- APAC stocks traded somewhat mixed in the absence of a lead from Wall St owing to the Presidents' Day holiday.

- Fed's Waller (voter) said the Fed cannot let uncertainty about policy paralyse action but it is appropriate to keep rates on hold for now.

- RBA delivered a widely expected 25bps rate cut but also noted the board remains cautious on prospects for further policy easing.

- European equity futures indicate a marginally softer cash market open with Euro Stoxx 50 futures down 0.1% after the cash market closed with gains of 0.5% on Monday.

- DXY is firmer, AUD marginally lags post-cautious RBA rate cut, EUR/USD remains on a 1.04 handle, Cable trades around the 1.26 mark.

- Looking ahead, highlights include UK Jobs, German ZEW Survey, Canadian CPI, Japanese Exports/Imports, BoE’s Bailey, ECB’s Cipollone, Fed’s Daly, Waller & Barr, Supply from UK & Germany, Earnings from Baidu, Medtronic, Conagra, Occidental Petroleum, HSBC, Antofagasta & Capgemini.

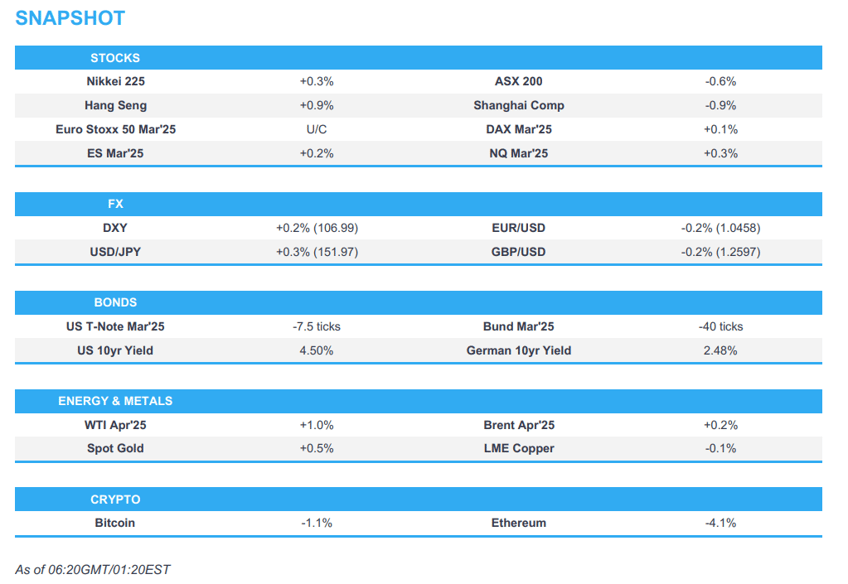

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stock markets were closed for Presidents' Day although equity futures saw mild gains in the shortened trading hours and T-note futures marginally declined after the jump on Friday following weak retail sales data. In terms of FX, the dollar was flat and the yen outperformed after strong GDP numbers whereas AUD was little changed ahead of the RBA overnight, while Brent prices settled higher on fading Russia and Ukraine optimism with peace talks facing disagreements while Ukraine recently targeted a Russian pipeline.

- Click here for a detailed summary.

TARIFFS

- US President Trump re-posted comments from Truth last week on tariffs in which he stated that he decided, for purposes of fairness, to charge a reciprocal tariff meaning, whatever countries charge the US, we will charge them “No more, no less!".

NOTABLE HEADLINES

- Fed's Waller (voter) said tariffs are expected to have a modest and non-persistent impact on prices that the Fed should try to look through when setting policy, while he added the recent CPI reading was disappointing but may be the result of seasonal adjustment issues. Waller also commented that the Fed cannot let uncertainty about policy paralyse action and decisions must be guided by data but added that it is appropriate to keep rates on hold for now and seasonal effects may be distorting data, as well as noted that he sees inflation progress in the past year as excruciatingly slow.

APAC TRADE

EQUITIES

- APAC stocks traded somewhat mixed in the absence of a lead from Wall St owing to the Presidents' Day holiday, while participants in the region braced for central bank updates beginning with the RBA rate decision.

- ASX 200 traded negative amid underperformance in energy and the top-weighted financials sector, while sentiment failed to benefit from the RBA's widely expected 25bps rate cut as it also signalled caution on further cuts.

- Nikkei 225 gained but with upside capped after swinging between gains and losses amid firmer yields and a quiet calendar.

- Hang Seng and Shanghai Comp were varied as the Hong Kong benchmark resumed its recent outperformance with the help of strength in tech and auto names, while the mainland was lacklustre as US-China frictions lingered and after reports noted that the PBoC may further limit its MLF rollover to prevent idle funds.

- US equity futures (ES +0.2%, NQ +0.3%) were positive albeit with price action quiet following yesterday's US holiday closure.

- European equity futures indicate a marginally softer cash market open with Euro Stoxx 50 futures down 0.1% after the cash market closed with gains of 0.5% on Monday.

FX

- DXY gradually strengthened as trade began to pick up from the holiday lull, while there were several recent Fed comments including from Waller who stated it is appropriate to keep rates on hold for now and that seasonal effects may be distorting data. Nonetheless, the rhetoric had little impact and participants now await more comments from Fed officials and President Trump.

- EUR/USD lacked demand following its recent failure to sustain the 1.0500 status and after European leaders met in Paris for an emergency summit on Ukraine with several calling for increased defence spending.

- GBP/USD continues its marginal pullback from yesterday's advances and just about gave back the 1.2600 status ahead of UK jobs and wages data, while UK PM Starmer is reportedly set to meet with US President Trump next week.

- USD/JPY regained some composure after the recent declines and just about reclaimed the 152.00 level despite the mild upside in yields in the aftermath of the recent stronger-than-expected Japanese economic growth.

- Antipodeans were somewhat mixed in which AUD/USD was choppy but ultimately found some support after the RBA rate decision where the central bank delivered a widely expected 25bps rate cut but also noted the board remains cautious on prospects for further policy easing, while RBA Governor Bullock also suggested that further rate cuts implied by market are not guaranteed. Conversely, NZD/USD underperformed ahead of tomorrow's RBNZ meeting with the central bank heavily priced by markets to deliver another 50bps cut.

- PBoC set USD/CNY mid-point at 7.1697 vs exp. 7.2538 (prev. 7.1702).

FIXED INCOME

- 10yr UST futures remained subdued after yesterday's cash market closure and with the latest Fed rhetoric providing little to shift the dial, while participants look ahead to more Fed speakers scheduled later today, as well as tomorrow's FOMC Minutes.

- Bund futures extended on the prior day's losses to below 132.00 level ahead of German supply and ZEW data.

- 10yr JGB futures attempted to recoup some of the recent losses but was later thwarted by a weak 20yr JGB auction.

COMMODITIES

- Crude futures kept afloat and took a breather following Monday's rebound amid a report that OPEC+ is mulling delaying bringing back oil barrels in April, although sources stated that no decision has been made yet and Russian Deputy PM Novak also denied that OPEC+ is considering a delay of the April oil supply restart.

- Spot gold strengthened and returned to above the USD 2,900/oz level with the precious metal unfazed by a firmer dollar.

- Copper futures prodded Monday's lows with demand hampered amid the mixed risk appetite in Asia.

CRYPTO

- Bitcoin eked mild gains with price action choppy on both sides of the USD 96,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBA cut the Cash Rate by 25bps to 4.10%, as expected, and said underlying inflation is moderating and the outlook remains uncertain, while it added that sustainably returning inflation to the target is the priority and the board will continue to rely on data and evolving risk assessments to guide decisions. RBA stated the board is more confident that inflation is moving toward the midpoint of the 2–3% target range but noted that upside risks remain and the board remains cautious on prospects for further policy easing. Furthermore, it stated that forecasts suggest that easing monetary policy too soon could stall disinflation and cause inflation to settle above the target midpoint.

- RBA Statement on Monetary Policy stated inflation and GDP have been softer than expected, while the labour market remains strong and domestic financial conditions are restrictive, with rates above neutral. RBA also noted a wide range of estimates for the neutral rate, with some estimates declining and it forecast GDP to grow by 2.0% in June 2025, 2.3% in June 2026, and 2.2% in June 2027, while CPI is forecast at 2.4% in June 2025, 3.2% in June 2026, and 2.7% in June 2027 with the trimmed mean inflation forecast at 2.7% for June 2025, 2026, and 2027. Furthermore, its forecasts assumed a cash rate of 4.0% in June 2025, 3.6% in December 2025, and 3.4% in June 2026.

- RBA Governor Bullock said in the post-meeting press conference that it is clear high rates have worked and cannot declare victory on inflation yet, while the strength of the jobs market has been surprising and further rate cuts implied by the market are not guaranteed. Bullock said cannot get too ahead of ourselves on rates and the rate cut was a difficult decision, as well as stated that they have to be patient and it is really important to get inflation down.

- China's state planner said 'precise' policies are to be implemented to help ease difficulties faced by private companies and the current political, economic, and social environment is conducive to the development of the private economy. NDRC stated that China will further break down barriers to market access and revise the negative list for market access as soon as possible, while it will continue efforts to solve financing difficulties and high costs for private enterprises, as well as plans to speed up preparations for the implementation of the private economy promotion law.

DATA RECAP

- RBNZ Survey showed household 1-year inflation expectation is at 4.0% (prev. 3.0%), 2-year inflation expectation is at 3.0% (prev. 3.0%) and 5-year inflation expectation is at 3.6% (prev. 3.4%).

GEOPOLITICS

MIDDLE EAST

- Israeli security official said they are preparing to receive the bodies of four hostages on Thursday and are working to secure the release of six living hostages on Saturday.

- Sources noted that the Egyptian plan on Gaza includes reconstruction within a period ranging from 3 to 5 years without displacing the population, according to Asharq News.

- US President Trump posted on Truth that US forces conducted a precision airstrike against a member of al-Qaeda in Syria this weekend.

- Iran’s Foreign Minister said they will never negotiate under pressure or threat but if the US negotiates with respect and dignity, the Iranian response will be with the same language.

- Russia is ready to help Tehran in solving problems related to Iran's nuclear program and the start of Russia-US talks will have no impact on Russia-Iran cooperation, according to TASS citing the Kremlin.

RUSSIA-UKRAINE

- Russia's sovereign wealth fund chief Dmitriev said in Riyadh that US-Russia talks on ending the Ukraine war are important and US businesses have lost millions due to leaving Russia, while he added that US businesses have lost USD 300bln after leaving Russia and believes US oil majors will at some point return to Russia.

- Ukrainian President Zelensky said he had a "long" call with French President Macron on security guarantees and achieving peace in Ukraine.

- US President Trump spoke with French President Macron about Ukraine, the European meeting, and Saudi talks between US and Russian officials.

- French President Macron said he spoke with US President Trump and then with Ukrainian President Zelensky, while he added that they will continue discussions about Ukraine in the coming days and work will continue based on the European Commission’s proposals, supporting Ukraine and investing in defence.

- UK PM Starmer said part of his message to European allies is that they’ve all got to step up on capability and on spending and funding, while he added that includes the UK which is why he has made a commitment to spend more, according to FT.

- German Chancellor Scholz rejected UK PM Starmer's call for Europe to step up and deploy troops to Ukraine as part of any peace deal, according to The Telegraph.

- Polish PM Tusk said all participants in the meeting on Ukraine had similar opinions to Poland on key issues and all agreed close cooperation within NATO is needed. Tusk added they realise that transatlantic relations are in a new stage and European partners realise that the time has come for greater European defence capabilities and spending.

- Danish PM said they must ramp up military preparedness and see no signs that the Russians want peace.

- European leaders at the Paris meeting agreed it would be dangerous to conclude a Ukraine ceasefire without a peace agreement at the same time, while they are ready to provide Ukraine with security guarantees depending on the level of US support.

OTHER

- Taiwan is considering a multi-billion-dollar weapons purchase from the US which could be between USD 7-10bln and could include coastal defence missiles and HIMARS rockets, while the package would send a message that Taiwan is committed to its defence, according to Reuters sources.

- North Korea’s Foreign Ministry said the US is pursuing an outdated and absurd plan of denuclearisation of the Korean Peninsula, while North Korea will adhere to bolstering its nuclear force, according to KCNA.

GLOBAL NEWS

- Crews responded to a plane crash at the Toronto Pearson airport, while the incident occurred upon landing involving a Delta Airlines (DAL) plane arriving from Minneapolis although all passengers and crew are accounted for.

EU/UK

NOTABLE HEADLINES

- ECB's Holzmann said there's some probability of a March rate cut and decisions in favour of more cuts are getting harder, according to Bloomberg.

- UK Chancellor Reeves will have to raise taxes by an extra GBP 12bln if she wants to boost defence spending to 2.5% of GDP and avoid a fresh round of austerity, according to The Telegraph.