Part of the difficulty in reading economic statistics to discern where we are in the cycle is the huge crater of 2020. A full shutdown like this had never happened before. All data just went nuts, seesawing one way down and then the other way up. Everyone is looking at this and trying to understand the implications.

Whatever you want to say about business cycles in the past, they followed patterns that could be traced. Theories could be mapped to explain them and policies constructed to avoid them. But it becomes a very different matter when you have suddenly imposed a global forced crash of nearly everything. We can only watch with amazement.

We have to add to this what seems to be a new problem, which is the outright gaming of the data for political reasons. We see it in all the big releases, from GDP to jobs to inflation. The spin in the press release has often contradicted the underlying data. Wall Street only follows the spin, and it is left just to a handful of people who care to unpack precisely what is going on.

The jobs data has all these problems. Each month, we hear about glorious job creation, only to find out later that they are mostly part-time jobs, mostly held by non-natives, while full-time jobs keep shrinking as real income continues to fall, now three years in a row. Parsing all of this and comparing it with the pre-2020 world becomes nearly impossible.

The latest jobs report underscores the point. The headline number seems amazing until you drill down into the jobs themselves. Looking at the more accurate household survey, instead of the establishment survey, we find a huge loss of 625,000 full-time jobs, and those are mitigated by an increase of part-time workers of 286,000. This is not a strong and vibrant market by any stretch. The press releases are pitching job losses as job gains.

It’s because of all this flimflammery that I’ve stuck with my sense that we have never really left the forced recession of March 2020. All the rest is just an illusion. Our disorientation is so severe that it is hard to process intellectually and psychologically. Despite all the cheerleading we get from the White House, the bottom line is that the whole country and the whole world are much poorer today than they were five years ago.

At some point, this problem, unless reversed dramatically with new policies, will come home to hit the jobs market. So far, this has not really been much of an issue because so many businesses lost employees during the lockdowns. There has been a recovery of sorts in hospitality and there has been a pent-up demand for labor there. We have seen some shift to the service industry from white-collar employment, and to part-time from full-time.

What we haven’t experienced on a large scale just yet is an outright shortage of places to work. But that might be starting to change now, with inflation driving up costs of everything including labor. Employers now find themselves in the position of grave reluctance to hire. Instead, they are squeezing existing payrolls for every bit of labor they can.

As a result, job openings are falling, and dramatically so. Even now, labor participation still has not recovered to pre-pandemic levels.

This is quite the change for many young people. Only a couple of years ago, jobs were plentiful, maybe not full-time and maybe not high-paying, but they were there. It’s no longer reliably true. Job seekers are now encountering a market that seems ever more stuck in the mud, with fewer positions being offered and ever-higher standards for employment.

Those with solid positions are clinging to them tightly, with a growing awareness that this is no time to switch or otherwise take risks. Feeling trapped in a job that is not quite to your liking means a more miserable life. This is doubly true if you hold a mortgage at a low rate from the past but dread the idea of taking on a new one at a much higher rate. As a result, people are feeling bound not only to their current positions but also trapped by their own plywood palaces.

This is not how a vibrant and flourishing economy is supposed to work. It only adds insult that people at the top of the food chain frequently deny that anything is going wrong at all. We are told daily that the economy is performing well and that we have experienced a robust recovery. There is not one person on Main Street who believes this.

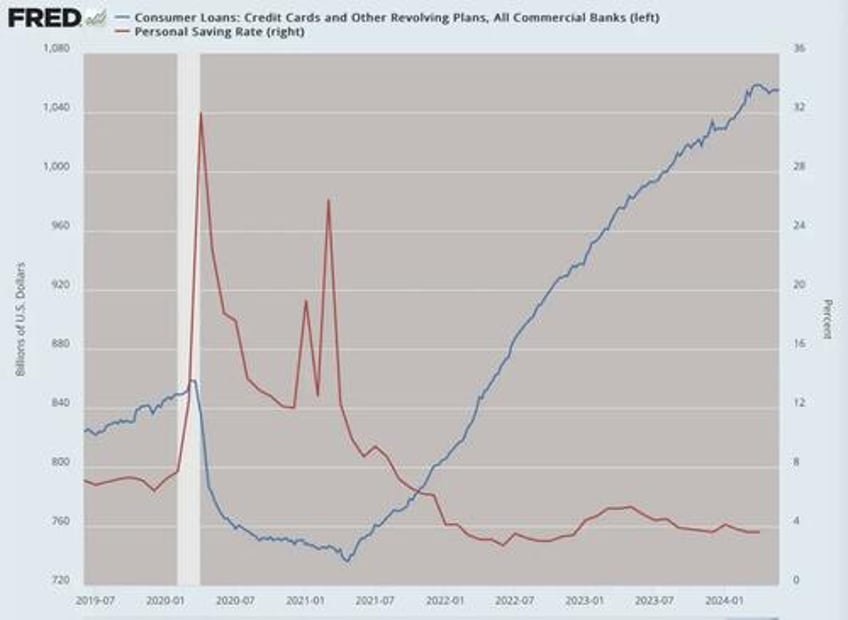

The underlying finances of households right now are on track toward disaster, with credit card debt still rising despite high interest rates and saving rates far below pre-lockdown levels. This is simply not sustainable.

News media continues to speculate about whether we will have a soft landing. But the metaphor is all wrong. The plane never took off in the first place. No matter where you look, if you look carefully, you see a degraded economic structure of stagnation plus inflation. This is not a good omen for the future.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.