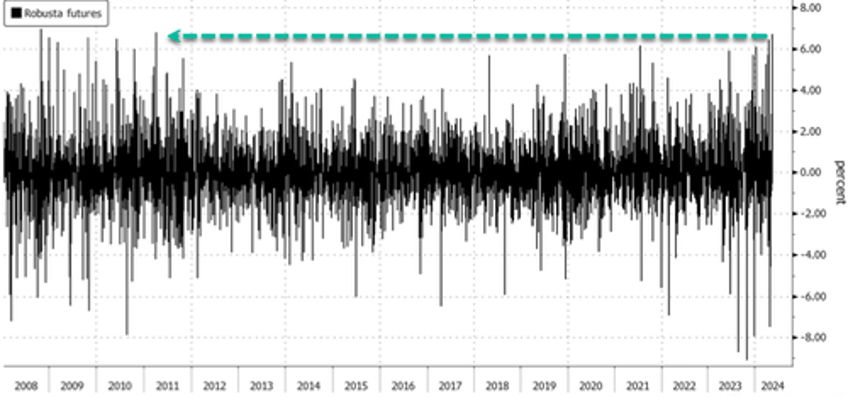

Futures for robusta, the cheaper coffee bean grown at lower altitudes and requiring less care than more expensive arabica, jumped the most in London on Tuesday since 2011 as concerns increased over shrinking supplies from top grower Vietnam.

Robusta bean prices in London closed up 6.72% on Tuesday, the largest daily increase since April 5, 2011—or more than 13 years ago. The driver has been droughts crushing production in Vietnam. Even though rains have improved the outlook, supply woes linger throughout the year.

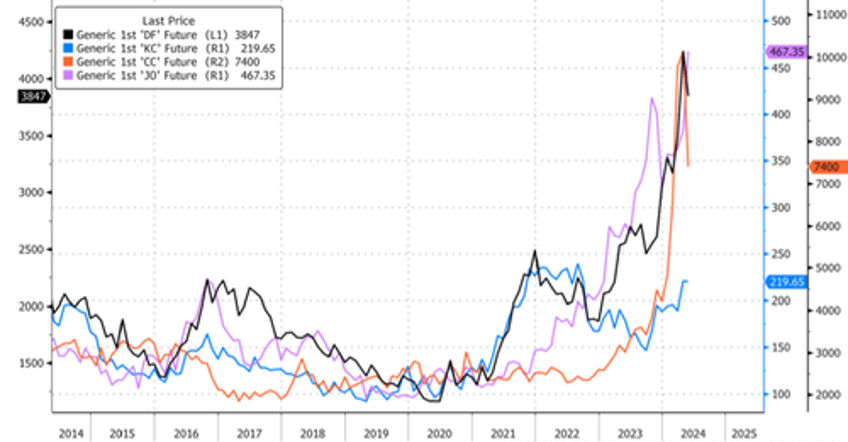

Robust demand for the bean and a recent International Coffee Organization report warning about global supply woes have sent bean prices soaring. Since 2020, the bean has jumped 265%.

On Tuesday, Andrea Illy, chairman of Italian coffee roaster Illycaffe SpA, warned on Bloomberg TV that demand for robusta beans is very strong, even as arabica is not being used in blends.

"It's a quite unique dynamic in the market," Illy said, adding that "for certain kinds of preparation, like instant coffee, robusta is more important."

A recent note from Rabobank analyst Guilherme Morya showed strong exports for robusta and arabica from Brazil, the world's top coffee producer. He cited the growing uncertainties about Vietnam's production as attracting fast-money hedge funds into the futures market.

Last Friday, a report from the US Department of Agriculture said harvests in Indonesia will begin this month or next, marking a "substantial delay from the norm" due to El-Nino-related droughts.

Here are two of our latest notes on the global physical coffee market:

- This Next Bean Is Hyperinflating, And It's Not Cocoa

- Robusta Coffee Bean Prices Near Half-Century High As Vietnam Supply Woes Spark World Crunch

Meanwhile, robusta, arabica, cocoa, and orange juice futures have been spiraling higher.

This comes as spot commodities tracked by Bloomberg are moving higher.

Soaring commodity prices are not the best news for Fed doves, hoping Powell will squeeze off at least two interest rate cuts by the end of the year.