Something remarkable happened today: an article by Fed mouthpiece Nick "Nikileaks" Timiraos strongly hinted that a 50bps rate cut is still on the table (see "The Fed’s Rate-Cut Dilemma: Start Big or Small?") despite the hotter than expected core CPI print this week, and despite an unemployment rate which dropped by 0.1% last week. To frame the Fed's argument, Nikileaks quoted Powell's former senior advisor Jon Faust who said “I don’t think we’re in a spot that really shouts out for a pre-emptive 50... But my preference would be slightly toward starting with 50. And I still think there’s a reasonable chance that the FOMC might get there as well.”

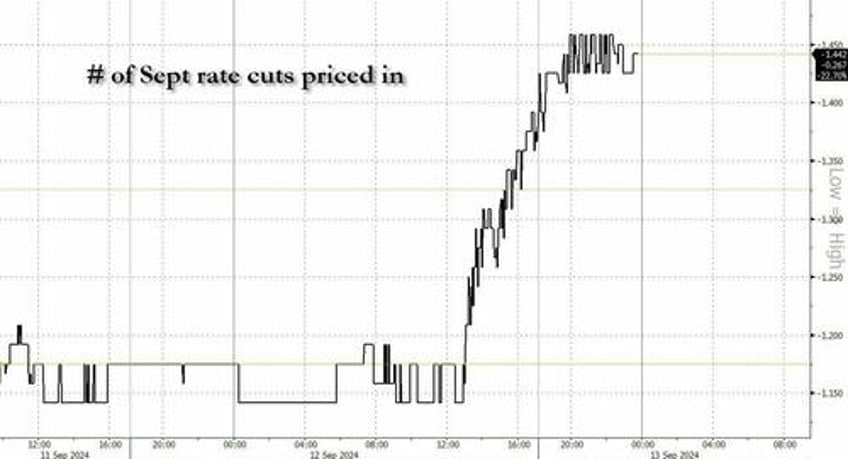

The article came out at the exact same time (1:02pm) as the ugly 30Y auction, which is why many were initially scratching their heads why a hawkish auction would spark a dovish market reaction. And boy what a reaction it was: Sept rate cut odds soared from 15% - where they landed after yesterday's hot CPI print - to 45% in just a few hours, as the market convinced itself that Timiraos is once again speaking for the Fed and signaling that 50bps is on the table (as it stands, whether we get 25bps or 50bps is a cointoss).