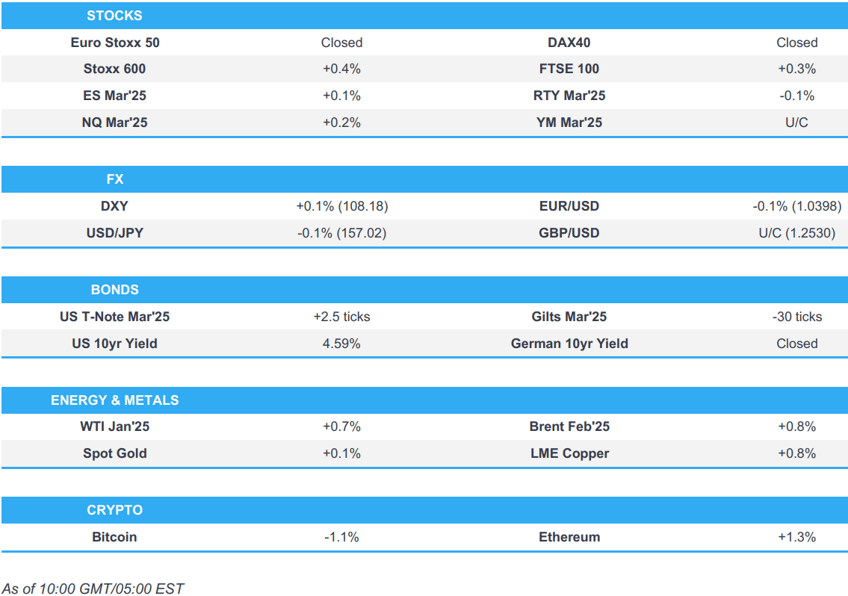

- Stoxx 600 edges a little higher, US futures trade either side of the unchanged mark.

- DXY is essentially flat with price action ultimately rangebound in quiet newsflow.

- USTs are slightly softer ahead of US supply; Bunds are closed for trade.

- Crude oil holds an upward bias, base metals are modestly firmer.

- Looking ahead, Richmond Fed Index and supply from the US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 +0.3% are slightly firmer today, in holiday-thinned conditions and with newsflow light.

- European sectors hold a strong positive bias, in-fitting with the sentiment seen in Europe. Travel & Leisure takes the top spot, paring some of the hefty losses seen in the prior session. Insurance is found at the bottom of the pile, joined closely by Consumer Products and Services.

- US equity futures are mixed and lack any firm direction, ultimately trading on either side of the unchanged mark.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is essentially flat and trading towards the upper end of a very tight 108.05-20 range, amid holiday-thinned conditions and ahead of Richmond Fed Index and US supply.

- EUR is incrementally on the backfoot and dipped just below the 1.04 mark in early European trade; confines for today at 1.0389-1.0410.

- GBP/USD has traded sideways in a very tight 1.2526-45 range, showing little momentum after reaching a broader 1.2526-1.2575 range earlier in the week.

- JPY is incrementally firmer thus far, but has traded sideways in the EU session. Overnight markets digested jawboning from Finance Minister Kato, which led the USD/JPY below 157.00; a level which has since been reclaimed. Japanese PM Ishiba said he will step up measures for increasing minimum wages; comments which sparked little move in the pair.

- Antipodeans are ever so slightly on the backfoot, with the Aussie unresponsive to RBA minutes. The minutes expressed confidence in inflation but cautioned that stronger-than-expected data could prolong the period before easing. AUD/USD and NZD/USD are tucked within yesterday's respective 0.6218-46 and 0.5632-66 ranges.

- PBoC set USD/CNY mid-point at 7.1876 vs exp. 7.3031 (prev. 7.1870)

- RBI likely sold USD to limit INR fall, according to traders cited by Reuters.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Gilts opened lower by two ticks but has since slipped slightly to a 92.19 trough in thin conditions with newsflow essentially non-existent for the UK. In a 92.07-46 band, which takes Gilts below the 92.18 base from last Friday and below that the 91.87 contract trough from last Thursday as Gilts reacted to the FOMC from the night before.

- USTs are essentially flat in an extremely narrow 108-16 to 108-19+ band while the curve is, at the margin, steepening. As above, catalysts are light though the docket ahead includes a 2yr FRN and a 5yr Note auction. Ahead, it remains to be seen if any concession emerges into the US supply.

- Click for a detailed summary

COMMODITIES

- WTI and Brent began the European morning on a firmer footing and continued to inch a little higher; recent geopolitical updates suggest an Israel-Hamas deal may not be as imminent as previously anticipated. Additionally, Israeli press floated the possibility of troops remaining in Southern Lebanon longer than agreed under a separate deal. Brent'Feb 25 at the top end of the day's range at around USD 73.20/bbl.

- Spot gold is on a slightly firmer footing and holds at the upper end of a tight USD 2612-2621/oz range; price action thus far has been very rangebound.

- 3M LME copper is on a firmer footing today, but still somewhat off the USD 9K mark (currently USD 8,972), in-fitting with the risk-tone and versus mostly subdued overnight price action.

- Click for a detailed summary

NOTABLE US HEADLINES

- Fed announced it would soon seek comment on changes to bank stress tests to improve transparency and reduce volatility, a decision made due to the changing legal landscape, according to Reuters.

- Tesla (TSLA) cuts the price of Model Y in China by CNY 10k

GEOPOLITICS

MIDDLE EAST

- "Jerusalem Post: The slow deployment of the Lebanese army in the south may push the Israeli army to remain in southern Lebanon after the end of the 60-day period", according to Sky News Arabia.

- "Israeli source: There is no real progress in negotiations with Hamas, but they continue", according to Sky News Arabia.

- US military said it conducted an airstrike in Syria, killing two ISIS operatives and wounding one, according to Reuters.

CRYPTO

- Bitcoin is on the backfoot and holds around the USD 94k mark, whilst Ethereum edges higher after a run of losses this week.

CENTRAL BANKS

- RBA Minutes (December meeting): Policy needed to be "sufficiently restrictive" until confidence on inflation was achieved. The Board had gained confidence on inflation since the prior meeting, but risks remained. Members noted that the Board had minimal tolerance for inflation remaining above target for too long. They stated that future data in line with or weaker than forecasts would give more confidence on inflation, at which point it would be appropriate to begin relaxing the degree of policy tightness. However, if data proved stronger than expected, it could indicate a longer period before easing policy. The Board observed signs that policy was not as restrictive as the current cash rate level would suggest. The labour market was resilient, while service inflation remained more persistent. Wages had slowed more than expected, potentially indicating that the labour market was not as tight as previously thought. Monthly CPI data suggested a modest downside risk to Q4 inflation forecasts. Additionally, upside inflation risks had diminished, while downside risks to economic activity had grown. The Board noted that more data and updated forecasts would be available by the February meeting. Members also stated that it was not possible to judge the impact of Trump's policies on Australia until more details were known.

- BoJ October meeting minutes (two meetings ago): A few members said they must scrutinise the impact of the past interest rate hike on the economy and prices when deciding policy. One member said they must take time and be cautious when deciding on the timing of the next rate hike. Members shared the view that the BoJ would keep raising rates if the economy and prices moved in line with its forecast. Additionally, one member noted that it was desirable to gradually raise rates if underlying inflation accelerated as projected. Another member pointed out that market rates could be lower than levels considered appropriate based on the BoJ's economic and price projections, as well as its guidance on monetary policy. Meanwhile, one member stated that it was hard to indicate with confidence the BoJ's medium- to long-term rate hike path due to uncertainty over Japan's neutral rate level and the transmission mechanism of monetary policy.

LATAM

- El Salvador's congress passed the President's bill to overturn a ban on metals mining, granting the government the sole authorisation to explore, exploit, extract, and process mining resources, according to Reuters.

- BCB announced a spot dollar auction of up to USD 3bln for December 26th, according to a statement.

APAC TRADE

- APAC stocks traded mostly firmer in choppy trade following a similar session on Wall Street, where stocks experienced volatility with low volumes amid the Christmas period.

- ASX 200 swung between modest gains and losses with earlier downside led by gold miners. The ASX showed little reaction to RBA minutes, which offered no significant new information.

- Nikkei 225 was initially supported by recent JPY weakening, but gains were shortlived as USD/JPY slipped back to session lows and eventually under 157.00.

- Hang Seng and Shanghai Comp were firmer and outperformed regionally despite a lack of significant macro newsflow, although China convened a national fiscal work conference in Beijing, according to the Ministry of Finance, and said they will step up fiscal spending and accelerate spending speed in 2025.

NOTABLE ASIA-PAC HEADLINES

- China's video game regulator approves 122 (prev. 112 M/M) domestic online games in December; approves 13 imported online games.

- Japanese PM Ishiba says will step up measures for increasing minimum wages. Adds that cabinet to approve fiscal 2025 budget on December 27.

- Japan's PM Ishiba will work to eliminate the public's uncertainty about the future in order to "boost private consumption"

- China is issuing a plan to encourage local gov'ts to introduce policies to bolster whole grain consumption, via State Media.

- China and Japan's Foreign Ministers will meet on Dec 25th, according to China's Foreign Ministry.

- South Korean Opposition Party is to propose the impeachment of acting President Han on Tuesday, via Yonhap.

- South Korean Opposition Party lawmaker says will wait until later this week to decide whether to submit bill to impeach acting President Han.

- China convened a national fiscal work conference in Beijing, according to the Ministry of Finance, and said they will step up fiscal spending and accelerate spending speed in 2025. Fiscal spending will focus more on people’s livelihood and boosting consumption. The government will arrange a larger scale of government bonds to provide more support for stabilising growth and will make efforts to fend off risks in key areas. Additionally, it will further increase transfer payments to local governments to strengthen their financial capacity and support the expansion of domestic demand. Plans include appropriately increasing the basic pensions for retirees and raising the basic pensions for urban and rural residents. Furthermore, China will improve tariff policies and deepen cooperation with ‘Belt and Road’ countries.

- Chinese authorities agreed to issue CNY 3tln in special bonds in 2025 (vs CNY 1tln in 2024), according to Reuters sources; part of proceeds will be use to recapitalise some large state-owned banks. Plans to use proceeds for consumer goods and industrial equipment trade-in schemes among others.

- Japanese Finance Minister Kato said it is important for currencies to move in a stable manner reflecting fundamentals, noting that there have recently been one-sided, sharp FX moves and expressing concern about recent FX moves. He stated that Japan will continue to coordinate with overseas authorities on forex policies and will take appropriate action against excessive moves, according to Reuters.

- High-level government review board has told White House it is unable to reach consensus on national security risks involved in Nippon Steel’s (5401 JT) acquisition of US Steel (X), according to WaPo. White House spokesperson then said they received the CFIUS evaluation and the President will review it, according to Reuters.

- BoK said it would deploy market stabilising measures should FX volatility increase and noted that the pace of household debt might rise with the easing of policy rates, according to Reuters.

DATA RECAP

- South Korean Consumer Sentiment Ind (Dec) 88.4 (Prev. 100.7).