It's not just the US that is in desperate need of refilling its strategic oil reserve after Biden drained it to score some quick political points ahead of the 2022 midterms. China also needs to refill its oil tanks after steadily drawing on those stockpiles for much of 2023... but like in the US, don’t expect a massive buying spree that will send global prices rallying.

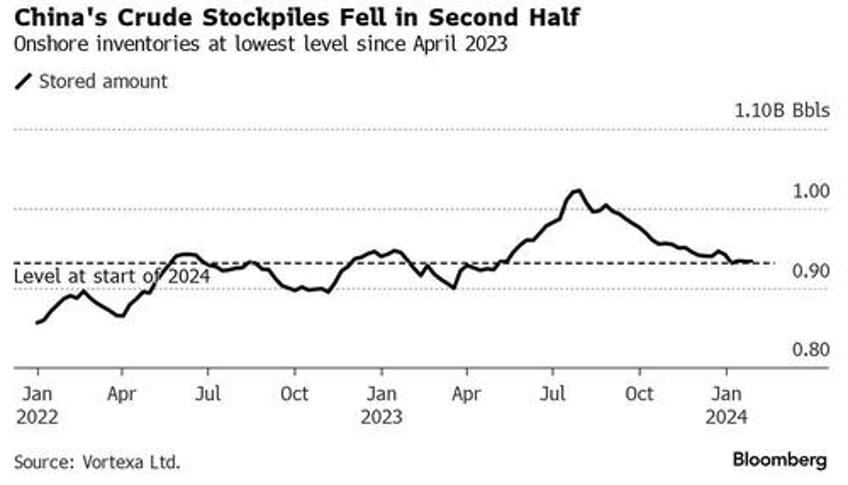

According to data from Vortexa, onshore inventories in the world’s biggest crude importer fell to an eight-month low at the start of the year. That’s likely to trigger more purchases on an international market which has been balanced between Middle East tensions and a transitory surge in US supply (which grinds to a halt the second the shale M&A wave is over).

As readers are well aware, China’s oil consumption - and estimates of how much it’s holding in reserve - are crucial to the trajectory of world prices. All the extra fuel consumed after Beijing abandoned its Covid Zero travel restrictions helped lift global benchmark Brent crude above $95 a barrel in September. But that pent-up demand now looks spent and China’s economy is struggling, suggesting that restocking by refineries this year will be moderate unless of course Beijing follows through with its intentions of aggressively restarting growth and halting the plunge in the local market.

Similar to the US, with oil prices now around $80 a barrel, that might not be low enough to tempt the government to add to its strategic reserves, although there is the risk that prices may rise much more if the Red Sea situation escalates, forcing both China and the US to miss their refilling window.

Although China’s crude imports hit an annual record in 2023, the peak came in the summer. And even though stockpiles have been depleted, they’re still running above their five-year average, as the Bloomberg chart below shows.

China’s been buying too much crude for years, at least in relation to the growth it’s seen in downstream consumption, and that was particularly true in 2023, said Emma Li, an analyst with Vortexa Ltd. “The nation could be looking to restock some inventories this year, but mostly for refinery use, with active buying for April to May arrival, as refiners prepare to boost runs post seasonal maintenance.”

Unlike the US, Beijing doesn’t publish official inventory data and is especially secretive about its strategic oil reserves. Chinese stockpiles - encompassing onshore commercial holdings and the government’s reserves — have dropped around 9% from a peak in late July, according to the Vortexa figures. They’re currently at 934 million barrels, compared with a five-year average of 920 million but of course that average also captures such slow growth outlier years as 2018 and 2020. Realistically, China's reserve should be at or near all time highs to keep in lockstep with growth.

Chinese crude stockpiles will likely build this quarter, with “restocking demand from majors,” said Jianan Sun, an analyst at Energy Aspects; he predicts that inventories will likely increase by more than 60 million barrels through this year.

All-told, Chinese demand related to refilling reserves in the first half is likely to be cautious, and a disappointment for oil market bulls.