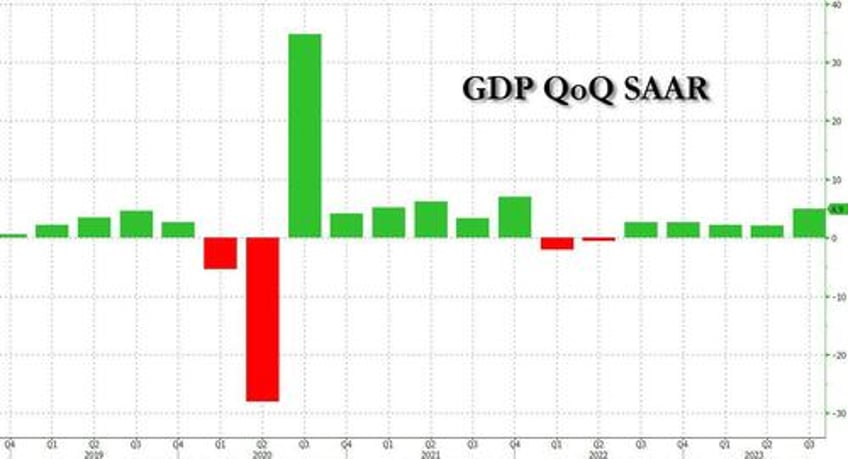

One month after comprehensive retroactive adjustments revised GDP data sharply lower, especially for personal consumption, moments ago the Bureau of Bidenomics Economic Analysis reported that in Q3, US GDP rose to an outlandishly high 4.9% in Q3 from 2.1% in Q2, and the highest since Q2 2021; the GDP print was well above the 4.5% consensus print if not quite as high as the 5.5% whisper number floated by some. The surge was driven by a sharp rebound in personal consumption, which surged from 0.8% in Q2 to 4.0% annualized in Q3; at the same time investment was up 8.4% and government spending up 4.6%.

According to the BEA, compared to the second quarter, the acceleration in GDP in the third quarter primarily reflected accelerations in consumer spending, inventory investment, and federal government spending and upturns in exports and housing investment. These movements were partly offset by a downturn in business investment and a deceleration in state and local government spending. Imports turned up.

Taking a closer look at the increase in consumer spending, this reflected increases in both services and goods. Within services, the leading contributors were housing and utilities, health care, financial services and insurance, and food services and accommodations. Within goods, the leading contributors to the increase were other nondurable goods (led by prescription drugs) as well as recreational goods and vehicles. The increase in inventory investment primarily reflected increases in manufacturing and retail trade.

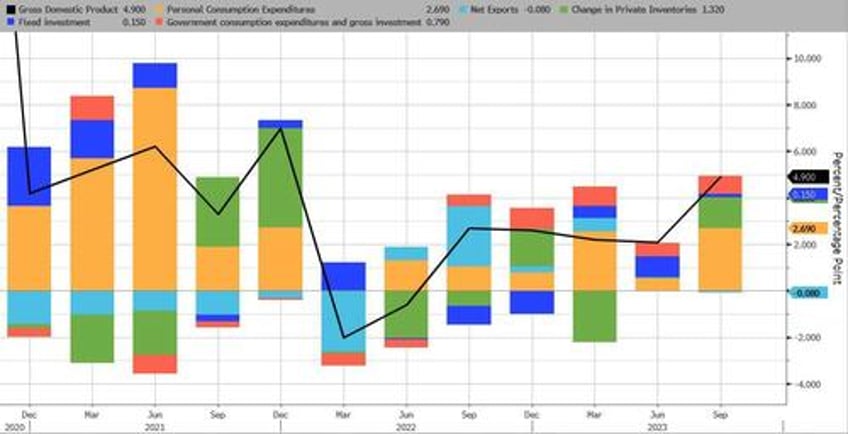

Here is a detailed breakdown of component contribution:

- Personal Consumption contributed 2.69% of the 4.88% GDP bottom line, up from 0.55% last quarter

- Fixed investment saw its contribution shrink to 0.15% from 0.90%

- The Change in Private Inventories on the other hand added 1.32% to the GDP print, up from 0.00% in Q2.

- Net exports was a wash, subtracting just 0.07% to the bottom line print, a modest reduction from the 0.04% increase last month.

- Government consumption was the final contributor, and it added 0.79%, an increase from 0.57% last quarter.

And here, a curious observation from Bloomberg which notes that services were the bigger component of consumer spending, contributing 1.62 percentage point to the 4.9% growth pace. That’s the strongest since the third quarter of 2021, when “revenge” spending after the reopening was the theme. "This time around, the Taylor Swift concert effect as well as the Barbie and Oppenheimer movies played a role."

While the GDP report came in hotter than expected, the reason why yields dipped and stocks rose is because on the core prices side, things were cooler than expected: yes, the price index came in at 3.5%, higher than the 2.7% expected, but core PCE (ex food and energy) rose 2.4%, down sharply from the 3.7% in Q2 and below the 2.5% expected.

Developing