Continued turmoil in the office market is causing concern as the third week of the new year nears.

Sources close with Bloomberg said a $308 million mortgage on a Manhattan office tower owned by Blackstone is being marketed at $150 million, or about a 50% haircut. This is the second attempt to sell the tower by the private equity giant, who defaulted on the debt.

Midland Loan Services, the special servicer, hired brokerage Jones Lang LaSalle Inc. to sell the tower at 1740 Broadway. The debt is packaged into a commercial mortgage-backed and marked at a 50% discount.

Bloomberg reported several months ago that a loan sales team at CBRE Group was hired to sell the debt but was quickly pulled off the market.

In April, the 26-story tower was appraised at $175 million, down a staggering 71% from $605 million in 2014. This was the time when the mortgage was originated.

Blackstone stopped funding operating shortfalls at the tower early last year and paying the mortgage. It appears the private equity firm has since abandoned the tower:

"We wrote this property off two years ago, and in the event a buyer is identified, we will work collaboratively to transfer the ownership," a Blackstone spokesperson said.

The massive discount on the tower could mean the new buyer has enough upside for an office-to-residential conversion. However, pulling permits and that whole process could take months, if not years, to complete.

The imploding value of 1740 Broadway is just a preview of what's coming down the pipe for towers in the borough and other major cities.

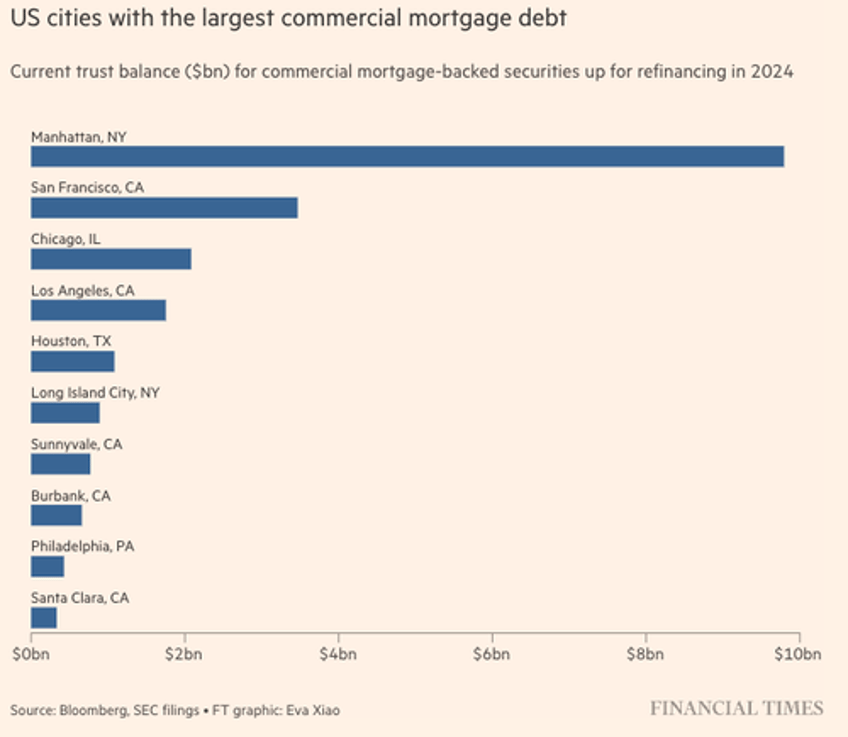

A new report by the Financial Times, which references the Mortgage Bankers Association data, shows $117 billion in CRE office debt needs to be repaid or refinanced this year. Much of this debt is concentrated in major cities such as Manhattan, San Francisco, Chicago, and Los Angeles.

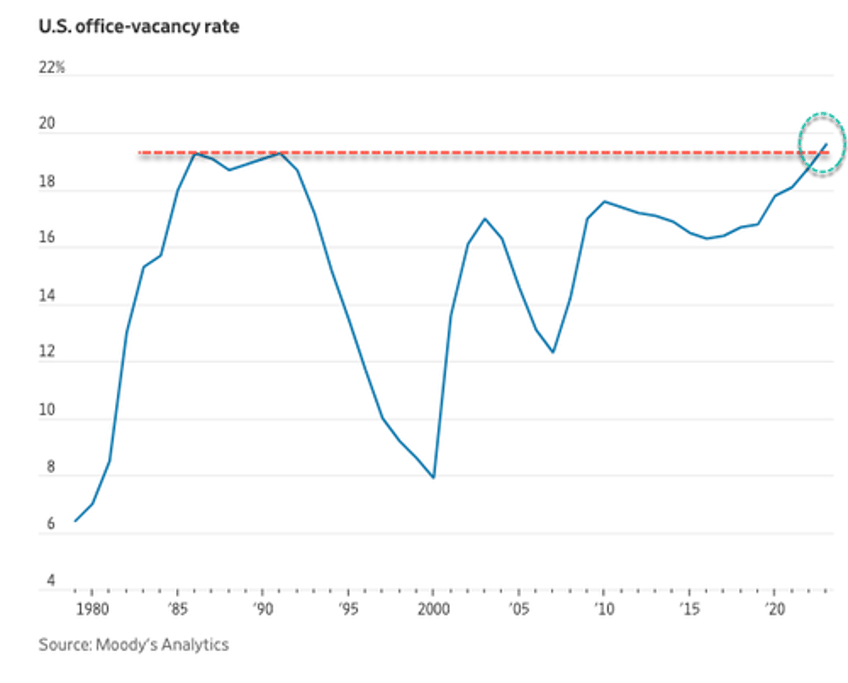

What's worse is that Moody's Analytics data shows that 19.6% of office space across major US metro areas was not leased as of the fourth quarter of 2023, exceeding the previous high of 19.3% in the commercial real estate downturn between 1986 and 1991.

As one economist recently warned: Buckle up for a rocky 2024.