The negative economic fallout from Elon Musk's Department of Government Efficiency (DOGE) is beginning to take hold and could unleash a severe financial crisis across the Washington, DC, Maryland, and Virginia area—home to the federal bureaucracy of Deep State elites. Jobless claims in DC are soaring, a surge in the number of homes and condominiums is hitting the market, and DOGE spending cuts will ricochet through the local economy.

Earlier this week, Dominic Konstam, head of macro strategy at Mizuho, asked: "DoGE-led recession risk?"

The market is focused on a negative economic fallout from Federal spending cuts. The level of potential Federal job losses is too small to derail growth, but overall government spending has been egregiously high in recent years. There has also been excessive job growth in the "government" sectors, including federal, state, and local government, as well as in education and health. If DoGE sets a precedent on jobs and achieves spending cuts that ricochet through the quasi-public sector, it is likely that new economic headwinds will develop.

To answer Konstam's question above, absolutely!

On Thursday morning, Torsten Slok, chief economist at Apollo, joined Bloomberg TV, warning, "The consensus expects total DOGE-related job cuts to be 300,000 ... However, studies show that for every federal employee, there are two contractors." He added: "As a result, layoffs could potentially be closer to 1 million."

Now apocalyptic government data reveals a dramatic collapse in US government transfer payments "to the rest of the world" (say goodbye to USAID). Reduced transfers mean higher savings and a fiscal shift ahead—a strong step toward taming inflation and reining in out-of-control Washington spending (or money laundering). However, this shift comes at a steep cost: DC recession for political elites.

The first step to fixing the US economy is here: US govt transfer payments "to the rest of the world" collapse (i.e. goodbye USAID), and the overall US savings rate soars

— zerohedge (@zerohedge) February 28, 2025

More of this. Much more of this pic.twitter.com/LHSTKDeXoC

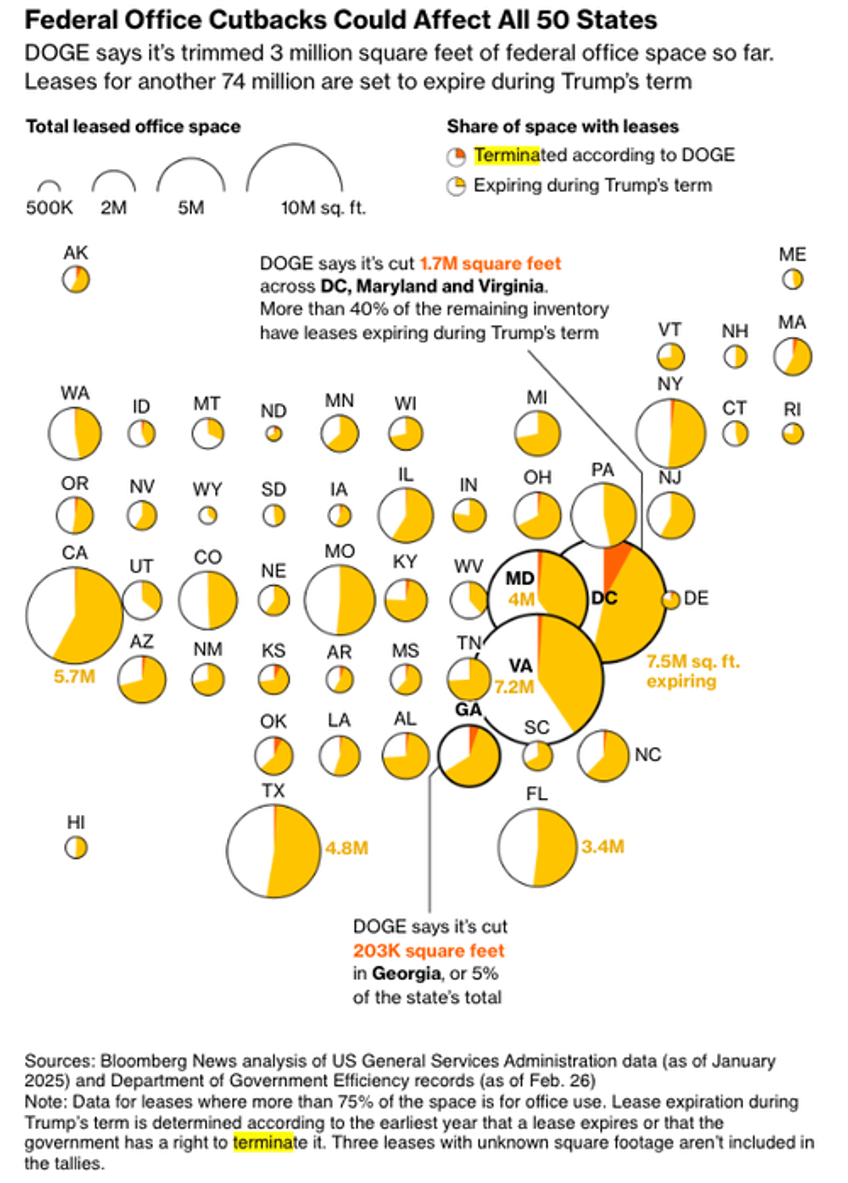

DOGE cuts will likely add pressure to the Washington, DC, Maryland, and Virginia commercial real estate in office.

CRE data company Trepp shows the federal gov't accounts for about 10% of all CRE buildings across the DC metro area.

"The DC office market is wiped out," Ben Miller, CEO of Fundrise, a Washington-based property investment platform, told Bloomberg. "Almost no office has equity value."

Miller said the DOGE-related downturn in the area will only make things worse for the CRE DC office market. He compared the situation unfolding to what happened in the 2008 financial crisis in New York City.

"The biggest employer in DC is shutting down the government," he said, adding, "So where other cities have only one problem — work from home — DC has two."

Nationwide, the US General Services Administration, which oversees the leasing and management of government buildings, spends about $5 billion annually on rent for roughly 144 million square feet of office space—one-third the size of Manhattan's entire office market.

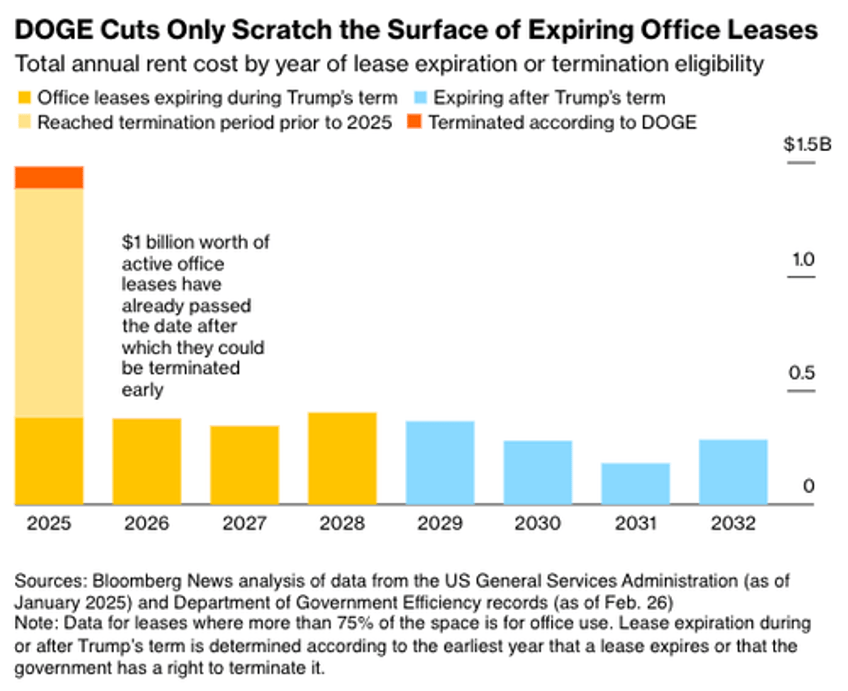

According to Bloomberg's analysis of GSA data, DOGE-related office cuts totaled about $100 million, and a billion dollars of active office leases have either expiration or termination dates before 2025. GSA data shows another $385 million of US office leases could be on the cutting block later this year.

Thanks.

— Elon Musk (@elonmusk) February 28, 2025

This is what draining the swamp looks like—a mandate the American people gave to President Trump. All signs point to economic storm clouds rapidly gathering over DC for the political class.