The delayed day of reckoning has arrived for millions of Americans who purchased vehicles with absurdly high monthly payments they no longer can afford. New data shows auto repossessions surged in the first half of the year, driven by elevated inflation and high interest rates, resulting in increased consumer distress (read: here & here) as the labor market slows.

Before we delve into the data from Cox Automotive, let's revisit several of our reports from mid-2022, showing how we have been diligently tracking the perfect storm brewing for auto repossessions:

July 2022: Are We Headed For An "Auto Loan Crisis" As Delinquencies Begin To Rise?

December 2022: Perfect Storm Arrives: "Massive Wave" Of Car Repossessions And Loan Defaults To Trigger Auto Market Disaster, Cripple US Economy

January 2023: "It's The Perfect Storm": More Americans Can't Afford Their Car Payments Than During The Peak Of Financial Crisis

November 2023: Americans Panic Search "Give Car Back" As Subprime Auto Loan Delinquency Erupts

February 2024: "Garbage Deals": Dealership Puts Customers In Cars With $3,000 Monthly Payments

Two years later, the deterioration has accelerated. Cox data shows repos jumped 23% in the first six months of this year compared with the same period in 2023. Repos started moving higher last year and have now exceeded pre-Covid levels, up 14% compared to the first half of 2019.

"When you think about the costs for rent and shelter and insurance, all those things hit consumers and they have to choose what they will pay," Jeremy Robb, senior director of economic and industry insights at Cox, told Bloomberg.

Robb warned, "More people are getting behind on payments because everything is more expensive."

Fitch Ratings data shows that the percentage of subprime auto borrowers who were at least 60 days late on their bill in June was around 5.62%, down from the record in February.

Data from Bankrate indicates that the average interest rate for a new 60-month auto loan is now 7.94%, while for a used car, it's around 12%. The average monthly payments have risen to $739 for new vehicles and $549 for used cars.

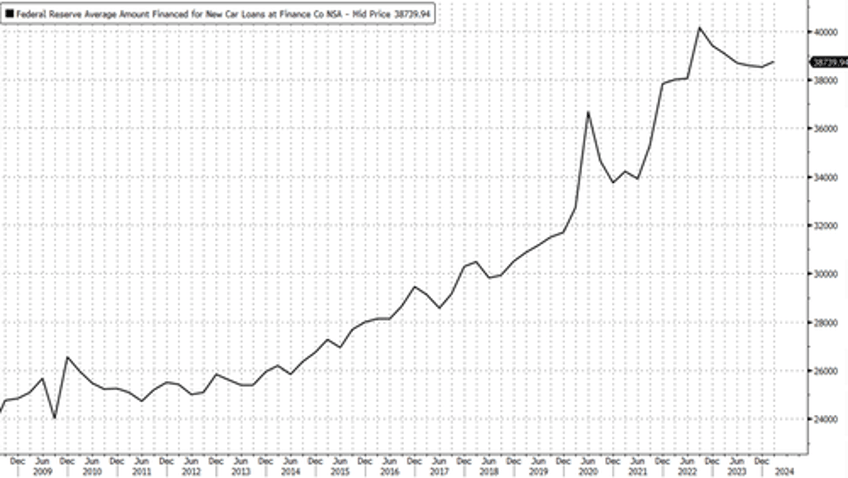

What's clear is that consumers have used more debt than ever to fund near-record new car purchases. Fast-forward to today and the ominous new development is that high monthly payments in a period of elevated inflation and high interest rates have made these vehicles unaffordable for some.

We believe this surge in nominal auto debt and elevated interest rates will crush the subprime borrowers as more fall behind on their car payments—a trend that should only accelerate.

Recently, Consumer Financial Protection Bureau officials have been concerned about troubling signs in the auto market, particularly among so-called subprime borrowers.

Now, it's a race against time for the Federal Reserve to provide relief to consumers. Traders are anticipating the first rate cut in September, driven by cooling inflation data.