No major macro today but more jawboning overnight from Beijing sparked some global gains in stocks.

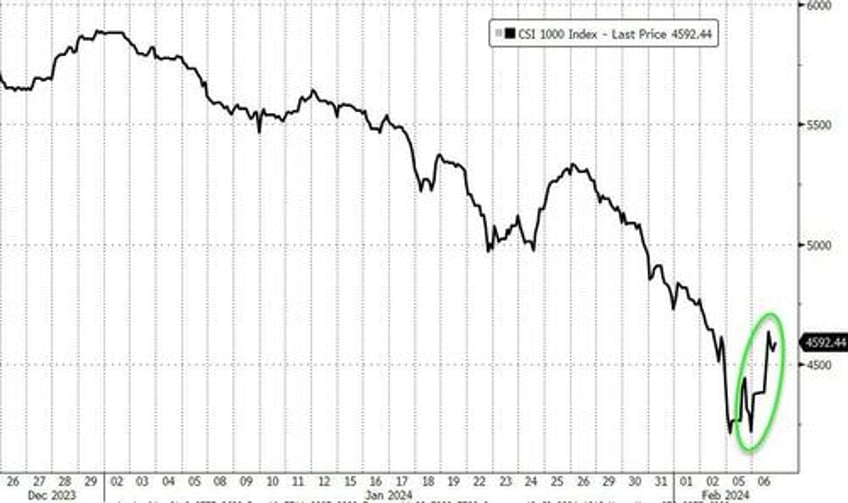

China Small Caps were up 7% (but put in context, not so impressive)...

However, today's biggest newsmakers was FedSpeak, Yellen yellin', and bank blow-ups...

Take your pick:

The Good: KASHKARI: 3M, 6M INFLATION RATES 'BASICALLY THERE' AT 2%; WE DO NOT THINK ABOUT POLITICS NOR UPCOMING ELECTION

Bad: MESTER: EXPECT FED TO GAIN CONFIDENCE TO CUT 'LATER THIS YEAR', DON'T FEEL THERE'S ANY NEED TO RUSH RATE CUTS, NO URGENCY TO SLOW PACE OF BALANCE-SHEET REDUCTION NOW

Ugly: YELLEN SAYS INCENTIVES TO MOVE AWAY FROM DOLLAR EXIST, NATURAL SANCTIONED COUNTRIES TRY WORKAROUNDS ON DOLLAR; BUT UNAWARE OF ANY DEEP THREAT TO THE DOLLAR

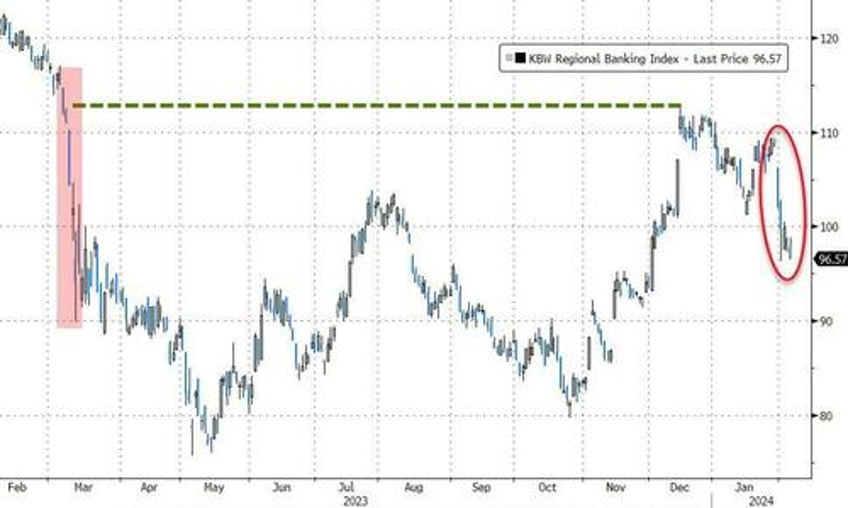

But ugliest of all was the regional banking system.

The KBW Regional Banking Index is down 15% from its December highs (which had basically run all the way back up to the pre-SVB levels) but down 12% in the last 5 days...

Source: Bloomberg

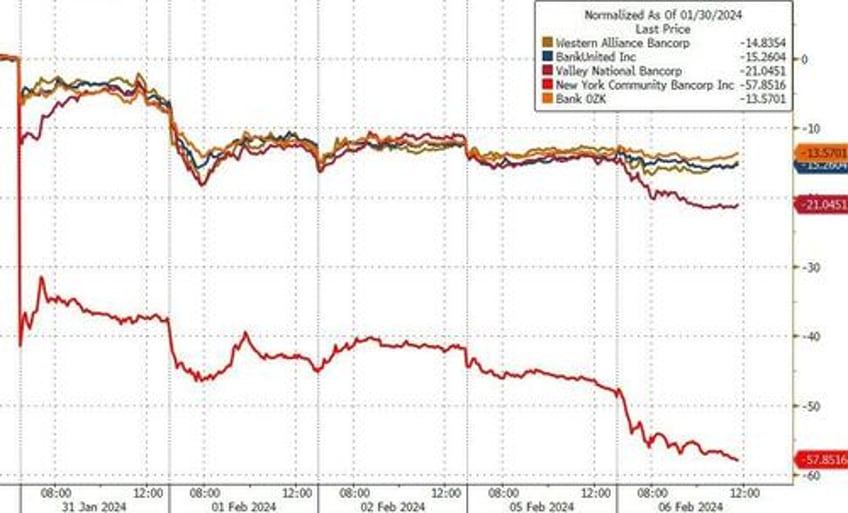

A few desks claimed that NYCB is 'idiosyncratic'...

*NEW YORK COMMUNITY BANCORP SINKS 22% TO HIT LOWEST SINCE 1997

...but to be frank, that's just bullshit. It just happens to be the first domino to fall...

Source: Bloomberg

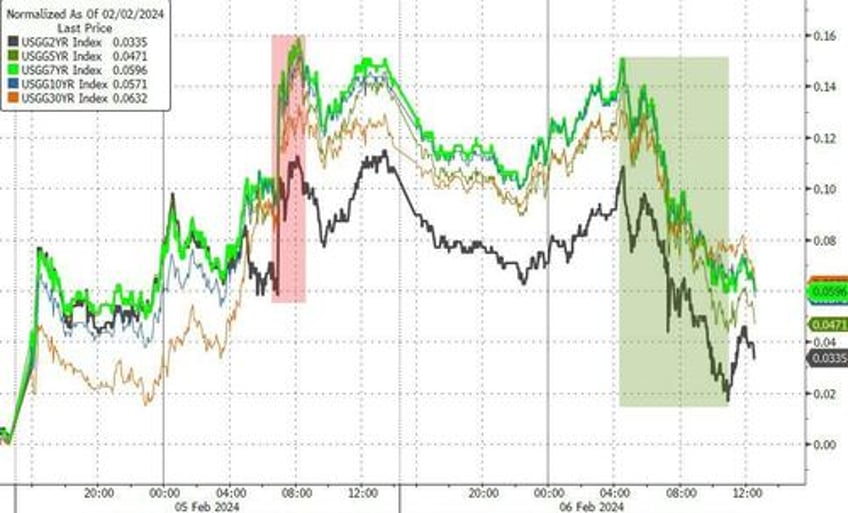

With bank bewilderment building, traders bid for bonds (with the short-end outperforming 2Y -8bps, 30Y -5bps). However, yields are still higher on the week...

Source: Bloomberg

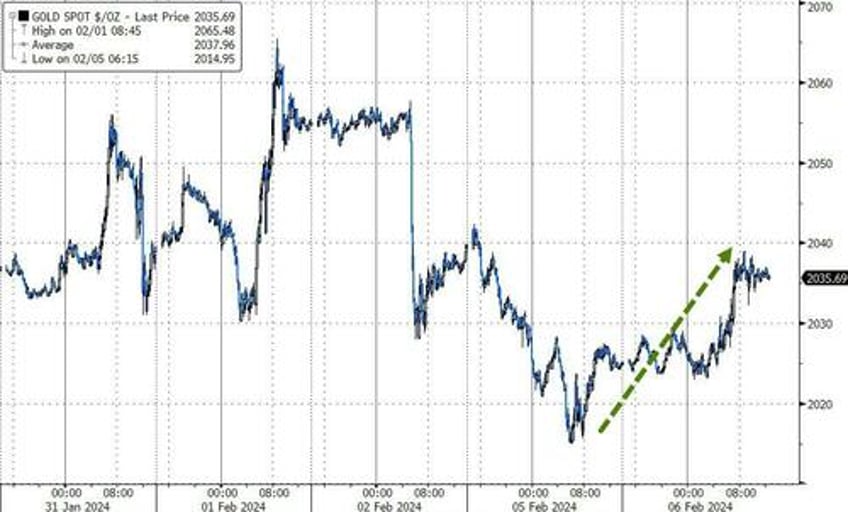

Bullion was also bid, with spot gold prices testing $2040...

Source: Bloomberg

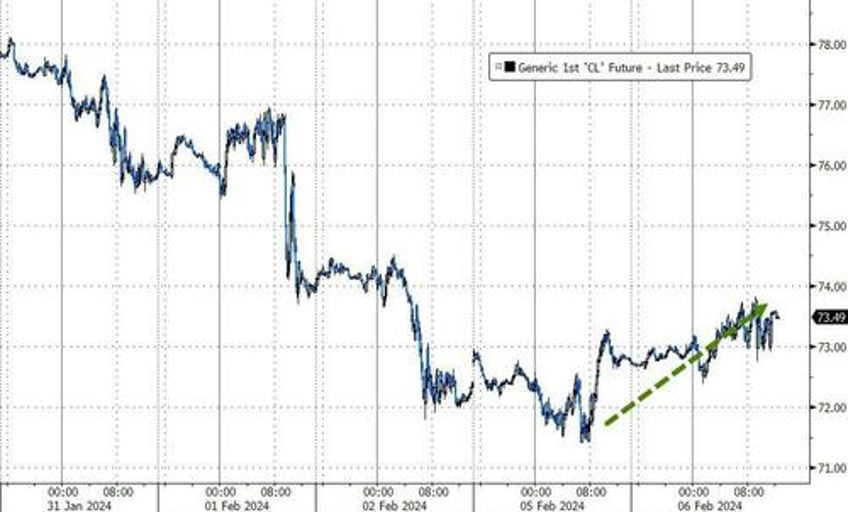

And so was black gold, with WTI back above $73...

Source: Bloomberg

And crypto was bid.

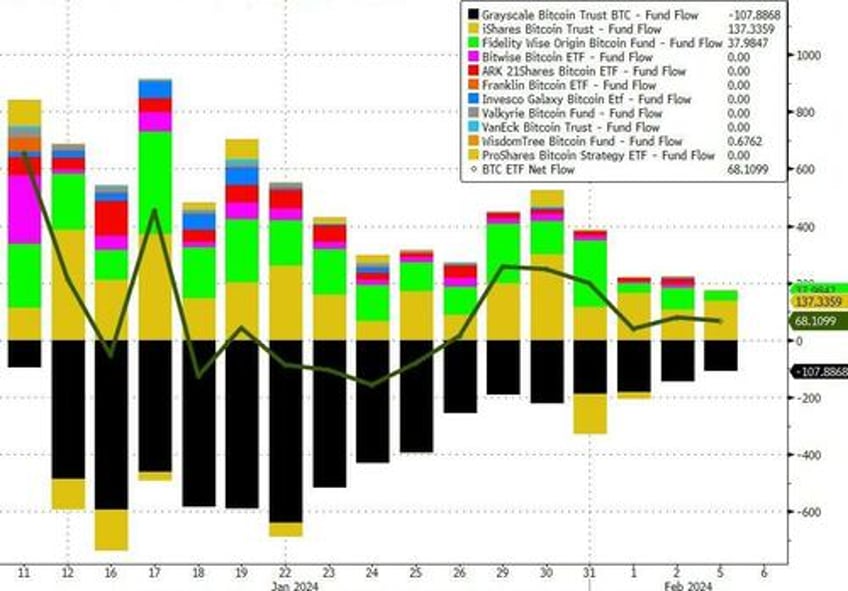

Yesterday saw the 7th straight day of net inflows to Bitcoin ETFs...

Source: Bloomberg

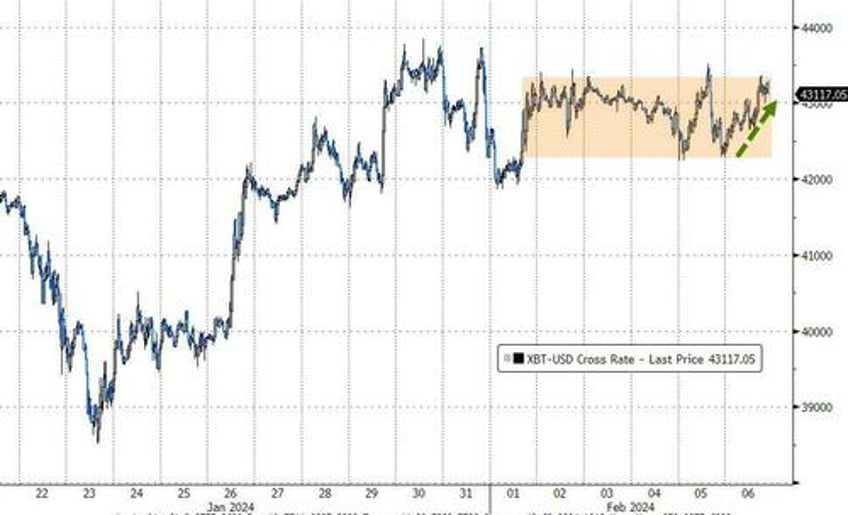

...and Bitcoin rallied today, but only modestly and within its recent range...

Source: Bloomberg

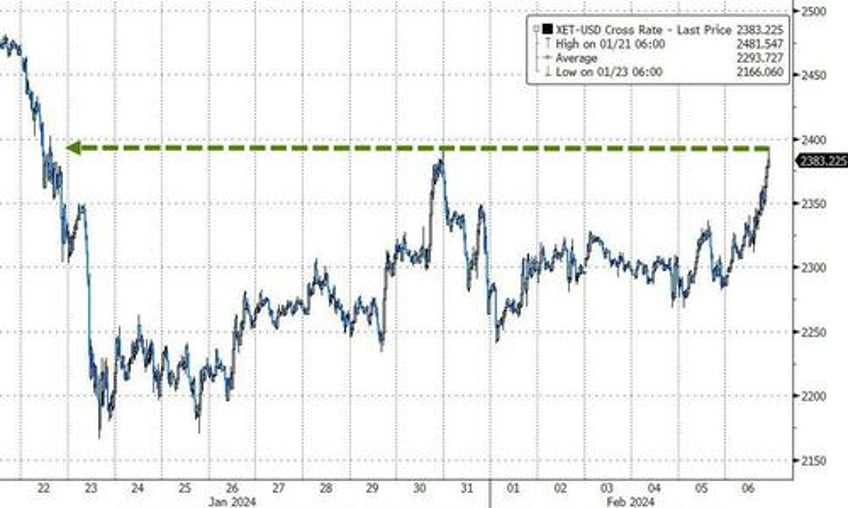

...but Ethereum surged up to $2375...

Source: Bloomberg

...with the ETHBTC pair rallying back above FOMC spike highs to two-week highs...

Source: Bloomberg

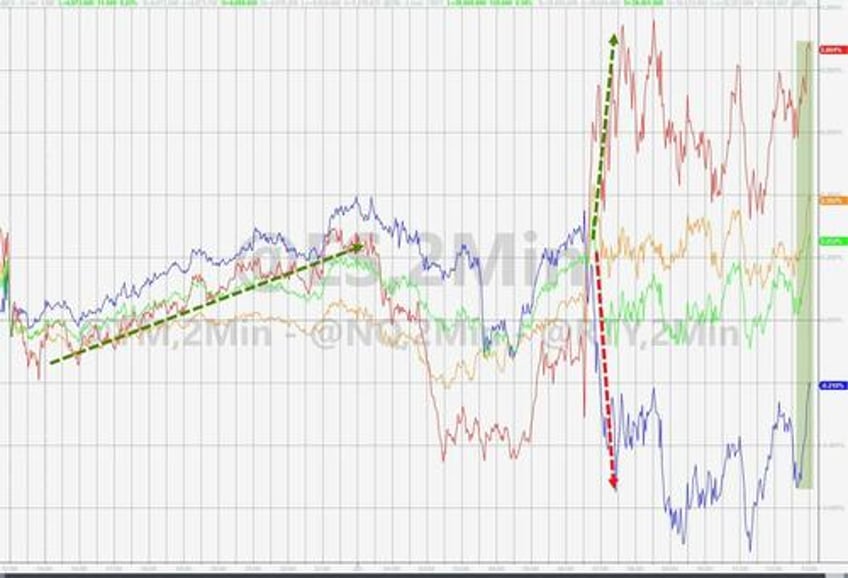

Big-tech actually had a down-day today (but rates were lower...). Small Caps were best (Short squeeze) and The Dow and S&P managed gains with a late-day surge...

MAG7 stocks drifted lower today...

Source: Bloomberg

After topping 85 (RSI) on the 'overbought scale last night, NVDA dared actually decline today (but not before it topped $700 overnight)...

But 'most shorted' stocks were squeezed hard from get-go (supporting small caps despite the bank bloodbath)...

Source: Bloomberg

Finally, as a reminder, Small banks are proper fucked without The Fed's (soon to be killed) BTFP bailout facility (red line)...

Source: Bloomberg

...and one can't help but notice the burgeoning balance sheet of the big banks - willing to scoop up small banks with the FDIC's help?

Don't believe us? Here's Jay Powell on Sunday:

"We looked at the larger banks' balance sheets, and it appears to be a manageable problem. There's some smaller and regional banks that have concentrated exposures in these areas that are challenged.

...

There will be expected losses.

It's a sizable problem... it doesn't appear to have the makings of the kind of crisis things that we've seen sometimes in the past.

I don't think there's much risk of a repeat of 2008. I also think, you know, we need to be careful about making proclamations about the.. future.

...

There will be certainly be some banks that have to be closed or merged out of, out of existence because of this. That'll be smaller banks, I suspect, for the most part.

You know, these are losses. It's a secular change in the use of downtown real estate. And the result will be losses for the owners and for the lenders, but it should be manageable."

Do you feel lucky, punk? Picking the right regional bank that will be bought before it's closed under FDIC?