By George Lei and Ye Xie, Bloomberg markets live reporters and strategist

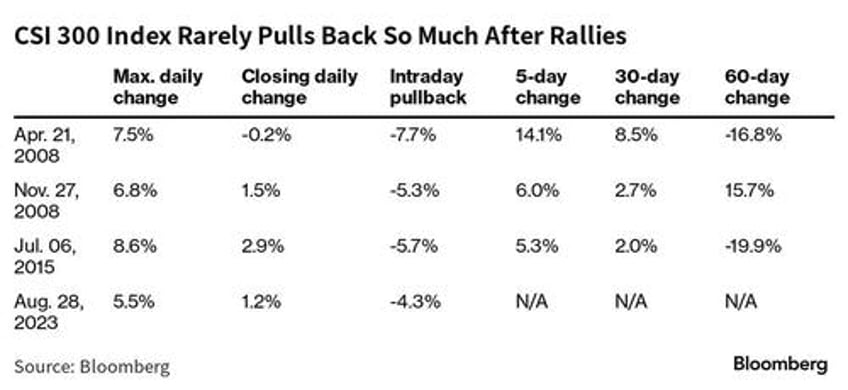

China’s benchmark CSI 300 index surged 5.5% on Monday as authorities unveiled a slew of supportive measures, including a reduction of the stamp duty. By the end of the session, the efforts had fallen flat with investors and the gauge had pared its gain to just 1.2%.

That price action suggests Beijing urgently needs to make a “whatever-it-takes” move — similar to the ECB’s open-ended commitments to saving the common currency in 2011 — or else risks further asset weakness.

The CSI 300 index’s early rally of as much as 5.5% sputtered during the session, with the gauge closing just 1.2% higher. That’s quite the rarity: There have been only three past occasions since 2004 when the equity index soared over 5 percentage points and then pared the gain by 4 percentage points.

Two of those episodes occurred during the 2008 global financial crisis. One happened in 2015 when China’s stock bubble burst. While history shows that the gauge often recovered in the week and month after such volatility, the index fell over the following 60 days in two of the three past instances.

The government has previously delivered massive stimulus to shore up not just financial markets, but also the real economy. During the 2008-2009 crisis, Beijing launched a 4-trillion yuan ($548 billion) spending package. And a program where the PBOC provided cash for policy lenders to finance urban renewal helped turn around a slumping property market in 2015. This time, however, a solution appears to be trickier.

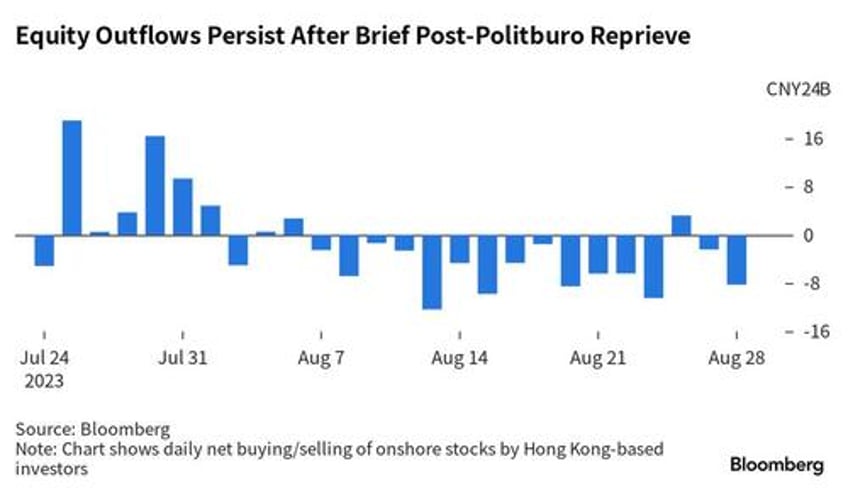

Beijing has stepped up its efforts over the past weekend to lift stocks and rescue the property market, according to Ting Lu, chief China economist at Nomura. Still, “the impact will be short-lived if these measures are not followed by measures for supporting the real economy,” he warned in a client note on Monday. In fact, Hong Kong-based investors have turned into net sellers of onshore Chinese equities throughout August, in contrast to a couple days of brief inflows in late July following positive signals from the politburo meeting.

Forecasts for China’s 2023 and 2024 GDP have been slashed on Wall Street over the past few weeks. The world’s second largest economy now risks missing Beijing’s own growth target for a second straight year and could expand at a sub-5% pace for three years in a row — something unheard of since the death of Mao Zedong in 1976. The sheer scale of the challenge calls for unprecedented policy actions, akin to the Fed’s commitment to purchasing “unlimited amounts of Treasury bonds” in March 2020 or Mario Draghi’s famous line 11 years ago: “The ECB is ready to do whatever it takes to preserve the euro.”

Beijing’s responses have so far been underwhelming and investors are keeping their hopes low after repeated disappointments over the past few years. A Bloomberg MLIV survey of 455 respondents found only 11% look forward to “really big, bazooka-like” stimulus, while more than half expect moderate steps that target specific industries. In a Bank of America survey two weeks ago, only 3% of those polled saw a stronger yuan in the next three months as a result of “policy stimulus restoring growth momentum.” If Beijing cannot surprise investors amid such a low threshold of expectations, Chinese markets are probably headed for further selloffs.