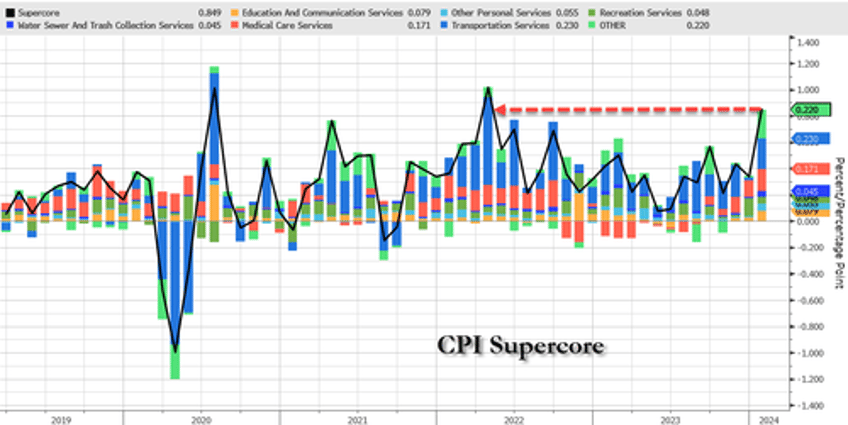

There was a collective gasp of surprise two weeks ago when not only did CPI and core CPI both come in far hotter than expected, but the closely watched sticky Super Core inflation - Core CPI Services Ex-Shelter index - soared 0.7% MoM (the biggest jump since Sept 2022...

... and while we correctly warned that the inflation print would come in red hot (see "CPI Preview: "There's A Genuine Risk" Inflation Will Come In Hotter Than Expected") most on Wall Street did not, and were scrambling to come up with justifications for why they were again collectively wrong, with Goldman being of particular note, as the bank attributed the spike to what it called a "January effect" and then assured its clients that "while some of the OER strength could persist if driven by the rebound in the single-family market, we continue to expect inflation in non-housing services to normalize in February and March now that the start-of-year price increases have been implemented."

Now the reason why Goldman, and so many others, scrambled to goalseek a narrative that sees the Fed cutting rates in March... or May.... or June (as Goldman now does, after previously forecasting both the former months as the start date of the Fed's easing cycle)... or whenever, is because that's the only thing that will validate the very bullish year-end S&P price targets by various banks which have been aggressively raised in recent weeks as the Wall Street lemming crew chased the momentum ignition sparked by a few AI-linked companies. But there is another reason why the Fed needs to cut: if it does not the odds of the market maintaining its upward glidepath into the November election, not to mention the so-called "strength" Bidenomics, are as dead as the dodo.

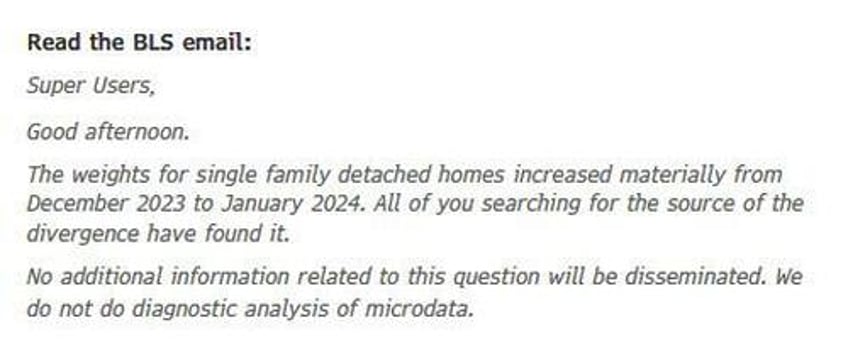

In other words, the real shock is not that inflation printed high - everyone knows how high prices are and in which direction they are moving - it is that Biden's Department of Labor Statistics admitted to this fact. So two weeks later, the BLS has realized precisely the error that it made, and as Bloomberg reported today, the US Labor Department’s statistical agency "sowed confusion" on Wall Street this week with an email about a key factor behind the jump in January’s CPI index

A Tuesday email to a group of data “super users”, seen by Bloomberg, suggested a surge in a measure of rental inflation — which left analysts puzzled — was caused by an adjustment to how subcomponents of the index are weighted.

Adding to the speculation that the data has been rigged and we are witnessing yet another conspiracy in action, one recipient said the BLS Statistics tried to retract it and that they were told to disregard its contents.

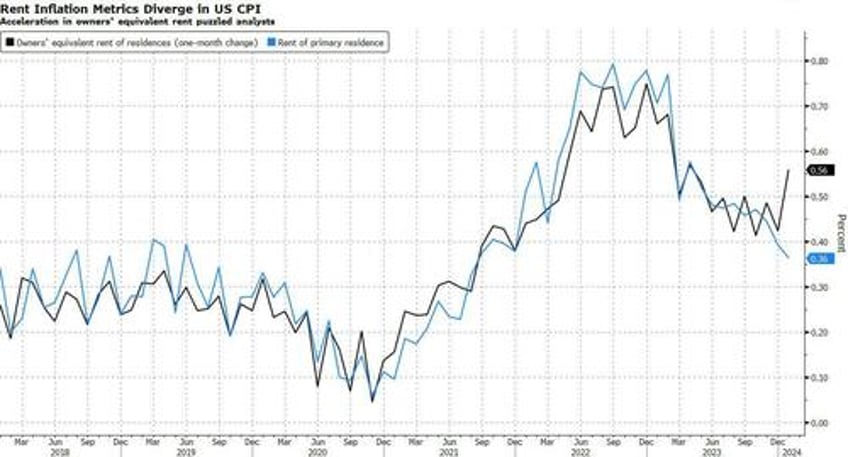

As we explained at the time, the spike in owners’ equivalent rent was a major factor behind the strength of the overall January CPI figure given its outsize weight in the index. Specifically, while Rent inflation rose 0.36% MoM, Owner-Equivalent rent jumped 0.56% and shelter inflation surged 0.63% sequentially, the biggest increase since February 2023. Whatever the reason, the cascade from the higher-than-expected CPI numbers eventually led Fed officials to warn there would be a delay to widely anticipated interest-rate cuts.

Which, however, is bad news for Biden as explained above, hence the following bizarre email sent out by the BLS:

It wasn't immediately clear who or what is a BLS "super user", but it was obvious that the BLS is now in damage control mode, trying to "justify" why it allowed the January CPI print to come in red hot. The implication is simple: now that the BLS knows what "caused" the spike it won't allow the same mistake twice.

The BLS is “currently looking into this data, and we may have additional communication regarding the rent and OER data soon,” an economist at the agency told Bloomberg in an emailed statement.

As Bloomberg explains, an increase in the weighting of single-family homes within the OER measure relative to multifamily units would tend to give it a temporary boost because supply of single-family homes has been restrained, keeping prices elevated, whereas multifamily supply has surged in recent years.

Furthermore, the acceleration in OER puzzled analysts because the rate of increase in a similar, though smaller, CPI component known as rent of primary residence continued to decelerate in January. The two typically move up and down together, and some suggested the larger OER move should be seen as a fluke.

Putting the puzzles pieces together, Pantheon Macro economist Ian Shepherdson wrote in a note to clients that if the weighting explanation proves correct, it could keep OER inflation readings elevated for the next several months.

“Prudence suggests” that “we should expect OER to rise at the January pace for the next five months, at which point it should revert to the rate of increase of primary rent,” he said.

Alternatively, if the BLS purposefully adjusted a weighting factor in an adverse way early in the year, it would then have many months in which it would be able to smooth out the negative January impact, allowing the monthly CPI print to come in well below where it would otherwise be. Of course, such an explanation would be rather conspiratorial and would suggest that the BLS is in cahoots with the Biden admin as it seeks to mitigate any potential upside price shocks in the months leading to the November election. Almost as conspiratorial as the BLS "accidentally" sending out an email to its "super users", and the promptly seeking to retract it....