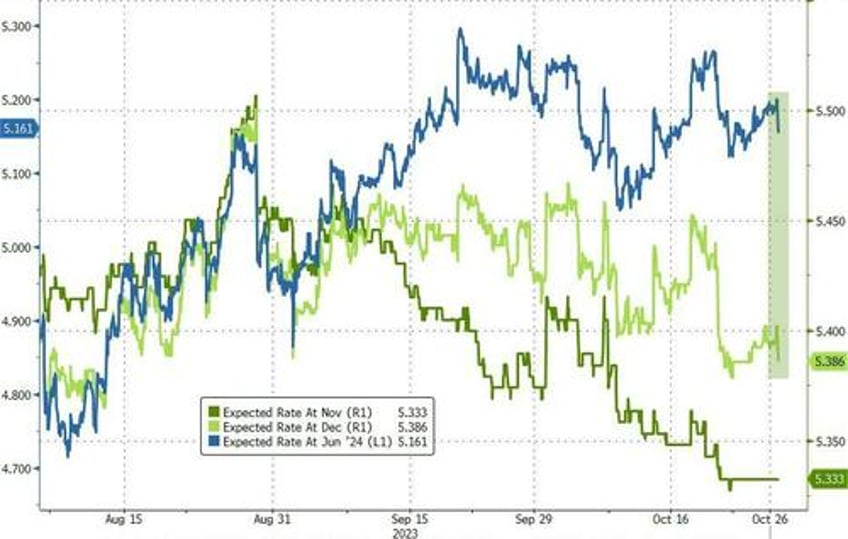

Q3 is signaling the opposite of stagflation with stronger than expected GDP growth and weaker than expected core PCE (durable goods orders were hot and continuing claims worse than expected) and that has pushed rate-change expectations lower (dovish)...

Source: Bloomberg

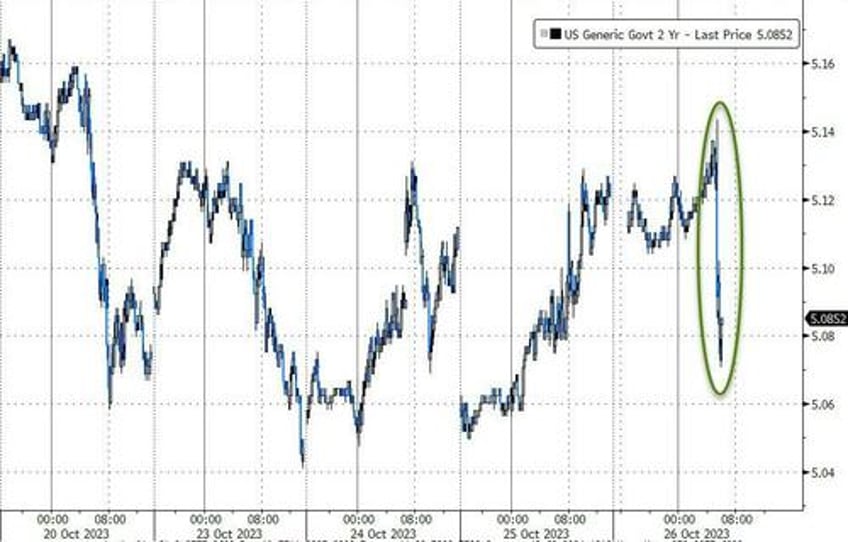

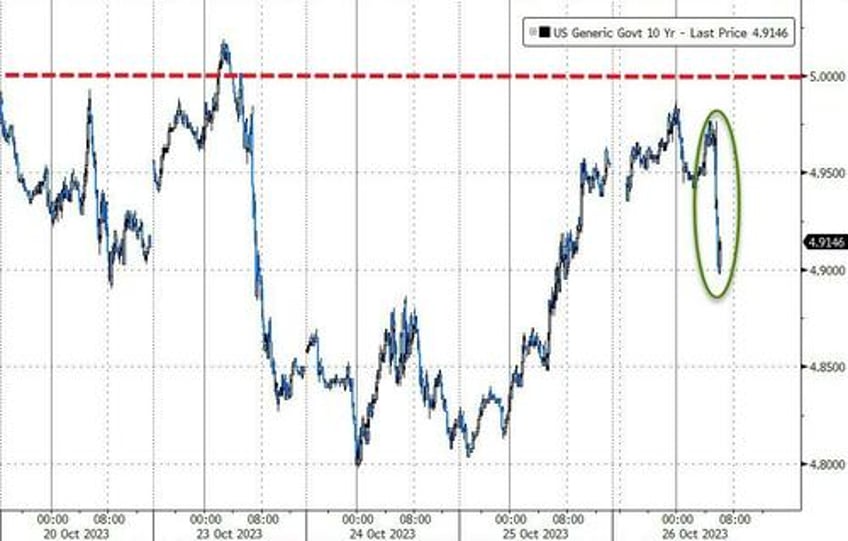

Treasury yields all fell on the print (down around 5bps or so)....

Source: Bloomberg

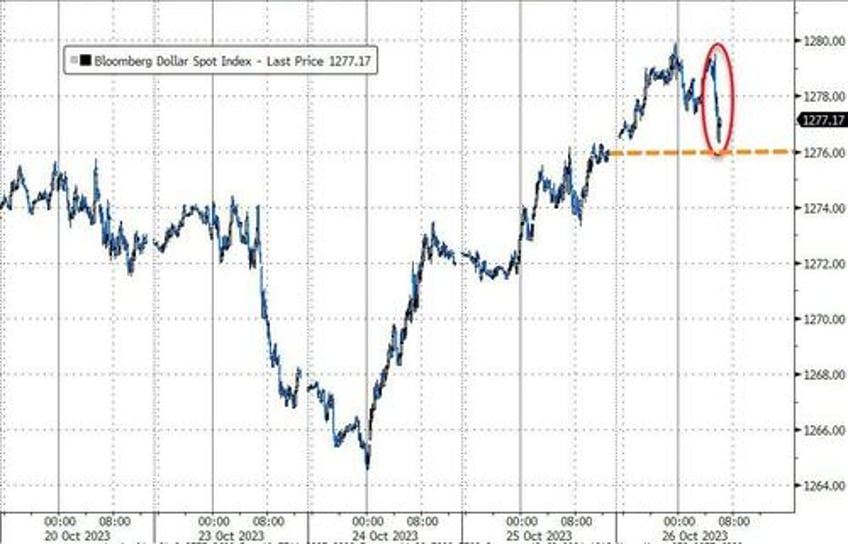

The dollar dropped back to unchanged on the day after the 'dovish' core PCE...

Source: Bloomberg

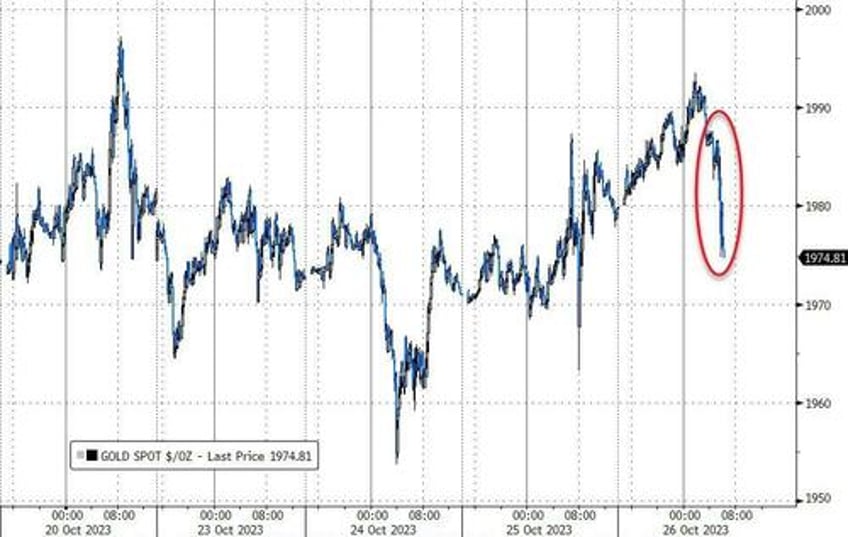

Gold is lower...

Source: Bloomberg

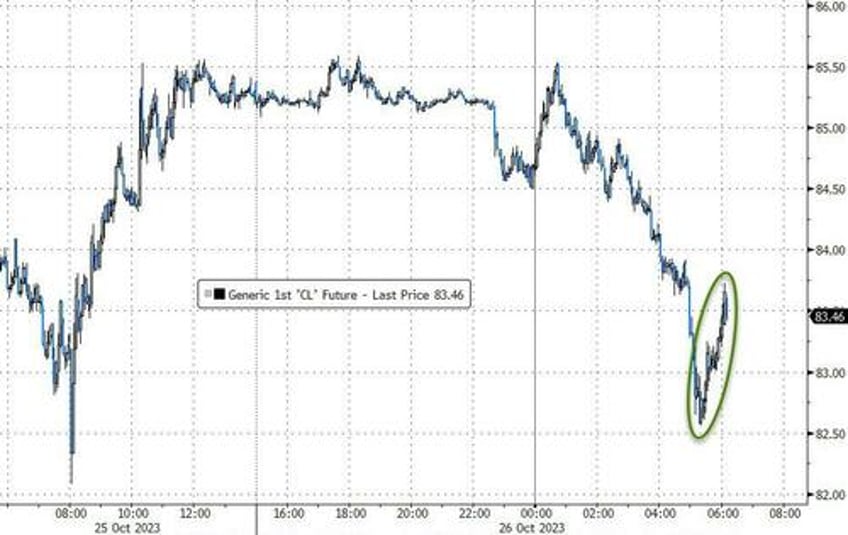

...and oil is up (demand)...

Source: Bloomberg

And stocks are higher... for now... with The Dow and Small Cap back in the green while S&P and Nasdaq remain red...

Can it hold until the close?

Judging by analysts' calls post-GDP, we suspect... no.

The market is discounting the third-quarter number and is focusing on the latest central bank decisions, and what it might mean for what the Fed does next week, Lindsey Piegza, chief economist for Stifel Financial Corp., told Bloomberg Television.

Goldman strategist Lindsay Rosners said that:

“...while this number is unsurprising, our expectations are for slower GDP going forward as positive contributions from volatile net exports and inventories are unlikely to be repeated...

While this one number makes the Fed weary of cutting rates, it does not move the needle for the November FOMC meeting which is certainly a skip. Higher and hold, yes. Higher and hiking, no.”

Rubeela Farooqi, Chief US economist at High Frequency Economics:

“We continue to forecast ongoing expansion in activity but expect the pace to slow quite significantly in the fourth quarter, as household spending slows, not only on payback for an unusually strong third quarter but also from the cumulative effects of rate hikes and tighter borrowing conditions, which should have a more material effect on both consumers and businesses going forward.”

Sell-the-kneejerk-higher-on-the-news?