- APAC stocks traded mixed as the region lacked firm conviction following the negative handover from Wall St.

- BoJ left rates unchanged as expected; Japan's economy is recovering moderately, albeit with some weak signs.

- European equity futures indicate a steady open with Euro Stoxx 50 future flat after the cash market closed with gains of 0.7%.

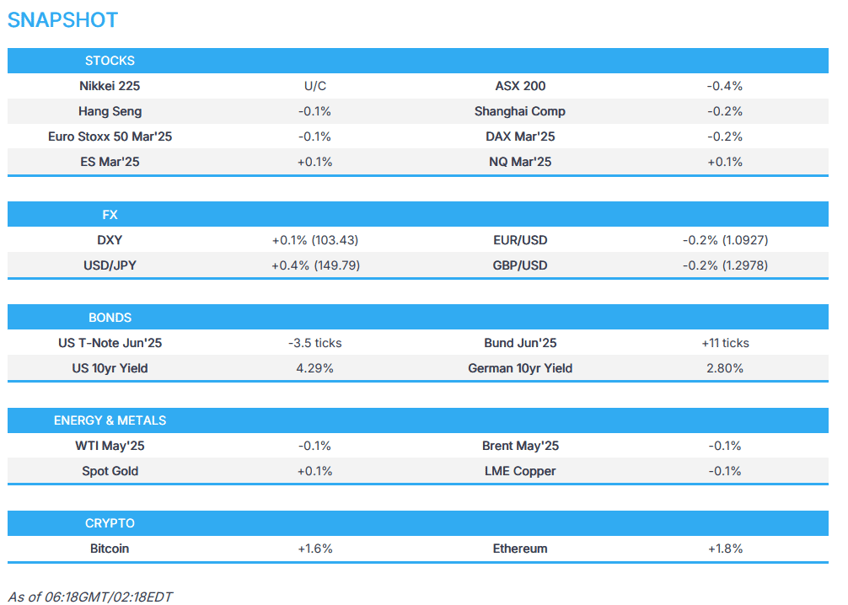

- DXY is a touch firmer, EUR/USD is lower but holding above 1.09, JPY is weaker post-BoJ.

- US President Trump said he and Russian President Putin agreed to an immediate ceasefire on all energy and infrastructure.

- Looking ahead, highlights include EZ Labour Costs & Wages, NZ GDP, FOMC & BCB Policy Decisions, BoJ’s Ueda, Fed Chair Powell, ECB’s de Guindos, Elderson, NVIDIA CEO Huang, Supply from Germany.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks resumed their selling with all major indices closing well in the red and the losses led by the Nasdaq amid pressure across the tech megacaps, while risk appetite failed to benefit from a slew of better-than-expected data releases and positive talks between US President Trump and Russian President Putin where they agreed on an immediate ceasefire on all energy and infrastructure, as well as to begin talks immediately regarding a complete ceasefire.

- SPX -1.07% at 5,614, NDX -1.66% at 19,483, DJI -0.62% at 41,581, RUT -0.89% at 2,050.

- Click here for a detailed summary.

TARIFFS/TRADE

- White House official said reciprocal tariffs are still intended to take effect from April 2nd, when asked about Treasury Secretary Bessent's comments.

- India's government recommended a 12% safeguard duty or temporary tax for 200 days on some steel products.

NOTABLE HEADLINES

- US President Trump posted an article on Truth Social stating “Trump’s tariffs are saving the American steel industry” and posted an article titled "President Trump Is Delivering Needed Economic Relief".

- WSJ's Timiraos wrote central banks can lower rates because of good or bad news and the window for ‘good’ cuts is closing due to new inflation risks, while he noted that most officials are expected to pencil in one or two rate cuts this year but projections are likely to obscure how the Fed’s wait-and-see holding pattern has undergone an important reset because of the threat of an expansive trade war that sends up prices.

- US Pentagon will cut up to 60k civilian jobs, according to AP.

APAC TRADE

EQUITIES

- APAC stocks traded mixed as the region lacked firm conviction following the negative handover from Wall St and as participants braced for central bank announcements including the BoJ decision which lacked any major fireworks.

- ASX 200 was subdued for most of the session and finished lower in the absence of any fresh bullish catalysts.

- Nikkei 225 initially benefitted from recent currency weakness which helped the index shrug off disappointing machinery orders and weaker-than-expected trade data to briefly reclaim the 38,000 level. However, the index then gradually pared its gains following the lack of surprises from the BoJ's unsurprising decision to maintain rates at 0.50%,

- Hang Seng and Shanghai Comp were choppy with participants cautious as they digested recent earnings releases and with tech stocks contained heading into Tencent's results due later today.

- US equity futures (ES +0.1%, NQ +0.2%) nursed some of yesterday's losses but with the rebound limited as the FOMC announcement looms.

- European equity futures indicate a steady open with Euro Stoxx 50 future flat after the cash market closed with gains of 0.7%.

FX

- DXY was rangebound after weakening yesterday despite several firmer-than-expected data releases stateside which prompted an upward revision in the Atlanta Fed GDPNow forecast, while there were recent comments from the White House that reciprocal tariffs are still intended to take effect from April 2nd and the attention for the US now turns to the FOMC.

- EUR/USD slightly pared some of its gains after the prior day's choppy performance despite the German Bundestag approval of the fiscal reform package, while EU wages data and inflation revisions are scheduled today.

- GBP/USD marginally softened and just about gave back the 1.3000 status amid light UK-specific catalysts, although it was reported that UK Chancellor Reeves plans a multi-billion pound public spending squeeze in next week's Spring Statement.

- USD/JPY was underpinned amid early gains in Japanese stocks and after weaker-than-expected data releases, while the BoJ announcement lacked any major fireworks as the central bank kept rates unchanged as widely expected.

- Antipodeans traded sideways amid the non-committal risk tone and with little reaction seen from the relatively stable Australian Leading Index and softer-than-expected New Zealand Current Account data.

- PBoC set USD/CNY mid-point at 7.1697 vs exp. 7.2330 (Prev. 7.1733).

FIXED INCOME

- 10yr UST futures faded some of their gains after catching a bid yesterday on the risk-off mood and strong 20yr auction.

- Bund futures kept afloat but with the upside capped after the Bundestag recently passed the fiscal reform package and with Germany scheduled to conduct Bund issuances later today.

- 10yr JGB futures declined despite the weaker-than-expected Machinery Orders and Trade Data from Japan, while demand was also not helped by the lack of surprises from the BoJ policy announcement.

COMMODITIES

- Crude futures remained subdued after yesterday's losses and with Trump-Putin talks said to be productive in which they agreed on a temporary halt on energy infrastructure strikes and to begin talks immediately on a complete ceasefire, while prices were not helped by mixed private inventory data which showed a larger-than-expected build in crude stockpiles.

- US Private Inventory Data (bbls): Crude +4.6mln (exp. +0.9mln), Distillate -2.1mln (exp. -0.3mln), Gasoline -1.7mln (exp. -2.4mln), Cushing -1.1mln.

- Nigeria’s President declared a state of emergency in the oil-producing Rivers state over pipeline vandalism.

- Spot gold notched fresh record highs in rangebound trade ahead of today's FOMC announcement.

- Copper futures traded little changed amid the mixed risk sentiment as participants braced for central bank updates.

CRYPTO

- Bitcoin was choppy overnight and just about returned to above the USD 83,000 level.

NOTABLE ASIA-PAC HEADLINES

- BoJ maintained its short-term interest rate target at 0.5%, as expected with the decision made by unanimous vote. BoJ said Japan's economy is recovering moderately, albeit with some weak signs, while consumption is increasing moderately as a trend and inflation expectations are also heightening moderately. BoJ stated they must be vigilant to the impact of financial and FX market moves on Japan's economy but added that Japan's economy is likely to continue growing above potential. Furthermore, it expects underlying inflation to converge towards a level consistent with the price target in the latter half of the three-year period projected under the Outlook Report but noted uncertainty surrounding Japan's economy and prices remains high.

DATA RECAP

- Japanese Machinery Orders MM (Jan) -3.5% vs. Exp. -0.5% (Prev. -1.2%, Rev. -0.8%)

- Japanese Machinery Orders YY (Jan) 4.4% vs. Exp. 6.9% (Prev. 4.3%)

- Japanese Trade Balance (JPY)(Feb) 584.5B vs. Exp. 722.8B (Prev. -2758.8B, Rev. -2736.6B)

- Japanese Exports YY (Feb) 11.4% vs. Exp. 12.1% (Prev. 7.2%, Rev. 7.3%)

- Japanese Imports YY (Feb) -0.7% vs. Exp. 0.1% (Prev. 16.7%, Rev. 16.2%)

GEOPOLITICS

MIDDLE EAST

- Israel’s Foreign Ministry said the Americans were informed before the attack and supported it, while it added that it is not a one-day attack and they will continue the military operation in the coming days. Furthermore, Israeli official Katz separately commented that they won't halt the fighting until all hostages are released.

- Israeli army attacked Khan Yunis and conducted heavy shelling in the southern Gaza Strip, according to Al Jazeera.

- Air raid sirens went off in southern Israel after a missile launch from Yemen was detected, according to the IDF.

- Hamas leader said continuation of the Israeli bombardment of Gaza will lead to the death of many Israeli prisoners and the movement is communicating with mediators to force Israel to respect its commitments to the ceasefire.

- US bombed targets in areas east of Hodeidah in Yemen and there were at least 10 US strikes that targeted areas in Yemen, according to Houthi media.

- Iranian-backed Houthis claimed responsibility for a fourth attack on US warships, according to AFP News Agency. It was also reported that the Houthis said they will expand their targets in Israel in the next hours and days if aggression against Gaza does not end.

RUSSIA-UKRAINE

- US President Trump said his call with Russian President Putin was very good and productive, while they agreed to an immediate ceasefire on all energy and infrastructure with the understanding that they will be working quickly to have a complete ceasefire. Trump later commented that they want to get the war over and he did not discuss aid to Ukraine with Russian President Putin.

- White House readout of the Trump-Putin call noted that they spoke about the need for peace and a ceasefire in the Ukraine war, while leaders agreed the movement to peace will begin with an energy and infrastructure ceasefire, as well as technical negotiations on implementation of a maritime ceasefire in the Black Sea, and on a full ceasefire and permanent peace with the negotiations to begin immediately in the Middle East. Leaders spoke broadly about the Middle East as a region of potential cooperation to prevent future conflicts and discussed the need to stop the proliferation of strategic weapons and will engage with others to ensure the broadest possible application. It was also stated that a future with an improved bilateral relationship between the US and Russia has a huge upside which includes enormous economic deals. Furthermore, the leaders shared the view that Iran should never be in a position to destroy Israel.

- Kremlin said Russian President Putin and US President Trump discussed Ukraine and agreed to stay in contact, while Ukraine and Russia are to swap 175 for 175 POWs. It was also reported that Putin reaffirmed commitment to peace in Ukraine and that Russia and the US are to set up expert groups on Ukrainian settlement. Furthermore, there are reportedly still some sticking points on a ceasefire in Ukraine and Putin said there must be a stop to Ukrainian mobilisation and arming of Ukraine, while Putin supports the idea of not hitting energy facilities and agreed to halt strikes on energy infrastructure for 30 days.

- Call between US President Trump and Russian President Putin reportedly lasted for 1.5 hours, according to MSNBC. Furthermore, an informed Russian source said the call between Russian President Putin and US President Trump went "very well", according to Sky News Arabia.

- Russia's Medvedev said the Putin-Trump call showed there is only Russia and the US in the 'dining room' eating a 'Kyiv-style cutlet' as a main course.

- US Special Envoy Witkoff said talks with Russia on the Ukraine war will take place on Sunday in Jeddah.

- Ukrainian President Zelensky said he hopes to speak to US President Trump to receive more details about discussions from the call with Russian President Putin and noted that Ukraine would support a proposal to stop strikes on energy infrastructure. Zelensky said Kyiv's partners would not agree to stop military aid and hopes it will continue, while he added that Ukraine will support any proposals that lead to stable and just peace.

- Ukrainian President Zelensky said Russia launched over 40 drones targeting civilian infrastructure and it is precisely such night attacks by Russia that destroy Ukraine’s energy and civilian infrastructure. Zelensky added the fact that Tuesday night attacks were no exception shows the need to continue pressure on Russia for the sake of peace, as well as noted that Russian President Putin de facto rejected the proposal for a complete ceasefire and it would be right for the world to reject any attempts by Putin to drag out the war in response.

- UK PM Starmer spoke with Ukrainian President Zelensky on Tuesday evening and discussed progress US President Trump had made towards a ceasefire in talks with Russia, according to Downing Street.

- Regional governor in Russia's Belgorod region said the situation remains difficult, a day after Russia said its forces had thwarted Ukrainian attempts to push across the border in Belgorod. It was separately reported that a drone attack sparked a fire at an oil depot in Russia's Krasnodar region, according to regional authorities.

- UK Foreign Secretary said the EU and UK are to accelerate shipments of arms to Ukraine ahead of a potential full ceasefire, according to Bloomberg.

OTHER

- US Secretary of State Rubio warned unless Venezuela's government accepts a flow of deportation flights, the US will impose new and escalating sanctions, while Venezuela's government said sanctions are an economic war and responsible for hardships.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves is planning a new multi-billion pound public spending squeeze in next week's Spring Statement, following an announcement on Tuesday of GBP 5bln in welfare cuts, according to FT.

- Irish Central Bank warned of significant impact from higher tariffs and cannot rule out a recession, while it lowered its GDP growth forecast for 2025 to 4.0% from 4.2% and 2026 forecast to 4.0% from 4.5%.

- European Council called for an acceleration of work to decisively ramp up Europe's defence readiness within the next five years, according to Reuters citing draft conclusions.