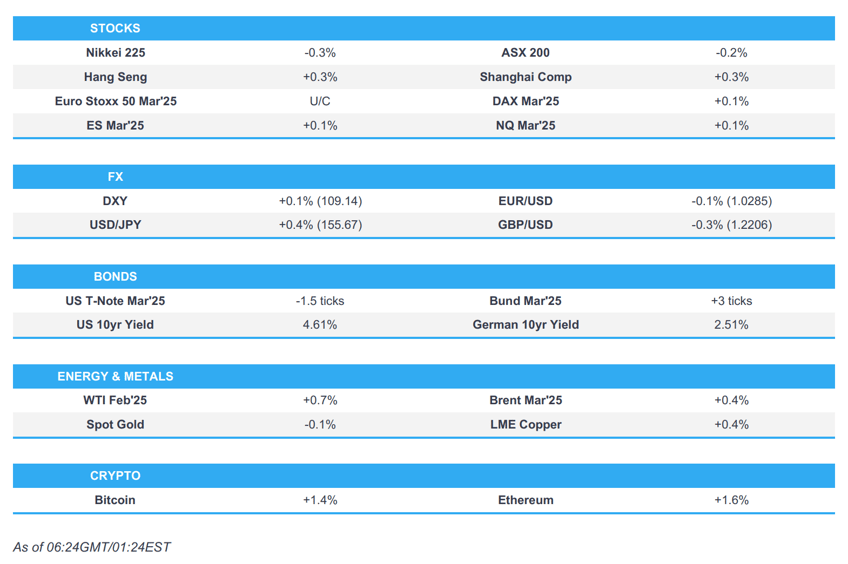

- APAC stocks were mixed in mostly rangebound trade after the uninspiring handover from Wall St and despite encouraging Chinese GDP and activity data.

- Hang Seng and Shanghai Comp were choppy with only mild support seen after GDP, Industrial Production & Retail Sales beat expectations with China's economy growing 5.4% Y/Y (exp. 5.0%) in Q4 and by 5.0% (exp. 4.9%) for 2024.

- DXY lacked conviction following the headwinds from a dovish Fed Waller; USD/JPY initially languished at its lowest in nearly a month; Antipodeans saw a muted reaction to Chinese data.

- Israel agreed to the Gaza hostage deal and the cabinet is to meet on Friday, according to Israeli media; Israeli National Security Minister Ben-Gvir said he will resign from the government if the Gaza ceasefire deal is approved.

- European equity futures indicate a flat cash market open with Euro Stoxx 50 futures U/C after the cash market closed with gains of 1.5% on Thursday.

- Looking ahead, highlights include US Industrial Production, CBO Budget and Economic Outlook, Comments from ECB’s Cipollone, Earnings from SLB, Fastenal, Truist, State Street & Citizens.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 d

US TRADE

EQUITIES

- US stock indices finished mostly lower following mixed data releases and despite the upward skew in sectors as Utilities and Real Estate sat atop of the pile with mega-cap sectors (Consumer Discretionary, Communications, Tech) the only ones in the red. On the earnings footing, MS and BAC continued the strong bank earnings although shares in the latter slipped, while TSMC also impressed.

- Nonetheless, the main highlight of the day was the rhetoric from Fed Governor Waller who tilted dovish as he suggested that a cut in March cannot be completely ruled out and that three or four cuts are possible this year depending on the data, which pressured the dollar, spurred upside in Treasuries and briefly supported stocks.

- SPX -0.21% at 5,937, NDX -0.69% at 21,091, DJIA -0.16% at 43,153, RUT +0.12% at 2,266.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Goolsbee (2025 voter) said he has grown less concerned about a labour-market slowdown and is less worried about unemployment turning into something worse.

- Canada's counter-tariff plan is reportedly to target US aluminium and steel, according to Bloomberg sources.

APAC TRADE

EQUITIES

- APAC stocks were mixed in mostly rangebound trade after the uninspiring handover from Wall St and despite encouraging Chinese GDP and activity data.

- ASX 200 traded indecisively as weakness in the top-weighted financials sector and telecoms clouded over the marginal gains in most sectors, while the index also failed to benefit from the mostly better-than-expected data in Australia's largest trading partner.

- Nikkei 225 continued to underperform amid recent currency strength and the potential for a BoJ rate hike next week.

- Hang Seng and Shanghai Comp were choppy with only mild support seen after GDP, Industrial Production & Retail Sales beat expectations with China's economy growing 5.4% Y/Y (exp. 5.0%) in Q4 and by 5.0% (exp. 4.9%) for 2024. Nonetheless, the data only briefly supported Chinese stocks which were ultimately rangebound after the mixed commentary from the stats bureau which noted the impact of external environment changes is deepening, domestic demand is not sufficient, and economic operations still face many difficulties and challenges but also stated that positive factors will outweigh negative factors for China's economy in 2025. In addition, US-China trade frictions continued to linger after the USTR found China shipbuilding to be actionable under Section 301.

- US equity futures eked marginal gains in uneventful trade after the prior day's lacklustre performance.

- European equity futures indicate a flat cash market open with Euro Stoxx 50 futures U/C after the cash market closed with gains of 1.5% on Thursday.

FX

- DXY lacked conviction following the headwinds from a dovish Fed Waller who does not think that a March cut can be completely ruled out and stated that cuts could start several months from now if current inflation expectations are met with three or four cuts possible this year if the data cooperates, while the greenback was also not helped by the recent mixed data releases stateside.

- EUR/USD was indecisive and traded on both sides of the 1.0300 level in quiet FX price action and after uneventful ECB Minutes.

- GBP/USD traded sideways after its returns to the 1.2200 handle with price action constrained after the miss on monthly UK GDP.

- USD/JPY initially languished at its lowest in nearly a month and briefly tested 155.00 to the downside heading into next week's BoJ meeting with a recent Bloomberg poll showing 74% of economists surveyed expect the BoJ to raise rates at the approaching meeting. However, the pair then gradually reversed course and recouped some of its recent losses.

- Antipodeans were ultimately subdued with a muted reaction seen to the better-than-expected Chinese GDP and activity data.

- PBoC set USD/CNY mid-point at 7.1889 vs exp. 7.3275 (prev. 7.1881).

FIXED INCOME

- 10yr UST futures took a breather after climbing yesterday on the back of the dovish comments from Fed's Waller who suggested not to completely rule out a rate cut in March and that three of four cuts are possible this year if the data cooperates.

- Bund futures sat around the prior day's best levels after recovering from the selling triggered by disappointing UK GDP and an upward revision to German CPI.

- 10yr JGB futures initially followed suit to the recent momentum in global peers but then pared its gains amid a lack of fresh pertinent drivers and with a potential BoJ rate hike next week.

COMMODITIES

- Crude futures nursed some of the prior day's losses with the rebound facilitated after stronger-than-expected Chinese data.

- US Treasury Secretary nominee Bessent said sanctions on Russia over the Ukraine war were not forceful enough and Biden was too concerned about raising the price of oil, burdening Trump with higher oil prices, while he would be in favour of increasing sanctions on Russian oil majors to levels that would bring Russia to the negotiating table. Furthermore, he said as US energy output climbs, they can squeeze Iran and noted with sanctions, they can "make Iran poor again".

- OPEC said the Dangote Petroleum Refinery (650k BPD) and its efforts to ramp up petrol production are impacting the petrol market in Europe, according to AFP.

- Colonial Pipeline now estimates an earlier-than-expected restart of Line 1 on Friday after it made progress with on-site work to identify the source of a leak on Line 1 and began repairs.

- Spot gold traded little changed and held on to most of the prior day's gains after reclaiming the USD 2,700/oz level.

- Copper futures were mildly supported as participants digested several economic releases from China including stronger-than-expected GDP and activity data.

CRYPTO

- Bitcoin extended on the prior day's gains and returned to above the USD 101k level.

NOTABLE ASIA-PAC HEADLINES

- China's stats bureau said China's economic operations were generally steady in 2024, but the impact from external environment changes is deepening and domestic demand is not sufficient, while it added that economic operations still face many difficulties and challenges. China stats bureau head said China's economic achievements in 2024 were hard won but China policy stimulus was timely and boosted confidence and growth, as well as noted they will continue to promote economic recovery and implement more pro-active economic policies. The stats bureau head said positive factors will outweigh negative factors for China's economy in 2025 and he is fully confident about China's economic development in 2025, while he added that facing external changes, China will prioritise boosting domestic demand especially consumption.

- US Trade Representative said China's dominance of maritime, logistics and shipbuilding sectors is actionable under Section 301 statute but did not make specific recommendations. USTR said China's targeting of maritime sectors is enabled by forced labour, lack of labour rights, and excess capacity in steel and other areas, while it displaces foreign firms, lessens competition and creates dependence on China.

- China's Commerce Ministry said China is strongly dissatisfied and firmly opposed to the US report about China's shipbuilding and logistics sectors, while it will closely monitor US actions and take necessary measures to safeguard its legitimate rights and interests. MOFCOM also said the relevant investigation is marked by 'unilateralism and protectionism', while it added the 'decline' of the US shipbuilding industry has nothing to do with China and it urged the US to stop shifting problems in its domestic industrial development onto China.

- China's Commerce Ministry requested the WTO to set up an expert group on Turkey's restrictions on electric vehicles imported from China and said the next step will be to start a litigation process in accordance with WTO rules.

- US President-elect Trump is considering an executive order to circumvent the TikTok ban which would allow TikTok to continue operating until new owners are found, according to NYT.

- BoJ is reportedly likely to hike in January barring any major Trump-driven market shocks, via Reuters citing sources; will make no major change to guidance that they will keep increasing rates. BoJ is unlikely to offer explicit guidance on the pace of future tightening or how far rates could eventually go, while source added "the market seems to have gotten the BoJ's message".

DATA RECAP

- Chinese GDP QQ SA (Q4) 1.6% vs. Exp. 1.6% (Prev. 0.9%, Rev. 1.3%)

- Chinese GDP YY (Q4) 5.4% vs. Exp. 5.0% (Prev. 4.6%)

- Chinese GDP YTD YY (Q4) 5.0% vs. Exp. 4.9% (Prev. 4.8%)

- Chinese Industrial Output YY (Dec) 6.2% vs. Exp. 5.4% (Prev. 5.4%)

- Chinese Retail Sales YY (Dec) 3.7% vs. Exp. 3.5% (Prev. 3.0%)

- Chinese Unemployment Rate Urban Area (Dec) 5.1% (Prev. 5.0%)

- Chinese China House Prices MM (Dec) 0.0% (Prev. -0.1%)

- Chinese China House Prices YY (Dec) -5.3% (Prev. -5.7%)

GEOPOLITICS

MIDDLE EAST

- Israel agreed to the Gaza hostage deal and the cabinet is to meet on Friday, according to Israeli media.

- Israeli National Security Minister Ben-Gvir said he will resign from the government if the Gaza ceasefire deal is approved.

- People close to US President-elect Trump conveyed a warning to Israeli officials that they don’t want the ceasefire agreement in Lebanon to collapse, according to i24.

RUSSIA-UKRAINE

- Russian President Putin and Iranian President Pezeshkian may discuss the situation in Syria, Palestine, Caucasus and the Iranian nuclear programme on Friday, according to TASS.

OTHER

- Chinese hackers reportedly accessed Treasury Secretary Yellen's computer in the US Treasury breach, according to Bloomberg.

- North Korean Foreign Ministry said it will exercise its thorough right to self-defence, according to KCNA.

EU/UK

NOTABLE HEADLINES

- French PM Bayrou survived a no-confidence motion against the government.