Alibaba Group's founder, Jack Ma, vanished from public view in late 2020 after making critical remarks about China's financial regulatory system. He briefly resurfaced in early 2021 during a video call with rural teachers but remained out of the spotlight for several years—until now.

Goldman's Philip Sun penned a note to clients overnight titled "A pic is worth thousands of words. President Xi shook hands with Jack Ma. Buy GS A500 inclusion basket?"

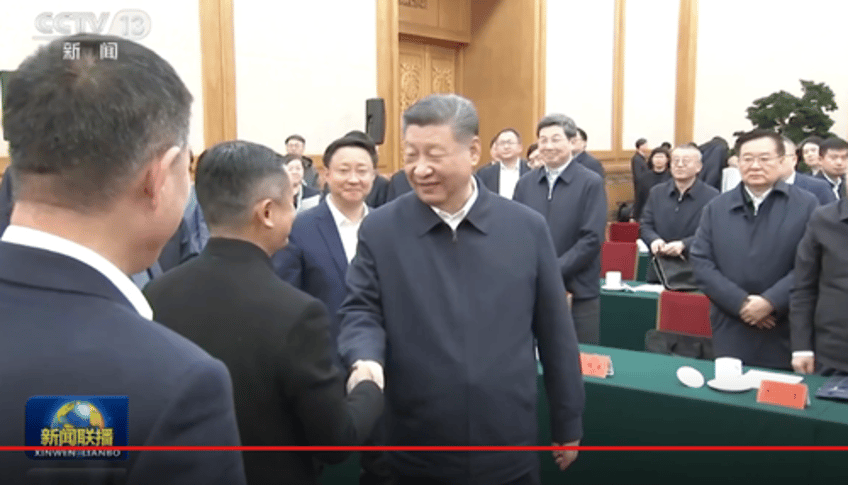

Sun was watching CCTV Prime Time News when top CCP leaders gathered at the Great Hall of the People for a meeting with Chinese business executives, including Jack Ma.

"I took a snapshot of President Xi shaking hands with Alibaba's founder Jack Ma," the analyst said, adding, "The young man sitting to the right of Pony Ma is DeepSeek founder Mr. Liang WenFeng (born in 1985)" and "The young man sitting to the right of Jack Ma (with 2 people in between them) is the robotics company UniTree's founder Mr. XingXing WANG (born in 1995)."

Ma was also joined by other private enterprise heads who spoke at the event, including Huawei's founder Ren Zhengfei, BYD's founder Wang Chuanfu, New Hope Group's founder Liu Yonghao, Will Semi's founder Yu Renrong, and Xiaomi's founder Lei Jun.

The rare meeting between Ma, other Chinese tech leaders, and President Xi signals the CCP's renewed confidence in the tech space after years of regulatory crackdowns.

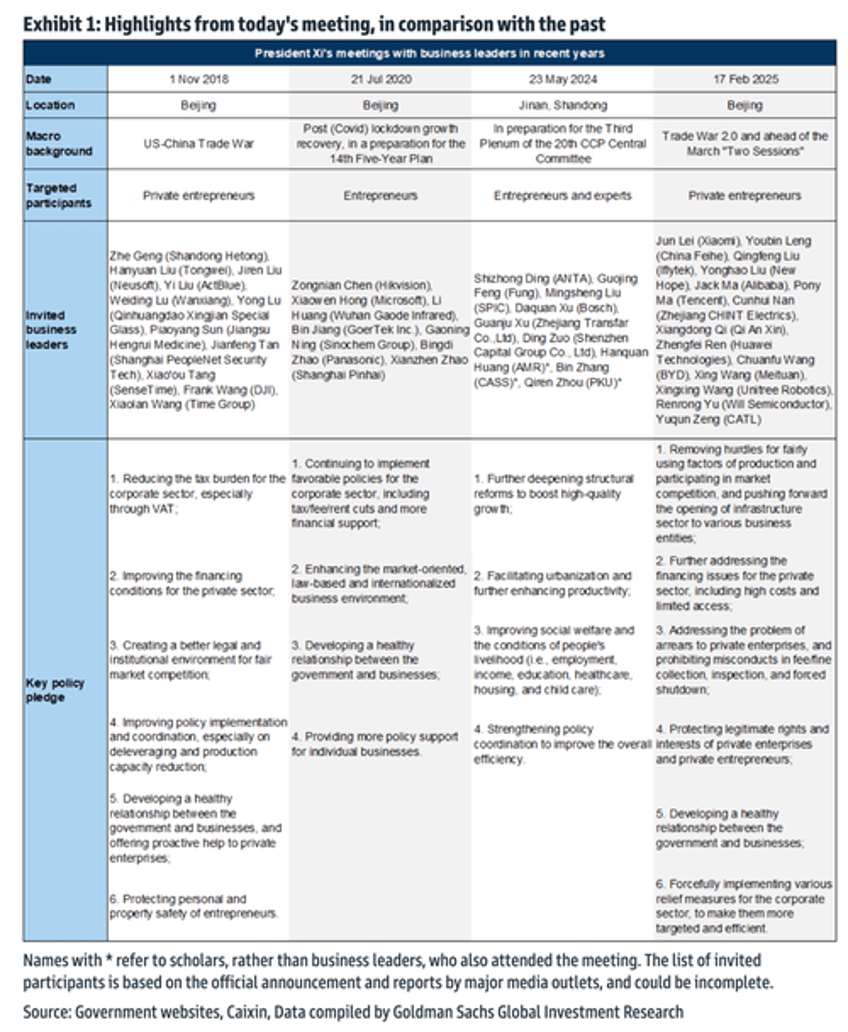

Summarized here:

Goldman's Sun told clients: "As mentioned this morning, I think the symposium is highly symbolic. It is yet another very strong testimony that China's political pendulum is swinging from the left (SOE's) to the right (POE's), as highlighted in the sales note below."

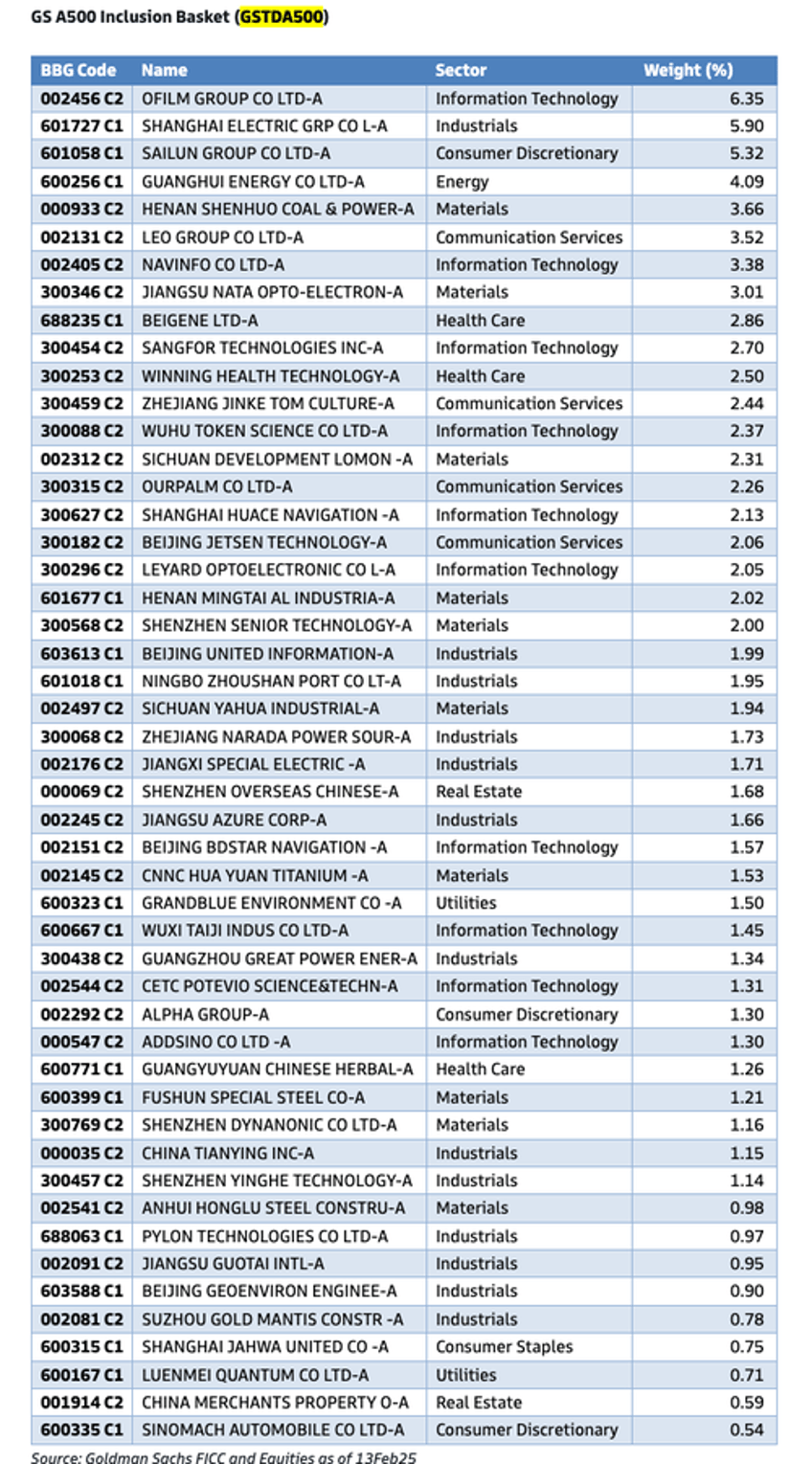

He told clients to consider "our GS A500 inclusion basket (GSTDA500)" to "get more exposure to China A-shares."

Ten days ago, Goldman's Hailey He informed clients her stance on Chinese tech stocks was "cautiously optimistic," noting that "AI enthusiasm sparked by Deepseek pushed Chinese tech shares into a bull market.

Goldman's He provided more color around "cautiously optimistic":

As China returns from one week CNY holiday, market sentiment on China asset improves as seen from the bullish price action in both equities and fixed income. Tariff reprieve, AI enthusiasm sparked by Deepseek and easy liquidity all contributed to the move.

China equities staged a meaningful rebound this week on AI optimism. HSI tech, the parameter of foreigner confidence, surged 23% from January lows. GS Asia internet research is bullish on further AI advancement and cost efficiencies. To highlight, the cost of Doubao, the most popular AI Chatbot in China, is 85% cheaper than industry average. In terms of stocks, we continue to see Tencent as best positioned in introducing To-C AI agent applications given the Weixin super-app with both social and transaction capabilities. We continue to be bullish on Alibaba (China's largest public cloud hyperscaler) and data centers (GDS, VNET) that will benefit from ongoing public cloud and AI computing demand growth from multi-year higher AI adoption. The latest piece from equity research on China AI can be accessed here.

In a separate note, Sat Duhra, portfolio manager at Janus Henderson Investors in Singapore, told clients, "This is a sector that has been ignored but like other purely domestic sectors, there are some bright spots," adding, "The recent DeepSeek announcement is a timely reminder that behind the scenes, industrial policy — for example Made in China 2025 — has pushed many sectors toward world-class status."

Deutsche Bank analyst Peter Milliken told clients, "We think 2025 is the year the investing world realizes China is out-competing the rest of the world."

"Investors, we believe, will have to pivot sharply to China in the medium term and will struggle to get access to its stocks without bidding them up," Milliken wrote.

China politics observer Alfred Wu of the Lee Kuan Yew School of Public Policy told The Straight Times that the meeting was twofold:

- to address international challenges

- and domestic economic stagnation.

"It is certainly good that the government hears from the private sector in person. But it remains to be seen whether this will lead to concrete actions that address their concerns," Associate Professor Wu said, citing the difficulty in getting loans and dealing with predatory behavior by local governments, such as profit-driven enforcement.

Professor Bert Hofman, an economist at NUS' East Asian Institute, viewed the meeting as a major signal that the government would begin supporting the private sector.

"China's innovation and development depend on a healthy private sector as demonstrated by the people in the meeting – all innovators in their own field. The fact that Jack Ma and Pony Ma (chief executive officer of Tencent) were in the meeting is good news for the platform economy, which had been under regulatory scrutiny for some time," Hofman said.

The return of Ma and the CCP's renewed love of domestic tech firms comes as China's rivalry with US tech companies intensifies amid an AI arms race and an ongoing 'Great Power' competition. This development is promising news for investors who have recently loaded up on cheap Chinese tech.

However, despite the rally in Chinese tech stocks and broader domestic markets, onshore equity ETFs saw 44 billion in outflows last week, marking the largest weekly outflow this year. It remains to be seen how the market will react once the plunge protectors step back.