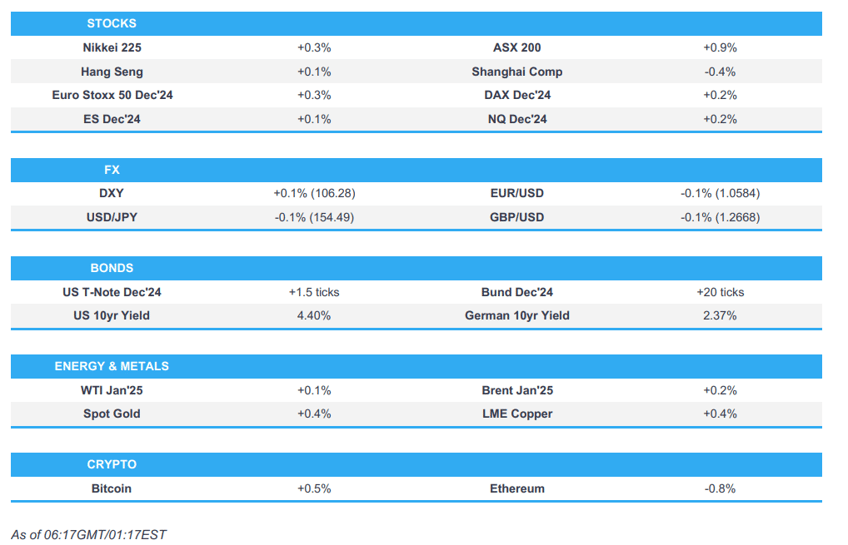

- APAC stocks traded mostly in the green following the similar performance stateside although gains were capped amid relatively quiet newsflow.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.3% after the cash market closed lower by 0.1% on Friday.

- FX markets are broadly steady, DXY holds above 106, EUR/USD sits below 1.06, JPY is a touch firmer.

- Crude futures held on to the prior day's gains, fixed income markets were uneventful overnight.

- Looking ahead, highlights include EZ HICP (Final), Canadian CPI, US Building Permits, NBH Policy Announcement, ECB’s Elderson, BoE's Bailey, Lombardelli, Mann & Taylor, Fed's Schmid, Supply from UK, Earnings from British Land, Sage, Ashtead, Severn Trent, Walmart, Xpeng, Lowe's & Medtronic.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stock markets mostly notched mild gains with outperformance in the tech-heavy Nasdaq 100 (+0.7%) which was buoyed by strength in Tesla (TSLA) (+5.7%) as it continued its post-Trump win rally, while sectors closed almost exclusively in the green with Energy and Communication Services the outperformers as the former was buoyed by the upside in the crude complex after Kazakhstan's Ministry of Energy announced oil production at the Tengiz oilfield (600k BPD) was reduced by 28-30% due to technical works and Equinor's Sverdrup (720k BPD) output was halted.

- SPX +0.39% at 5,894, NDX +0.71% at 20,539, DJIA -0.13% at 43,390, RUT +0.11% at 2,306.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Senior administration official said the Biden administration urges Congress to approve roughly USD 100bln for various disaster relief programmes after deadly hurricanes.

- US President-elect Trump is said to be pressuring senators to confirm Matt Gaetz as Attorney General, according to Axios. However, it was also reported that Trump admitted Gaetz may not be confirmed by the Senate, according to NYT.

APAC TRADE

EQUITIES

- APAC stocks traded mostly in the green following the similar performance stateside although gains were capped amid relatively quiet newsflow with no major fresh macro catalysts to drive price action.

- ASX 200 outperformed and notched a fresh record high with all sectors in the green and the advances led by a tech resurgence and strength in gold miners, while there were recent amiable Xi-Albanese comments and Morgan Stanley raised its ASX 200 target.

- Nikkei 225 traded higher and shrugged off a firmer currency as Japan aims for cabinet approval of an economic package soon.

- Hang Seng and Shanghai Comp swung between gains and losses despite better-than-expected earnings from Xiaomi which failed to lift shares in the smartphone/EV maker, while support pledges by regulators did little to boost sentiment and the EU is also reportedly to demand tech transfers from Chinese companies in return for EU subsidies which would apply to batteries but could be expanded to other green sectors.

- US equity futures (ES +0.1%, NQ +0.2%) were marginally higher following the prior day's mild gains but with the upside limited by a lack of drivers.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.3% after the cash market closed lower by 0.1% on Friday.

FX

- DXY was contained after the prior day's losses and amid the absence of any major catalysts in a week with very little in the way of key events from the US aside from Nvidia earnings, Flash PMIs and Fed speakers.

- EUR/USD held on to most of yesterday's spoils but with upside capped by resistance around the 1.0600 level.

- GBP/USD traded sideways with a firm footing at the 1.2600 handle with participants looking ahead to BoE comments at the MPC Treasury Committee hearings.

- USD/JPY continued its pullback from above 155.00 to test 154.00 to the downside where it found some support, while there were few catalysts to drive price action although Finance Minister Kato reiterated the familiar jawboning that it is important for currencies to move in a stable manner reflecting fundamentals and they will continue to take appropriate action against excessive FX moves.

- Antipodeans conformed to the uneventful mood across the FX space after the lack of fireworks from the RBA's November meeting minutes which stated the Board is vigilant to upside inflation risks and policy is needed to remain restrictive, while it saw no immediate need to change the Cash Rate and noted it is not possible to rule anything in or out on future changes in the Cash Rate.

- PBoC set USD/CNY mid-point at 7.1911 vs exp. 7.2305 (prev. 7.1907).

FIXED INCOME

- 10yr UST futures were rangebound after yesterday's choppy performance amidst thin newsflow and a lack of major catalysts.

- Bund futures traded uneventfully after reclaiming the 132.00 level and with little on the calendar out of the eurozone scheduled for Tuesday aside from the final October EU inflation data.

- 10yr JGB futures eked mild gains in quiet trade amid the absence of data releases from Japan and with a muted reaction seen despite the stronger demand at the latest enhanced liquidity auction for long- to super-long JGBs.

COMMODITIES

- Crude futures held on to the prior day's gains after benefitting from a weaker dollar and output-related disruptions.

- Spot gold remained underpinned following its recent return to above the USD 2600/oz level.

- Copper futures mildly gained alongside the mostly positive risk environment and support pledges by Chinese officials.

CRYPTO

- Bitcoin steadily gained overnight and reverted to back above the USD 91,000 level.

- US President-elect Trump is to meet privately with Coinbase (COIN) CEO Brian Armstrong, according to WSJ.

NOTABLE ASIA-PAC HEADLINES

- PBoC's Zhu said China will deepen Qualified Foreign Institutional Investor and Renminbi Qualified Foreign Institutional Investor reforms, while it will support Hong Kong to develop the offshore yuan market.

- Chinese Vice Premier He Lifeng said they will support more quality enterprises to list and issue bonds in Hong Kong, as well as support Chinese financial institutions in Hong Kong to expand their business.

- China's NFRA chief said Chinese banks have sufficient buffers for risk and they will implement the new CNY 60bln limit on local government debt and support financial institutions in debt restructuring to ease pressure on local governments. Furthermore, efforts will focus on improving financial service facilitation in the Greater Bay Area through interoperability of regulatory mechanisms and targeted policy issuance, while there are encouraging Chinese-funded banks and insurance institutions to set up their regional headquarters in Hong Kong to support its economic development.

- China CSRC Chairman Wu Qing said they will support listings inside and outside of the mainland.

- EU is reportedly to demand technology transfers from Chinese companies in return for EU subsidies, while the requirements would apply to batteries but could be expanded to other green sectors, according to FT.

- Hong Kong jailed all 45 Hong Kong pro-democracy campaigners in the city's largest security trial with legal scholar Benny Tai sentenced to 10 years in prison for subversion and student leader Joshua Wong sentenced to 4 years and 8 months, while it was later reported that the US strongly condemned the jailing of the democracy activists, according to AFP.

- Japanese Economic Revitalisation Minister Akazawa said they are aiming for cabinet approval of the economic package soon and it is crucial to boost pay for all generations with the package, while DPP head Tamaki also said that they aim for cabinet approval of economic measures by Friday.

- Japanese Finance Minister Kato said it is important for currencies to move in a stable manner reflecting fundamentals and they will continue to take appropriate action against excessive forex moves. Kato stated there is absolutely no change to their stance on forex and they have been seeing somewhat one-sided, sharp moves in the forex market since late September, while he reiterated they are closely watching FX moves with the utmost sense of urgency.

- RBA Minutes from the November 5th meeting stated the Board is vigilant to upside inflation risks and policy is needed to remain restrictive, while it saw no immediate need to change the Cash Rate and reiterated it is not possible to rule anything in or out on future changes in the Cash Rate. RBA Minutes noted their forecasts were based on the technical assumption for the Cash Rate to stay steady until mid-2025 and the Board considered what might warrant future change in cash rate or prolonged steady period, as well as discussed scenarios where policy would need to stay restrictive for longer or tighten further but also considered scenarios where a rate cut would be justified, including weak consumption. Furthermore, RBA noted the supply gap might be wider than assumed, necessitating tighter policy and rates might need to rise if the Board judged policy was not as restrictive as assumed, while it also stated that the Board had "minimal tolerance" for inflation above forecasts and would need more than one good quarterly inflation report to justify rate cut.

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said Israel will carry out operations against Hezbollah even if an agreement is signed with Lebanon, according to Sky News Arabia.

- Lebanon and Hezbollah agreed to the US proposal for a ceasefire with Israel with 'some comments' on content, according to a senior Lebanese politician who stated the US ceasefire proposal is the most serious attempt yet to end the fighting.

- US State Department spokesman said progress has been made in negotiations on the ceasefire agreement in Lebanon, according to Axios. It was also reported that US envoy Hochstein headed to Beirut after receiving clarifications that they are able to reach an agreement, according to Al Jazeera citing Israel's Channel 12.

- Israel launched a strike on central Beirut, according to a Reuters witness.

- Hezbollah said it bombarded a gathering of Israeli enemy forces south of the town of Khiam, according to Al Jazeera.

- Israeli Foreign Minister urged the UN to pressure Iraq after attacks by pro-Iran factions and said the government of Iraq is responsible for any actions that occur within or from its territory, according to Sky News Arabia and Asharq News.

- Iran's Foreign Ministry said new EU and UK sanctions against Iran are unjustified, baseless and contradict international law.

- Iranian Ambassador to Russia said there are no obstacles to concluding a strategic cooperation agreement between Russia and Iran, according to Asharq News.

OTHER

- US Ambassador to the UN said on Monday that the US will announce additional security assistance for Ukraine in the coming days, according to Reuters.

- French President Macron said US President Biden's decision to allow Ukraine the use of US-provided weapons to strike inside of Russia is a good decision, according to Reuters.

- Kremlin spokesperson said Russia is ready to normalise ties with the US but will not tango alone, while a spokesperson also said that Russia's amendments to its nuclear doctrine have been formulated but not formalised yet, according to TASS.

- Russia and Chinese foreign ministers discussed 'unprecedented' strategic bilateral relations on the sidelines of the G20 meeting in Brazil, according to Russian agencies cited by Reuters.

- EU foreign chief Borrell said the role of China is becoming bigger and bigger in the Ukraine war and without Iran and China, Russia could not support its military effort.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer announced the relaunch of UK-India free trade talks, while it was also reported that Starmer met with Japanese PM Ishiba and agreed to start "2 + 2" economic and trade cooperation talks between the UK and Japan.

- ECB's Vujcic said the risk of inflation undershooting has picked up.