One month after the downbeat November Beige Book found economic activity was "slowing", moments ago the Fed released the latest, December Beige Book in which we find a continuation of said gloominess because a majority of the twelve Federal Reserve Districts reported "little or no change in economic activity since the prior Beige Book period" while of the four districts that differed, three reported modest growth and one reported a moderate decline.

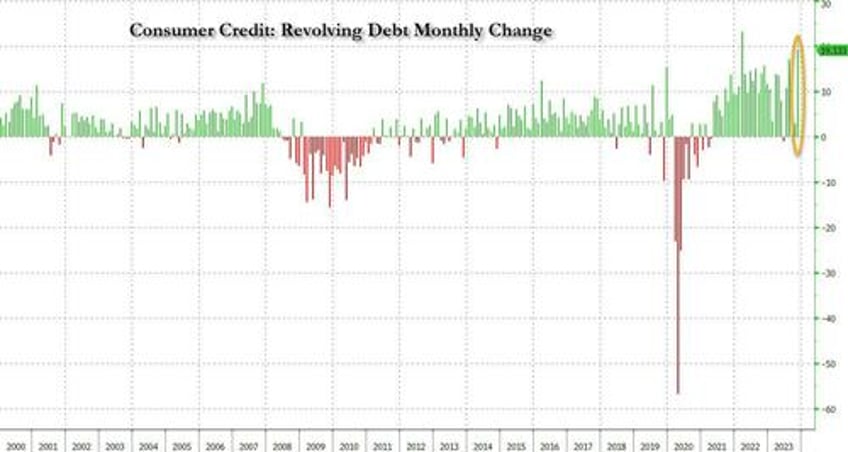

That said, consumers - which as we reported previously loaded up on near-record amount of credit card debt to pay for holiday purchases...

... delivered some seasonal relief over the holidays by "meeting expectations in most Districts and by exceeding expectations in three Districts, including in New York", which noted strong holiday spending on apparel, toys, and sporting goods. In addition, seasonal demand lifted airfreight volume from e-commerce in Richmond and credit card lending in Philadelphia. Said eruption in credit card usage also boosted leisure travel as several Districts noted, while a tourism contact described New York City as bustling.

On the other hand, contacts from nearly all Districts reported decreases in manufacturing activity while districts continued to note that "high interest rates were limiting auto sales and real estate deals." The flip side is that the prospect of falling interest rates was cited by numerous contacts in various sectors as a source of optimism; now all we need is for the Biden admin to admit the economy is, in fact, slowing. In contrast, concerns about the office market, weakening overall demand, and the 2024 political cycle were often cited as sources of economic uncertainty.

Overall, "most Districts indicated that expectations of their firms for future growth were positive, had improved, or both"

Some more details from the latest Beige Book, starting with labor markets:

- Seven Districts described little or no net change in overall employment levels, while the pace of job growth was described as modest to moderate in four Districts.

- Two Districts continued to note a tight labor market, and several described hiring challenges for firms seeking specialty skills, such as auto mechanics or experienced engineers in the Boston and San Francisco Districts, respectively.

- However, nearly all Districts cited one or more signs of a cooling labor market, such as larger applicant pools, lower turnover rates, more selective hiring by firms, and easing wage pressures.

- The pace of wage growth was characterized as moderate in Boston, Richmond, Chicago, and Dallas; as modest in New York and Philadelphia; and as slight in St. Louis.

- Firms from many Districts expected wage pressures to ease and wage growth to fall further over the next year.

Turning to price pressures, six districts noted that their contacts had reported slight or modest price increases, and two

noted moderate increases. Five districts also noted that overall price increases had subsided to some degree from the prior period, while three others indicated no significant shift in price pressures. Some more:

- Firms in most Districts cited examples of steady or falling input prices, especially in the manufacturing and construction sectors, and more discounting by auto dealers.

- Districts also noted that increased consumer price sensitivity had forced retailers to narrow their profit margins and to push back in turn on their suppliers’ efforts to raise prices.

- Premium increases for property and casualty insurance and for health insurance continue to impact most firms.

- Three Districts noted that their firms were expecting price increases to ease further over the next year, while four Districts’ firms anticipated little change

Turning to the specific regional Feds, we found these summaries notable

- Boston: Economic activity was down slightly. Employment was stable, and wage growth was moderate. Manufacturers reported mostly weaker sales but remained cautiously optimistic for 2024. The Boston area experienced strong growth in tourism and convention activity. Home sales stayed in the doldrums, but contacts expressed optimism that the market would rebound in 2024 pending a decline in home mortgage rates.

- New York: Regional economic activity declined slightly. Labor market conditions remained solid but continued to cool as the demand for labor softened. Led by a strong holiday season, consumer spending increased moderately. Manufacturing activity contracted sharply. Prices rose modestly. Businesses and households across the District expressed concern about the high cost and reduced availability of credit.

- Philadelphia: Business activity held steady during the current Beige Book period—after falling for most of 2023. Employment grew slightly, and labor availability improved. Wage and price inflation subsided further, with prices rising at a slight pace as consumers pushed back more on higher prices, especially among lower-income households. Sentiment improved, but firms remained cautious and expectations for economic growth remained subdued.

- Cleveland: District business activity edged up. Employment stabilized, and wage increases returned to more typical levels. Cost and price pressures changed little after easing through much of 2023, though upward price pressure persisted in certain industries. Retailers reported strong sales for discounted items, and consumers became more reliant on "buy now, pay later" payment options.

- Richmond: The regional economy grew mildly in recent weeks as consumer spending was flat to increasing modestly. Nonfinancial services demand and commercial real estate activity was little changed. Meanwhile, trade and trucking volumes were down modestly and residential housing sales and mortgage lending softened. Employment and wages rose moderately and inflation moderated but remained elevated.

- Atlanta: Economic activity grew at a slow pace. Labor markets cooled further, and wage pressures eased. Some nonlabor input costs moderated. Retail sales were mixed. Travel activity remained strong, but spending at hotels declined. Home sales slowed, on balance. Banking conditions were mixed. Transportation activity was sluggish. Energy demand was robust.

- Chicago: Economic activity in the Seventh District was up modestly. Employment increased moderately; nonbusiness contacts saw a modest increase in activity; consumer spending was up slightly; construction and real estate and business spending were flat; and manufacturing decreased modestly. Prices and wages rose moderately, while financial conditions loosened modestly. Net farm incomes were above average in 2023.

- St. Louis: Economic activity has remained unchanged since our previous report. Labor markets eased, and the rate of price increases for many firms has slowed over the past few months. Travel and hospitality firms reported strong leisure travel growth during the holiday season and an optimistic outlook for the upcoming year. Rental prices were flat and residential inventory rose slightly.

- Minneapolis: District economic activity was down slightly. Hiring was positive but job postings declined. Wage pressures continued to moderate, approaching pre-pandemic conditions. Price increases were mild, with most firms reporting no change in input or final prices. Holiday sales and traffic were generally strong, but construction and manufacturing activity decreased.

- Kansas City: Economic activity in the Tenth District declined moderately. Consumer spending fell, even at low-cost quick-serve restaurants. Demand for seasonal employment was low, with few workers converting to full-time. Commercial real estate transactions were suppressed, while CRE loan modification activity was inhibited by lenders' concerns about credit performance and borrower liquidity.

- Dallas: Economic activity expanded at a modest pace over the reporting period, with most sectors holding steady or experiencing slight growth. Wage growth moderated and input cost and selling price growth held slightly above average overall. Business outlooks were neutral to pessimistic, with contacts citing weakening demand as the primary concern going forward.

- San Francisco: Economic activity was stable overall. Labor availability improved, and wage and price pressures eased. Retail sales grew modestly, and demand for services was mixed. Demand for manufactured products weakened, while conditions in agriculture were solid. Real estate activity varied by property type. Financial sector conditions changed little.

One particular highlight: The Kansas City Fed notes that "commercial real estate transactions were suppressed, while CRE loan modification activity was inhibited by lenders' concerns about credit performance and borrower liquidity." In other words, the Fed is now on notice that unless it cuts rates, a CRE accident is just waiting to happen.

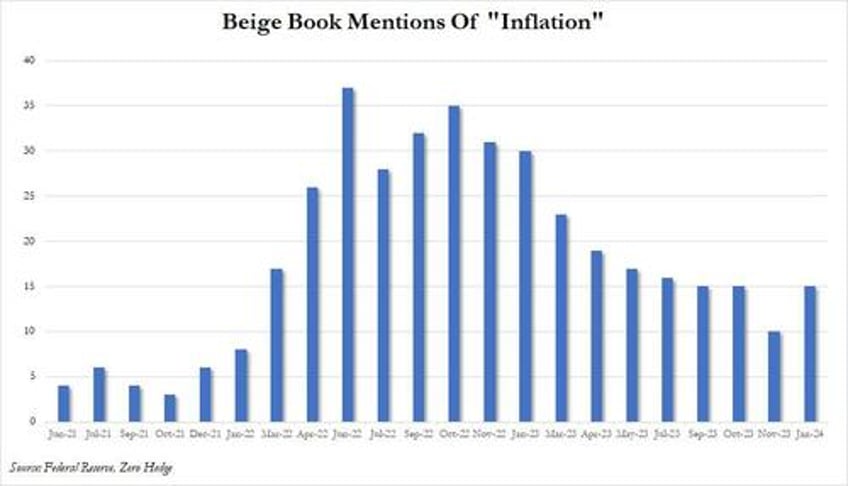

Finally, taking a visual approach to the data, we find that after mentions of inflation dropped to the lowest since Jan 2022 in November, in January there was a material rebound with 15 mentions of the world, suggesting that prices may indeed be headed higher.

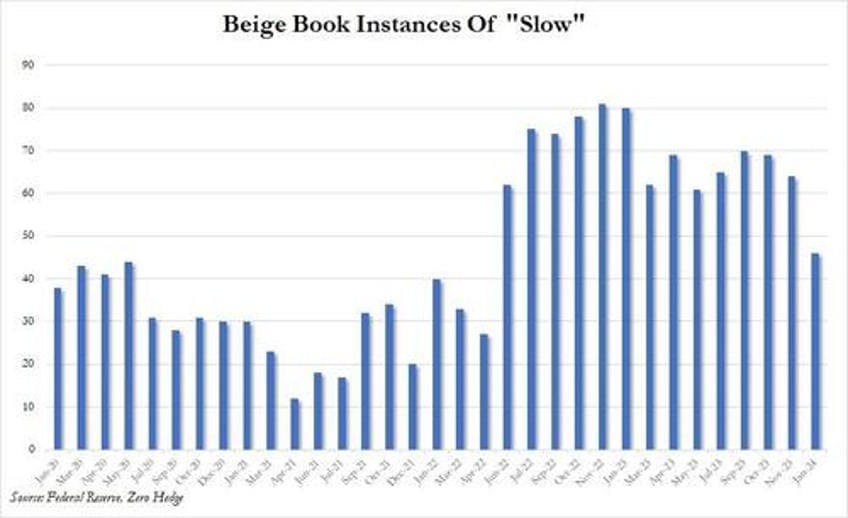

Perhaps the only silver lining in today's data is that while we would expect mentions of "slowing" to jump in keeping with the broader report theme, what actually happened was a drop in the use of that word to the lowest since April 2022, suggesting that a soft landing is still possible but only if the Fed is careful and eases into it.

More in the full Beige Book (link).