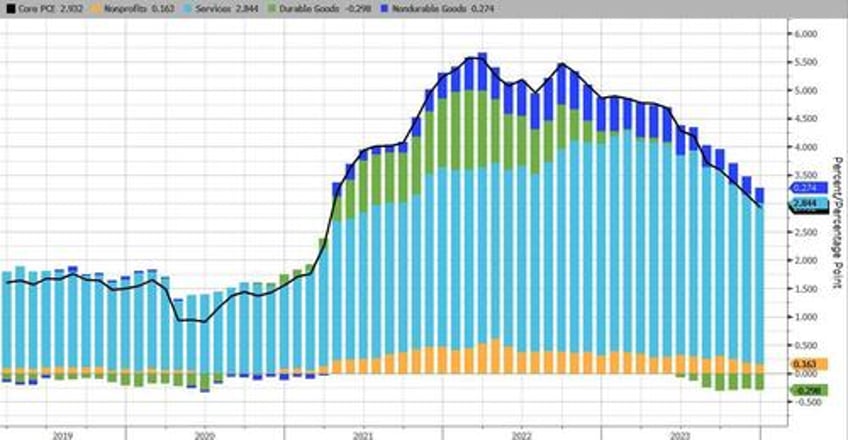

Core PCE lor January, the Fed s preferred gauge of inflation, will be released on Thursday, 29th February at 8:30am ET. As Newsquawk reports, the report will be key as it will be used to confirm the hot inflationary narrative seen from the other January inflation data. Following the hot CPI, PPI and US import prices, many analysts ramped up their PCE forecasts.

- The street expects Core PCE to rise 0.4% M/M (range of 0.1-0.4%) accelerating from December's 0.2%, and the highest monthly reading in 12 months;

- The Y/Y Core PCE print is seen easing to 2.8% (range of 2 6-2.9%) from 2.9%.

- Meanwhile headline PCE is seen at 0.3% M/M (prev. 0 2%: range 0.2-0 4%) and 2.4% Y/Y (prev. 2.6%: c range of 2.2-2 7%).

- The super core metrics which are considered to be levered to wage pressures, will also be closely watched. According to Nomura, "we forecast an even larger increase in US supercore PCE inflation to 0.569% m-o-m, the fastest pace since December 2021"

In the January CPI release, services ex-housing saw a notable rise, and further pressure in the January PCE figures will add to the rise already seen in December, where Core PCE services prices ex-housing M/M rose to 0.3% from 0.1%.

Also within the report Personal Income is expected to rise by 0.4% in January from 0.3% in December with consumption seen easing to 0.2% from 0.7%: real consumption is expected to decline by 0.1%. The downbeat consumption metrics would be in fitting with the soft January' Retail Sales report. Meanwhile, major retail earnings have seen both Home Depot (HD) and Lowe’s (LOW) note that the extreme weather in January saw an unfavorable impact.

In its preview of the core PCE report, Goldman economists said that "based on details in the PPI, CPI, and import price reports, we estimate that the core PCE price index rose 0.43% in January (vs. 0.35% previously)."

Meanwhile, as reported earlier, the market is now too dealing with a bunch of confusion around the recent BLS email communication with their “super user” market participants regarding OER inflation methodology adjustments, which then could create UPSIDE RISK to our inflation forecast…more from Nomura:

“Without any official announcement, the BLS made changes to their OER calculation methodology in January 2024 (assigning more weight to detached single-family homes) although the BLS website states that the weight for single-family homes has increased in January 2023 (as opposed to January 2024),

Rent inflation is higher for single-family homes than for apartments and other structures.(This is a bit surprising because CoreLogic, a private research firm, estimates that rent inflation for both single-family homes and other types of structures has moderated for a while.)

That's how we reacted when we got the original email from the BLS. Then we sent a follow-up email to the BLS asking if our above interpretation was correct. We have not heard back from them but some of our clients seem to have received a response from the BLS saying that the original email should be ignored and they were looking into this.

Despite some uncertainty, there is the possibility that the recent resilience of OER inflation might not be a fluke if single-family rent is structurally higher and the BLS allocates a higher weight to single-family units in OER calculation.

At this moment, we are waiting for an official statement from the BLS, but there is some upside risk to our inflation forecast.”

* * *

Fed Views: The Fed will no doubt be watching this data closely for confirmation on the expected pick up in the M/M figures, with Fed's Waller noting that although the data is not out yet, "an estimate factoring in producer prices is that core PCE inflation rose to a 12-month rate of 2 8 percent and three- and six- month rates rose to 2 4 percent and 2.5 percent respectively."

Waller stated that while this is not a welcome development the Fed has made a lot of progress and the latest CPI revisions show the progress was not a mirage. Nonetheless he wants to see a couple more months of inflation data to be sure that January was a one-off and the Fed is still on the right track. The Fed Governor also warned "I see predominately upside risks to my general expectation that inflation will continue to move toward the FOMC's 2 percent goal ." Therefore Waller supports being patient on Fed policy, concluding his latest speech with the quip. "What's the rush?"