Submitted by Sam Bourgi of CreditNews

For the average American, 2023 was the worst year ever for housing affordability—and now there’s more data to back it up.

According to Redfin data analyzed by Creditnews Research, the average U.S. household can only afford 15.5% of the homes that went up for sale in 2023—the lowest on record.

By comparison, the average household had the means to buy 20.7% of homes for sale in 2022 and over 40% before the pandemic.

Redfin data also showed the number of affordable homes for sale plunged to record lows in 2023, falling 40.9% to 352,500.

According to Redfin’s Lily Katz, “elevated mortgage rates and stubbornly high prices made the listings hitting the market more expensive” in 2023.

This analysis is based on home listings in 97 of the most populous U.S. metro areas. A house is considered “affordable” if the buyer’s mortgage payment is no more than 30% of their region’s median household income.

The 30% threshold isn’t some arbitrary number.

The Department of Housing and Urban Development says households that spend more than a third of their income on housing are far more likely to run into financial troubles.

Redfin's data mirror Creditnews Research’s Housing Affordability Report, which showed that the average American's mortgage burden is the worst since 1981 when rates peaked at over 18%.

Although the housing affordability crisis is often blamed on record home prices, it's the root cause behind those prices that has been working against homebuyers in 2023.

Homeowners aren’t budging

Americans who purchased a home before 2021 have built up massive equity as their property values surged during Covid. According to Fed research, homeowners saw their equity rise from $139,100 in 2019 to $201,000 in 2022.

So, why aren’t they selling and cashing in? Because they don’t want to trade in their current mortgage rate for a much higher one.

According to Creditnews Research, 23.4% of existing mortgages were originated in 2021 when rates were below 3%. Another 17.8% of mortgages were originated in 2020—the year the Fed cut interest rates back to zero.

Now, nearly two-thirds (64.5%) of U.S. mortgages have rates under 4%. These buyers have “golden handcuffs” —they don’t want to give up their current rate for a much higher one.

Although mortgage rates have declined since late October, they’re still double what they were before 2021.

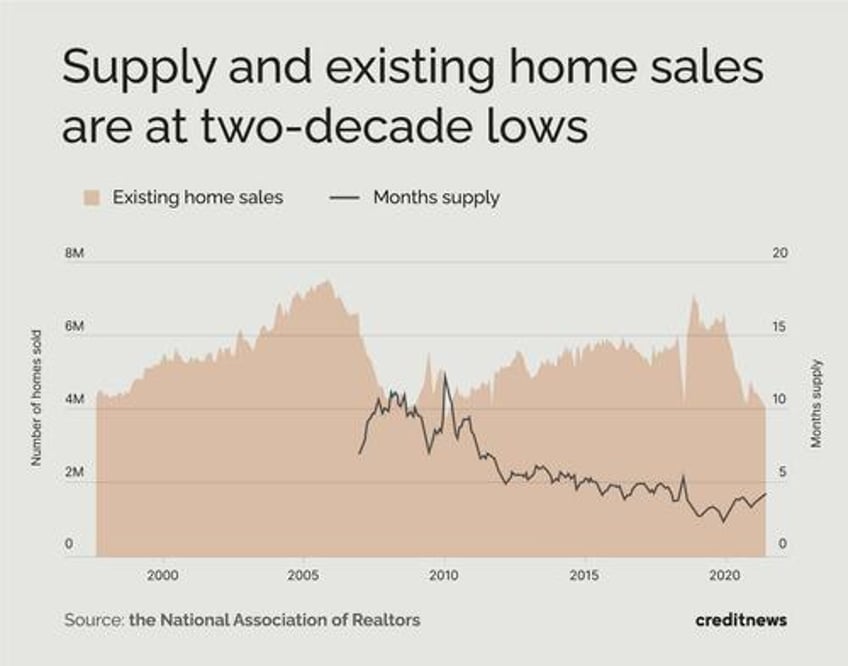

With homeowners refusing to sell, housing inventories have plunged to 20-year lows, according to the National Association of Realtors (NAR). And less supply means buyers are competing for fewer listings—a feedback loop that keeps pushing prices higher.

According to NAR data, the housing market has about 3.5 months’ worth of supply at the current sales pace. As a result, existing home sales have plunged to 13-year lows and are on track for their worst year in more than four decades.

Experts predict lower mortgage rates, but will they help?

With mortgage rates declining for eight consecutive weeks, industry experts believe rates will continue heading lower in 2024.

The NAR has pegged 30-year interest rates as low as 6.1% in 2024 before rebounding slightly to 6.3%. The Mortgage Bankers Association has a similar view and expects rates to drop to 6.1% by the end of the year.

Meanwhile, Mortgage News Daily’s chief operating officer Matthew Graham believes rates could fall even below 5% next year.

Lower mortgage rates should help ease housing costs, but even 5% might not be enough to fix the housing shortage—the root cause of record home prices.

“The supply of homes for sale remains scarce,” wrote Nancy Vanden Houten, an economist at Oxford Economics. “Lower mortgage rates may bring some sellers off the sidelines, though most homeowners with mortgages still have rates well below current market rates.”