationship is a model of nation-to-nation collaboration and is a peace guarantee, while their two defence ministries have continuously expanded cooperation and interactions such as drills and exchanges, including more than 100 projects this year. The official added that the US is trying to suppress any technological development centre that is not obedient to it which is double containment and suppression of China and Russia. Furthermore, the Russian Deputy Defence Minister said Russia has unique experience of fighting against various Western weapons and is ready to share it with partners, according to RIA.

- China's Defence Ministry said major countries must the take lead in safeguarding global security and should never interfere in other countries' internal affairs. China's Defence Ministry also stated it is important to uphold fairness, justice, international rule of law, and enhance the authority of the UN, while it added that peace talks and political settlement are the only solutions for the Ukraine crisis and Israeli-Palestinian conflict.

- North Korean leader Kim oversaw a test-fire for the new 600MM multiple rocket launcher, while he inspected a training base for special operations armed forces and guided combatants drills, as well as inspected the nuclear weapons institute and production base of weapons-grade nuclear materials, according to KCNA. It was later reported that South Korea condemned North Korea's unveiling of a uranium enrichment facility and said it will never accept North Korea's possession of nuclear weapons, according to the Unification Ministry.

EU/UK

NOTABLE HEADLINES

- An ECB October rate cut is said to be unlikely for now and a move before December would take exceptional negative growth surprises, according to Reuters sources. Furthermore, sources added that a move on October 17th could not be ruled out but it was not likely because policymakers would not have much new information by then and would rather wait for a new round of projections in December.

- ECB officials have not ruled out a rate cut at the October meeting and Governing Council members aren’t yet in a position to rule out an interest-rate cut at their next decision on October 17th even if such a move is unlikely, according to Bloomberg sources. Furthermore, given the downside risks to economic growth in the EZ, officials would rather keep open the option to lower borrowing costs at that meeting.

- ECB's Nagel says expect to reach inflation goal at the end of next year and core inflation is also going in the right direction, according to German radio.

- ECB's Simkus discussed monetary policy in interview on Radio LRT, while he stated that additional reductions will rely on information and speed of rate cuts will depend on data.