British chip designer Arm Holdings shares priced at $51 last night - the top end of the expected ($47-$51) range - raising around $5 billion and valuing the company at over $54 billion.

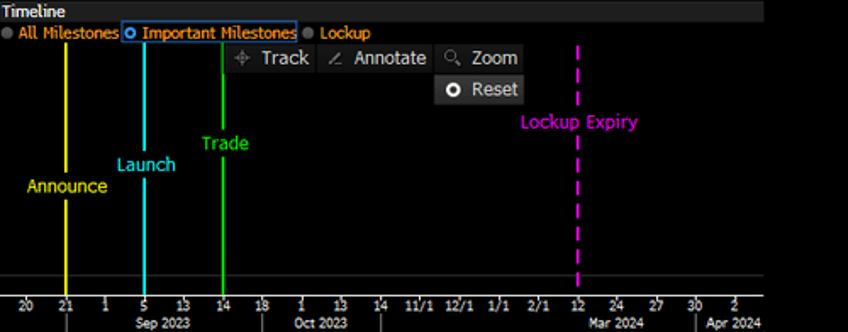

Trading - under the ticker symbol ARM - is set to begin during the US cash session, serving as a barometer for initial public tech offerings amid 18 months of uncertainty.

The price was decided on after meetings Wednesday afternoon between underwriters (including Barclays, Goldman Sachs, JP Morgan, and Mizuho Securties USA), and company executives, according to people familiar with the matter.

Initially, the company was eyeing a price of $52 a share, but later settled on $51.

On Monday, Financial Times spoke with people familiar with the IPO who said the deal was over five times oversubscribed.

This IPO will be the largest since electric truck maker Rivian debuted on the public markets in 2021 during the pandemic-era mania and will serve as a barometer for tech IPOs after the new-issue market slowed to the lowest level in decades because of soaring interest rates and inflation that forced investors from risky tech plays to safe haven money markets.

While the $54 billion valuation is 70% higher than what SoftBank paid for Arm in 2016, it's significantly less than the $64 billion valuation SoftBank recently purchased a quarter of its shares from the Vision Fund.

Arm said in its prospectus that revenue in its fiscal year that ended in March slipped less than 1% from the prior year to $2.68 billion. Net income in fiscal 2023 dropped 22% to $524 million.

At $54 billion, Arm would carry a P/E multiple of about 104 (based on profit in the latest fiscal year).

That's just shy of the exorbitant 108x multiple that Nvidia carries (after forecasting revenue growth of 170% for the current quarter, driven by AI chips).

For context, the Invesco PHLX Semiconductor ETF, which tracks the performance of the 30 biggest US chip companies, has a P/E ratio of about 25.

Arm's core business supplies chip makers with essential circuit designs. It was founded in 1990 and has ridden the handheld phone craze for the last three decades, becoming a dominant supplier to that industry. Now, the company is betting on artificial intelligence and data centers amid a slowdown in the global smartphone industry.

While Arm's IPO was oversubscribed and strong trading is expected on Thursday (and IPO participants shares are locked up until March 2024), market watchers will use this new listing to gauge the market's overall health.