By Mish Shedlock of MishTalk

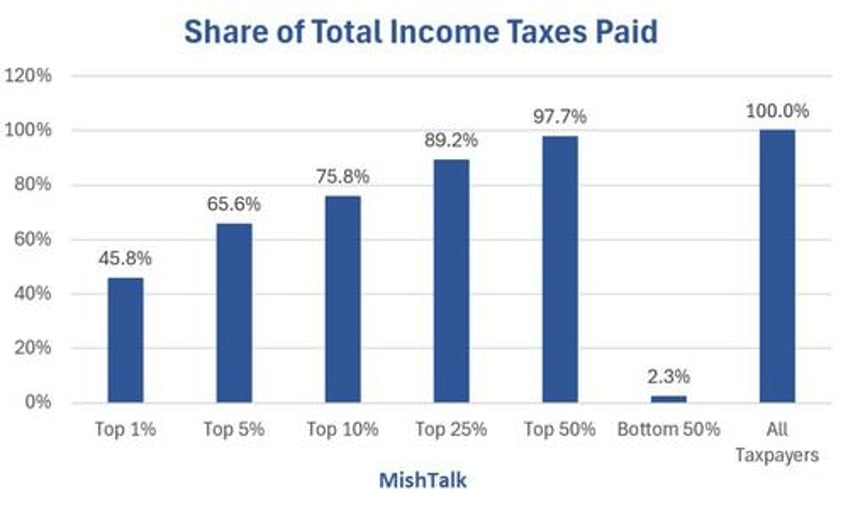

What percentage of all income tax collection should the top 1 percent pay? Top 10 percent?

Summary of the Latest Federal Income Tax Data

Inquiring minds may wish to peruse a Summary of the Latest Federal Income Tax Data, 2024 Update by the Tax Foundation.

I downloaded their data and created all but one of the charts in this post. The Foundation calls it the 2024 update but the latest data is for 2021.

The bottom half of taxpayers, or taxpayers making under $46,637, faced an average income tax rate of 3.3 percent. As household income increases, average income tax rates rise. For example, taxpayers with AGI between the 10th and 5th percentiles ($169,800 and $252,840) paid an average income tax rate of 14.3 percent—four times the rate paid by taxpayers in the bottom half.

The top 1 percent of taxpayers (AGI of $682,577 and above) paid the highest average income tax rate of 25.93 percent—nearly eight times the rate faced by the bottom half of taxpayers.

Income tax after credits (the measure of “income taxes paid” above) does not account for the refundable portion of tax credits such as the EITC. If the refundable portion were included, the tax share of the top income groups would be higher and the average tax rate of bottom income groups would be lower. The refundable portion is classified as a spending program by the Office of Management and Budget (OMB) and therefore is not included by the IRS in these figures.

The only tax analyzed here is the federal individual income tax, which is responsible for more than 25 percent of the nation’s taxes paid (at all levels of government). Federal income taxes are much more progressive than federal payroll taxes, which are responsible for about 20 percent of all taxes paid (at all levels of government), and are more progressive than most state and local taxes.

AGI is a fairly narrow income concept and does not include income items like government transfers (except for the portion of Social Security benefits that is taxed), the value of employer-provided health insurance, underreported or unreported income (most notably that of sole proprietors), income derived from municipal bond interest, net imputed rental income, and others.

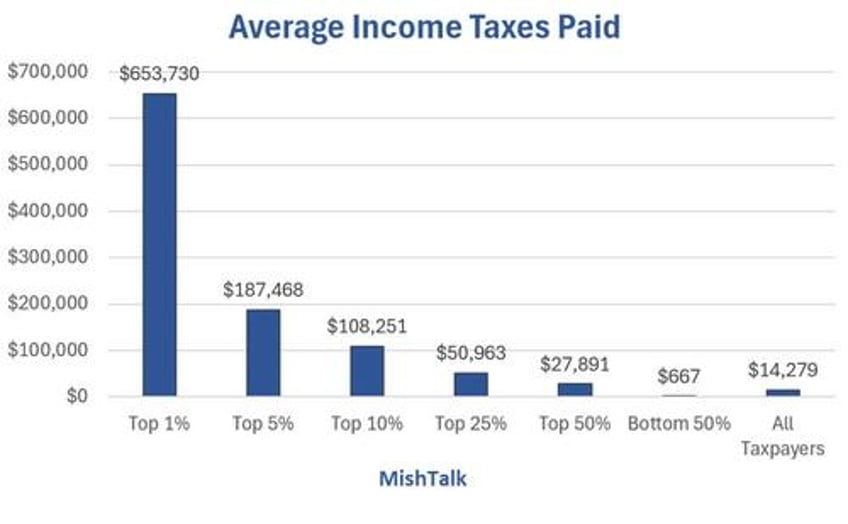

Average Income Taxes Paid 2024

The top 1 percent pay an average of $653,730 in Federal income taxes. The top 10 percent pay an average of $108,251 in Federal income taxes.

The Tax Foundation reports the bottom 50 percent pay an average of $667 but that is overstated.

Counting child tax credits, earned income, food stamps, and rent support, the bottom 50 percent pay negative taxes. They get much more back than they put in.

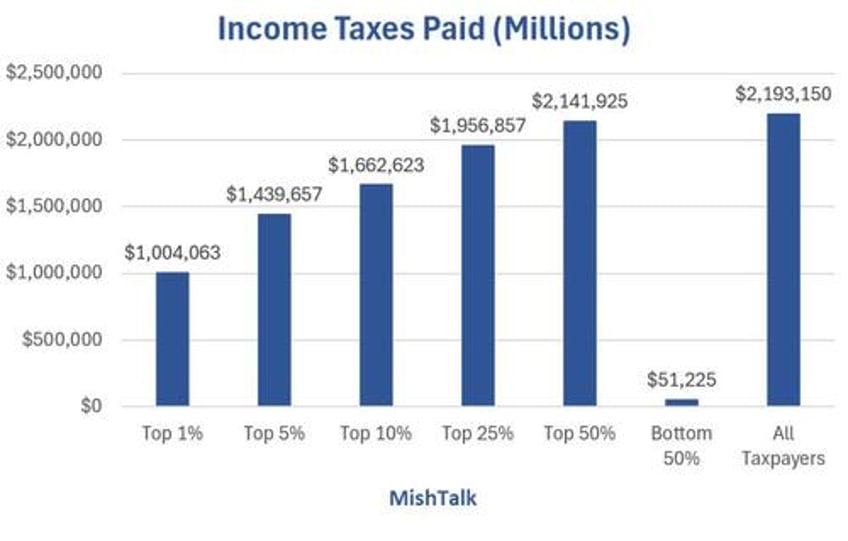

Income Taxes Paid Millions 2024

The top 1 percent contribute over $1 trillion annually. That is nearly half of what the top 50 percent contribute.

The bottom 50 percent allegedly contribute $51 billion except in practice as noted above they actually pay negative income tax.

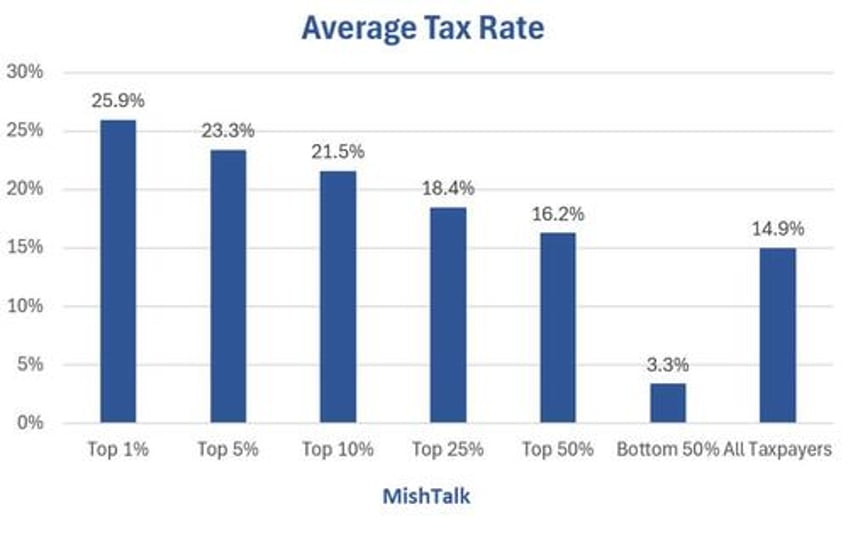

Average Tax Rate

For all the whining about how little the top pay, on average that just isn’t true.

Warren Buffet is fond of saying his secretary pays a higher tax rate than he does, but that is the exception (depending on how much he pays her).

Bear in mind these are Federal Income taxes. There are also state income taxes, payroll taxes, capital gains, etc.

Rising Fair Share

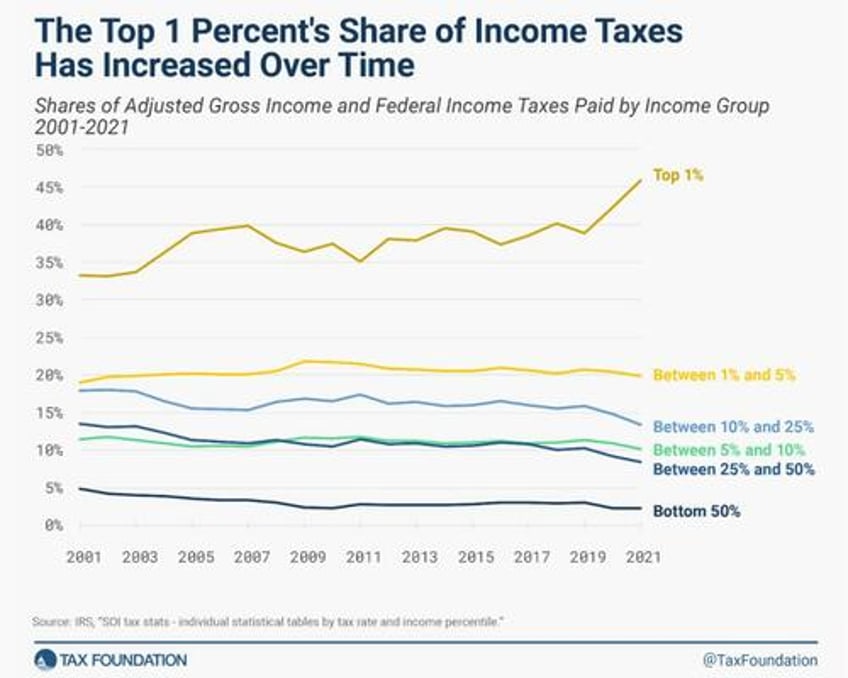

That’s a bonus chart courtesy of the Tax Foundation. It shows that the share of income taxes paid by the top 1 percent increased from 33.2 percent in 2001 to 45.8 percent in 2021.

2021 was heavily influenced by the pandemic which affected lower paid employees more.

Given the bottom half gets money back, and collections and there are also state income taxes, payroll taxes, capital gains, etc. what percentage is fair share?

Do we have a collection problem or a spending problem?