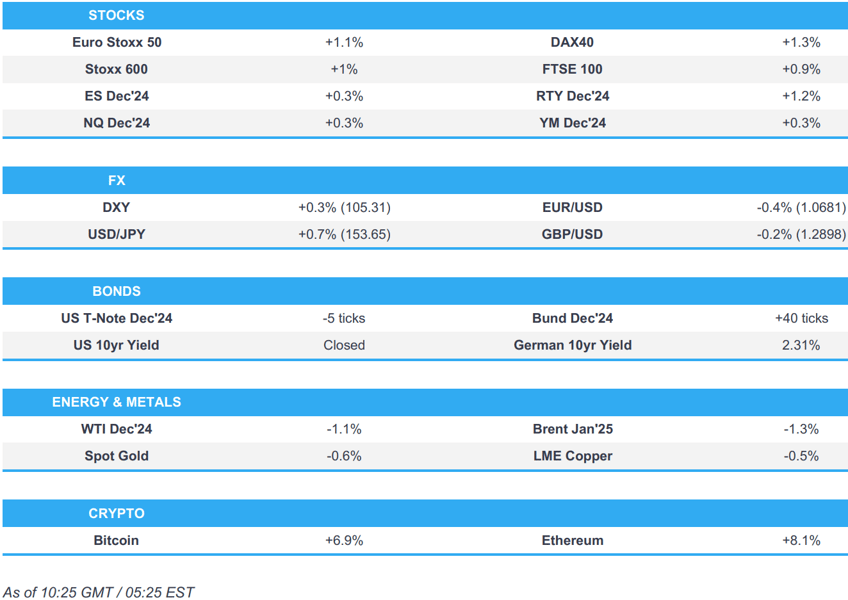

- Equities are entirely in the green, with a strong European morning thus far; the RTY outperforms.

- DXY is on a firmer footing with the Trump Trade still in action, JPY underperforms following the BoJ SOO which highlighted the lack of urgency to hike.

- Bonds are mixed, with Bunds firmer amid suggestions that Chancellor Scholz could bring forward a vote of no-confidence; Treasury cash trade is closed on account of US Veterans Day.

- Crude slips on comments by Hezbollah that there are negotiations to stop the war; XAU/base metals are hampered by the stronger Dollar and softer-than-expected Chinese inflation metrics overnight.

- Looking ahead, No Tier 1 events. As a reminder, today is US Veterans Day.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+1%) opened on a strong footing and continued to climb higher into the morning; some of the upside has since subsided, with indices now traversing best levels.

- European sectors hold a strong positive bias, with only Basic Resources sitting ever-so-slightly in negative territory. The sector is weighed on by slight losses in metals prices, given the continued disappointing inflation metrics out of China. Construction & Materials tops the pile, joined by Insurance and then Chemicals thereafter.

- US Equity Futures (ES +0.3%, NQ +0.3% RTY +1.2%) are entirely in the green, with very clear outperformance in the economy-linked RTY, with the “Trump Trade” very much still in action.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has started the week off on the front foot as markets continue to digest the likely impact of a Trump Presidency and a potential Republican sweep. DXY has extended above Friday's peak at 105.20 but is yet to reclaim the post-election peak at 105.44.

- EUR has extended on Friday's losses with EUR/USD slipping further onto a 1.06 handle. Absent an improvement in the Eurozone outlook, the pair could end up testing its YTD low from 16th April at 1.0601.

- GBP is softer vs. the USD but to a lesser extent than most peers with EUR/GBP hitting a fresh YTD low at 0.8282. Cable is tucked within Friday's 1.2884-1.2989 range.

- JPY is the notable laggard across the majors with the ongoing reasssessment of the relative Fed vs. BoJ policy paths continuing to guide the pair. The latest BoJ summary of opinions has been noted as a potential source of weakness for the JPY with the account continuing to highlight a lack of urgency for immediate hikes. USD/JPY has been as high as 153.85.

- Antipodeans are both flat vs. the broadly stronger USD with some support garnered from the positive risk tone.

- PBoC set USD/CNY mid-point at 7.1786 vs exp. 7.1813 (prev. 7.1433).

- SNB Vice Chairman Martin said the central bank has made absolutely no commitment to future interest rate cuts and the next rate decision will depend on the assessment in December. Martin said the Franc is attractive as a safe haven and due to low Swiss inflation, while he added it is expected to appreciate in nominal terms in the future but real appreciation of the currency has been limited.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A firmer start to the week with Bunds taking some reprieve on murmurings that the German no-confidence motion could occur sooner than thought, while such a motion will likely snuff out the traffic light coalition, at least it resolves the uncertainty. Hit a 132.59 peak early doors before stabilising around 20 ticks off this but has since inched back up to a fresh 132.61 high.

- USTs are slightly softer, paring some of the gains seen on Thursday/Friday which were largely a rebound from Trump-induced pressure on Wednesday. Note, conditions today are thin with the calendar sparse and Veteran’s Day meaning cash trade is closed. Currently pivoting the 110-00 figure, a move lower has support between 109-30 to 109-07 from last week.

- Gilts were initially flat, but have been inching higher in recent trade, in-fitting with peers. Attention this week is on a speech from BoE’s Bailey, remarks which will be judged to see if the hawkish bias from last week. Currently, towards the upper-end of 94.00-94.43 parameters.

- Click for a detailed summary

COMMODITIES

- Crude was initially firmer on the session but only modestly so. Focus on geopols, with the main update overnight being Qatar announcing that mediation efforts between Israel and Hamas are on hold. Thereafter, commentary via Al Arabiya that Hezbollah says there are negotiations to stop the war sparked marked pressure; Brent'Jan slumped to session lows of USD 72.79/bbl, but is just off worst levels.

- Spot gold is pressured, weighed on by the stronger USD and soft performance of China overnight as the region reacted to the lack of major stimulus in Friday’s session.

- Base metals are hampered by the stronger Dollar, the lack of China stimulus and disappointing CPI data from the region overnight weighing on metals generally. 3M LME Copper below the USD 9.5k handle.

- BSEE estimated that approximately 27.59% of the current daily oil production and 16.67% of the current daily natural gas production in the Gulf of Mexico has been shut-in due to Tropical Storm Rafael. It was later reported that Chevron (CVX) began to redeploy personnel and restore output at its Gulf of Mexico platforms that was shut-in due to Rafael.

- Saudi crude oil supply to China set to fall 36.5mln barrels in December, according to Reuters citing sources. Two other North Asian refiners to receive full Saudi crude allocation for December

- Click for a detailed summary

NOTABLE DATA RECAP

- Norwegian Core Inflation YY (Oct) 2.7% vs. Exp. 2.7% (Prev. 3.1%); MM 0.2% vs. Exp. 0.3% (Prev. 0.3%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves will set out the government’s plans to stimulate economic growth through the principles of stability, investment and reform, as well as hail the benefits of free trade amid impending US protectionism during her first Mansion House address on Thursday, according to FT.

- UK HMRC is set to return GBP 700mln to top UK companies after the UK won an appeal against a Brussels state aid clampdown which had forced London to collect tax against its wishes, according to FT.

- German Chancellor Scholz said he wouldn't have a problem with a vote of confidence before Christmas and that there is a good chance he will win another mandate to form another government, according to CGTN Europe.

- ECB's Holzmann said a rate cut is possible in December as things look at the moment and there is nothing at the moment that would argue against that but that does not mean it will automatically happen, while he added they do not have the latest forecasts and data which they will get in December and will decide on that basis.

- Fitch affirmed Spain at A-; Outlook revised to Positive from Stable, while it affirmed Poland at A; Outlook Stable and affirmed Lithuania at A; Outlook Stable. It was also reported that Moody’s upgraded Croatia to A3; Outlook changed to Stable from Positive.

- EU sees little chance of a quick China deal to avoid EV tariffs, via Bloomberg

NOTABLE US HEADLINES

- Fed’s Kashkari (2026 voter) said if growth and productivity are strong, the Fed may not cut as much, while he reiterated that housing inflation will take a while to come down all the way and they have made progress but want to get the job done on inflation. Kashkari also stated that the Fed wants to have confidence inflation will go all the way back to 2% and need to see more evidence before deciding on another cut.

- Edison Research projected Republicans won another seat in the US House bringing their total to 213, while Democrats have 204 seats with 218 needed for control.

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- Hezbollah says there are negotiations to stop the war, according to Al Arabiya.

- Israeli Foreign Minister says "We are ready to end the war when our objectives are achieved"; there is progress on Lebanon ceasefire talks, working with the Americans on this. No decision on the issue of annexing areas of the West Bank. The main challenge will be to enforce what is agreed. "The war is not over yet". Hezbollah's capabilities are severely reduced, majority of missile capacity is destroyed. Pushes back on the prospect of a Palestinian state, does not believe this is realistic. Israel has responded positively to Gaza ceasefire proposals, Hamas has refused to move forward. Trump has made it clear he understands the danger of Iran's nuclear ambitions

MIDDLE EAST

- Israel called upon Israelis not to attend cultural and sports events abroad in the week ahead, according to a statement from the PM’s office.

- Israeli media reported sirens heard in central Israel and the Israeli army reported interception of a missile approaching Israel coming from Yemen, according to Sky News Arabia.

- Israel conducted a strike on a residential building near Damascus which resulted in casualties, according to the Syrian state news agency.

- US National Security Adviser Sullivan said the US will make a judgement this week about the progress Israel made over the Blinken/Austin letter on humanitarian aid to Gaza. Sullivan also stated that President Biden will go through the top US foreign policy and domestic issues with President-elect Trump on Wednesday and Biden will make the case to Congress that they need ongoing resources for Ukraine beyond the end of his term.

- Qatar’s Foreign Ministry said its mediation efforts between Israel and Hamas are currently on hold and reports it is withdrawing from the Gaza ceasefire mediation are not accurate, while it said it will resume mediating in ceasefire talks when there is enough seriousness to end the brutal war.

- Iranian Foreign Minister Araqchi said a new scenario was fabricated after the US charged an Iranian man in the plot to kill President-elect Trump, while he said Iran is not after nuclear weapons and confidence building is needed from both sides.

- IRGC's Khatam al-Anbiya Headquarters deputy commander said Iran provides Hezbollah with ammunition and is not afraid of declaring it, while he added that Hezbollah has also publicly announced its affiliation with Iran, according to Iran International English.

- IAEA Director General Grossi will travel to Tehran this week for high-level meetings with the Iranian government.

- Iran announced the death of 5 security forces in an armed attack on the Pakistani border, according to Al Arabiya.

- Iraqi armed factions announce attack on a "vital target" in southern Israel with marches, according to Sky News Arabia.

- US-British aggression was reported on Yemen's capital Sanaa and the Amran governorate, according to Al Masirah TV.

- Two personnel from Saudi-led coalition forces were killed in an attack by a Yemeni Defence Ministry employee in Yemen’s Seiyun.

OTHER

- Russia's Kremlin reports that rumors of a Putin/Trump call were false - there was no call.

- US President-elect Trump spoke on the phone with Russian President Putin on Thursday and discussed the war in Ukraine, while Trump urged Putin not to escalate the war in Ukraine, according to The Washington Post.

- Russian Foreign Ministry said on Saturday that there are no grounds for talking about resuming dialogue with the US on strategic stability and arms, while it added that US President-elect Trump’s promises to resolve the crisis in Ukraine fast are nothing more than rhetoric.

- Russia and Ukraine launched their biggest drone attacks on each other since the start of the conflict, with several people injured in the tensions, according to LBC.

- Russian President Putin signed the law on ratification of the strategic partnership with North Korea, according to TASS.

- Ukrainian top military commander Syrski told a senior US general of reports regarding North Korean troops preparing to take part in combat alongside Russian forces, as well as noted that the front-line situation remains difficult and is showing signs of escalation.

- Ukrainian drones hit a chemical producer in Russia’s Tula region overnight.

- Chinese President Xi signed an order of regulations to guarantee military equipment, effective from December 1st.

- China’s Foreign Ministry said China firmly opposes the Philippines’ Marine Zones Act which severely infringes on China’s territorial sovereignty and maritime rights in the South China Sea, while China’s Coast Guard said the Philippines has frequently sent military police, civilian vessels and aircraft to intrude into the air and sea space near Huangyan Island, which is also known as Scarborough Shoal.

- Philippines aims to buy a US missile launcher in a move likely to anger China, according to FT.

CRYPTO

- Bitcoin soared past USD 80k over the weekend, and continued to climb higher today; currently sitting above USD 81k.

APAC TRADE

- APAC stocks began the week mostly subdued amid China-related headwinds following the recent fiscal stimulus disappointment and softer-than-expected Chinese inflation data from over the weekend.

- ASX 200 was dragged lower by weakness in the commodity and consumer-related sectors.

- Nikkei 225 traded indecisively but with the initial downside cushioned alongside currency weakness.

- Hang Seng and Shanghai Comp were pressured with underperformance in Hong Kong amid losses in property and tech although some chipmakers were boosted after the US ordered TSMC to halt shipments to China of chips used in AI applications. Elsewhere, the mainland traded cautiously after last Friday's announcement of fiscal measures disappointed those hoping for a more forceful stimulus in the aftermath of the Trump election victory, while Chinese CPI and PPI data were softer-than-expected and showed a worsening of the factory-gate deflation.

NOTABLE ASIA-PAC HEADLINES

- Foxconn (2317 TT) Jan-Sept net profit TWD 2.68bln.

- PBoC will step up counter cyclical adjustment: reiterates accommodative monetary policy stance, will actively prevent and resolve financial risk, will improve tools to deal with abnormal stock market news. Will broaden FDI channels. Increase loans for "while list" housing projects.

- China's Finance Ministry frontloads part of 2025's central Govt. fiscal funds for affordable housing, renovation of villages, towns and residential quarters

- Ishiba will continue to be the Japanese PM, after receiving 221/465 lower house votes

- China International Import Expo saw a 2% Y/Y increase in intended transaction value to USD 80bln.

- China and Peru will sign a deal to strengthen a Free Trade Agreement with the improved FTA to increase commerce by at least 50%, while President Xi is to travel to Peru with 400 business people interested in investing in infrastructure and technology.

- TSMC (2330 TT) was ordered by the US to stop shipments to China of advanced chips used for AI applications.

- BoJ Summary of Opinions from the October meeting noted a member said no change to the BoJ's stance it will adjust the degree of monetary support if its economic and price forecasts are met and a member said they must remain vigilant regarding the overseas economic outlook and market movements. There was also the opinion that risk of a US hard landing is subsiding but it cannot yet be said with certainty that markets are stabilising, while it was noted that the BoJ must communicate clearly that it will continue to raise the policy rate if its economic and price forecasts are met. Furthermore, a member said the BoJ must take time and move cautiously in raising rates and a member also stated that Japan is not in a phase where it needs massive monetary support, so the BoJ can consider additional rate hikes after pausing temporarily to gauge US economic developments.

DATA RECAP

- Chinese CPI MM (Oct) -0.3% vs. Exp. -0.1% (Prev. 0.0%); YY 0.3% vs. Exp. 0.4% (Prev. 0.4%)

- Chinese PPI YY (Oct) -2.9% vs. Exp. -2.5% (Prev. -2.8%)

- China Oct M2 money supply +7.5% Y/Y (exp. 6.9%)

- New Zealand Inflation Forecast 1 Yr (Q4) Q1 2.05% (Prev. 2.4%); 2 yrs Q1 2.12% (Prev. 2.03%)