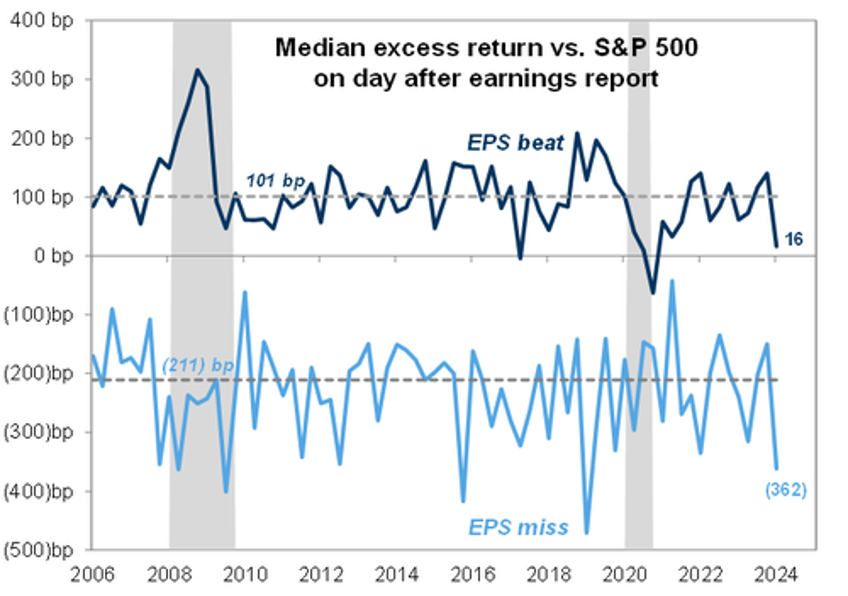

One week ago, we shared some observations from Goldman trader John Flood who noted that "Despite A Very Low Bar, Earnings Beats Are Not Being Rewarded While Misses Are Getting Severely Punished" (with a few notable exceptions), namely that while firms beating earnings estimates by at least 1-std dev outperformed the S&P 500 by only +16bps on the trading session directly after reporting (vs historical avg of +101bps of outperformance), companies missing earnings estimates by at least 1 SD have underperformed the S&P 500 by -362bps (vs historical avg of -211bps of underperformance), which makes Q1 the most punitive earnings season since 2019.

Fast forward one week into the earnings season when the rest of all remaining megacap techs have reported, and the bottom line is that the low bar effect continues.