“It’s death by 1,000 cuts. It’s the worst presidency with regard to energy policy I’ve ever seen — and I’ve been involved in energy for 40 years, my entire career.”

Those were the words of Steve Pruett, chief executive of Elevation Resources, to Financial Times last week, talking about how the Biden Administration has gone out of its way to make life difficult for the energy sector.

After the deregulation seen during Donald Trump's presidency, a tailwind for the sector, President Biden has prioritized tackling climate change and promised to regulate the oil and gas sectors more tightly.

His administration has introduced a range of environmental regulations, including endangered species protections, methane leak controls, and limits on offshore leasing and new licenses for liquefying and exporting American gas. All the while he has been draining the U.S. Strategic Petroleum Reserve while trying to cover up the tracks of inflation that is spinning out of control under his watch.

While many Democratic voters see these regulations as necessary, they have certainly rendered Biden unpopular in Midland, Texas, FT writes.

Midland lies at the core of the Permian Basin, which produces over 6.1 million barrels of oil a day—more than some OPEC nations—positioning the US as the largest oil producer globally.

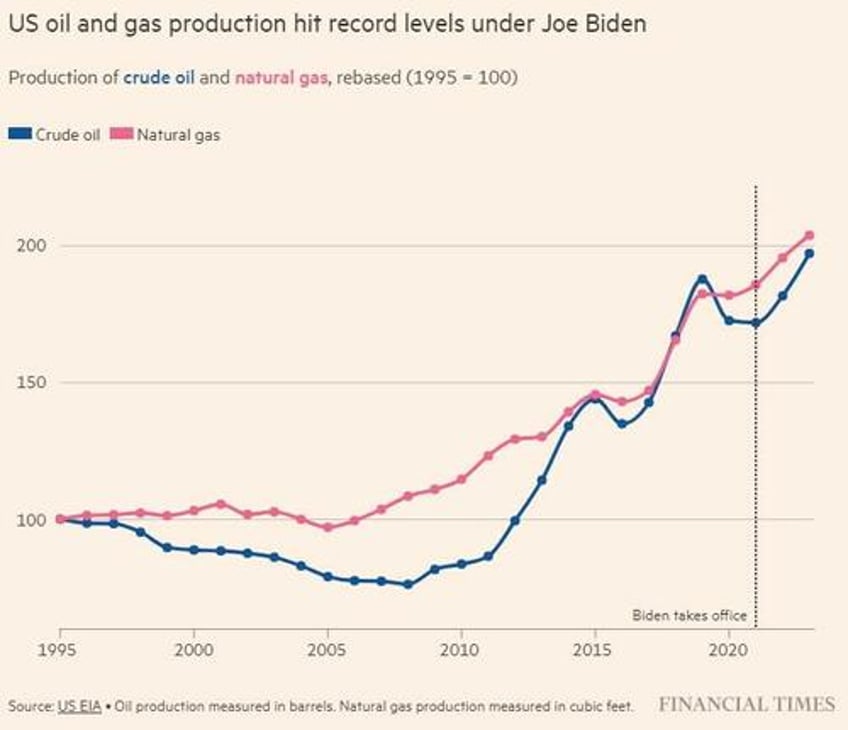

FT notes that with the presidential election six months away, energy policy is a major divide between Biden and Trump. Despite Biden's best efforts, U.S. oil production has soared to record levels, over 13 million barrels per day, boosted by commodity price increases following Russia's 2022 invasion of Ukraine. Investors have seen substantial returns, with ExxonMobil shares - one of our favorite investments we have been touting for years - doubling since Biden's inauguration.

Nonetheless, industry insiders believe these achievements have happened despite White House policies, not because of them, and fear further regulations could harm the sector long-term.

Stephen Robertson, executive vice-president of the Permian Basin Petroleum Association commented: “In Biden’s campaign to become president, he said he was going to end the oil and gas industry — he is doing that.”

“There have been over 200 actions taken by this administration opposed to the oil and gas industry. There’s not one of these that will be the end of the industry . . . but there’s going to be a straw that breaks the camel’s back.”

Biden said while campaigning in 2020: “The oil industry pollutes significantly. It has to be replaced by renewable energy over time.”

In 2024, the oil industry will be behind Trump. FT notes that Pennsylvania, a key swing state and the second-largest shale gas producer in the U.S. after Texas, plays a crucial role in presidential elections. Trump won the state in 2016, but Biden narrowly took it in 2020.

Biden's suspension of new LNG permits has been unpopular in Pennsylvania, where the oil and gas sector employs around 80,000 people. Trump, promising to reverse this policy, was met with strong support at a recent rally in the swing state.

Even local Democrats, including Governor Josh Shapiro, a Biden ally, have opposed the freeze and urged its repeal.

Alexandra Adams at the National Resources Defense Council, a non-profit added: “From day one, the Biden administration has made a strong commitment to addressing climate change.”

But Biden's energy policies, aiming to reduce oil and gas pollution, have sparked significant opposition from the industry, which fears these measures will limit future U.S. production and energy security.

This conflict intensified as Biden took actions like suspending new LNG terminal licenses and restricting offshore drilling, despite oil and gas production reaching record highs under his administration. Industry stakeholders argue these regulations threaten investments and job stability, particularly affecting smaller companies that cannot easily absorb new costs.

Now, as election tensions rise, the industry is heavily funding campaigns advocating for fewer restrictions and promoting fossil fuel reliance, signaling deep concerns about the potential impacts of continued regulatory changes.

Harold Hamm, founder of Continental Resources told Financial Times: “We have what we call punitive regulation and punitive policy that has been brought about by this administration.”

Mike Sommers, head of the American Petroleum Institute concluded: “We need predictability. And when governments change rules at the drop of a hat without much consultation that sends a signal that if you’re going to invest in that place your investment may be at risk.”