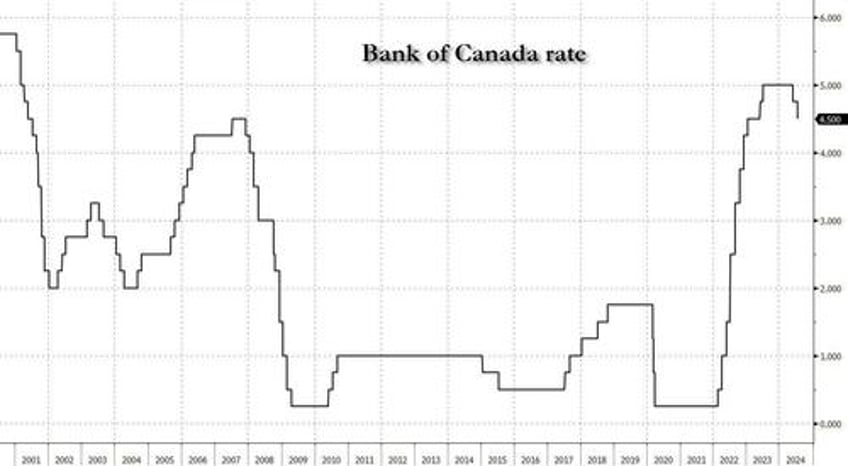

The Bank of Canada, which last month became the first G7 bank to launch an easing cycle, moments ago cut interest rates by a quarter percentage point for a second consecutive meeting and signaled further easing ahead as inflation worries wane.

The cut was expected by virtually all surveyed economists; OIS priced in about 22bps of cuts into the decision. A recent easing of inflationary pressures and the central bank's inflation forecast prompted the decision.

The central bank said "CPI inflation moderated to 2.7% in June after increasing in May. Broad inflationary pressures are easing. The Bank’s preferred measures of core inflation have been below 3% for several months and the breadth of price increases across components of the CPI is now near its historical norm."

“With the target in sight and more excess supply in the economy, the downside risks are taking on increased weight in our monetary policy deliberations,” BOC Governor Tiff Macklem said in prepared remarks.

Macklem reiterated that it’s “reasonable” to expect further interest rate cuts, and that the bank will be taking its decisions “one at a time,” pushing back on expectations that the bank is on a predetermined cutting path.

The Bank’s preferred measures of core inflation are expected to slow to about 2½% in the second half of 2024 and ease gradually through 2025. The Bank expects CPI inflation to come down below core inflation in the second half of this year, largely because of base year effects on gasoline prices. As those effects wear off, CPI inflation may edge up again before settling around the 2% target next year."

BOC officials say they’ve continued to make progress on bringing price pressures to heel, and that a return to the 2% inflation target is “in sight.” The June consumer price index, which showed inflation decelerated to a 2.7% yearly pace, also pointed to slowing underlying price pressures, the bank said.

Overall, Bloomberg summarizes, officials seems more convinced that price pressures are under control, and are increasingly focused on preserving a soft landing for the economy. The dovish suite of communications suggest that governing council has shifted their attention to ensuring inflation does not substantially undershoot the 2% target.

The bank said wage growth, while elevated, is moderating as the labor market loosens. Corporate pricing behavior has “largely normalized”, and inflation expectations have come down. In June, the final paragraph of the bank’s policy statement had focused on those concerns, but the July statement was largely rewritten to focus on “ongoing excess supply” and “opposing forces” on inflation — the bank sees shelter and services holding up progress.

There was no mention of the recent reacceleration of the 3-month moving average of the bank’s preferred core measures, which accelerated to 2.91% in June. Instead, policymakers highlighted progress on the yearly change of median and trim CPI — which is expected to decelerate to 2.5%, according to newly added projections.

It’s a marked shift in the bank’s attitude toward inflation. A summary of deliberations from the officials’ June meeting showed policymakers had debated whether more disinflation proof was needed before easing. Now they’re more convinced they have enough evidence. The balance of risks is changing too. Officials listed weaker-than-expected household spending as a main downside risk, pointing to upcoming mortgage renewals as a risk to consumption growth. In its statement, the bank said it’s seeing more “signs of slack” in the labor market, and said job-seekers are taking longer to find work.

As noted above, last month the Bank of Canada became the first Group of Seven central bank to cut interest rates. Since then, the ECB has also started easing, with the Fed expected to join the party, potentially as soon as July.

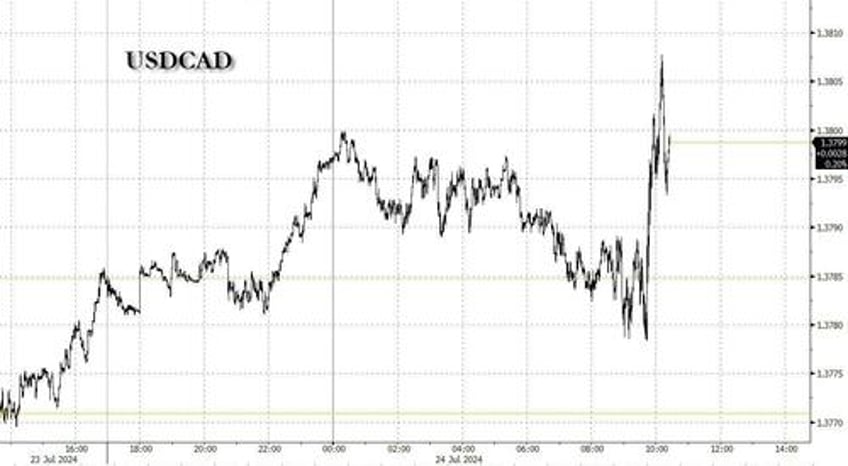

USDCAD rose 0.1% after the decision, rising to 1.38, the highest level in 3 months, while Canada's 2y yield fell about 2bp.