Jonathan '50 cent' Ruffer - infamous for his scooping up massive profits in front of the options market steamroller over the past few years - is back with a new trade for 2024: Japanic!

Jonathan '50 cent' Ruffer

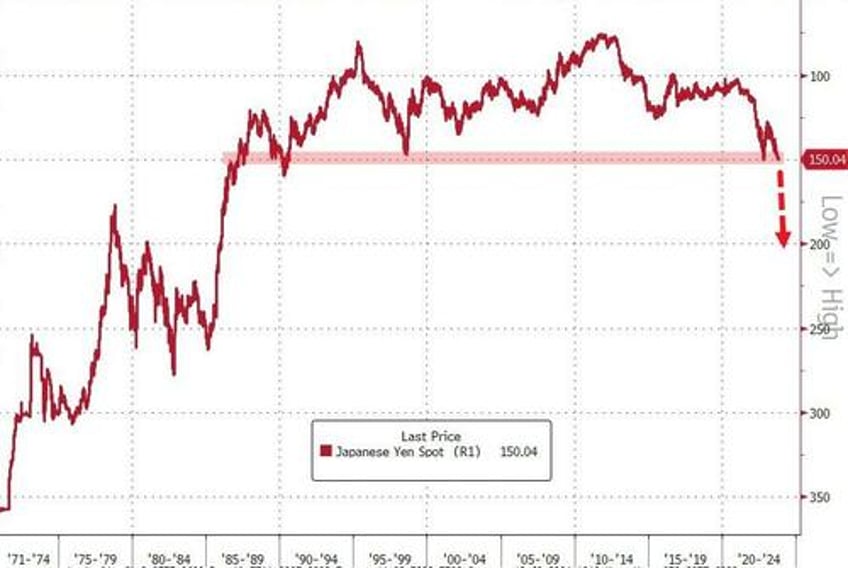

Instead of snapping up VIX options priced at 50 cents (hence his nickname), he explains in his latest letter to investors that he has a "big position" in the Japanese Yen - betting that the currency will collapse "violently" some time soon (as a reminder, The BoJ meets next week).

"The yen has been moving lower for a long while. With currencies, it is always dangerous to try to anticipate a change of direction, even when the fundamentals cry out for it, and our performance has suffered accordingly. We believe the yen is oversold for technical reasons and that, when these dissipate, it is likely to move sharply higher. Moreover, when it does, it is likely to be concertinaed into a brisk uncontrollable move upwards. This happened, to our advantage, in 2008, and we believe that today’s backcloth will cause a repetition of that dynamic."

Ruffer sees two factors working simultaneously to reinforce his trade: forced sellers of foreign currencies, and simultaneously, forced buyers of yen.

"The compulsion to buy yen will come from two diametrically opposite sources – one domestic, one international.

Local demand for yen will come about in the aftermath of Bank of Japan Governor Ueda’s increasing isolation in trying to hold the yields of the government bonds well below the international rate. The most likely way out of this impasse is for the authorities to compel domestic institutions to acquire such bonds at their current (anomalously expensive) prices. To do this, those institutions will have to sell down big holdings of foreign government bonds, denominated, of course, in foreign currencies. Many of those holdings have already been hedged into yen, but much of it will still be held in local currencies, with the conversion into yen telescoped into a short time window.

The international constituency of forced sellers are those foreigners who have borrowed in yen to enjoy a lower interest rate regime than the one in which the assets are purchased. That constituency is more aware of the double advantage of a low interest rate and a steadily diminishing value of their borrowings than they are of the dangers of a currency mismatch which, at the key moment, moves sharply against them."

If these events occur in the course of a market dislocation, Ruffer says "the exchange rate could move as violently as it did in 2008 (up by 50% against sterling in short order)."

USDJPY has been battling with 150/USD for a while now, prompting various interventions...

However, nothing lasts forever, and as Ruffer explains, the market's stability is an illusion, and everyone's about to take the red pill...

"At the heart of our investment strategy is the belief that 2023 has seen fundamental truths – with their gravitational pulls on valuations – momentarily overwhelmed by market forces.

These forces can, in the short term, be very much stronger than a mere ‘gravitational pull’, but in the long term gravity always beats a good party."

So, never bet against gravity, as armchair philosopher Ruffer concludes:

"In summary, the world has more than a tinge of aurora borealis.

It is a dystopian world where everyone is a victim, the central authorities in the West buy off every dissatisfaction with money they haven’t got, and a new order awaits its time, still to come.

If you know where to look, there are eternal truths that are observable by eternal pieces of evidence.

In the field, it is rheumatism in the knee which heralds the change from father to son; in the West, it’s the day that the cost of paying the interest on a nation’s borrowings overtakes the (sharply rising) defence budget.

Just as with the yen, we’ve seen this all before, and we know how it ends, but that doesn’t mean the journey won’t be bumpy along the way."

Ruffer's view is not that out-of-consensus, but there is something unique:

"In my experience, it is unusual to find two separate constituencies of forced buyers – to find a single one is enough. It is the strong possibility of an extraordinary upward move in the Japanese currency which provides us with the stamina to withstand the general day-to-day attrition of the yen. If the net result produces merely a satisfactory ultimate return, we will be disappointed."

His timing could be perfect as we noted earlier in the week, there is a sense of immediacy coming out of the Bank of Japan with regards to its curve-control experiment, just hours after the central bank intervened in the bond market, including:

Bank of Japan officials “are likely to monitor bond yield movements until the last minute before making a decision on whether to adjust the yield curve control program.”

Implicit in that wording is the suggestion that the central bank may be ready to adjust its curve control before next week’s decision, should push come to a shove.

That may be especially so should the functioning of the bond market worsen.

There comes a point in any intervention where the tipping point is determined not by the amount of money spent in defense of a policy but by the dislocations that it spawns.

And the BOJ sources story suggests that the pain threshold is near, if not already reached.

While an end to negative rates may still be away, a shift in curve control may come sooner than markets reckon, especially given Ruffer's "firm conviction that inflation is in an inexorable up-cycle. We do not put timings on it, but two factors will prove more powerful at stoking rising prices than the single force pulling the other way – the impact of central bank tightening."

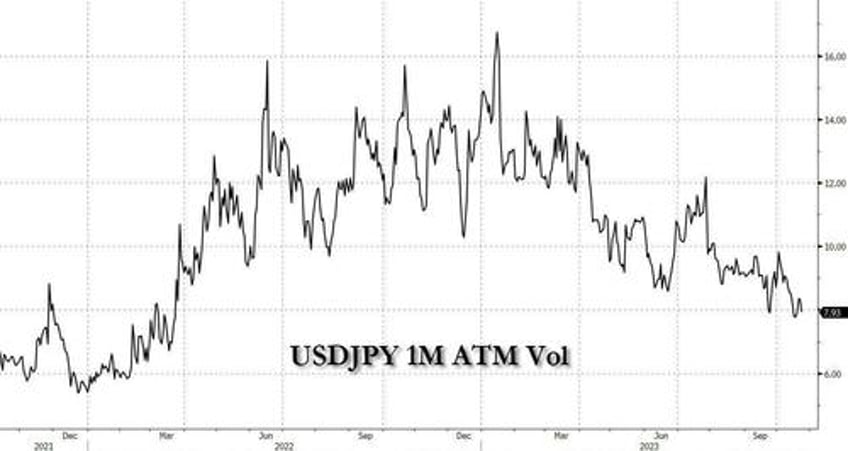

With vols so low...

...maybe it's to jump on the Japanic trade!