- APAC stocks began the week mostly subdued following the recent China fiscal stimulus disappointment and softer-than-expected Chinese inflation data.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.4% after the cash market closed lower by 1.0% on Friday.

- German Chancellor Scholz said he wouldn't have a problem with a vote of confidence before Christmas.

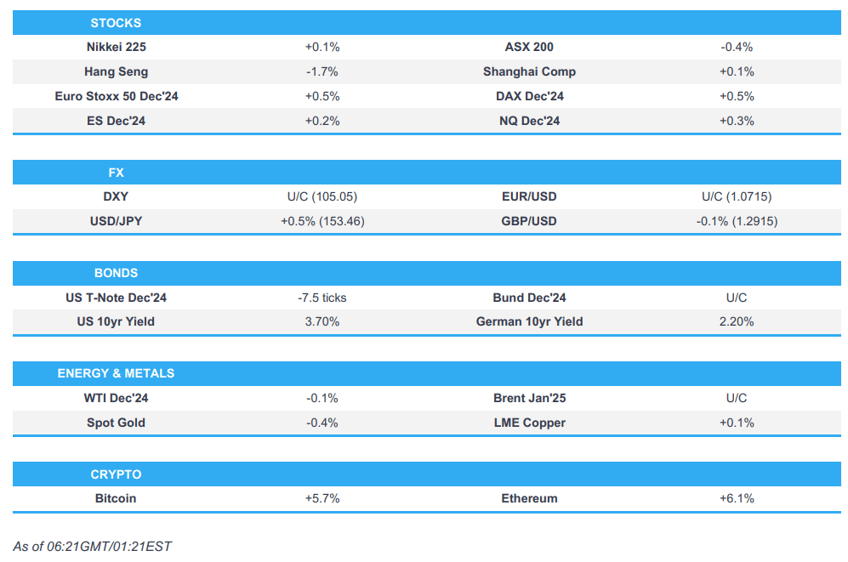

- DXY is steady and just above the 105 mark, EUR/USD is little changed on a 1.07 handle, JPY lags its major peers.

- Looking ahead, today sees a lack of tier 1 highlights. Note, today is Veterans Day in the US.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were bid on Friday in which the SPX briefly rose above 6k before paring into the closing bell with advances led by Utilities, Real Estate and Consumer Staples although the Nasdaq was the relative underperformer as Tech and Communication lagged. Price action in markets was primarily categorised by post-election trade as participants continued to react to the Trump win and the dollar resumed to the upside after weakness the day before although T-notes continued to flatten after the steepening seen on Trump's victory.

- SPX +0.38% at 5,996, NDX +0.07% at 21,117,DJIA +0.59% at 43,989, RUT +0.71% at 2,400.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed’s Kashkari (2026 voter) said if growth and productivity are strong, the Fed may not cut as much, while he reiterated that housing inflation will take a while to come down all the way and they have made progress but want to get the job done on inflation. Kashkari also stated that the Fed wants to have confidence inflation will go all the way back to 2% and need to see more evidence before deciding on another cut.

- Edison Research projected Republicans won another seat in the US House bringing their total to 213, while Democrats have 204 seats with 218 needed for control.

APAC TRADE

EQUITIES

- APAC stocks began the week mostly subdued amid China-related headwinds following the recent fiscal stimulus disappointment and softer-than-expected Chinese inflation data from over the weekend.

- ASX 200 was dragged lower by weakness in the commodity and consumer-related sectors.

- Nikkei 225 traded indecisively but with the initial downside cushioned alongside currency weakness.

- Hang Seng and Shanghai Comp were pressured with underperformance in Hong Kong amid losses in property and tech although some chipmakers were boosted after the US ordered TSMC to halt shipments to China of chips used in AI applications. Elsewhere, the mainland traded cautiously after last Friday's announcement of fiscal measures disappointed those hoping for a more forceful stimulus in the aftermath of the Trump election victory, while Chinese CPI and PPI data were softer-than-expected and showed a worsening of the factory-gate deflation.

- US equity futures (ES +0.2%) remained afloat in quiet trade after recently printing fresh record highs.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.4% after the cash market closed lower by 1.0% on Friday.

FX

- DXY kept to within a tight range amid a lack of major US-specific drivers and with attention this week on the latest US CPI report, while there were recent comments from Fed's Kashkari that if growth and productivity are strong, the Fed may not cut as much and noted that they have made progress but want to get the job done on inflation.

- EUR/USD was little changed at the 1.0700 handle as recent ECB commentary did little to shift the dial in which Holzmann suggested there was currently no reason not to cut rates in December but added that it does not mean it will automatically happen.

- GBP/USD traded uneventfully amid a lack of catalysts and after its recent return from a brief dip beneath 1.2900.

- USD/JPY edged higher and returned to the 153.00 territory after the BoJ Summary of Opinions continued to highlight a lack of urgency for immediate hikes but noted it will continue to raise the policy rate if its economic and price forecasts are met.

- Antipodeans conformed to the predominantly quiet picture across the FX space with the upside hampered by subdued commodity prices and the risk-averse tone.

- PBoC set USD/CNY mid-point at 7.1786 vs exp. 7.1813 (prev. 7.1433).

- SNB Vice Chairman Martin said the central bank has made absolutely no commitment to future interest rate cuts and the next rate decision will depend on the assessment in December. Martin said the Franc is attractive as a safe haven and due to low Swiss inflation, while he added it is expected to appreciate in nominal terms in the future but real appreciation of the currency has been limited.

FIXED INCOME

- 10yr UST futures trickled lower after last Friday's flattening and with the US bond market closed for Veterans Day.

- Bund futures marginally eased from Friday's peak with prices lingering around the 132.00 level.

- 10yr JGB futures traded uneventfully after the BoJ Summary of Opinions continued to suggest a lack of urgency for an immediate rate increase although it was also noted that there was no change to the BoJ's stance it will adjust the degree of monetary support if its economic and price forecasts are met.

COMMODITIES

- Crude futures were lacklustre with WTI crude futures testing the USD 70/bbl level to the downside following a lack of major geopolitical escalation over the weekend and with headwinds from soft China inflation data and stimulus disappointment.

- BSEE estimated that approximately 27.59% of the current daily oil production and 16.67% of the current daily natural gas production in the Gulf of Mexico has been shut-in due to Tropical Storm Rafael. It was later reported that Chevron (CVX) began to redeploy personnel and restore output at its Gulf of Mexico platforms that was shut-in due to Rafael.

- Spot gold gradually weakened in rangebound trade amid light pertinent catalysts and an uneventful dollar.

- Copper futures were restricted amid the downbeat mood in Asia and selling pressure in Chinese commodities.

CRYPTO

- Bitcoin extended on its record highs and topped the 81,000 level for the first time.

NOTABLE ASIA-PAC HEADLINES

- China International Import Expo saw a 2% Y/Y increase in intended transaction value to USD 80bln.

- China and Peru will sign a deal to strengthen a Free Trade Agreement with the improved FTA to increase commerce by at least 50%, while President Xi is to travel to Peru with 400 business people interested in investing in infrastructure and technology.

- TSMC (2330 TT) was ordered by the US to stop shipments to China of advanced chips used for AI applications.

- BoJ Summary of Opinions from the October meeting noted a member said no change to the BoJ's stance it will adjust the degree of monetary support if its economic and price forecasts are met and a member said they must remain vigilant regarding the overseas economic outlook and market movements. There was also the opinion that risk of a US hard landing is subsiding but it cannot yet be said with certainty that markets are stabilising, while it was noted that the BoJ must communicate clearly that it will continue to raise the policy rate if its economic and price forecasts are met. Furthermore, a member said the BoJ must take time and move cautiously in raising rates and a member also stated that Japan is not in a phase where it needs massive monetary support, so the BoJ can consider additional rate hikes after pausing temporarily to gauge US economic developments.

DATA RECAP

- Chinese CPI MM (Oct) -0.3% vs. Exp. -0.1% (Prev. 0.0%)

- Chinese CPI YY (Oct) 0.3% vs. Exp. 0.4% (Prev. 0.4%)

- Chinese PPI YY (Oct) -2.9% vs. Exp. -2.5% (Prev. -2.8%)

- New Zealand Inflation Forecast 1 Yr (Q4) Q1 2.05% (Prev. 2.4%)

- New Zealand Inflation Forecast 2 yrs (Q4) Q1 2.12% (Prev. 2.03%)

GEOPOLITICS

MIDDLE EAST

- Israel called upon Israelis not to attend cultural and sports events abroad in the week ahead, according to a statement from the PM’s office.

- Israeli media reported sirens heard in central Israel and the Israeli army reported interception of a missile approaching Israel coming from Yemen, according to Sky News Arabia.

- Israel conducted a strike on a residential building near Damascus which resulted in casualties, according to the Syrian state news agency.

- US National Security Adviser Sullivan said the US will make a judgement this week about the progress Israel made over the Blinken/Austin letter on humanitarian aid to Gaza. Sullivan also stated that President Biden will go through the top US foreign policy and domestic issues with President-elect Trump on Wednesday and Biden will make the case to Congress that they need ongoing resources for Ukraine beyond the end of his term.

- Qatar’s Foreign Ministry said its mediation efforts between Israel and Hamas are currently on hold and reports it is withdrawing from the Gaza ceasefire mediation are not accurate, while it said it will resume mediating in ceasefire talks when there is enough seriousness to end the brutal war.

- Iranian Foreign Minister Araqchi said a new scenario was fabricated after the US charged an Iranian man in the plot to kill President-elect Trump, while he said Iran is not after nuclear weapons and confidence building is needed from both sides.

- IRGC's Khatam al-Anbiya Headquarters deputy commander said Iran provides Hezbollah with ammunition and is not afraid of declaring it, while he added that Hezbollah has also publicly announced its affiliation with Iran, according to Iran International English.

- IAEA Director General Grossi will travel to Tehran this week for high-level meetings with the Iranian government.

- Iran announced the death of 5 security forces in an armed attack on the Pakistani border, according to Al Arabiya.

- Iraqi armed factions announce attack on a "vital target" in southern Israel with marches, according to Sky News Arabia.

- US-British aggression was reported on Yemen's capital Sanaa and the Amran governorate, according to Al Masirah TV.

- Two personnel from Saudi-led coalition forces were killed in an attack by a Yemeni Defence Ministry employee in Yemen’s Seiyun.

OTHER

- US President-elect Trump spoke on the phone with Russian President Putin on Thursday and discussed the war in Ukraine, while Trump urged Putin not to escalate the war in Ukraine, according to The Washington Post.

- Russian Foreign Ministry said on Saturday that there are no grounds for talking about resuming dialogue with the US on strategic stability and arms, while it added that US President-elect Trump’s promises to resolve the crisis in Ukraine fast are nothing more than rhetoric.

- Russia and Ukraine launched their biggest drone attacks on each other since the start of the conflict, with several people injured in the tensions, according to LBC.

- Russian President Putin signed the law on ratification of the strategic partnership with North Korea, according to TASS.

- Ukrainian top military commander Syrski told a senior US general of reports regarding North Korean troops preparing to take part in combat alongside Russian forces, as well as noted that the front-line situation remains difficult and is showing signs of escalation.

- Ukrainian drones hit a chemical producer in Russia’s Tula region overnight.

- Chinese President Xi signed an order of regulations to guarantee military equipment, effective from December 1st.

- China’s Foreign Ministry said China firmly opposes the Philippines’ Marine Zones Act which severely infringes on China’s territorial sovereignty and maritime rights in the South China Sea, while China’s Coast Guard said the Philippines has frequently sent military police, civilian vessels and aircraft to intrude into the air and sea space near Huangyan Island, which is also known as Scarborough Shoal.

- Philippines aims to buy a US missile launcher in a move likely to anger China, according to FT.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves will set out the government’s plans to stimulate economic growth through the principles of stability, investment and reform, as well as hail the benefits of free trade amid impending US protectionism during her first Mansion House address on Thursday, according to FT.

- UK HMRC is set to return GBP 700mln to top UK companies after the UK won an appeal against a Brussels state aid clampdown which had forced London to collect tax against its wishes, according to FT.

- German Chancellor Scholz said he wouldn't have a problem with a vote of confidence before Christmas and that there is a good chance he will win another mandate to form another government, according to CGTN Europe.

- ECB's Holzmann said a rate cut is possible in December as things look at the moment and there is nothing at the moment that would argue against that but that does not mean it will automatically happen, while he added they do not have the latest forecasts and data which they will get in December and will decide on that basis.

- Fitch affirmed Spain at A-; Outlook revised to Positive from Stable, while it affirmed Poland at A; Outlook Stable and affirmed Lithuania at A; Outlook Stable. It was also reported that Moody’s upgraded Croatia to A3; Outlook changed to Stable from Positive.