- ECB policy announcement and rate decision due at 1:15pm BST/ 08:15am EDT, press conference from 1:45pm BST/8:45am EDT

- 39/69 analysts surveyed by Reuters (before this week's sources piece) expected the ECB to stand pat on the deposit rate at 3.75%

- Post-sources, markets now assign a 68% chance to a 25bps hike in the Deposit Rate If the ECB opts to deliver a hike, it will likely signal the intention to pause thereafter

OVERVIEW: As Newsquawk writes, ahead of today's "close call" ECB decision, 39/69 analysts surveyed by Reuters expected the ECB to stand pat on the deposit rate at 3.75%, with the remaining 30 looking for a 25bps hike to 4.0%. Since the survey was taken, a sources piece by Reuters News noted that the 2024 inflation forecast is expected to be revised higher from the 3% in June. As such, markets now assign a 68% chance to a 25bps hike. Data since the July meeting has put the ECB in a bind of needing to be cautious in the face of slowing growth, but not conveying a sense of complacency over inflation. Any decision to hike will likely be judged as the ECB having reached its terminal rate.

PRIOR MEETING: As expected, the ECB pulled the trigger on another 25bps hike, taking the deposit rate to 3.75%. Aside from the decision itself, focus for the statement was on the modest adjustment to the Bank's language on future decisions whereby the key ECB interest rates will be "set at" sufficiently restrictive levels for as long as necessary vs. the previous wording of "brought to". Elsewhere, the GC also opted to set the remuneration of minimum reserves at 0% (vs. prev. matching the deposit rate). In the follow-up press conference, Lagarde stated that policymakers were unanimous in their stance. When initially questioned over whether she thinks the Bank has more ground to cover, she said the decision will be based on the data and the GC is "open-minded". When pressed on the matter later during the press conference, Lagarde stated that at this moment in time she "would not say so" with regards to there being more ground to cover. On the balance sheet, Lagarde remarked that a reduction had not been discussed and there would be no tradeoffs between rates and QT.

RECENT ECONOMIC DEVELOPMENTS: August HICP held steady at 5.3% Y/Y, with the super-core reading still at an elevated level of 5.3% Y/Y, despite falling from 5.5%. The ECB Consumer Inflation Expectations survey for July saw the 12-month ahead metric remain at 3.4%, whilst the 3-year ahead rose to 2.4% from 2.3%. Elsewhere, the 5y5y inflation forward remains at a lofty 2.6%. Since July, Q2 Q/Q growth was revised lower to just 0.1% from 0.3%, whilst more timely survey data saw the Eurozone composite PMI in August fall to 46.7 from 48.6 with the accompanying release noting that “The disappointing numbers contributed to a downward revision of our GDP nowcast which stands now at -0.1% for the third quarter”. Furthermore, interest rate increases are clearly having an impact on lending in the Eurozone with bank lending to the private sector at just 1.6% Y/Y in July. In the labour market, the EZ-wide unemployment rate remains at the historic low of 6.4%, whilst Q2 unit labour costs rose 6.5% Y/Y in Q2 vs. the Q1 outturn of 6.0%.

RECENT COMMUNICATIONS: Since the prior meeting, President Lagarde has reiterated that decisions will be taken on a meeting by meeting approach, depending on the data. However, she did note that she is "pretty confident" that by the end of 2023 inflation numbers will look different". Thought-leader Schnabel of Germany noted that activity has moderated visibly, and forward-looking indicators signal weakness ahead, however, she remains of the view that underlying price pressures remain stubbornly high. On rates, she opined that the ECB cannot commit to future actions, meaning it cannot trade off a need for a further tightening of monetary policy today against a promise to hold rates at a certain level for longer. Chief Economist Lane remarked "I would underline the fact that there has been some easing in goods inflation and services inflation, which is a welcome development." He added that he expects to see core inflation come down throughout the autumn. At the hawkish end of the spectrum, Netherland's Knot said that markets may be underestimating a September hike, whilst Slovakia's Kazimir said one more (likely last) interest rate hike is still needed. At the more dovish end, Portugal's Centeno is of the view that inflation is slowing much faster than it rose, and there is a risk of "doing too much" on rates

RATES/BALANCE SHEET: 39/69 analysts surveyed by Reuters expected the ECB to stand pat on the deposit rate at 3.75%, with the remaining 30 looking for a 25bps hike to 4.0%. Since the survey was taken, a sources piece by Reuters News noted that the 2024 inflation forecast is expected to be revised higher from the 3% in June. As such, markets now assign a 68% chance to a 25bps hike. As highlighted above, data since the July meeting has put the ECB in a bind of needing to be cautious in the face of slowing growth, but not conveying a sense of complacency over inflation. Even though inflation is set to fall throughout the remainder of the year, the ECB has been consistent in its messaging that it will be following the actual data rather than projections; such a stance, it could be argued, would suggest that the Bank still has one more hike in its locker. Hawkish bodies on the GC such as Kazimir and Knot appear to subscribe to this view (as noted above). It remains to be seen how close to a consensus view this is on the GC with President Lagarde continuing to stress the Bank’s meeting-by-meeting approach. If the ECB pauses on rates, it will likely signal that it will be willing to tighten policy further if required. However, given that the growth outlook is deteriorating, it is hard to see whether Lagarde would be able to get a consensus for such a move further down the line and the market may view a pause as the ECB having reached terminal. If rates are held steady, ING suggests “…an earlier end to PEPP reinvestments could eventually be the bargaining chip the doves would have to accept for the hawks to agree to a pause”. Note, such a move would be unlikely at this juncture with Hawk Knot seemingly not backing such a move at this stage after stating that "...reneging on earlier guidance has a cost. At this moment I don’t think we should incur this cost".

PROJECTIONS: For the accompanying macro projections, consensus expects the 2023 inflation forecast of 5.4% to be upgraded to 5.5%, 2024 to be revised higher from 3.0% to "above 3%", according to Reuters, whilst the 2025 projection of 2.2% will see "no fundamental change", via Reuters. From a growth perspective, 2023 GDP is expected to be lowered to 0.6% from 0.9%, 2024 cut to 0.9% from 1.5% and 2025 trimmed to 1.5% from 1.6%.

* * *

Turning to the ING Economics team, they write that even though they have always thought that every central bank meeting in the world is data-dependent, Lagarde emphasised the ECB’s dependence on incoming data between July and September. Almost two months later, released macro data since the July meeting have pointed to a kind of stagflation scenario in the eurozone with confidence indicators plunging and inflation remaining high. They conclude that it is a "A very complicated mixed bag, making the ECB decision anything but easy" but in any case, ING expects a very heated debate with a close outcome; in the end, the bank is sticking to its view that the ECB will hike rates one final time.

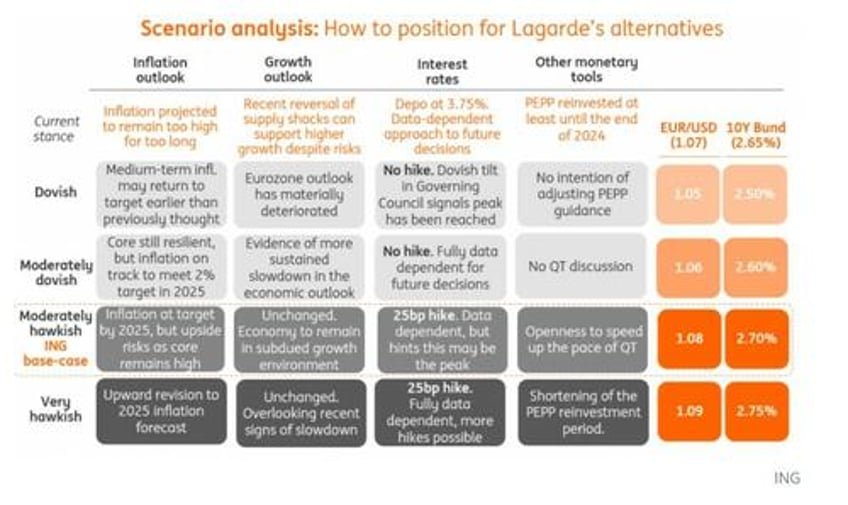

And here is the ECB scenario analysis matrix.