Banks are exposed to bond prices falling at an increasing rate as a rising and positive US stock-bond correlation drives a widening in the bond risk premium.

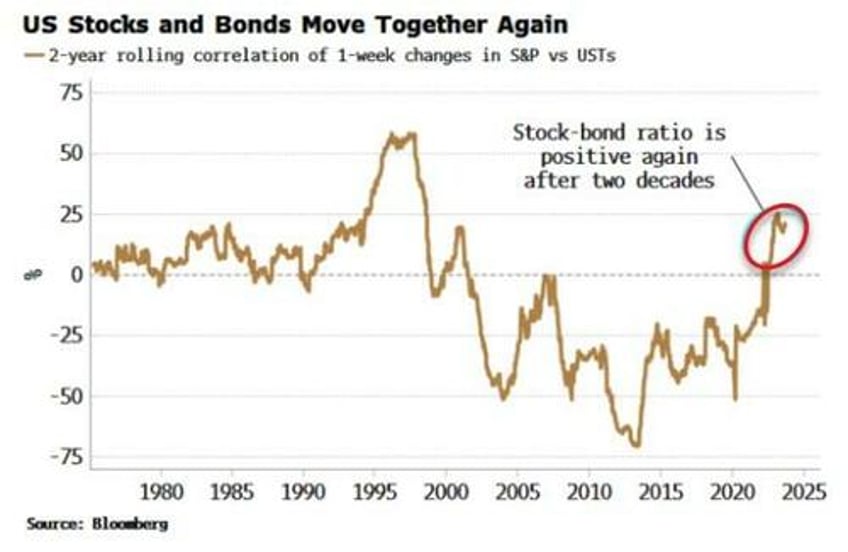

After two decades of being negative, the stock-bond correlation - one of most important relationships in finance - has turned positive again. Bond prices, under renewed pressure after the hawkish lean in Wednesday’s FOMC, are biased structurally lower as the risk premium for bonds rises, leaving leveraged and mark-to-market holders of USTs – such as banks and hedge funds – exposed to potentially significant capital losses.

Of all the cognitive biases, recency bias is one of the most pernicious and prevalent. Nowhere in markets is this more pertinent than the relationship between stocks and bonds. For most of the last century they have moved together, i.e. their correlation has been positive.

But for the past 20 years the correlation was negative. Bonds acting as a natural hedge for stocks had profound implications for investment, fueling strategies such as risk parity.

That correlation has now flipped back to positive. But recency bias means most have yet to fully digest what this means.

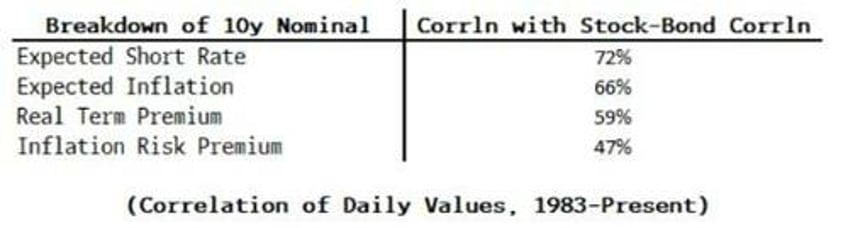

Why have stocks and bonds started to move together again? As with anything in markets that’s not doing what it used to, the culprit is inflation. To see this, we decompose nominal yields into the expected real short-term rate, the real bond risk premium (aka term premium), expected inflation and the inflation risk premium (the DKW model, explained in this Fed paper).

In simple terms, there is a positive relationship between nominal yields and the stock-bond correlation - higher yields coincide with a higher stock-bond correlation - but the decomposition tells us that all of the underlying inputs are statistically significant positive drivers of the ratio (with high t-stats and relatively high correlations).

The highest correlations come from the expected short rate and expected inflation, but as the Fed is expected to raise rates in response to higher inflation, these two are themselves positively related.

Thus the primary underlying driver of the stock-bond ratio is inflation expectations. This is what we saw in the mid 1960s to the late 1990s period of elevated inflation and a positive stock-bond correlation, i.e. inflation expectations were driving stocks and bonds together.

We are now back in that world, where rising inflation expectations are causing stocks and bonds to co-move. This has two pivotal implications:

Bonds are no longer a portfolio hedge

Bonds are not a recession hedge

When stocks have a negative correlation with bonds, they are highly sought after as not only do they make money when bonds lose money, they also smooth returns. In a recent paper by Robeco’s Roderick Molenaar et al, they show that when stocks and bonds are negatively correlated, 100% of the variance of a multi-asset portfolio comes from the equity contribution.

The risk-parity strategy of volatility-weighting portfolios of stocks and bonds has been a beneficiary of the negative stock-bond correlation.

It’s perhaps little surprise that Ray Dalio, co-CIO of Bridgewater Associates, the pioneer of risk parity, recently said he would prefer to be in cash than bonds.

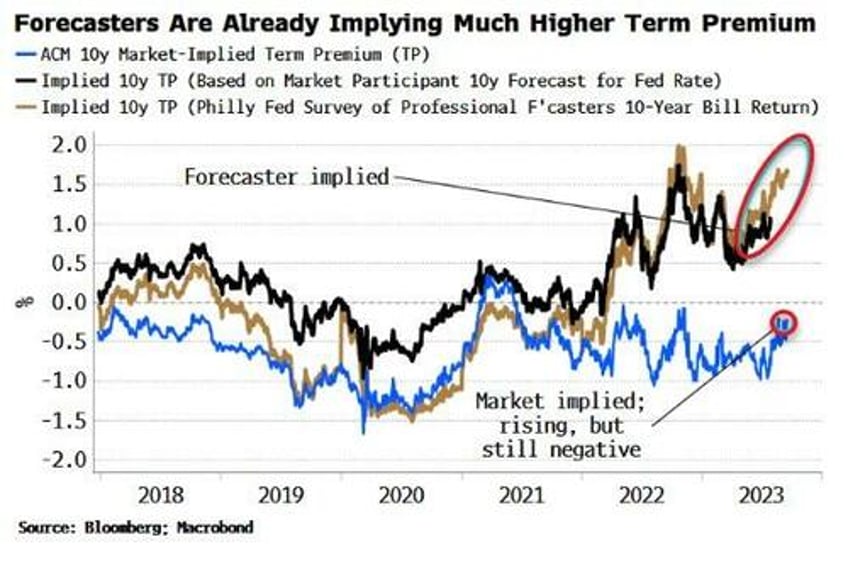

Bonds’ portfolio “super power” has driven their risk premium to all-time lows in recent years. But as they lose this enviable capability, the risk premium – still negative on market-implied measures – is highly likely to keep rising, perhaps significantly so, taking bond prices much lower.

Compounding the problem is that bonds are losing their efficacy in acting as a recession hedge. In the prior low-and-stable inflation regime, the Phillips curve (if you believe in those sort of things) was linear and stable, meaning that as unemployment rose, inflation typically fell.

That becomes self-fulfilling, as when stocks fall in response to a growth shock, bonds should rise as inflation eases. Even if you’re not a fan of academic models like the Phillips curve, that’s empirically what we saw in 21st century recessions.

But once more, elevated and more volatile inflation has upended everything. Higher inflation past a certain threshold typically leads to a non-linear and unstable Phillips curve, consistent with what we are observing today. Now, inflation and unemployment are not assumed to move as inversely, or with the same regularity. A growth shock may come with rising inflation, bad for bonds as well as equities.

The expectation that higher inflation has corrupted the Phillips curve adds additional upward pressure to stock-bond’s correlation, taking it positive and ensuring bonds will not act as a recession hedge when the next downturn hits.

Bonds thus suffer a double whammy to their appeal and so cannot command the same yield discount. Yet even though market-implied estimates of term premium such as the ADM model have risen, they are still negative. Further, they are much lower than survey-based estimates, which are now significantly positive and began to accelerate higher in 2022.

Term premium is prone to moving much higher, and thus bond prices much lower, to fully express the risks from a positive stock-bond correlation that is perhaps already being picked up in forecasters’ surveys.

With positioning in USTs long, this poses risks to bond holders, to yields and to the wider market.

The JPM client survey of Treasury long positioning is in the top part of its range, while asset managers are very long, based on COT data. But it is hedge funds and banks that could pose the biggest risks.

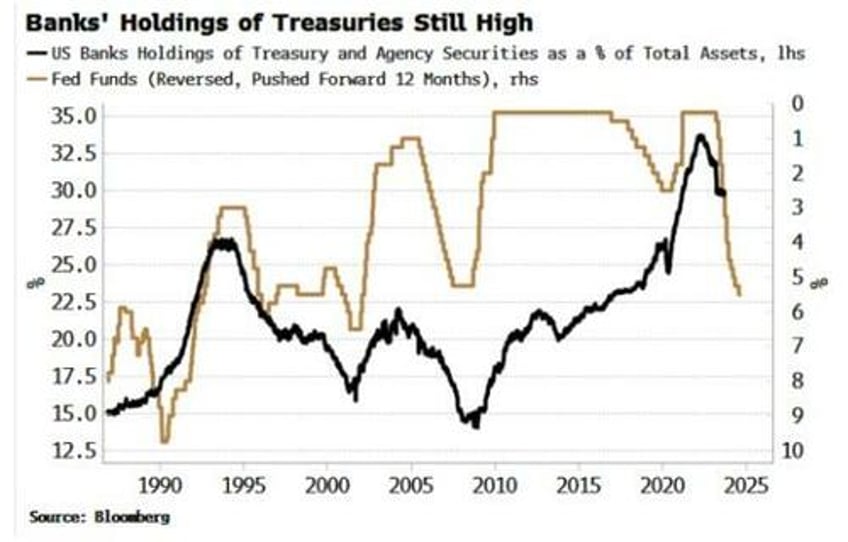

US banks’ holdings of USTs have fallen from their peak, but remain historically elevated at over 30% of assets. They generally reduce their holdings when rates rise, but this time they may not have moved fast enough.

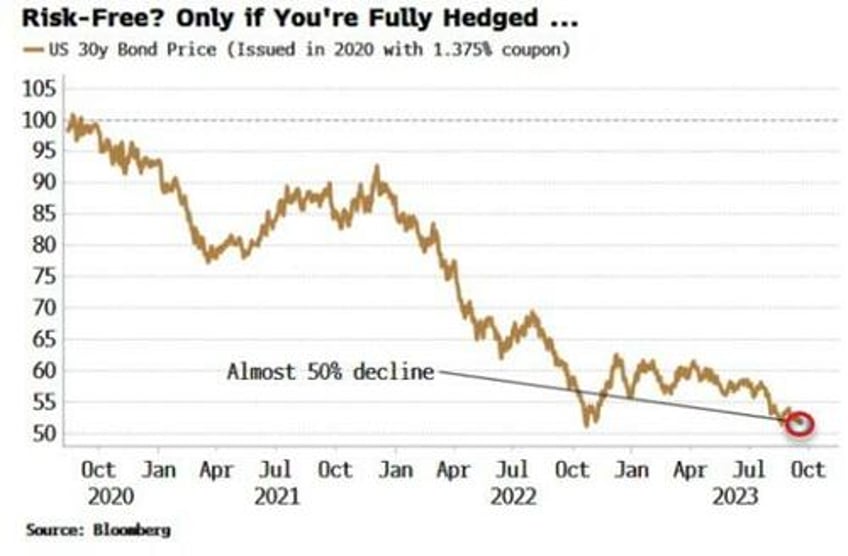

Hedging will help, but that can’t always be taken for granted. Anyway, with e.g. 30y USTs issued three years ago down almost 50% in value, hedges may not be sufficiently sized to cope with such big moves in what is supposedly a risk-free asset.

If recency bias is wrong in informing us about how stocks and bonds now behave, it may end up being salutary in reminding us that banks, such as SVB, can fail when bond prices fall sharply.