Equities in China are getting closer to a tradeable bottom, based on internal measures of breadth, improving liquidity conditions, and tentative signs the property market may be troughing.

Stocks in China continue to lag their global peers, with the MSCI China the third-worst performing index year to date, beating only the MSCI Hong Kong and Thailand indices.

There have been several false dawns since China lifted Covid restrictions, and we’re likely not quite there yet, but breadth in the country’s stocks is approaching the point where typically they have bottomed. That’s on top of further easing measures announced today, including a cut in stamp duty for Hong Kong stock trading.

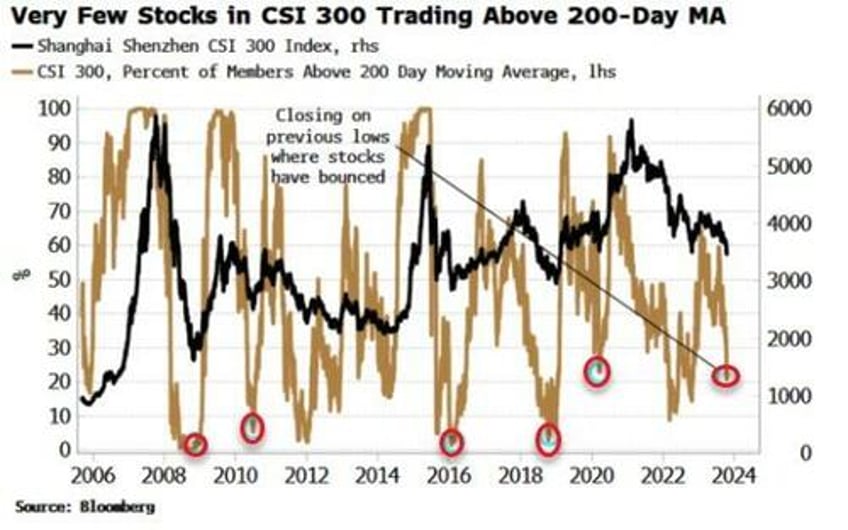

The percentage of stocks in the CSI 300 trading above their 200-day moving average is now about 20%, and dropping fast.

Levels between 0% and 10% have often marked reversals in the index. The index itself is also well below its 200-day moving average.

The advance-decline ratio is flat-lining, showing that on net very few stocks are advancing. Similarly the net number of stocks making new 52-week lows is markedly negative. It also not yet at capitulatory levels, but is approaching them.

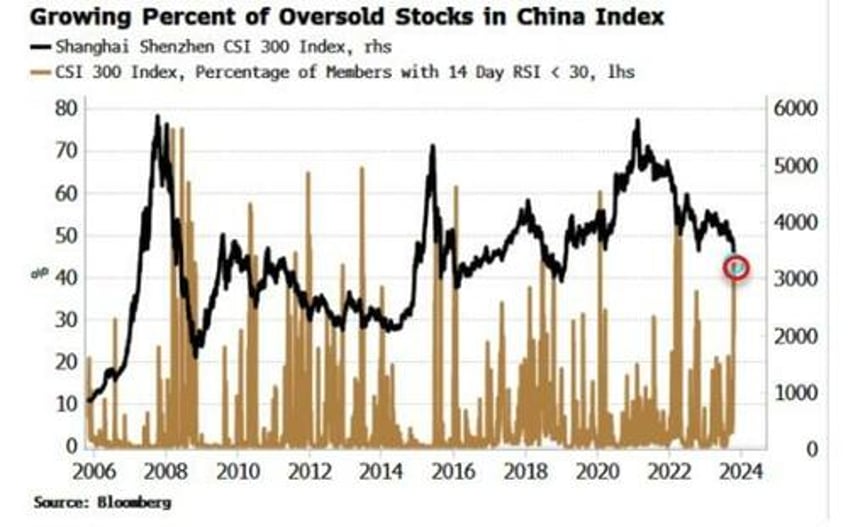

That also applies to the percentage of stocks whose 14-day RSI is below 30. This is at over 40%; previously when it has been more than 50% it has often marked at least a short-term bounce in price.

China is incrementally adding more liquidity, with PBOC net-repo injections at a series high on a 3-month summed basis.

Medium-term lending is also picking up, with one-year policy loans on track to make an all-time high.

Monetary loosening is being joined by increased fiscal easing, with the central government -- less encumbered than local governments -- stepping up issuance (as speculated previously). It was announced today that the budget deficit ratio will be raised (from 3% to about 3.8% of GDP), and additional sovereign debt of one trillion yuan is to be issued in the fourth quarter.

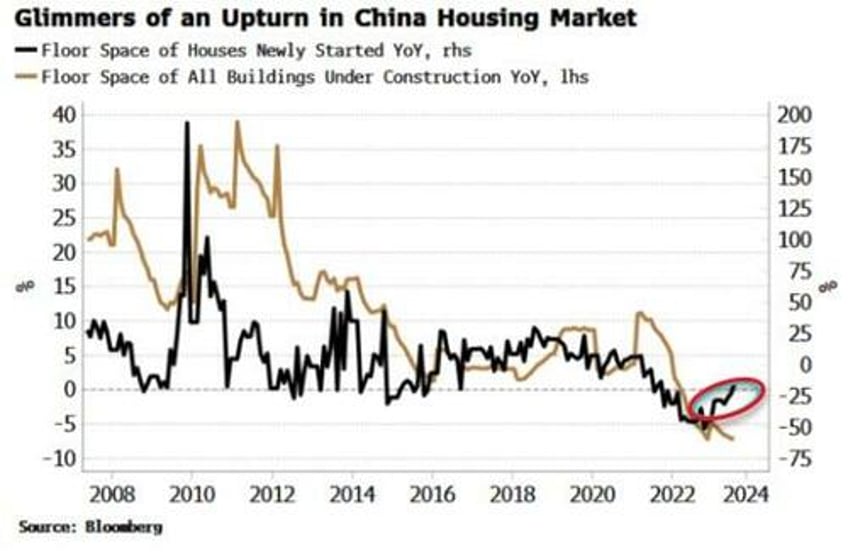

Crucial to a sustainable recovery in China is the real-estate market. Property developers continue to struggle with debt problems, most prominently Country Garden, which has been deemed to be in default on a dollar bond for the first time.

Stress will persist until the property market can be reanimated. There is a hint of an early recovery, with the growth rate of floor space on new houses steadily rising through this year.