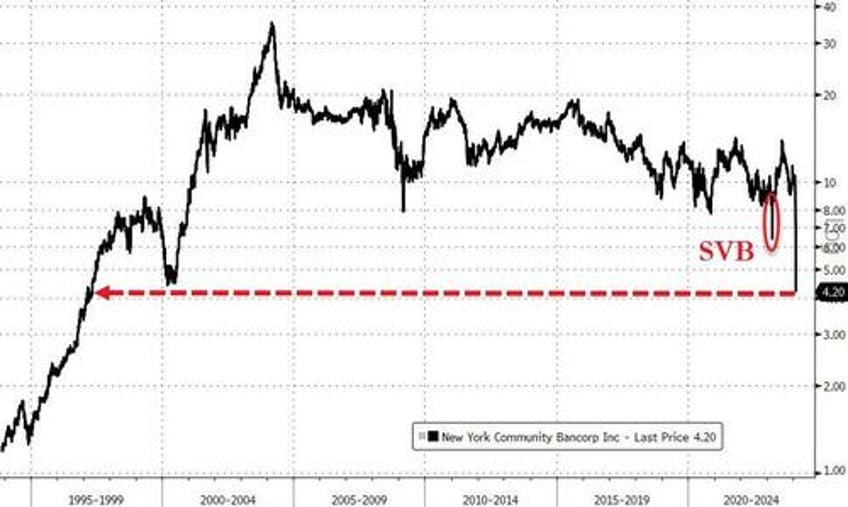

Having seen the share price collapse to its lowest since 1997, following the regional lender's reporting of a surprising (and large) loss for Q4 and slashing its dividend (to 5c vs 17c exp), ratings agency Moody's has cut all long-term and some short-term ratings of New York Community Bancorp to 'junk' (Ba2 from Baa3).

NYCB is extending losses to a $3 handle after the downgrade...

While we heard all day about how NYCB was an idiosyncratic issue, Moody's warns that this is anything but, generalizing to the multi-family CRE space being a problem:

NYCB is highly concentrated in rent regulated multi-family properties, a segment which has historically performed well for them. However, this cycle may be different.

While vacancy rates are low for this CRE segment, properties may face different challenges this cycle due to higher interest expense when refinanced and already higher maintenance costs due to inflationary pressures.

These higher costs may prove more challenging for owners of rent regulated properties to pass along through rent increases to tenants.

Beyond rent-regulated, the bank has a significant concentration of low fixed-rate multifamily loans. This type of loan portfolio faces refinancing risk.

As a reminder,:

Once a $3 trillion asset class, offices now are “probably worth $1.8 trillion,” said Barry Sternlicht, chief executive officer of Starwood Capital Group.

“There’s $1.2 trillion of losses spread somewhere, and nobody knows exactly where it all is.”

Additionally, Moody's warns this could end badly:

"The company's elevated use of market funding may limit the bank's financial flexibility in the current environment."

Moody's also points out that, as of Dec 31st, 33% of NYCB's deposits were uninsured, and "could face significant funding and liquidity pressure if there is a loss of depositor confidence."

The total amount of public bonds & loans outstanding affected by this downgrade is $1.14 billion, according to data compiled by Bloomberg.

* * *

RATINGS RATIONALE

[ZH: emphasis ours]

Today's rating action reflects multi-faceted financial, risk-management and governance challenges facing NYCB.

In terms of financial strategy, the bank is seeking to build its capital but just took an unanticipated loss on commercial real estate (CRE) which is a significant concentration for the bank.

The downgrade reflects Moody's views that NYCB faces high governance risks from its transition with regards to the leadership of its second and third lines of defense, the risk and audit functions of the bank, at a pivotal time. In Moody's view, control functions with strong knowledge of a bank's risks are key to a bank's credit strength.

NYCB's core historical commercial real estate lending, significant and unanticipated loss on its New York office and multifamily property could create potential confidence sensitivity.

The company's elevated use of market funding may limit the bank's financial flexibility in the current environment.

NYCB is highly concentrated in rent regulated multi-family properties, a segment which has historically performed well for them. However, this cycle may be different. While vacancy rates are low for this CRE segment, properties may face different challenges this cycle due to higher interest expense when refinanced and already higher maintenance costs due to inflationary pressures. These higher costs may prove more challenging for owners of rent regulated properties to pass along through rent increases to tenants. Beyond rent-regulated, the bank has a significant concentration of low fixed-rate multifamily loans. This type of loan portfolio faces refinancing risk.

For the year, provision for credit losses rose 526% to $833 million from $133 million in 2022. Allowance for credit losses stands at $992 million as of 31 December 2023 which equates to 1.17% of total loans, or 1.26% when excluding loans with government guarantees and warehouse loans. Reserve for office loans is approximately 8% while reserves for multifamily is approximately 0.82%.

Moody's views NYCB's funding and liquidity as a relative weakness when compared to peers due to its relatively high dependence on market-sensitive wholesale funding and a smaller pool of liquid assets when compared with peers. NYCB's loan-to-deposit ratio was 104% as of 31 December 2023, also higher than most peers. Market funding increased 49% during the fourth quarter to $20.3 billion, in part to fund an increase in the bank's liquidity buffer as the bank prepares for Regulation YY compliance. Market funds as a percentage of tangible banking assets (TBA) rose to 18.8% as of 31 December 2023 from 12.9% in the prior quarter and 23.6% at the end of 2022. Liquid banking assets as a percentage of TBA rose to 18.2% as of 31 December 2023 from 14.5% in the prior quarter and 12.9% at the end of 2022.

NYCB's share of uninsured deposits was 33% as of 31 December 2023.

The bank could face significant funding and liquidity pressure if there is a loss of depositor confidence.

NYCB relies heavily on wholesale funding from the Federal Home Loan Bank of New York.

NYCB's capitalization, as measured by its common equity tier 1 (CET1) ratio, fell to 9.1% as of 31 December 2023 from 9.59% the prior quarter and 9.06% as of 31 December 2022. The decline in capital resulted from a $252 million net loss in the fourth quarter driven by a $552 million provision for credit losses. NYCB is targeting a 10% CET1 ratio by the end of 2024 and has cut its dividend to 5 cents a quarter from 17 cents to assist with capital generation.

Pressure on profitability could challenge NYCB's internal capital generation plans. Management expects net interest margin (NIM) to be between 2.4% and 2.5% in 2024 as the company repositions into lower-yielding liquid assets to prepare for Regulation YY compliance. NIM was 2.99% in 2023 compared to 2.35% in 2022. Further provisions for credit losses, rising compliance costs, and higher funding costs could also negatively impact earnings. The bank's transition to a Category IV bank entails meaningful investments in its risk management and compliance that will also weigh on profitability.

Reflecting Moody's views of the high governance risks NYCB faces, Moody's introduced a one-notch negative qualitative adjustment to Flagstar Bank, NA's BCA and changed NYCB's governance issuer profile score to G-4 from G-2 and NYCB's ESG credit impact score to CIS-4 from CIS-2 to reflect the negative impact this risk has on NYCB's ratings.

This should not come as a huge surprise, as we detailed earlier, Small banks are proper fucked without The Fed's (soon to be killed) BTFP bailout facility (red line)...

Source: Bloomberg

...and one can't help but notice the burgeoning balance sheet of the big banks - willing to scoop up small banks with the FDIC's help?

Don't believe us? Here's Jay Powell on Sunday:

"We looked at the larger banks' balance sheets, and it appears to be a manageable problem. There's some smaller and regional banks that have concentrated exposures in these areas that are challenged.

...

There will be expected losses.

It's a sizable problem... it doesn't appear to have the makings of the kind of crisis things that we've seen sometimes in the past.

I don't think there's much risk of a repeat of 2008. I also think, you know, we need to be careful about making proclamations about the.. future.

...

There will be certainly be some banks that have to be closed or merged out of, out of existence because of this. That'll be smaller banks, I suspect, for the most part.

You know, these are losses. It's a secular change in the use of downtown real estate. And the result will be losses for the owners and for the lenders, but it should be manageable."

Do you feel lucky, punk? Picking the right regional bank that will be bought before it's closed under FDIC?

Canary meat coalmine.