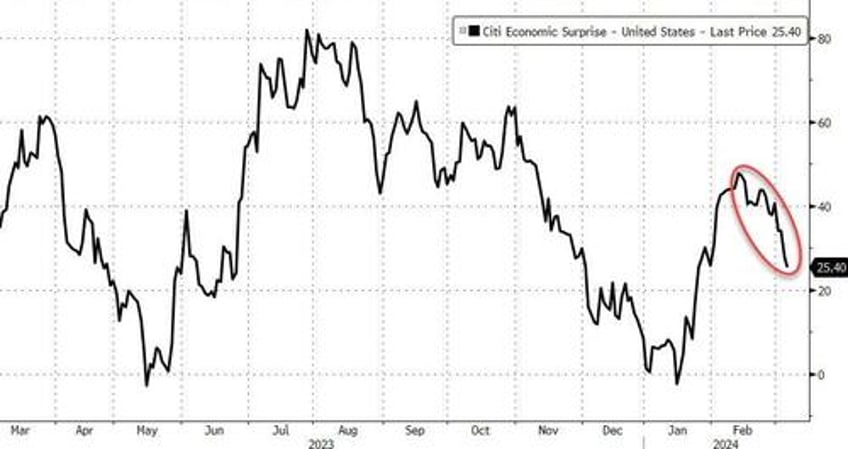

Bonds, big-tech, bitcoin, and bullion all rallied today as the dollar dived after disappointing jobs data and a no-less-hawkish Fed Chair Powell.

ADP and JOLTS both printed weaker than expected and the Beige Book signaled weakness for the consumer...

Source: Bloomberg

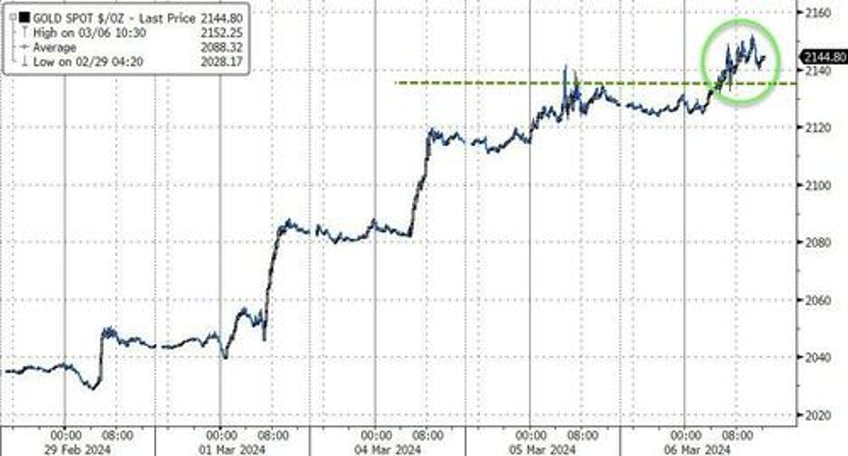

A new record high for spot gold prices...

Source: Bloomberg

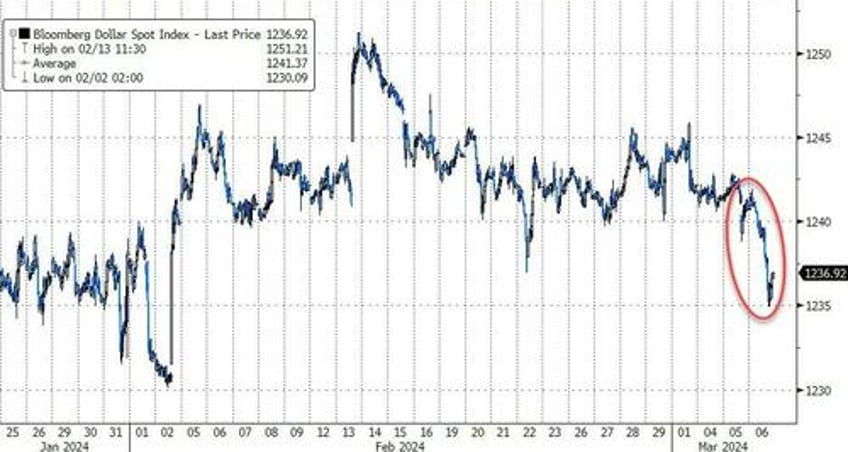

As the dollar dived on a small rise in rate-cut expectations...

Source: Bloomberg

All the US Majors managed gains on the day but were well off the highs with The Dow lagging and Nasdaq and Small Caps leading...

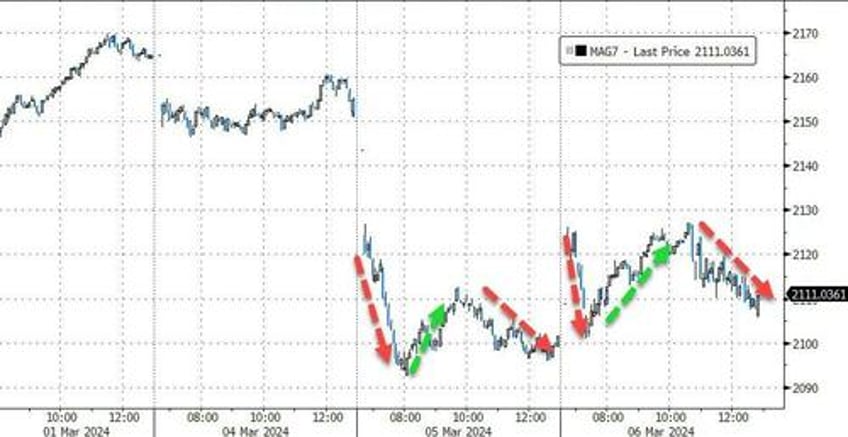

Mag7 Stocks gave back their early day gains following a similar pattern to yesterday...

Source: Bloomberg

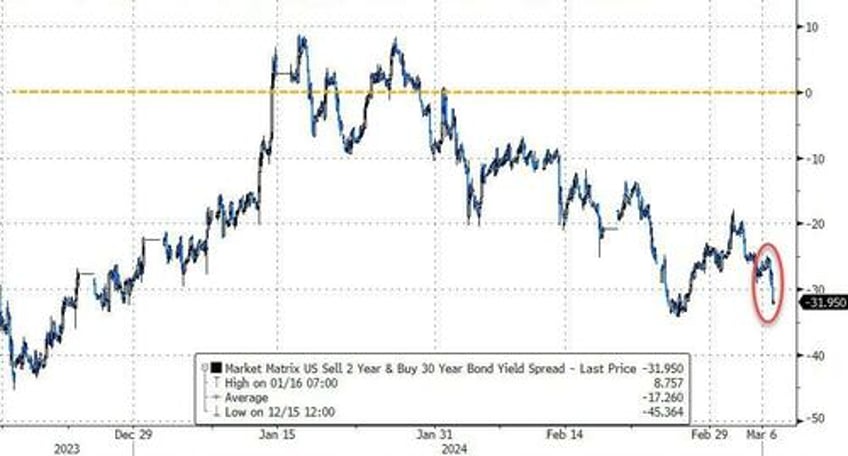

Bonds were mixed with the short-end lagging as the long-end saw yields 5-6bps lower on the day. On the week, 2Y remains the only segment higher in yield..

Source: Bloomberg

The 10Y yield hit a one-month low today...

Source: Bloomberg

Which has flattened the yield curve further...

Source: Bloomberg

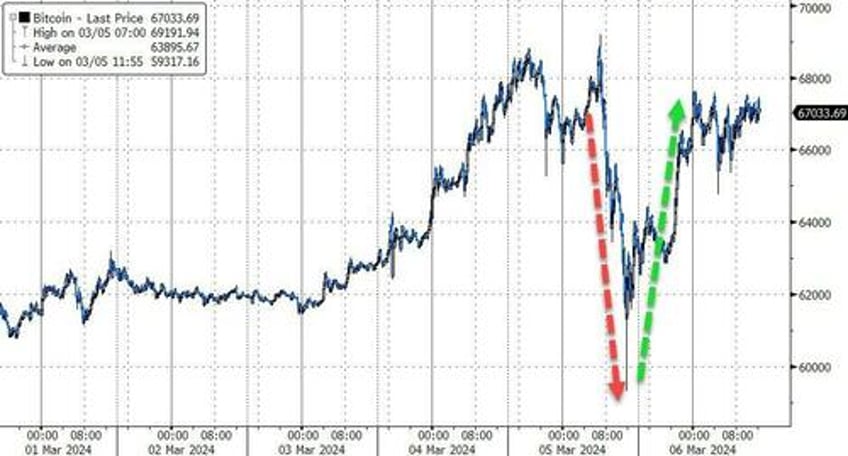

After yesterday's insane day in crypto, Bitcoin recovered a lot of its crash-from-record-high losses, back above $67,000...

Source: Bloomberg

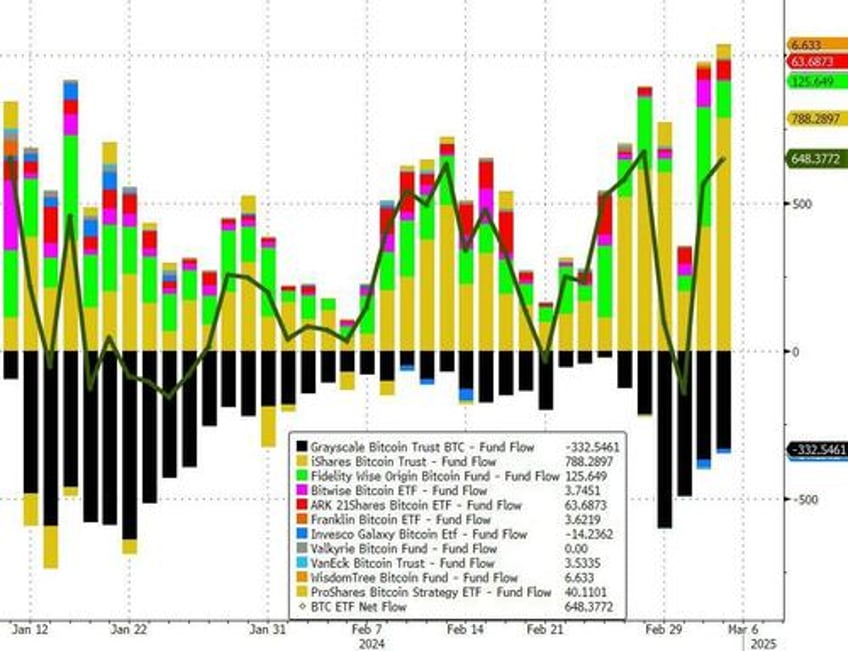

Which should not be total surprise given yesterday saw MASSIVE net inflows into BTC ETFs...

Source: Bloomberg

not only are they HODLers they are rabid BTDFers https://t.co/ETIyYajyoi

— zerohedge (@zerohedge) March 6, 2024

Ethereum did even better, taking out yesterday's high to trade above $3900...

Source: Bloomberg

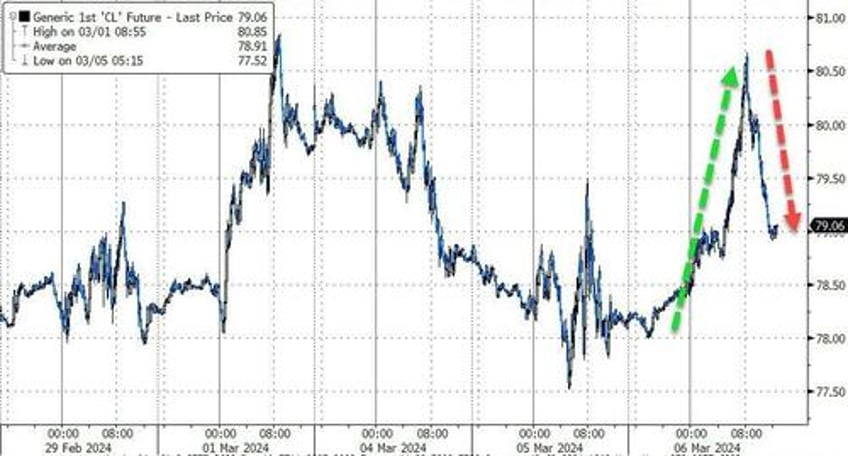

Oil price ended higher but not before a good pump and dump intraday that lifted WTI above $80.50...

Source: Bloomberg

Finally, New York Community Bancorp was a total shitshow and deserves a section of its own. From $3.20 close to $1.70 lows... then Mnuchin and his hot wife stepped in at $2 and the stock ripped up to $4.40... only to sink back basically to unchanged...

Source: Bloomberg

What are the odds that a billion will solve their problem? Options traders dumped their puts on the news (and some calls were bought), but...

NYCB share price did not extend gains on the news or the cover? We're gonna need a bigger boat.