In the latest annual farce meant to boost confidence in the banking sector, moments ago the Fed announced that all the biggest US banks passed annual stress test with flying colors, paving the way for higher shareholder payouts as the industry awaits a watered-down version of a separate proposal for stricter capital requirements. Of course, all the banks that collapsed last March passed the "stress test" too, so there's that.

While the largest banks faced steeper hypothetical losses this year due to riskier portfolios, and the group would take nearly $685 billion in losses driving a larger drop in capital than in last year’s scenario, the results were “within the range of recent stress tests,” the regulator said, and furthermore each firm stayed above its minimum capital requirements during a hypothetical recession, which of course is even more farcical than the Fed's forecasting record as the central bank can't possibly imagine what the next recession will look like. As such it may not be a bad idea to actually stress the "stress test" but since that will never happen, we may as well carry on.

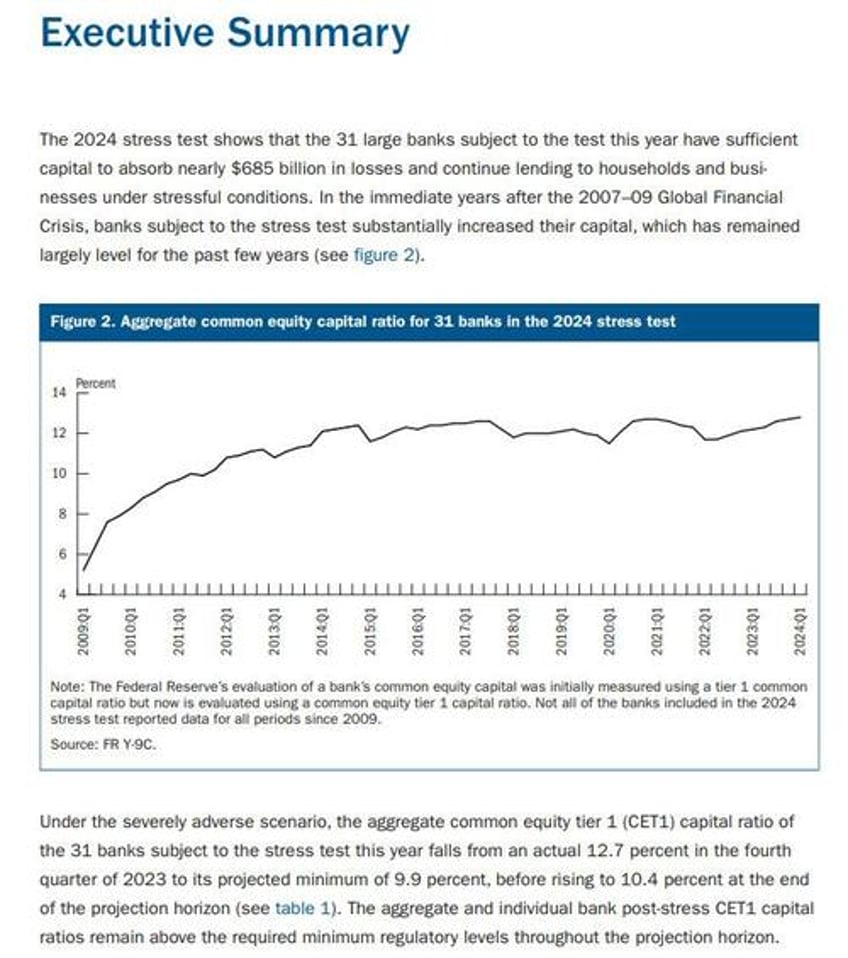

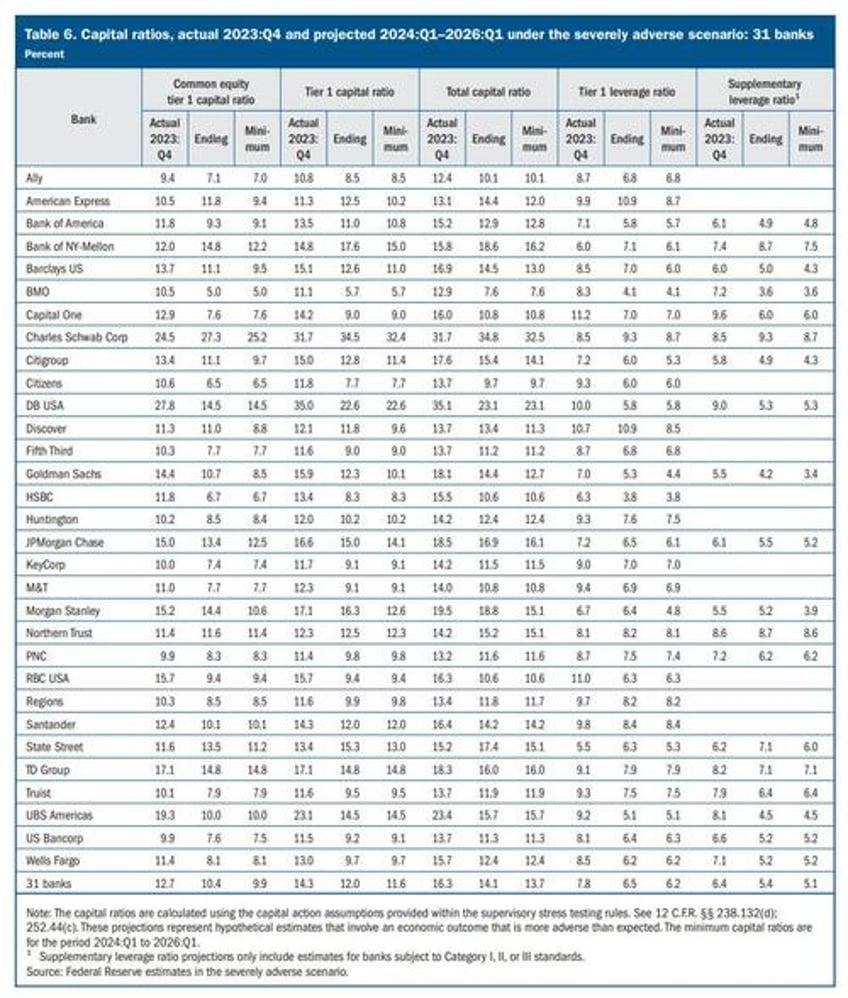

This round of the annual farce exam included 31 banks, each with at least $100 billion in assets. For the group as a whole, the so-called common equity Tier 1 capital, the highest-quality regulatory capital, would bottom out at 9.9%, well above the 4.5% minimum requirement. Of course, this is the same Fed that predicted that there would be no bank failures in a non-recession scenario in 2023 so feel free to laugh at any moment.

“The goal of our test is to help to ensure that banks have enough capital to absorb losses in a highly stressful scenario.” Michael Barr, the Fed’s vice chair for supervision, said in a statement. “This test shows that they do.”

What Michael meant is that the goal of the test is to greenlight even more stock buybacks and dividends to the banks and bankers which are also owners of the Fed itself, in what can only pass as a grotesque conflict of interest. And the fact that year after year all the banks pass with flying colors is not even worth commenting any more.

While every firm passed, results varied among them. At JPMorgan, the biggest US bank, the CET1 ratio would decline to 12.5%, from 15% at year-end. Among the megabanks, Wells Fargo’s CET1 fell to the lowest level at 8.1%, from 11.4% at year-end. That they’re so far above the minimum is likely to bolster their case against additional dramatic increases.

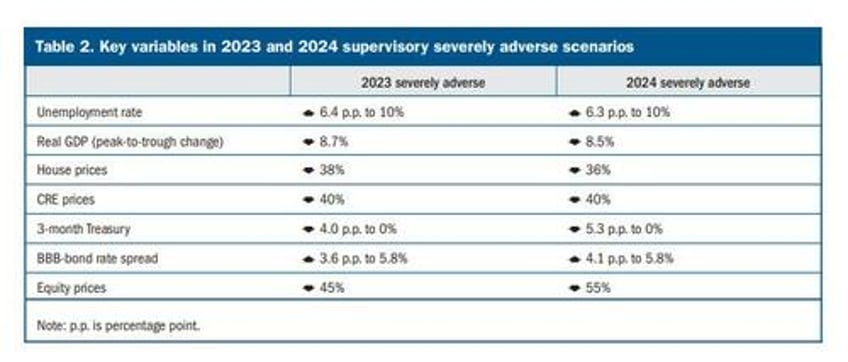

And speaking of test scenarios, this year’s “severely adverse” scenario included a 10% peak in US unemployment, a 55% drop in equity prices and a 40% decline in commercial real estate prices. As with last year, a subset of firms with large trading businesses faced an additional “global market shock” component involving equity price declines, a sharp rise in short-term Treasury rates and a weaker dollar.

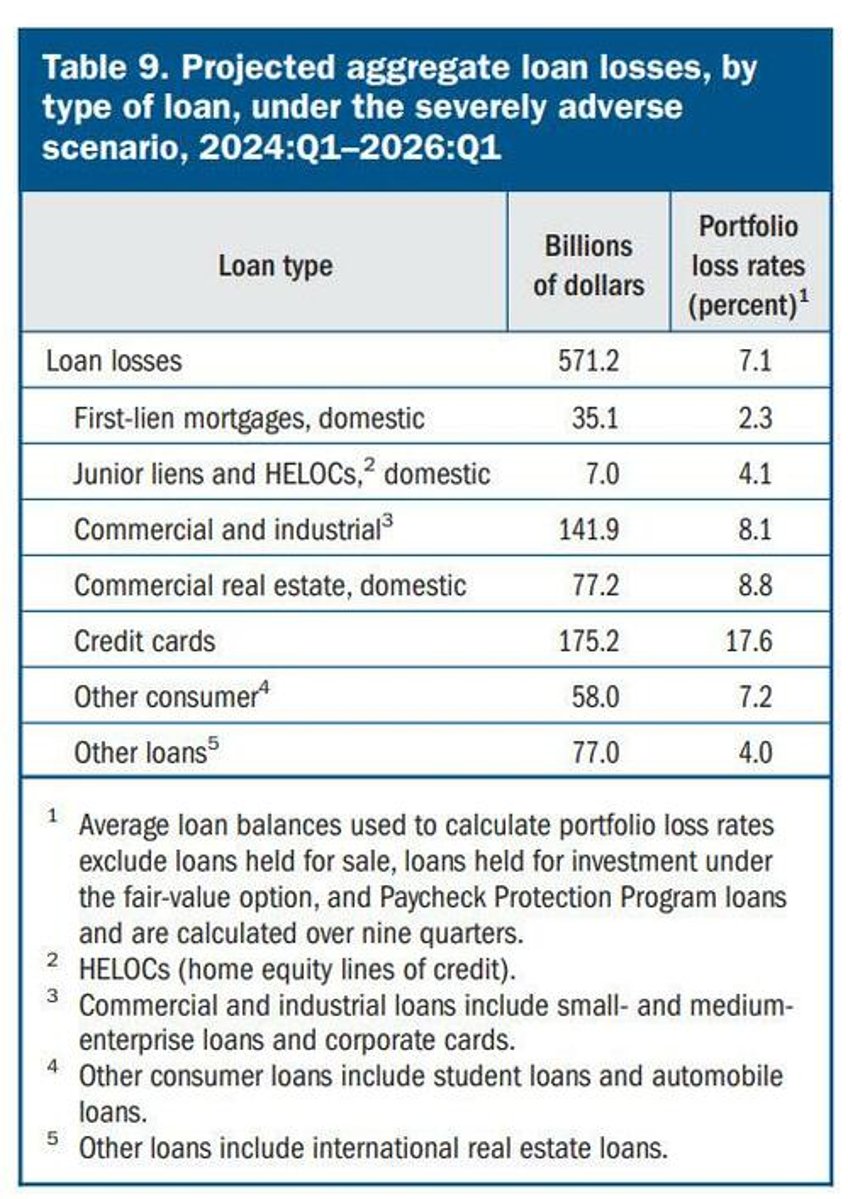

According to the Fed, the losses that would be created by a a "severe recession" are projected to be $684 billion and comprise:

- $571 billion in loan losses, accounting for 83 percent of total losses;

- $16 billion in additional losses from items such as loans booked under the fair-value option (see table 7), accounting for 2 percent of total losses;

- $91 billion in trading and counterparty losses at the 10 banks with substantial trading, processing, or custodial operations, accounting for 13 percent of total losses; and

- $6 billion in securities losses, accounting for 1 percent of total losses

For loans measured at amortized cost, projected aggregate losses are $571 billion, with the loan loss rate at 7.1 percent. These loan losses flow into pre-tax net income through the projection of provisions for loan and lease losses, which is $573 billion in aggregate and takes into account banks’ established allowances for credit losses at the start of the projection horizon.

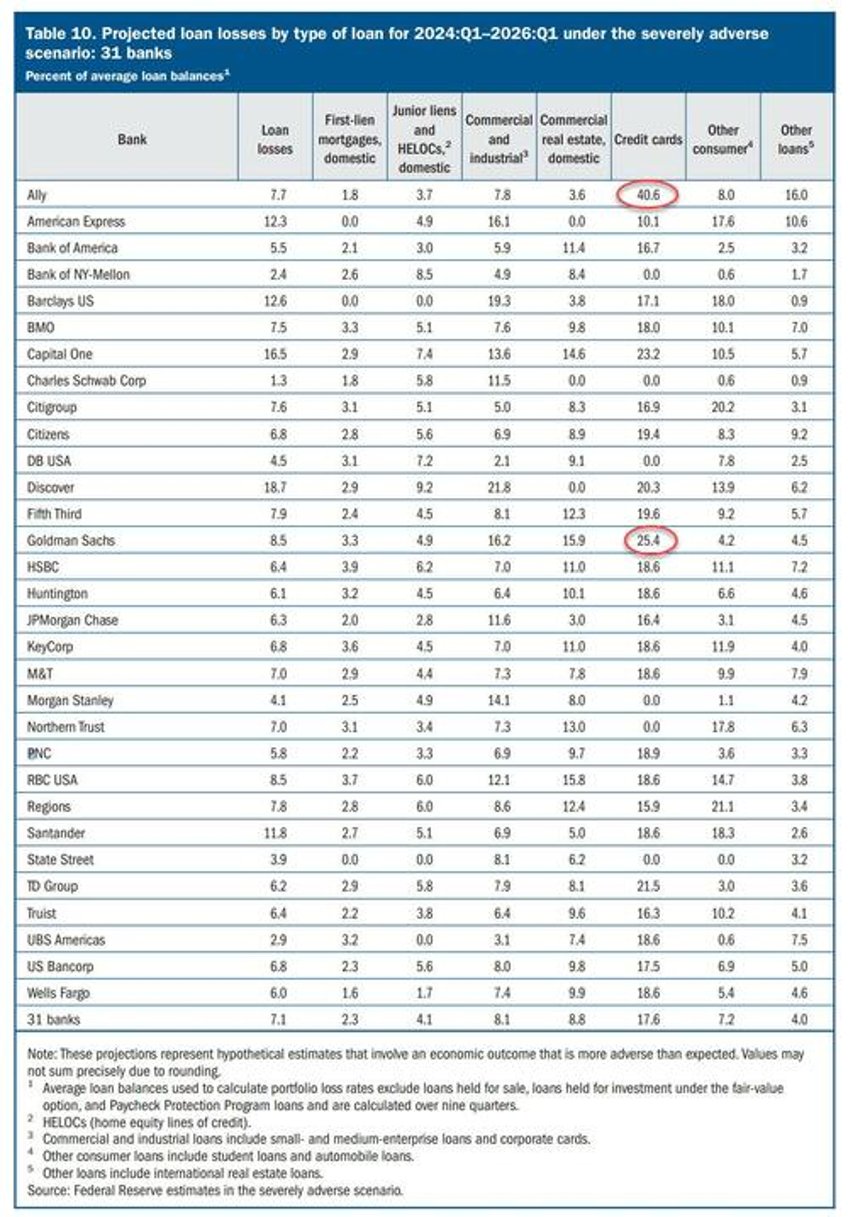

Projected consumer loan losses represent a smaller share (40 percent) of total losses than commercial loan losses (43 percent). The loan portfolio that constitutes the largest amount of losses is credit cards, representing 26 percent of total losses.

Total loan loss rates vary significantly across banks, ranging between 1.3 percent and 18.7 percent. . This range results from differences in loan portfolio composition, which materially affects losses because projected loss rates vary significantly for different types of loans. For example, aggregate loan loss rates range from 2.3 percent on domestic first-lien mortgages to 17.6 percent on credit cards due to the sensitivity and historical performance of these loans. Some loan portfolios are sensitive to home prices or unemployment rates and may experience high stressed loss rates due to the considerable stress on these factors in the severely adverse scenario

Aggregate trading and counterparty losses, which also flow into pre-tax net income, are $91 billion for the 10 banks subject to the global market shock component and/or the largest counterparty default component of the severely adverse scenario. Individual bank losses range from $1 billion to $18 billion, resulting from the specific risk characteristics of each bank’s trading positions and counterparty exposures, inclusive of hedges. Importantly, these projected losses are based on the trading positions and counterparty exposures held by banks on the same as-of date (October 13, 2023) and could have varied if they had been based on a different date.

Here is the full list of projected loan losses by banks for the 31 banks in the stress test. What is remarkable is that Goldman, the former master of the universe, now has the second crappiest, subprimiest credit card portfolio of all US banks; only Ally bank is worse....

... something which wasn't lost on the market.

The results Wednesday underscore “the usefulness of the extra capital that banks have built in recent years above their minimum requirements,” Barr said. “Because of that extra capital cushion, we expect that large banks would be able to continue extending credit to households and businesses during a time of financial stress.”

Capital requirements have been a topic of fierce debate in Washington in the year since the last stress test. Last July, the Fed and other regulators unveiled a long-awaited plan for more stringent rules that they said would result in a 16% hike for banks with more than $100 billion in assets.

But since there have been no bank failures in the past 15 months, and everyone forgot just how insolvent the US banking system is with over $500BN in unrealized losses, this push was quickly abandoned.

And so, bank bosses launched a lobbying blitz, arguing they already have enough capital and the new rules would hurt consumers and businesses. They pushed for major revisions or scrapping the plan entirely, and they won: earlier this year Fed Chair Jerome Powell said there would be “broad and material changes.”

Still, Barr re-emphasized the need for banks to hold onto more capital in the statement Wednesday. He attributed the higher losses this year to higher credit card balances and delinquencies; riskier corporate credit portfolios; and a combination of higher costs and lower fee revenue in recent years driving less net income to counter losses. Those three factors “suggest required capital buffers should be larger,” Barr said.

According to Bloomberg, the Fed has shown the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency a three-page document of possible revisions to last year’s proposal that would soften the capital increase to as little as 5%. Officials haven’t reached an agreement, and it’s unclear whether they can finish a revised plan before the US presidential election in November.

Meanwhile, the biggest US banks have wasted no time to put the "incident" of March 2023 behind them when only an emergency intervention by the Fed prevented a wholesale bank run and firesale from all banks, and signaled optimism about their capital levels this year, ramping up buybacks even ahead of the stress test results. The six largest lenders bought back more than $14 billion of stock in the first quarter, a 73% jump from the pace in the second half of last year. Executives have touted excess capital in recent months, including a surprise dividend hike at JPMorgan that CEO Jamie Dimon said was because “our capital cup runneth over.”

The Fed said Wednesday that it expects banks to wait until after 4:30 p.m. Friday to publicize any plans for dividends and buybacks. The agency expects stress capital buffers, the required cushion driven by stress-test results, to go up in aggregate as the liquidity that the Fed feeds banks via various emergency mechanisms and acronyms always eventually leaks out to their shareholders about a year later.

Read the full stress test results here.