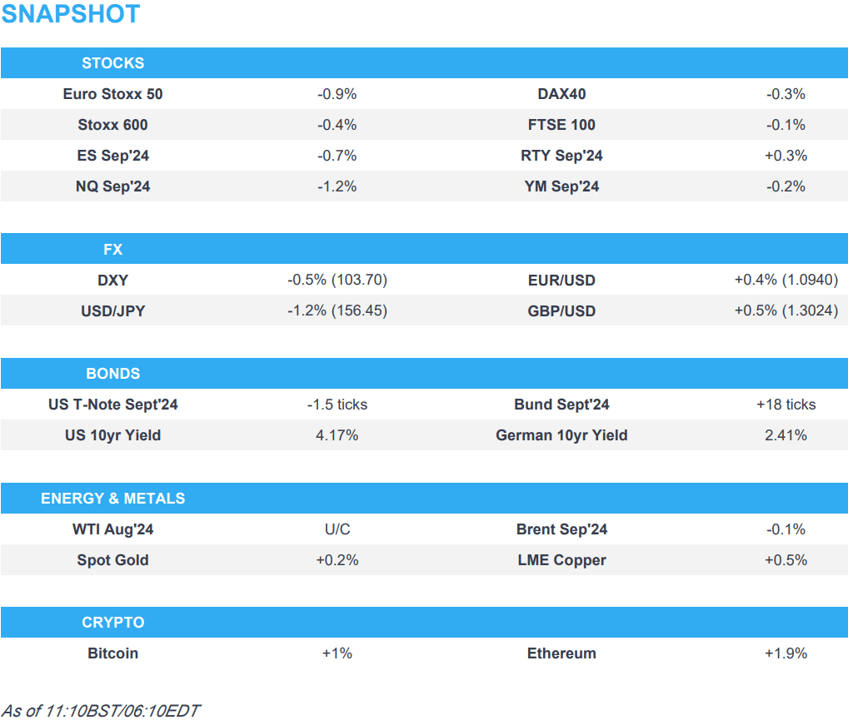

- European equities almost entirely in the red with sentiment hit following ASML earnings; results which has led to significant NQ weakness

- Dollar is weaker and slips to 103.70, carry trade unwinding seen with significant strength in JPY & CHF, GBP climbs past 1.30

- Fixed complex is rangebound, with Bunds underpinned but USTs capped near Tuesday’s best into supply

- Crude is incrementally firmer, initially catching a bid amid the weaker Dollar, a move which also helped to prop up XAU

- Looking ahead, US Industrial Production & Building Permits, Comments from Fed's Barkin & Waller, Supply from the US, Earnings from Johnson & Johnson, US Bancorp & United Airlines.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.5%) are almost entirely in the red, with sentiment hit after ASML (-6.6%) reported Q2 earnings, which has significantly weighed on the AEX (-0.9%) and more notably on the tech-heavy NQ. Updates from Maersk also factor, Co. noted that Red Sea disruptions have extended beyond far-east Europe.

- European sectors hold a strong negative bias, with Tech the clear underperformer, dragged down by ASML weakness. Consumer Products were initially the best-performing sector, propped up by post-earning gains in Adidas; but the sector is now flat.

- US Equity Futures (ES -0.7%, NQ -1.3%, RTY U/C) are entirely in the red, with clear underperformance in the tech-heavy NQ, in reaction to the ASML results; Nvidia (-3.1%), AMD (-3%), Broadcom (-3.1%). The RTY remains fairly resilient to the selling pressure.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is firmly below 104 and at its lowest level since 21st March with the USD hit by a combination of strength in low yielders as carry trades are unwound and a strong NZD and GBP post-CPI. Thereafter, commentary from Fed's Williams who noted the "Fed is closer but not ready to cut", helped to prop up DXY from a 103.67 base.

- EUR/USD is lifted by the pull back in the USD with the dollar very much the dominant force for the pair. EZ fundamentals are lacking ahead of tomorrow's ECB; EUR/USD has been as high as 1.0944; next target is the March 14th peak at 1.0954.

- GBP is firmer in the wake of UK inflation data which came in above expectations**; services inflation is markedly above the MPC's expectation. Cable above 1.30 for the first time since July 19th.

- JPY is the best performer across the majors with USD/JPY now down as low as 156.11 vs. the session high at 158.61. This follows on from a broader move triggered last week by comments from Powell, soft US CPI and Japanese intervention. Some desks are attributing today's aggressive price action to a reassessment of the JPY's role as a funding currency alongside the pullback in US yields, which could also have broader implications for high yielders; whilst Reuters suggests intervention could be playing a role.

- NZD performing well despite a miss on both QQ and YY headline inflation with some desks noting the strength in non-tradeable inflation. After an initial dip to a multi-month low at 0.6041, the pair has managed to eclipse yesterday's 0.6079 high.

- USD/CHF has slipped today to 0.8875, in fitting with the broader unwind of carry trades.

- PBoC set USD/CNY mid-point at 7.1318 vs exp. 7.2630 (prev. 7.1328).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are directionally in-fitting with peers but with magnitudes more contained so far, holding just below Wednesday's 111-13+ peak having been within half a tick overnight and around three shy in the European morning. A modest hawkish reaction was seen following commentary from Fed's Williams, who noted that "the Fed is closer but not ready to cut".

- Bunds saw two way action on the UK CPI (more below) but was ultimately softer and printed a 132.35 base, around 14 ticks below opening levels. Thereafter, a deterioration in the broader risk tone was seen and potentially driven by ASML (strong numbers, however Q3 guidance soft & China exposure), Trump tariff talk overnight and an update from Maersk around increasing Red Sea disruptions.

- An essentially unchanged open for Gilts after a sticky UK CPI release. Data which lessens but does not entirely remove the possibility of an August cut; a narrative which, alongside participants waiting for Thursday's wages. 2029 DMO tap was robust, but not quite as strong as the prior tap, which briefly weighed on Gilts by a couple of ticks.

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 3.1x (prev. 3.59x), average yield 4.023% (prev. 4.083%), tail 0.9bps (prev. 0.3bps)

- Germany sells EUR 0.824bln vs exp. EUR 1bln 2.50% 2054 Bund and EUR 0.808bln vs exp. EUR 1.5bln 0.00% 2052 Bund.

- Click for a detailed summary

COMMODITIES

- Initially firmer but then reversed amid the broader risk aversion, though the initial upside were seemingly as a function of the weaker Dollar coupled with the heightened geopolitical landscape after Former President Trump flagged a hawkish policy towards China. Brent September currently holds around USD 83.60/bbl.

- Mixed trade across precious metals with outperformance seen in spot palladium while spot silver is the clear laggard. Spot gold ekes mild gains following yesterday's rise to fresh ATHs at USD 2,482.42/oz as the yellow metal zeros in on USD 2,500/oz.

- Base metals trade mostly firmer despite the broader risk aversion following back-to-back sessions of losses amid China woes earlier in the week. In more recent trade, the complex is seemingly propped up by the softer Dollar.

- US Private Inventory Data (bbls): Crude -4.4mln (exp. +1mln), Distillate +4.9mln (exp. -0.5mln), Gasoline +0.4mln (exp. -1.7mln), Cushing -0.7mln.

- Russia plans to make extra crude production cuts to compensate for pumping above its OPEC+ quota in the warm seasons of this year and next, according to Bloomberg sources.

- Antofagasta (ANTO LN) Q2'24 Production report: quarterly production +20%, FY production exp. in lower end of guidance range of 670-710k tonnes. Gold Production 33,600 ounces.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK CPI YY (Jun) 2.0% vs. Exp. 1.9% (Prev. 2.0%); Services YY (Jun) 5.7% vs. Exp. 5.60% (Prev. 5.70%)

- UK CPI MM (Jun) 0.1% vs. Exp. 0.1% (Prev. 0.3%); Services MM (Jun) 0.6% vs. Exp. 0.40% (Prev. 0.60%)

- UK Core CPI YY (Jun) 3.5% vs. Exp. 3.5% (Prev. 3.5%); MM (Jun) 0.2% vs. Exp. 0.1% (Prev. 0.5%)

- ONS May UK House Prices +2.2% Y/Y (prev. +1.3% in Apr)

- EU HICP Final YY (Jun) 2.5% vs. Exp. 2.5% (Prev. 2.5%)

NOTABLE EUROPEAN HEADLINES

- ASML (ASML NA) - Q2 (EUR): Revenue 6.24bln (exp. 6.03bln), Net Income 1.58bln (exp. 1.44bln), Bookings 5.57bln (exp. 4.41bln), EPS 4.01 (exp. 3.68). Q3 Outlook Revenue 6.7-7.3bln (exp. 7.66bln). CEO: currently see strong developments in AI, driving most of the industry recovery and growth, ahead of other market segments.

- Maersk (MAERSKB DC) said the Red Sea disruptions have extended beyond far-east Europe routes to the entire ocean network; Asian exports are more impacted than Asian imports by the ongoing situation in the Red Sea.

NOTABLE US HEADLINES

- Fed's Williams (voter) says the Fed is closer but not ready to cut; a rate cut will be appropriate in the coming months; more data will help provide confidence on inflation; seeing broad-based declines in inflation, via WSJ. The labour market is not weak. Williams pushes back against concerns that bringing inflation back to 2% would be more difficult than it had been so far. Even if the Fed starts to lower rates, they would remain at a setting that still restrains economic activity. Last three months of data are getting the Fed closer to the disinflationary trends the Fed is looking for. The current rate stance is appropriate to achieve goals.

- US President Biden is set to announce support for major Supreme Court changes, while proposals could include term limits and an enforceable ethics code, according to The Washington Post.

- Former US President Trump said "Trumponomics" equates to low interest rates and tariffs, while he said he would not seek to remove Fed Chair Powell before his term ends and would consider JPMorgan CEO Dimon to serve as Treasury Secretary. Furthermore, he said the Fed should abstain from cutting rates before the November election and wants to bring the corporate tax rate to as low as 15%, according to a Bloomberg Businessweek interview.

- Elevance Health (ELV) Q2 2024 (USD): EPS 10.12 (exp. 10.01), Revenue 43.20bln (exp. 43.05bln). FY EPS view 37.20 (exp. 37.28), FY Revenue view (exp. 172.bln).

- Capital One Financial (COF) pledges USD 265bln to lending and philanthropy in the scenario that the Discovery Financial (DFS) deal goes through

GEOPOLITICS

MIDDLE EAST

- Israeli media reported more than 80 rockets were fired from Lebanon on Tuesday night, according to Sky News Arabia.

- Lebanon's Hezbollah chief says Israel persistence in targeting civilians will push Lebanon to target "new colonies" that were not previously targeted.

OTHER

- Russian Deputy PM Novak says the latest EU sanctions targeting Russia's LNG industry are illegal, according to TASS.

- Hungarian Foreign Minister said efforts are being made to hold a second peace conference on Ukraine this year, according to RIA.

- Japan is making the final arrangement to contribute USD 3.3bln to Ukraine aid using frozen Russian assets which is about 6% of the total G7 package, according to Kyodo.

- Former US President Trump said Taiwan should pay the US for protection from China and that he is at best lukewarm about standing up to Chinese aggression, according to a Bloomberg interview. It was later reported that Taiwan's Premier said regarding the Trump interview that the relationship between Taiwan and the US is very firm, while he added that peace and stability of the Taiwan Strait and the Indo-Pacific region are our common responsibility and that Taiwan is willing to take on more responsibility.

CRYPTO

- Bitcoin climbs and holds above USD 65k, whilst Ethereum gains but still yet to firmly breach USD 3.5k.

APAC TRADE

- APAC stocks were mixed despite the positive handover from Wall St where the S&P 500 and DJIA extended to fresh record highs following better-than-expected Retail Sales data, as China trade frictions and tariff threats clouded over Asia-Pac sentiment.

- ASX 200 gained with notable strength in gold-related stocks after the precious metal rose to a fresh record level, while the mining sector is positive but with upside capped amid indecision in BHP despite posting better-than-expected quarterly iron ore output.

- Nikkei 225 gradually reversed its initial advances with trade restrained by a lack of drivers and a quiet calendar aside from the monthly Reuters Tankan survey which showed an improvement in large manufacturers’ sentiment.

- Hang Seng and Shanghai Comp. were lacklustre amid tariff fears and trade frictions after Trump suggested 60%-100% tariffs on China, while the Biden administration is to issue a proposed rule on Chinese connected vehicles in about a month and warned allies of stricter trade rules in the China chip crackdown.

NOTABLE ASIA-PAC HEADLINES

- PBoC reportedly questions banks on bond holdings in a push to cool the rally, according to Bloomberg.

- US reportedly warned allies of stricter trade rules in the China chip crackdown with the US mulling whether to impose the Foreign Direct Product Rule, while US restriction would hit technology from Tokyo Electron (8035 JT) and ASML (ASML NA), according to Bloomberg.

- Former US President Trump said he no longer plans to ban TikTok, while he wants new tariffs for China of between 60%-100% and would impose a 10% tariff on imports from other countries, according to a Bloomberg interview.

- Japan's Outgoing Top Currency Diplomat Kanda says will respond appropriately to excessive FX moves, via Kyodo; if speculators cause excessive moves, "we have no choice but to respond appropriately". In close contact with other countries' authorities, there has been no criticism.

- Traders suspect Japanese intervention could be behind the surge in JPY, according to Reuters

DATA RECAP

- New Zealand CPI QQ (Q2) 0.4% vs. Exp. 0.5% (Prev. 0.6%); YY (Q2) 3.3% vs. Exp. 3.4% (Prev. 4.0%)

- New Zealand Q2 CPI Non-Tradeable rose 5.4% Y/Y.

- RBNZ Sectoral Factor Model Inflation Index (Q2) 3.6% (Prev. 4.2%)