Submitted by QTR's Fringe Finance

One doesn’t have to look much further than one of the market’s most popular stocks to read the tea leaves that we could be on the verge of a slowdown in markets.

If you want the full “fear-mongering” bang for your buck, you can go back and read this piece I wrote about 48 hours ago, describing why I think the next market crash—likely already well on its way—is going to break the brains of a lot of market participants.

But yesterday, the inspiration to write about one example of this supercycle peaking came to me ever so delicately, as it often does—while I was frustratedly cursing out one of my home appliances. Because nothing says “we’re at the top of a stock market supercycle” more than a balding 42-year-old man, in the midst of his 390-square-foot apartment, screaming at an inanimate object made in China out of plastic.

The frustration I was having was with the “Apple Intelligence” product in the form of an Apple HomePod that I leave sitting around and use for the sole purpose of occasionally listening to music and getting a daily weather report.

But this week, that all changed when I asked the compendium of all computing power known to the human race the extremely complex mathematical question of how many days were in the month of February this year.

🔥 50% OFF FOR LIFE: Using this coupon entitles you to 50% off an annual subscription to Fringe Finance for life: Get 50% off forever

I was washing dishes at the time that I wanted to know the answer, so both my hands were occupied. It seemed like the perfect time to finally take advantage of all this “AI revolution” bullshit that I had kept hearing about, and had been underutilizing by simply asking for a weather report every day.

“Hey Siri, how many days are in February?”

So imagine my surprise when I asked Siri how many days were in the month of February, and she retorted: “I’m sorry, I can’t answer that right now. Here are some responses I found on the web. Would you like me to send them to your phone?”

“Are you f*cking kidding me?” I thought to myself.

I guess the joke is on me. What a fool I’ve been. I’ve been watching the news about artificial intelligence and commenting on how it relates to the stock market for more than a year now. Yet by prompting my Apple product with just a simple query, it responded as though I was asking for it to mine all the bitcoin in the world in under a second… and make me a turkey and Swiss on white bread with mayo at the same time.

I immediately thought back to a rant that I posted a couple of weeks ago about the new “innovative” camera button on the side of the new iPhones.

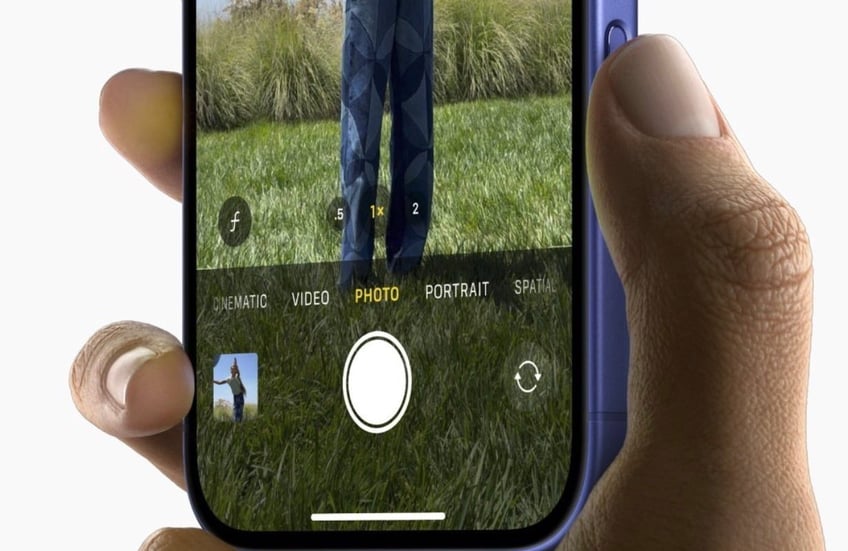

For the uninitiated, Apple has put a new button on its iPhone 16 other than the standard volume buttons and the other action button on the opposite side of the device. There is now a third button, lower than the single action button on the same side of the phone, that is supposed to give you quick and easy access to the camera and allow you to zoom in and zoom out with ease.

Instead, what this piece of “innovation” does is get in the way. I am constantly opening and then toggling the settings within my camera app as a result of inadvertently pushing this button. It gets in the way all the f*cking time and is constantly interrupting whatever actual task I am trying to see through.

I’m sure there has to be some easy way to disable it, but I haven’t taken the three minutes necessary to figure it out and that’s beside the point—I shouldn’t have to figure it out. Innovation is supposed to make things quicker, faster, and easier. The “invention” of putting another button where you would normally rest your thumb while holding the phone to watch it is anything but.

It is a counterintuitive gimmick presented as something helpful in order to try and sell more phones. It’s the opposite of what Steve Jobs and Jony Ive would have advocated for: it’s in the way, it’s extraneous, and it slows down and muddies up the user experience.

And the revelation of this bullshit feature came just months after one of Apple’s biggest innovation flops: the Apple Vision Pro. From the jump, I knew this product would be a nightmare, simply because there was no circumstance in which I could ever envision myself using it. It doesn’t matter if those goggles were able to put me into augmented reality situations at the Playboy Mansion daily or simulate 50-yard-line front-row tickets to the Eagles winning the Super Bowl—I still would not be caught dead wearing them. I won’t ever be that guy.

“It looks good on you, though!” - Al Czervik, Caddyshack

The hilarious thing is that, at the onset of the idea, the product was pitched as something people would walk around with and wear all the time. In fact, after its launch, several people were spotted doing so in major cities. Photos of them were taken, and they were promptly ridiculed for what they looked like walking around with translucent digital ski goggles on.

The failure of the product marked an attempt at a new line of products for Apple for the first time in a long time. After the Apple Watch, there haven’t been too many new “innovations” on the hardware side coming out of the company. If people were looking to use the Apple Vision Pro as a gauge of whether or not the company still had its mojo as it relates to innovation, the answer is a resounding no.

With two strikes against it, the company also trades at 35x earnings and, as many people pointed out on social media after its last earnings report, is barely growing revenue in the low single digits. As Whitney Tilson said in my interview with him over the weekend, there are definitely far worse names to own. At the end of the day, Apple has a near monopoly and is a consistent cash generator with a massive capital base that will likely continue as one of the top companies in the world and a blue-chip stock for many years to come. However, if you ask me, that doesn’t mean to go out and buy it indiscriminately here at 35x earnings—especially as the economy is getting ready to turn and the company isn’t showing any real tangible path for significant growth, at least as it relates to hardware, anytime soon.

Perhaps it is apropos that Apple is one of the top names in the S&P 500 index and the NASDAQ, because its story provides a good analogue to the market overall—still generating cash and earnings but extremely aggressively valued while at the same time not showing any clear pathway for a reasonable bull case going forward. Not unlike the tech sector as a whole, it’s difficult to map out where the next “killer” piece of hardware or software is going to come from out of Apple. How will they grow revenue again?

Because of not only its popularity but also its inclusion in almost any ETF you can imagine, the adage of “so goes Apple, so goes the market” has never seemed more appropriate than right now.

And as it relates to either… I’d be hard-pressed to find a reason to buy them here. But here's a couple names I might take a look at.

Now read:

- Stocks I'm Watching As The Market Sells Off

- The Fed, With No Earnings, Is Taking Us on a Magic Carpet Trip

- Taibbi: Trump Has A "Once In A Lifetime" Chance For Disclosure

- This Next Market Crash Will Break Our Fragile Brains

- DOGE Is What Happens When Trust In Government Hits Zero

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.