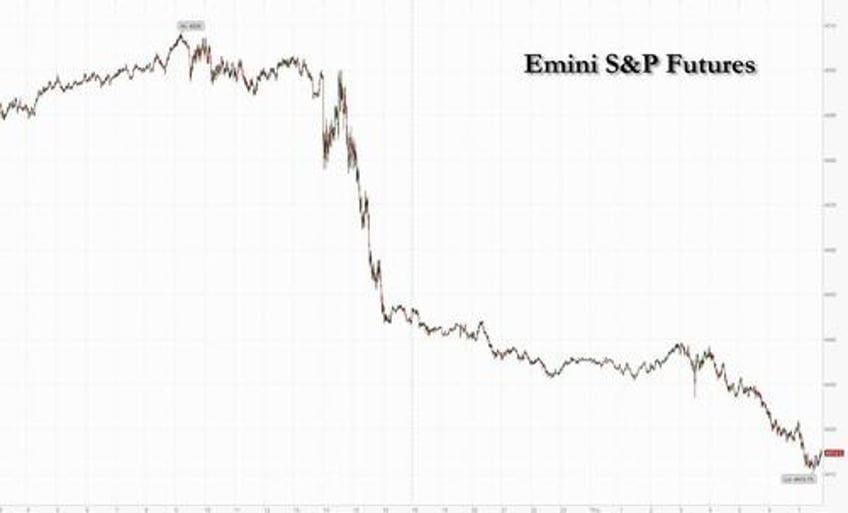

Futures are sharply lower, extending yesterday's steep losses after the Fed’s hawkish pause. The Fed wasn't alone in keeping rates unchanged: it was followed by both the SNB and BOE, both of which surprised markets by not raising rates and sending the franc and sterling sliding. On the other hand, the inflation-ridden Riksbank and Norges both hiked, telling investors to expect more such moves. Hyperinflating basket case Turkey hiked by 500bps, in line with expectations. As of 7:45am, S&P futures tumbled 0.7% to 4,415, while Nasdaq 100 futures were down 1% briefly dipping below the key 15,000 level. Most Treasury yields climbed apart from two-year rates, which edged lower. The Bloomberg Dollar Spot Index traded near the day’s highs, pressuring most other Group-of-10 currencies. Brent crude fell for a third-straight day, trading below $93. Gold slid and Bitcoin declined 1%. Today’s macro data focus is on Jobless Claims, Existing Home Sales, Leading Index, and Philly Fed.

In premarket trading, Splunk was set to open sharply higher after Cisco announced it would purchase the company for $157/share (it closed just below $120). Broadcom slumped after a report by The Information that Google has discussed dropping the company as an AI chips supplier as early as 2027. FedEx shares rise as much as 5.4% after the courier raised the lower end of its fiscal 2024 adjusted EPS forecast, thanks to cost cutting, strong pricing and customers who switched to the courier from its main rival on concern over a potential strike, and prompting analysts to hike their price targets on the stock. Analysts were positive on the company’s cost reduction progress and highlighted the strong performance at its Ground unit and said that guidance is still conservative. Here are the other notable premarket movers:

- ARM Holdings shares fall 2.3%, with the chip designer nearing its $51 IPO price, as rising bond yields put pressure on growth stocks, with tech peers down too.

- Broadcom shares drop as much as 4.6%, following a report from The Information that Google executives “extensively” discussed dropping the semiconductor maker as an AI chips supplier as early as 2027, citing a person familiar with the matter.

- CrowdStrike shares rise as much as 3.4%, as analysts hike their price targets on the stock following the Fal.Con cybersecurity conference and investor briefing, at which it set out new targets. Analysts said the company’s margin outlook was especially strong, and new products such should help boost growth.

- Film and entertainment stocks rise, after Hollywood Studios and writers came a step closer to reaching a deal to end months of strikes. Warner Bros (WBD US) +3.1% and Paramount (PARA US) +3%.

The Fed on Wednesday held its target range, while updated quarterly projections showed most officials favored another rate hike in 2023. Policymakers also see less easing next year, with the median forecast for the federal funds rate at 5.1% by year-end, up from 4.6% when projections were last updated in June.

“People did expect a hawkish hold from the Fed, but it’s the extent of the hawkishness that surprised,” said Lee Hardman, a strategist at MUFG Bank Ltd. “We thought they may take one cut out of next year’s forecasts — instead they took two out. So it was much more hawkish than markets were pricing in.”

Some non-Fed headlines came from BAC’s CFO who says, “It’s difficult to see a US recession when the consumer is spending 4% more year-over year.” Axios reported that the US Chamber of Commerce’s Small Business Index, a confidence indicator, has reached its highest level since COVID struck US markets in early 2020. The survey includes 751 business, each that have fewer than 500 people; 71% say they expect revenue to increase next year. Spoiler alert: it won't.

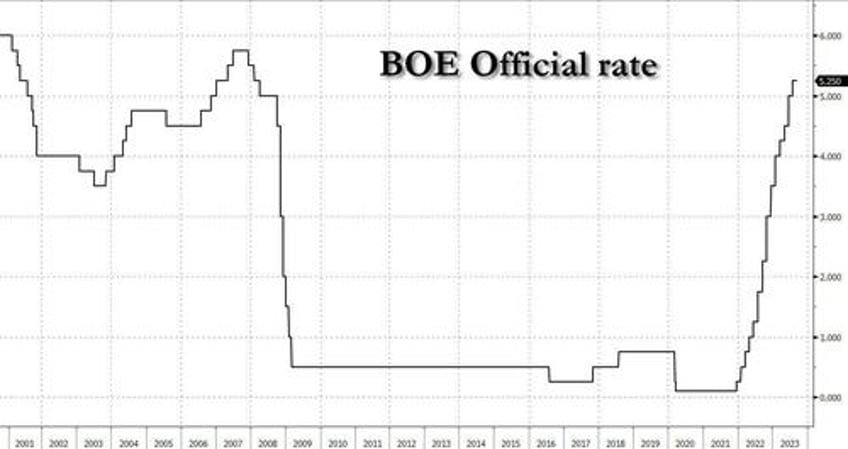

Europe's Stoxx 600 Index declined 1% but was off session lows, with all sectors in the red, as traders digested the Fed’s higher-for-longer message. Travel and leisure stocks fell the most, while miners and industrial stocks also underperformed. Swiss equities were higher after the SNB unexpectedly paused rate hikes, while the BOE is due to announce its rate decision later Shares in UK banks and home builders rose as traders slashed their bets on further rate hikes with UBS saying the BOE hiking cycle is now over. The central bank held its key rate at 5.25%, ending a series of 14 successive hikes since December 2021, after a surprise drop in August inflation this week.

“Inflation has fallen a lot in recent months and we think it will continue to do so,” BOE Governor Andrew Bailey said in a written statement. “That’s welcome news. But there is no room for complacency. We need to be sure inflation returns to normal and we will continue to take the decisions necessary to do just that.”

A day after the Federal Reserve’s meeting, Europe had its own frenetic flurry of central bank decisions. Before the BOE, Swiss National Bank surprised investors by holding interest rates, causing the franc’s steepest drop since May against the euro. Sweden’s Riksbank increased its key rate as expected and said more hikes were possible, while Norway’s central bank said more tightening may come in December after raising rates to the highest in more than 14 years. Here are Europe's top movers:

- Merck shares gain as much as 2.2% after Citi raised its recommendation on the German biotech group to buy, predicting performance in the firm’s Life Science and Semiconductor segments will recover in the near future.

- JD Sports shares rise as much as 8.6% after reporting results that Peel Hunt analysts said reflected a “surprisingly strong” performance in the US following recent guidance cuts from peers Foot Locker and Dick’s Sporting Goods.

- Next shares gain as much as 2.5% after the UK retailer boosted its pretax profit outlook for the full year, following other guidance raises in August and June. The third guidance update in three months is impressive, with the sales outlook suggesting resilience in the first half, Jefferies said.

- Safilo shares rise as much as 8.1%, the most intraday since August 2022, after the Italian eyewear company said it’s launching its Carrera Smart Glasses with Amazon.com’s Alexa technology, according to a statement late on Wednesday.

- Valneva shares rise as much as 4.7% after the French pharmaceutical firm reported better-than-expected first-half earnings. Van Lanschot Kempen sees a “strong set” of figures with beats across the board.

- CVS Group shares gain as much as 4.4% after the veterinary services firm reports better-than-expected profit. The stock plummeted earlier this month as UK antitrust regulators announced a probe of the sector.

- Delivery Hero rises as much as 2%, adding to Wednesday’s 7.1% gain, as the food delivery company confirmed that it’s mulling a sale of some businesses in Southeast Asia. Analysts said a potential deal could boost the company’s balance sheet and profit by shaking off some unprofitable operations that are currently involved in intensive competition.

- Ocado shares drop as much as 9.3% after being downgraded to underperform from neutral at BNP Paribas Exane, which cited the British online grocer’s share price rally in recent months.

- SSP Group shares fall as much as 8.7% after the food services company gave a trading update saying it expects full-year EPS toward the lower end of its guidance range. Analysts at Goodbody and Shore Capital noted the FX headwinds apparent in the update, but were encouraged by the opportunity from new business.

- Engcon shares drop as much as 8.9% after an editorial column on Swedish retail-trading website Placera.se recommended its users sell the Swedish industrial firm’s shares, citing a high valuation and slowing growth prospects.

- Quadient shares fall as much as 8.7% after the French postal- and document-services company reported first-half results that Oddo said were slightly below estimates.

Earlier in the session, Asian stocks fell the most in nearly a month after the Fed signaled that interest rates will remain higher for longer amid renewed economic strength, while Chinese equities slumped on persistent pessimism. The MSCI Asia Pacific Index dropped as much as 1.4%, set for a fourth day of losses, led by health-care and technology shares. Most markets in the region were down, with South Korea’s Kospi Index slumping more than 1% as large-cap chip and battery stocks dragged. The Fed left its benchmark interest rate unchanged as expected, while indicating that borrowing costs will likely stay higher for longer after one more hike this year. The message triggered overnight losses in Wall Street, gains in Treasury yields and strength in the dollar.

- Hang Seng and Shanghai Comp declined alongside the downbeat mood across regional peers, although the losses in the mainland were initially cushioned following the Chinese Cabinet’s pledge to speed up the development of the advanced manufacturing sector and amid resilience in developers after Guangzhou adjust purchase rules for several districts.

- Japan's Nikkei 225 retreated below the 33,000 level as Japanese yields climbed to decade highs and with the BoJ kickstarting its 2-day policy meeting.

- Australia's ASX 200 was lower with the top-weighted financial industry leading the broad declines.

- India’s benchmark stocks gauge dropped for a third consecutive session to its two-week low as US Federal Reserve’s signal to keep interest rates higher for longer spooked equities in Asia. The S&P BSE Sensex fell 0.9% to 66,230.24 in Mumbai, its lowest close since Sept. 6. The NSE Nifty 50 Index declined 0.8% to 19,742.35. ICICI Bank contributed the most to the Sensex’s decline, decreasing 2.8%. Out of 30 shares in the Sensex index, 6 rose and 20 fell, while 4 were unchanged.

In FX, the dollar gained against most major currencies, aside from the yen, which traded around 148 per dollar after weakening on Wednesday to the lowest level since November.

- EUR/CHF rises as much as 0.8% to 0.9656, the biggest daily jump since June

- EUR/SEK drops as much as 0.9% to 11.7687; it rose earlier to 11.9381 after the Riskbank announced a quarter-point interest rate increase

- EUR/NOK drops as much as 0.4% to 11.4573 before halving losses; Wednesday’s low is 11.4560

- GBP/USD falls as much as 0.4% to 1.2265, after the BOE unexpectedly ended its hiking cycle

With most central banks out of the way, attention now turns to Friday's BOJ announcement. There are heightened prospects of official support for the Japanese currency, said John Vail, chief global strategist for Nikko Asset Management Co. in Tokyo. “Japan’s Ministry of Finance is likely to intervene in large fashion at 150 per dollar because it is hard to tolerate more inflationary pressure.”

The value of the yen has slumped to the lowest on record, as measured against a broad basket of its peers and adjusted for inflation, according to data from the Bank for International Settlements. This underscores the pressure to address yen weakness at the Bank of Japan, which is where this week’s series of central bank policy meetings wraps up on Friday.

In rates, treasury yields were broadly higher after the rate on the two-year note, which is more sensitive to imminent Fed moves, hit the highest since 2006 on Wednesday. After resuming post-Fed selloff in early Asia session, front-end of the Treasuries curve trades richer on the day into early US, outperforming belly and long-end as steepening move extends. US yields richer by 2bp across front-end of the curve while belly out to long-end trades cheaper by 1.5bp to 4bp on the day; 10-year yields around 4.45% the highest level since 2007, underperforming bunds and gilts by 1.5bp and 5bp in the sector. Gilts were supported after Bank of England keeps rates unchanged. Long-end Treasury yields also reach new cycle highs, joining rest of the curve after Wednesday’s Fed decision. Dollar IG issuance slate includes IBK 5Y; issuance paused Wednesday for the Fed decision and is expected to remain quiet for Thursday. US economic data slate includes 2Q current account balance, September Philadelphia Fed business outlook and weekly initial jobless claims (8:30am), August existing home sales and leading index (10am); no Fed speakers scheduled.

In commodities, oil’s breakneck rally is taking a breather as a smaller-than-expected drop in US crude stockpiles bolstered technical resistance to further gains; crude futures declined with WTI falling 1% to trade near $88.80. Spot gold drops 0.4%.

To the day ahead, and we’ll get the Bank of England’s latest policy decision, and also hear remarks from the ECB’s Schnabel and Lane. Otherwise, data releases include the US weekly initial jobless claims, existing home sales for August, the Conference Board’s leading index for August, and the Philadelphia Fed’s business outlook for September. In the Euro Area, we’ll get the preliminary consumer confidence reading for September, whilst in the UK there’s the public finances for August.

Market Snapshot

- S&P 500 futures down 0.4% to 4,430.50

- Brent Futures down 1.3% to $92.35/bbl

- Gold spot down 0.2% to $1,926.07

- U.S. Dollar Index up 0.13% to 105.46

- STOXX Europe 600 down 0.7% to 457.60

- MXAP down 1.5% to 159.24

- MXAPJ down 1.6% to 492.56

- Nikkei down 1.4% to 32,571.03

- Topix down 0.9% to 2,383.41

- Hang Seng Index down 1.3% to 17,655.41

- Shanghai Composite down 0.8% to 3,084.70

- Sensex down 0.9% to 66,197.17

- Australia S&P/ASX 200 down 1.4% to 7,065.23

- Kospi down 1.7% to 2,514.97

- German 10Y yield little changed at 2.73%

- Euro little changed at $1.0657

- Brent Futures down 1.3% to $92.35/bbl

Top Overnight News

- Japan may be nearing a point where it can declare victory in its battle against deflation, paving the way for further BOJ policy normalization. Nikkei

- As China's stock market struggles to recover, regulators have started to probe some hedge funds and brokerages on quantitative trading strategies amid a growing outcry against a sector able to profit from share price falls and volatility. RTRS

- Natural gas prices sink in Europe as Chevron seems close to resolving a strike in Australia while flows recover in Norway. BBG

- Norway’s central bank hikes rates by 25bp to 4.25%, as expected, and provides hawkish forward guidance by signaling another increase in Dec (most assumed today’s hike would be the last one). Switzerland’s SNB surprises markets by leaving rates unchanged (economists were anticipating a 25bp hike). BBG

- Poland looks to downplay remarks from its PM about no longer supplying weapons to Ukraine, insisting that the country remains a committed to helping Kyiv achieve victory. FT

- Google has talked “extensively” about dropping Broadcom as its AI chip supplier as soon as 2027 as the internet giant looks to cut costs and utilize proprietary silicon (in addition, Google is working to replace Broadcom with Marvell for network interface chips). The Information

- House Republicans reported major progress charting a path forward on a partisan bill to avert a government shutdown and a Department of Defense spending bill — two measures that suffered public setbacks just a day before — after Speaker Kevin McCarthy (R-Calif.) hashed out a new framework for a GOP-only stopgap proposal in a House Republican conference meeting that lasted more than two hours on Wednesday. The Hill

- AMZN is abandoning plans to impose a new fee on merchants that don’t use its shipping services amid increased regulatory/antitrust scrutiny on the company from the gov’t. BBG

- FDX reported very strong FQ1 earnings, with EPS of 4.55 (vs. the Street 3.73), thanks to aggressive cost cutting, and the full-year EPS outlook was increased (although by less than the Q1 beat). RTRS

A more detailed look at global markets courtesy of Newquawk

Asia-Pac stocks were pressured in the aftermath of the FOMC’s hawkish pause. ASX 200 was lower with the top-weighted financial industry leading the broad declines. Nikkei 225 retreated below the 33,000 level as Japanese yields climbed to decade highs and with the BoJ kickstarting its 2-day policy meeting. Hang Seng and Shanghai Comp declined alongside the downbeat mood across regional peers, although the losses in the mainland were initially cushioned following the Chinese Cabinet’s pledge to speed up the development of the advanced manufacturing sector and amid resilience in developers after Guangzhou adjust purchase rules for several districts.

Top Asian News

- Japanese PM Kishida said he will instruct people to pull together the pillars of an economic package early next week, while they will include measures to counter inflation and social measures to counter declining population, according to Reuters.

- Chinese Commerce Ministry says some firms have obtained export licenses for gallium and germanium; willing to seek a basket of solutions for the Australian wine dispute.

- China's 2023 nat gas demand seen at 396.4BCM, +8% Y, via CNOOC; LNG imports 70.79mln/T, +10.9% YY. Nat gas demand from China seen peaking in 2040 at 700BCM.

European bourses are pressured as the region reacts to Wednesday's FOMC where a hawkish hold was delivered, Euro Stoxx 50 -1.1%. Action which continues the tone of APAC trade but with the region conscious of a Chinese cabinet pledge around manufacturing and also beginning to look ahead to Friday's BoJ. Sectors are primarily in the red with the exception of Retail post-earnings from JD Sports and Next which reside towards the top of the Stoxx 600; Travel/Leisure and Basic Resources lag, latter on benchmark activity and numerous price target cuts. US futures are lower across the board but with action slightly more contained when compared to European peers, ES -0.4%, NQ -0.6%; today's docket has a handful of data points before Friday's Fed speak resumption with Cook, Daly & Kashkari. Google (GOOG) reportedly wants to ditch Broadcom (AVGO) as its TPU sever chip supplier to reduce AI costs, according to The Information; Since last year has been working to replace Broadcom with Marvell Technology (MRVL). Pre-market: GOOG -0.7%, AVGO -5.2%, MRVL +3.5%

Top European News

- Sunak Gambles on Voters Focusing More on Costs Than Climate

- Next Raises Guidance Again as Wage Gains Boost Shoppers

- SNB Surprises With Rate Pause as Tightening Tames Inflation

- Riksbank Hikes Swedish Rate With Door Kept Open to Act Again

- Norway Raises Rate Again and Signals Another Move in December

- Swiss Stocks Outshine Peers as SNB Pauses; Fed Weighs on Region

FX

- The Fed revives Greenback fortunes via more hawkish dot plots, DXY firmly back above 105.000 within a 105.400-680 range.

- Franc collapses as SNB defies expectations for a 25bp hike and bases new forecasts on steady 1.75% rate, EUR/CHF and USD/CHF spike circa 100 pips to 0.9677 and 0.9078 respectively.

- Pound flounders in the dark about BoE prospects for midday as markets remain split between pause and 1/4 point rate rise, Cable sub-1.2300 from just over 1.2350 at best.

- Yen and Euro pare declines vs. Dollar ahead of 148.50 and 1.0600, with EUR/USD propped up by a Fib and option expiries.

- Norwegian Crown underpinned around 11.5000 vs. Euro after hawkish Norges Bank hike, Swedish Krona choppy on either side of 11.9000 as Riksbank reaches a peak and hedges 25% FX reserves.

- PBoC set USD/CNY mid-point at 7.1730 vs exp. 7.3052 (prev. 7.1732)

- The European Commission has sent a letter to Poland listing 11 questions to determine the scope of the visa-for-bribes scandal and the EU security impact, via Politico; the letter warns that Poland could be violating EU law

Fixed Income

- Bonds off worst levels, but still heavy in wake of hawkish FOMC and through slew of other Central Bank pronouncements.

- Bunds below par between 129.69-23 parameters, Gilts sub-96.00 within 96.41-95.81 range and T-note nearer base of 108-16/25+ bounds pre-BoE, IJC, Philly Fed and ECB speakers

Commodities

- Crude benchmarks are softer intraday given broader risk sentiment post-Fed, WTI below USD 89.00/bbl and Brent down to a test of USD 92.00/bbl respectively at worst; currently off these lows.

- Dutch TTF pressured as Offshore Alliance members at Woodside have overwhelmingly voted to endorse a deal with the company.

- Spot gold is under modest pressure as the USD remains bid with base metals similarly pressured on the broader risk tone.

- Saudi Crown Prince MBS responded that output reductions are purely based on supply and demand to the market when asked about criticism that oil output cuts help Russia.

- Australian industrial arbitrator said Chevron (CVX) and unions are on the precipice of achieving the first enterprise agreements for LNG facilities and discussions have resulted in widespread agreement on the majority of provisions of proposals. The arbitrator made recommendations on pay and working conditions for Chevron and unions to consider but noted that a failure to settle all outstanding issues would result in the agreed provisions simply evaporating, while parties are required to advise the commission of their acceptance or rejection of recommendations by 09:00 Sydney time on Friday.

- Offshore Alliance members at Woodside (WDS AT) have overwhelmingly voted to endorse a deal with the company while members at Chevron (CVX) will meet tonight to consider a recommendation made by the Fair Work Commission, according to a statement.

- Natural Gas Pipeline Co. declared a force majeure on the M&M line near compressor station 158 located in Dewey County, Oklahoma.

- Russia is mulling an additional tax on exports for some commodities including metals, according to sources cited by Reuters.

Geopolitics

- Russian Foreign Ministry said NATO drills near Russian borders are increasingly provocative and aggressive in nature, as well increase risks of incidents, according to RIA.

- Saudi Arabia said solving the Palestinian issue is critical to a deal with Israel, according to FT. In relevant news, Saudi Crown Prince MBS said he is prepared to work with whoever is leading Israel if there is a breakthrough in negotiations for normalisation with Israel, while he had also commented that Saudis will get a nuclear weapon if Iran does first, according to AFP and Fox News.

- Iranian President Raisi said Iran has no problem with IAEA inspections of its nuclear sites.

- Qatar held separate bilateral meetings with the US and Iran this week, touching on nuclear and drone issues, according to sources cited by Reuters.

- Kuwait's PM said the Iraqi ruling on regulating navigation in Khor Abdullah Waterway includes historical fallacies and Iraq needs to take concrete, decisive and urgent measures to address the ruling, according to Reuters.

- Nagorno-Karabakh ethnic Armenians say Azerbaijani forces have violated the ceasefire; Azerbaijan denies its forces violated the ceasefire.

US Event Calendar

- 08:30: Sept. Initial Jobless Claims, est. 225,000, prior 220,000

- 08:30: Sept. Continuing Claims, est. 1.69m, prior 1.69m

- 08:30: Sept. Philadelphia Fed Business Outl, est. -1.0, prior 12.0

- 08:30: 2Q Current Account Balance, est. -$220b, prior -$219.3b

- 10:00: Aug. Existing Home Sales MoM, est. 0.7%, prior -2.2%

- 10:00: Aug. Leading Index, est. -0.5%, prior -0.4%

DB's Jim Reid concludes the overnight wrap

As widely expected, the FOMC kept the fed funds rate on hold yesterday, but this pause was accompanied by clear hawkish undertones and both bonds and equities sold off notably in the aftermath. 10yr US yields are at 4.43% as I type this morning, +12bps above where they were prior to the meeting. The starting point for the hawkishness came from the updated dot plot in the new Summary of Economic Projections. The end-2023 median dot was unchanged at 5.6%, but the median dot for 2024 moved 50bps higher to 5.1% (our US economists had expected 2024 to move up by 25bps). So the median FOMC member is pencilling in only two rate cuts in 2024, after one more hike this year. Interestingly, the newly published projections for 2026 showed the median dot at 2.9%, still above the long-term projection of 2.5%, so pointing to a persistently "tight" policy stance. The higher 2024-25 dot plot came as the SEP moved further towards a soft landing view, lowering unemployment projections for both 2024 and 2025 by 0.4pp to 4.1%. That would be only a slight uptick from the latest 3.8% level.

In the press conference Powell actually said that he “would not” have a soft landing as a baseline expectation, though later adding that soft landing is a primary objective for the FOMC. A little bit of a confusing message but overall, Powell reinforced a higher-for-longer message. Echoing the dot plot, he noted that the neutral rate may have risen and it was “certainly possible that the neutral rate...at this moment is higher than (the long-run rate)”. He also downplayed the prospects of cuts, saying that the FOMC was “never intending to send a signal” about timing of rate cuts with its dot plot and that “there’s so much uncertainty around” this.

Powell’s comments did see some moderation of the near-term tightening bias. He noted several times that the Fed is now in a position to “proceed carefully”. The prepared remarks struck a softer tone on labour market tightness and Powell highlighted that the last three inflation prints were “very good” readings, though not yet enough for the Fed to be confident they have reached a “sufficiently restrictive” stance. Our US economists note that with the FOMC end-2023 projections being likely too high on inflation and too low on unemployment, these set a relatively low bar for skipping the final projected hike. Correspondingly, our economists continue to expect no further rate increases – see the reaction note here for their full take.

So overall, the Fed sent a clear message that they think rates will stay high for longer, and the markets took this on board. Fed fund futures saw the chances of another hike by the end of the year move up to 54% from 45% the day before, with the peak rate now priced for January 2024 (with a 58% chance of a hike by then). Fed funds pricing for end-24 rose by +13.3bps on the day, and 20bps from its earlier intra-day lows, to a new cycle high of 4.76% (this is still more than 30bps below the Fed’s new median dot). My CoTD yesterday looked the implications of this pricing. Although it reflects the market pricing in a soft landing, the high levels probably increase the risk of a hard one. See the short note here.

In the bond market, the 2yr Treasury yield had been trading a few bps lower prior to the Fed decision but spiked by nearly 10bps in its immediate aftermath and closed +8.5bps up on the day at 5.18%, the highest level since 2006. The 10yr yield was up by +4.9bps to 4.41%, a new post-2007 high and is above 4.43% as I type. Meanwhile, the 10yr real yield closed above 2% for the first time since early 2009 (+6.6bps to 2.05%). Equities also lost ground in response to the Fed’s hawkish signal. The S&P 500 was down -0.94% by the close, with the decline coming during and after Powell’s press conference. Tech stocks lagged, with the NASDAQ down -1.53% and the Magnificent Seven mega caps down -2.20%. In FX, the dollar index gained about half a percent following the Fed event, closing up +0.19% on the day after trading lower earlier on. This morning in Asia, the trend continues with the dollar index rising another +0.2% and to fresh 14-year highs. The Yen has drifted to the lowest level since last November since the FOMC with this being an interesting set up ahead of the BoJ tomorrow morning.

Equity markets across Asia are also tumbling this morning with the KOSPI (-1.44%) leading losses followed by the Hang Seng (-1.21%), the Nikkei (-1.14%), the Shanghai Composite (-0.58%) and the CSI (-0.52%). S&P 500 (-0.25%) and NASDAQ 100 (-0.35%) futures are also moving lower again as the FOMC message continues to reverberate.

With the Fed out of the way, attention will now turn to the Bank of England, who are announcing their latest policy decision at 12:00 London time. Up until yesterday morning, it had been widely expected that the BoE would deliver another 25bp hike. But we then got a strong downside surprise from the August CPI print, where headline inflation unexpectedly fell to +6.7% (vs. +7.0% expected). So markets are now only pricing in a 46% chance of a rate hike today, and it’s very finely balanced as we approach the decision.

Our own UK economist at DB has also changed his call following the CPI data (link here), and now thinks that the BoE will skip a rate hike at this meeting. He thinks that the CPI print offers the MPC more optionality to pause, and there were also positive signs beyond the headline number. For instance, core CPI fell to +6.2% (vs. +6.8% expected), whilst the closely-watched services CPI rate fell to +6.8% as well. However, he still sees this decision as finely balanced, with the big miss in inflation and weaker growth momentum now in stark contrast to elevated wage growth. The growing chance of a pause has been evident among gilts as well, with 10yr yields experiencing a sharp decline of -13.0bps yesterday. In addition, the 2yr yield (-16.2bps) closed at a 3-month low of 4.82%.

Elsewhere in Europe, markets put in a strong performance ahead of the Fed’s decision, with the STOXX 600 (+0.91%) recovering from its rough start to the week. That was echoed across the major indices, with the DAX (+0.75%), the CAC 40 (+0.67%) and the FTSE 100 (+0.93%) posting solid gains of their own. It was the same story on the bond side too, as yields on 10yr bunds (-3.6bps), OATs (-4.4bps) and BTPs (-6.6bps) moved off their highs from the previous day. All before the FOMC of course.

Looking at yesterday’s other data, German PPI continued to plunge, with the latest reading for August at -12.6% (vs. -12.5% expected). That’s the fastest decline in recorded data back to 1948, although that is down from a record peak one year earlier of almost +46%.

To the day ahead, and we’ll get the Bank of England’s latest policy decision, and also hear remarks from the ECB’s Schnabel and Lane. Otherwise, data releases include the US weekly initial jobless claims, existing home sales for August, the Conference Board’s leading index for August, and the Philadelphia Fed’s business outlook for September. In the Euro Area, we’ll get the preliminary consumer confidence reading for September, whilst in the UK there’s the public finances for August.