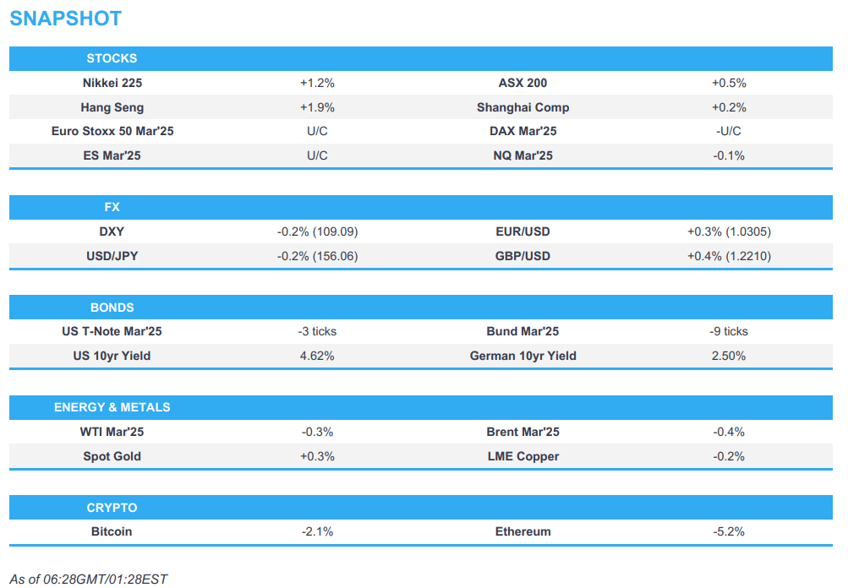

- APAC stocks were mostly higher following last Friday's gains on Wall St; markets look ahead to Trump's inauguration.

- Trump provided reprieve for TikTok from the US ban; also said he is set to sign dozens of executive orders within hours of taking office.

- European equity futures indicate a steady cash market open with the Euro Stoxx 50 future flat after the cash market closed higher by 0.8% on Friday.

- DXY is softer but holding above the 109 mark, EUR/USD and USD/JPY sit just above 1.03 and 156 respectively.

- Israel’s cabinet gave final approval to the Gaza ceasefire deal with the six-week ceasefire effective from Sunday.

- Looking ahead, highlights include German Producer Prices, BoC SCE, Second inauguration of US President-elect Trump, Supply from UK.

- Martin Luther King Jr. Day; Newsquawk will run a full service on MLK Day despite US market closures due to the US Presidential Inauguration.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

EQUITIES

- US stocks were bid on Friday supported by optimism on US/Sino relations after a phone call with US President-elect Trump and China President Xi, who both expressed a desire for a positive start to their relationship when Trump gets inaugurated on Monday. T-notes meanwhile flattened in likely profit-taking after the dovish inflation data and dovish commentary from Waller last week ahead of Trump's inauguration where focus will lie on executive orders around tariffs/spending.

- SPX +1.00% at 5,997, NDX +1.66% at 21,441, DJIA +0.78% at 43,488, RUT +0.40% at 2,276.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President-elect Trump said in a Washington rally on the eve of his inauguration that they are going to stop the invasion of their borders and will unlock liquid gold from under their feet. Trump also said he will act on Monday with historic speed and strength, unleash energy resources and use emergency powers to allow people to build big AI plants, while he reaffirmed his plan to utilise tariffs and reduce taxes. Furthermore, Trump said he will sign dozens of executive orders within hours of taking office and the number of orders will be close to 100.

- US President-elect Trump is planning a blitz of executive orders during the first days of his return to the White House and is expected to issue orders on deportations, tariffs and cuts to regulation, while Trump's team is planning a national emergency on the US-Mexico border, according to WSJ.

- US President-elect Trump’s team plans to initiate large-scale deportations on Tuesday, according to WSJ. It was separately reported that Trump’s border czar Homan said the incoming administration has not decided whether to launch immigration raid in Chicago in the week ahead, according to The Washington Post. Furthermore, Trump is to classify drug cartels as foreign terrorist organisations, according to Punchbowl.

- Vivek Ramaswamy could withdraw from working with the Department of Government Efficiency ahead of his bid for Ohio Governor, according to Politico.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher following last Friday's gains on Wall St and with some positive developments over the weekend including the start of the Israel-Hamas ceasefire and US President-elect Trump providing reprieve for TikTok from the US ban on the eve of his inauguration.

- ASX 200 mildly gained with the index helped by strength in tech, real estate and the top-weighted financials sector.

- Nikkei 225 saw early notable strength and briefly reclaimed the 39,000 level in the aftermath of the better-than-expected Machinery Orders from Japan which comfortably beat expectations and showed a surprise M/M expansion.

- Hang Seng and Shanghai Comp were underpinned with tech driving the outperformance in Hong Kong after Trump pledged a reprieve for TikTok regarding the US ban which initially took effect on Sunday and with sentiment also helped by the constructive Trump-Xi call on Friday. Furthermore, China's LPRs were maintained at the current levels as expected, while China's Cabinet noted it will strengthen policy support for employment and provide supportive services to actively promote high-quality and sufficient employment.

- US equity futures (ES U/C) were indecisive and took a breather after Friday's advances with the US on an extended weekend due to Martin Luther King Jr. Day.

- European equity futures indicate a steady cash market open with the Euro Stoxx 50 future flat after the cash market closed higher by 0.8% on Friday.

FX

- DXY eventually softened with US participants on a long weekend due to Martin Luther King Jr. Day and with all eyes on the Presidential Inauguration, as well as the incoming President's first actions upon returning to the White House with Trump reportedly set to unleash a blitz of executive orders. Furthermore, there was a lack of FX-moving catalysts from over the weekend and the Fed also entered into a blackout period.

- EUR/USD edged higher and reclaimed the 1.0300 status, while there were comments over the weekend from ECB’s Schnabel that the ECB is getting closer and closer to the point where it needs to take a closer look at whether and how much further it can cut interest rates. Furthermore, ECB's Holzmann said a January rate cut is not a foregone conclusion, ECB risks credibility cutting rates when CPI is increasing.

- GBP/USD steadily rebounded from Friday's trough and returned to the 1.2200 territory with an acceleration seen in the latest UK Rightmove House Price Index.

- USD/JPY trickled lower to test 156.00 to the downside with Japanese currency supported ahead of the BoJ rate decision later in the week and after Japanese Machinery Orders topped estimates.

- Antipodeans benefitted in tandem with the strength in CNH following the constructive dialogue from the Trump-Xi call last Friday and with Trump vowing a 90-day reprieve for TikTok regarding the US ban.

- PBoC set USD/CNY mid-point at 7.1886 vs exp. 7.3353 (prev. 7.1889).

FIXED INCOME

- 10yr UST futures lacked firm direction with US markets closed on Monday for Martin Luther King Jr. Day.

- Bund futures traded rangebound after the prior week's late rebound stalled just shy of the 132.00 level and with German Producer Prices due later.

- 10yr JGB futures kept afloat with support seen near the 141.00 level although the upside was capped after stronger-than-expected Machinery Orders from Japan and as participants continued to await the BoJ rate decision on Friday where the central bank is expected to hike rates.

COMMODITIES

- Crude futures were little changed with demand hampered after the Israel-Hamas ceasefire took effect and with US President-elect Trump vowing to declare a national energy emergency as soon as he takes office.

- US President-elect Trump is to declare a national energy emergency to unlock new powers as part of his plan to unleash domestic energy production while seeking to reverse President Biden’s actions to combat climate change, according to people familiar with the matter cited by Bloomberg.

- BP (BP/ LN) announced the Shah Deniz Alpha platform has restarted.

- Iran set February Iranian light crude price to Asia at Oman/Dubai + USD 1.95/bbl.

- Libya’s NOC said subsidiary AGOCO’s production rates reached 304k bpd.

- Spot gold saw two-way price action with initial pressure following a break beneath the USD 2,700/oz level before gradually recovering.

- Copper futures extends on Friday's pullback and failed to benefit from the constructive risk sentiment.

- Goldman Sachs estimates that the copper market is pricing almost a 50% probability of 10% US tariffs on copper by end-Q1. Assign a 10% probability to a 10% effective tariff on gold in the next 12-months.

CRYPTO

- Bitcoin mildly gained overnight and briefly returned to above the USD 102k level but with price action choppy after its pullback over the weekend.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1 Year (Jan) 3.10% vs. Exp. 3.10% (Prev. 3.10%)

- Chinese Loan Prime Rate 5 Year (Jan) 3.60% vs. Exp. 3.60% (Prev. 3.60%)

- US President-elect Trump told advisers he wants to visit China when he is President and it was reported that Trump told his team that he would visit China after the inauguration, according to CNN. However, Trump officials noted that no plans for a China trip have been made, according to WSJ.

- Chinese Vice Premier Han Zheng said to US VP-elect Vance that economic and trade relations are important issues of common concern, as well as commented that while differences and frictions exist, common interests and space for cooperation are huge. Han said China hopes US companies will continue to invest and 'take root' in China and welcomes US companies, including Tesla, to 'seize the opportunity' and share fruits of China's development.

- TikTok app ban in the US began on Sunday. However, it was later reported that Trump said he will issue an executive order on Monday to extend the period of time before the law takes effect and there will be no liability for any company that helps keep TikTok from going dark before his order, while TikTok restored its service and thanked Trump for providing necessary clarity that service providers will not face penalties.

- US House Speaker Johnson said he thinks Trump will try to force a true divesture of TikTok, while it was also reported that incoming National Security Adviser Waltz said Trump needs time to evaluate TikTok and that every company in China has some connection to the Chinese Communist Party.

- China issued its 2024-2035 plan to build a strong education nation and said it will ensure education spending from the public budget increases annually and it will accelerate the development of a high-quality employment service system for university graduates, according to Xinhua.

- South Korean President Yoon was formally arrested which triggered riots by his supporters at the courthouse.

DATA RECAP

- Japanese Machinery Orders MM (Nov) 3.4% vs. Exp. -0.4% (Prev. 2.1%)

- Japanese Machinery Orders YY (Nov) 10.3% vs. Exp. 5.6% (Prev. 5.6%)

GEOPOLITICS

MIDDLE EAST

- Israel’s cabinet gave final approval to the Gaza ceasefire deal with the six-week ceasefire effective from Sunday, while Israeli forces started withdrawing from areas in Gaza’s Rafah to the Philadelphi Corridor along the border between Egypt and Gaza.

- Israeli PM Netanyahu said they will not relent until all hostages are released and noted the first stage of the deal is a temporary ceasefire, while he added Trump and Biden support Israel’s right to resume fighting if the second stage is fruitless and if they must return to fighting, they will do that in new and forceful ways.

- Israel’s Foreign Minister said there is no future peace, stability and security for both sides if Hamas stays in power. It was separately reported that Israel’s Finance Minister said he received assurances that Israel will not stop the war.

- Israeli official announced that the first three Israeli hostages were freed by Hamas in the Gaza ceasefire and hostages deal.

- Israeli forces reportedly raided the villages of Odla and Beit Fuik southeast of Nablus in the West Bank, according to Al Jazeera sources.

- Hamas armed wing spokesman said the group abides by the ceasefire agreements and that success requires Israel's commitment, while the spokesman said an Israel violation could endanger the process and urged mediators to compel Israel to commit to the Gaza ceasefire agreement.

- Yemen’s Houthis warned ‘hostile forces’ in the Red Sea against any aggression on Yemen during the Gaza ceasefire and it will coordinate closely with the Palestinian resistance to deal with Israel in case of any violations of the ceasefire deal.

- US President Biden said the Gaza ceasefire deal has come to fruition and hundreds of trucks are entering Gaza to assist civilians, while Biden added it now falls on the Trump administration to implement the Gaza deal.

- Incoming US National Security Adviser Waltz said they will make decisive decisions on Iran next month, while he added Iran is weak and its air defences have been eliminated, according to Al Arabiya.

- "Israel has made a decision to attack Iran's nuclear facilities," a senior EU official told Al-Arabiya over the weekend. The official estimated that Israel is expected to carry out the attack in the coming months, Israel's N12 reports.

RUSSIA-UKRAINE

- Ukrainian media reported a state of air alert was declared and explosions heard in Ukraine's Chernihiv, according to Asharq News.

- Ukraine's military said it struck an oil depot in Russia’s Kaluga province, while Russia’s Defence Ministry said Russian forces struck Ukrainian military facilities with high-precision weapons.

EU/UK

NOTABLE HEADLINES

- UK senior Treasury minister Jones said US President-elect Trump is unlikely to impose trade tariffs on the UK and that Britain should not look at the incoming US President as a risk, according to FT.

- ECB’s Schnabel said that they currently see no major risks that could prevent them from reaching their 2% target and if that is the case, they will probably be able to lower interest rates further but also noted that they must proceed carefully. Schnabel added that "we are getting closer and closer to the point where we need to take a closer look at whether and how much further we can cut interest rates.” according to Bloomberg citing an interview with Finanztip.

- ECB's Holzmann says a January rate cut is not a foregone conclusion, ECB risks credibility cutting rates when CPI is increasing.

DATA RECAP

- UK Rightmove House Price Index MM (Jan) 1.7% (Prev. -1.7%)

- UK Rightmove House Price Index YY (Jan) 1.8% (Prev. 1.4%)